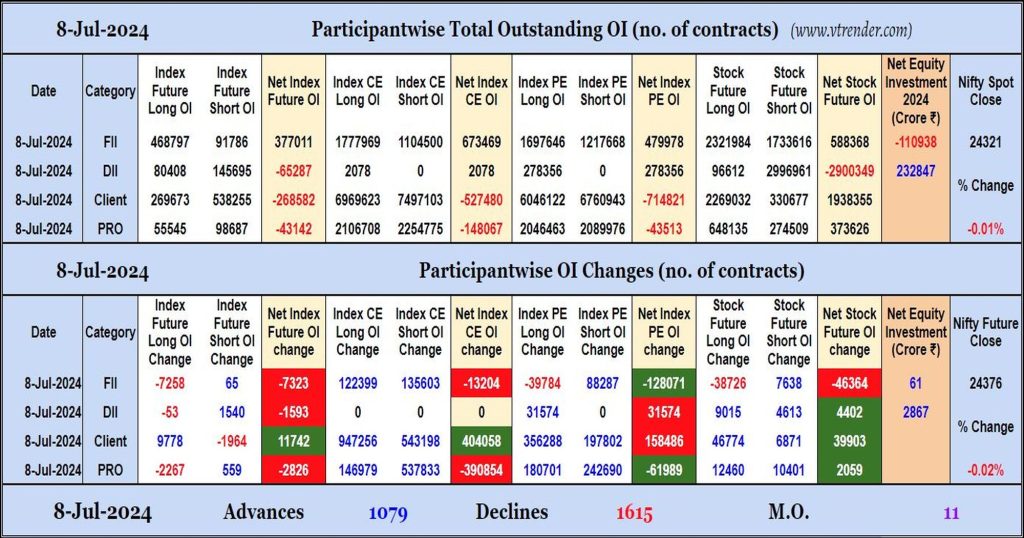

Participantwise Open Interest (Daily changes) – 8th JUL 2024

FIIs have added net shorts in Index CE, Index PE and Stocks Futures.

Desi MO (McClellans Oscillator for NSE) – 8th JUL 2024

MO at 11

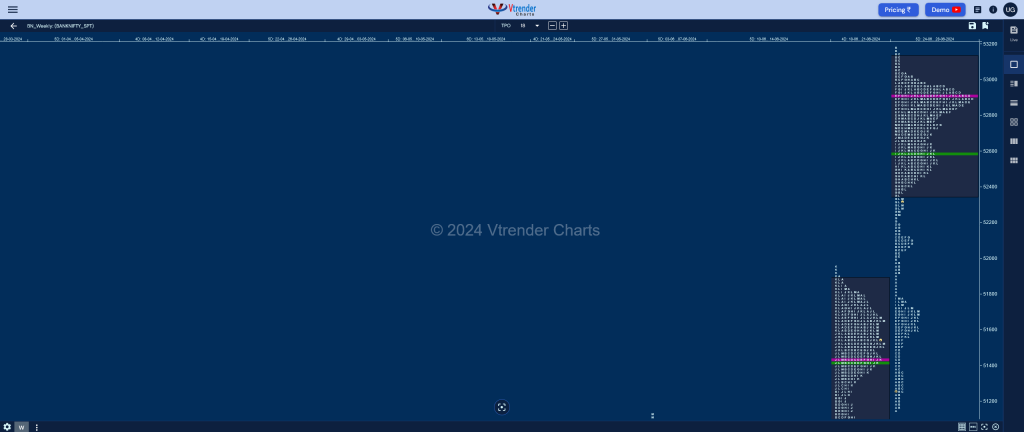

Market Profile Analysis dated 05th Jul 2024

Nifty Jul F: 24379 [ 24419 / 24240 ] Open Type OAOR (Open Auction) Volumes of 34,324 contracts Above average Initial Balance 105 points (24345 – 24240) Volumes of 72,548 contracts Above average Day Type Normal Variation – 179 pts Volumes of 2,30,381 contracts Average to be updated… Click here to view the latest profile in […]

