Desi MO (McClellans Oscillator for NSE) – 4th JUL 2024

MO at 24

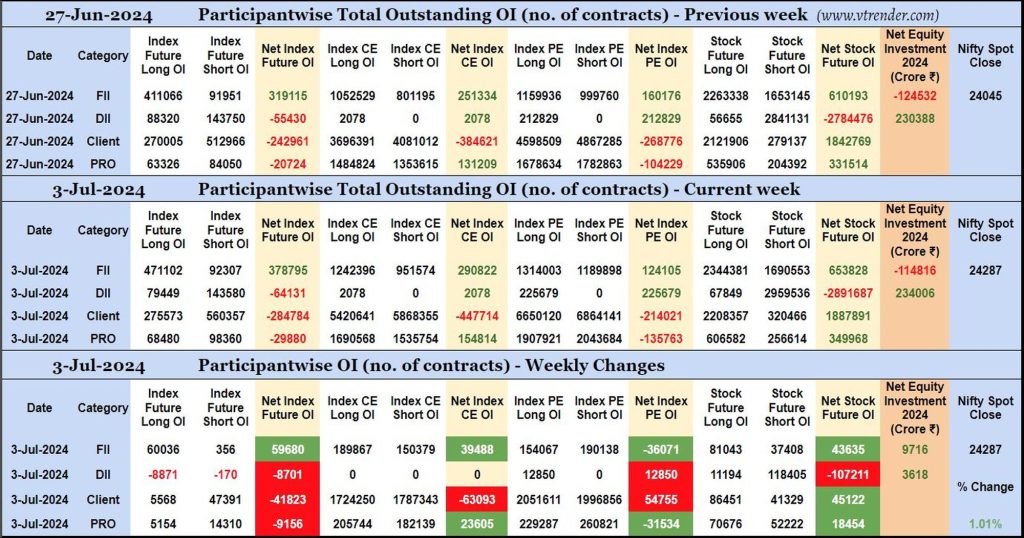

Participantwise Open Interest (Mid-week changes) – 3rd JUL 2024

FIIs have added net 59K long Index Futures, net 39K long Index CE, net 36K short Index PE and net 43K long Stocks Futures contracts in the current week.

FIIs have been net buyers in equity segment for ₹9716 crore so far this week.

Desi MO (McClellans Oscillator for NSE) – 3rd JUL 2024

MO at 23

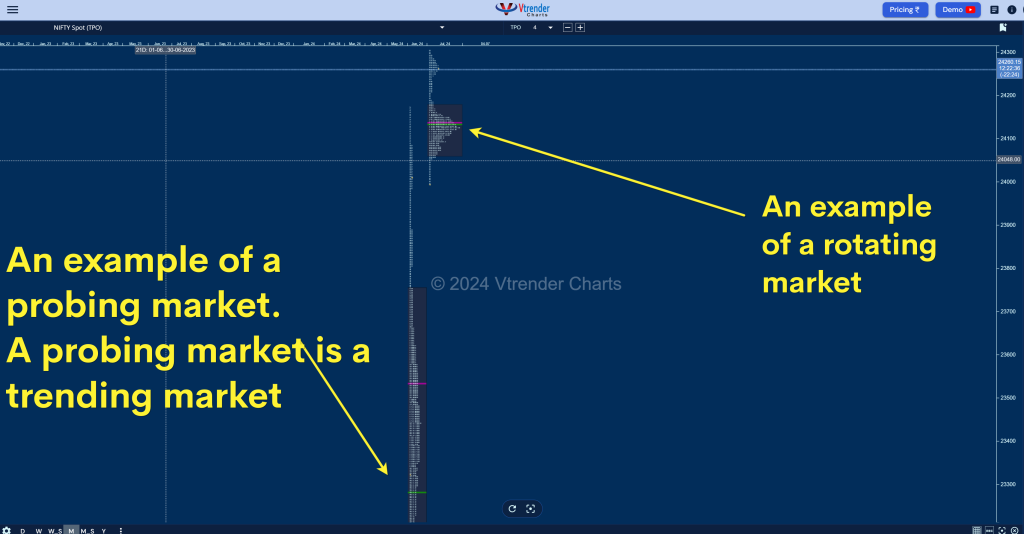

Mean Reverting Markets: A Guide for Short-Term Derivatives Traders Using VWAP

In the fast-paced world of trading, market behaviors often oscillate between various states. Sometimes the markets trend and sometimes they go sideways . The trending markets in MarketProfile are called Probes and the sideways markets are called rotations. A characteristic of a sideways market is the mean reverting market, a concept that is particularly useful […]