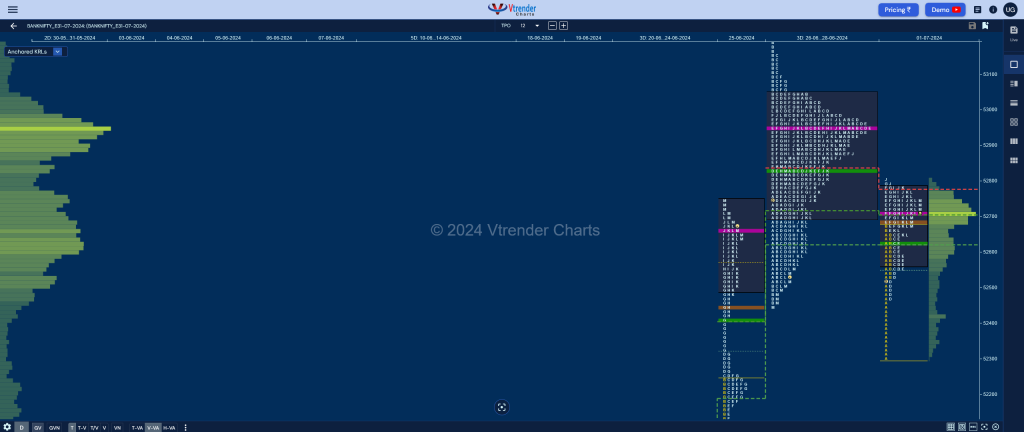

Weekly Spot Charts (01st to 05th Jul 2024) and Market Profile Analysis

Nifty Spot: 24323 [ 24401 / 23992 ] Monday – 24142 [ 24164 / 23992 ] – Normal Variation (Up) Tuesday – 24123 [ 24236 / 24056 ] – Normal (b shape) Wednesday – 24286 [ 24309 / 24207 ] – Normal (p shape) Thursday – 24302 [ 24401 / 24281 ] – Normal Variation (Down) […]

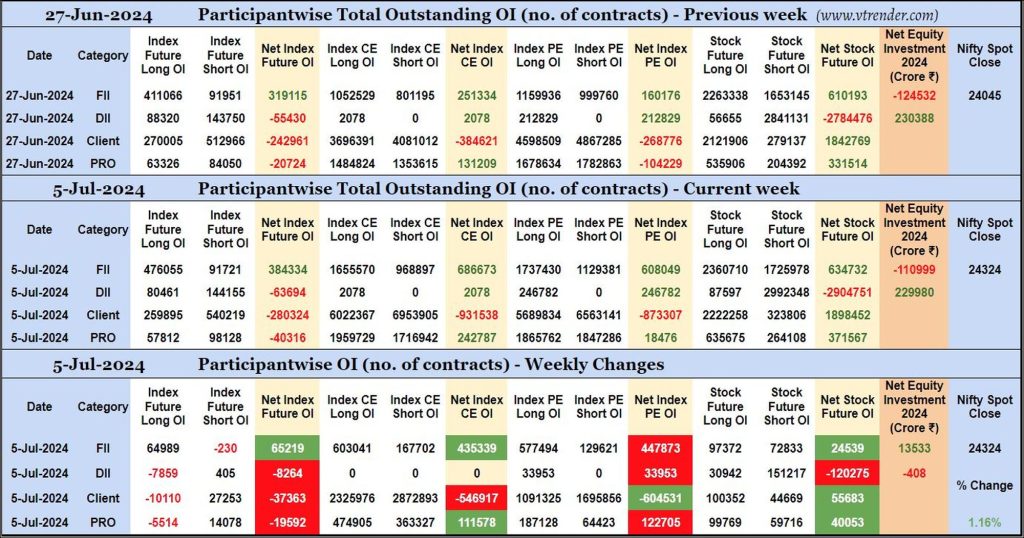

Participantwise Open Interest (Weekly changes) – 5th JUL 2024

FIIs have added 64K long Index Futures, net 435K long Index CE, net 447K long Index PE and net 24K long Stocks Futures contracts this week.

FIIs have been net buyers in equity segment for ₹13533 crore during the week.

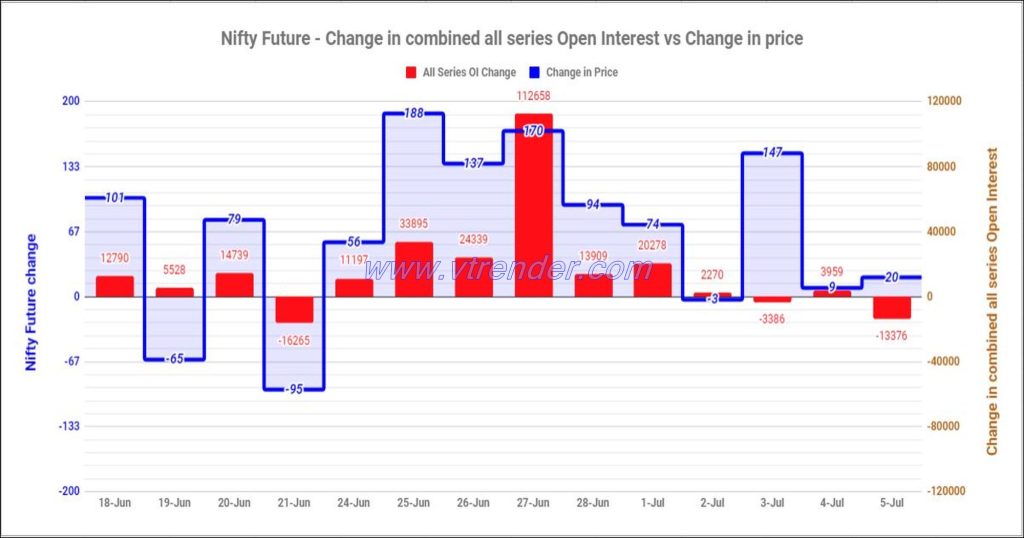

Nifty and Banknifty Futures with all series combined Open Interest – 5th JUL 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