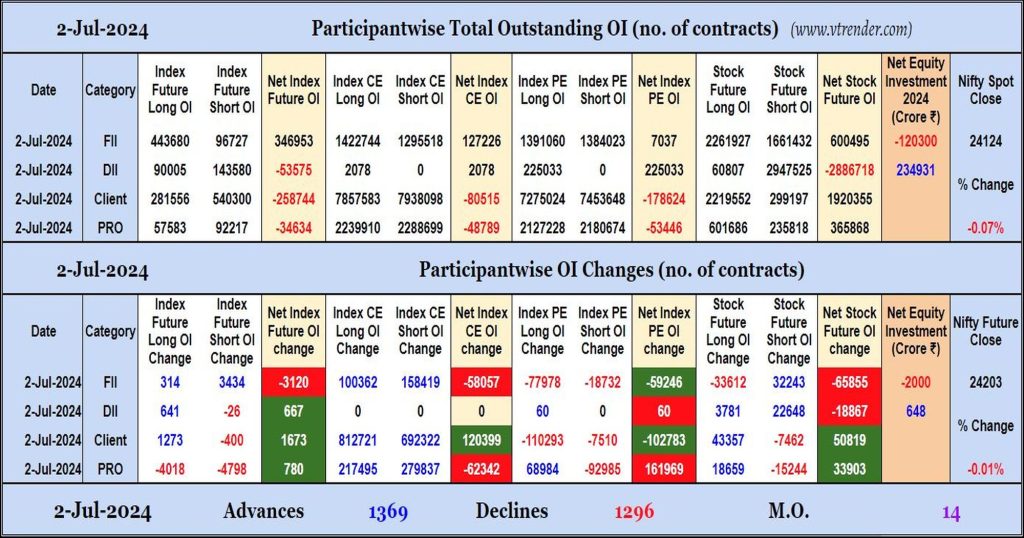

Participantwise Open Interest (Daily changes) – 2nd JUL 2024

FIIs have added net shorts in Index Futures, Index CE and Stocks Futures, they have been net selles in equity segment as well.

Desi MO (McClellans Oscillator for NSE) – 2nd JUL 2024

MO at 14

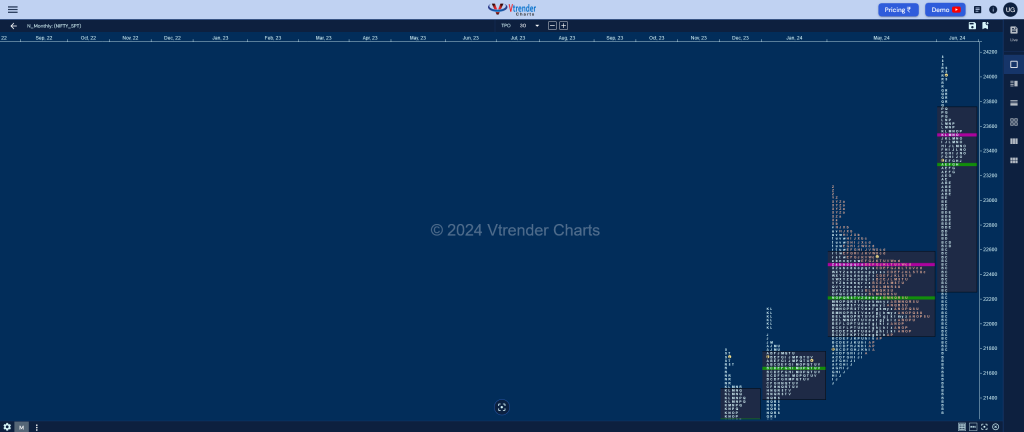

Market Profile Analysis dated 01st Jul 2024

Nifty Jul F: 24206 [ 24225 / 24082 ] Open Type OA (Open Auction) Volumes of 25,331 contracts Average Initial Balance 97 points (24179 – 24082) Volumes of 61,160 contracts Average Day Type Normal (‘p’ shape) – 143 pts Volumes of 1,63,209 contracts Below average to be updated… Click here to view the latest profile in […]

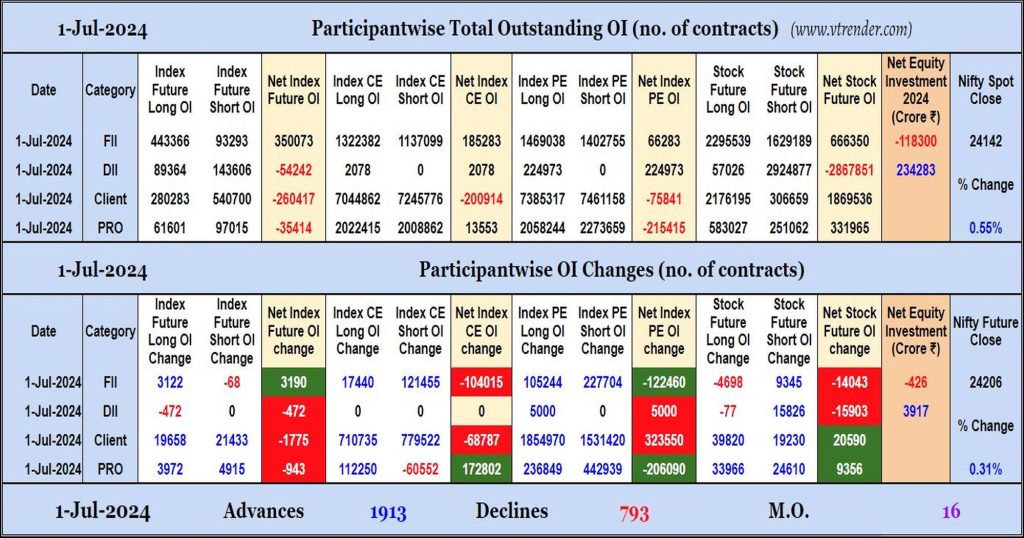

Participantwise Open Interest (Daily changes) – 1st JUL 2024

FIIs have added net longs in Index Futures and net shorts in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 1st JUL 2024

MO at 16

Weekly Spot Charts (24th to 28th Jun 2024) and Market Profile Analysis

Nifty Spot: 24010 [ 24174 / 23350 ] Monday – 23538 [ 23558 / 23350 ] – Double Distribution (Up) Tuesday – 23721 [ 23754 / 23562 ] – Neutral Extreme (Up) Wednesday – 23868 [ 23890 / 23670 ] – Trend Day (Up) Thursday – 24044 [ 24087 / 23805 ] – Normal Variation (Up) […]