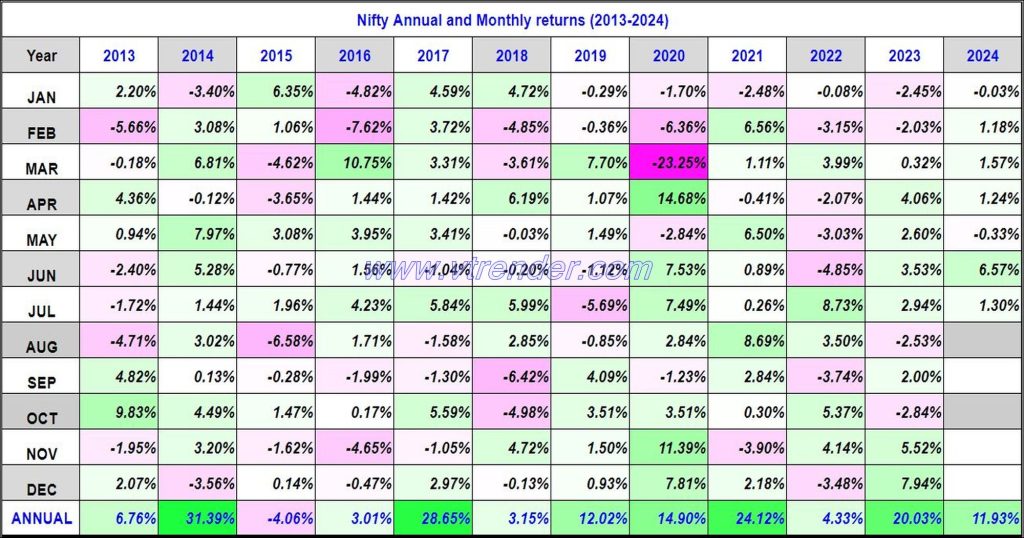

Nifty 50 Monthly and Annual returns (1991-2024) updated 5th JUL 2024

Nifty50 returns Year 2024 11.93% / Nifty50 returns JUL 2024 1.30%

Desi MO (McClellans Oscillator for NSE) – 5th JUL 2024

MO at 27

Market Profile Analysis dated 04th Jul 2024

Nifty Jul F: 24359 [ 24455 / 24335 ] Open Type OAOR (Open Auction) Volumes of 24,665 contracts Average Initial Balance 67 points (24455 – 24388) Volumes of 59,479 contracts Below average Day Type Normal Variation – 120 pts Volumes of 1,96,993 contracts Below average to be updated… Click here to view the latest profile in […]

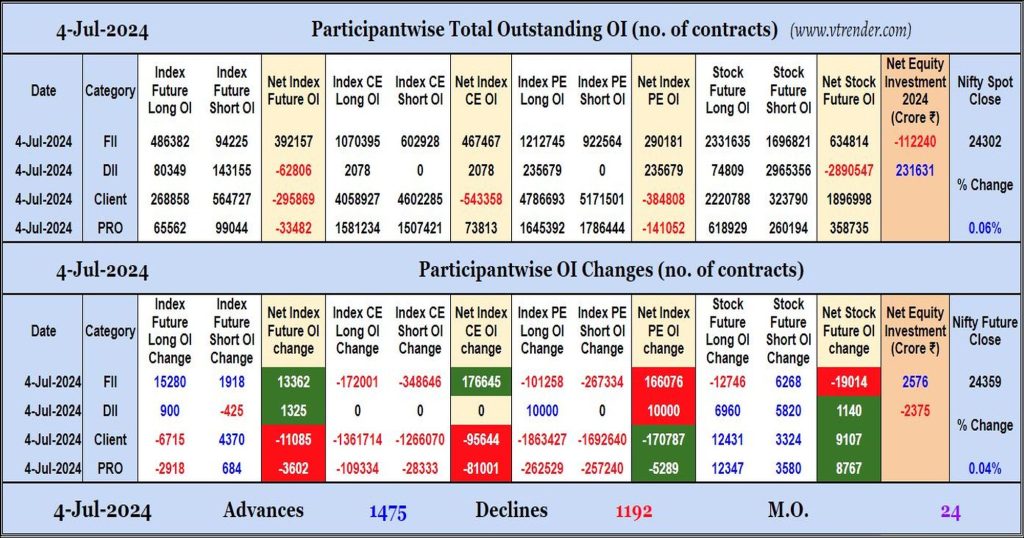

Participantwise Open Interest (Daily changes) – 4th JUL 2024

FIIs have added net longs in Index Futures while adding net shorts in Stocks Futures and shedding Open Interest in Index Options. They were net buyers in equity market.