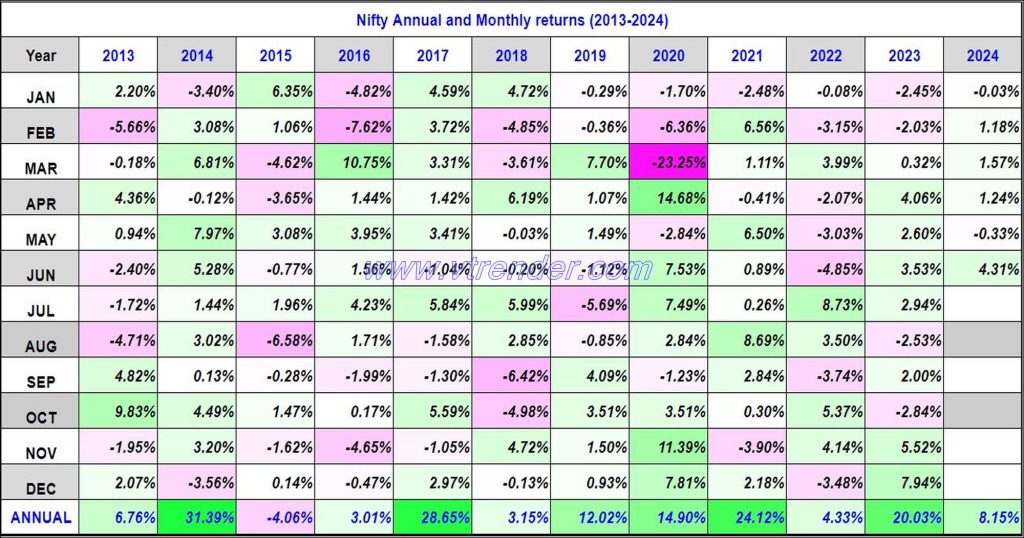

Nifty 50 Monthly and Annual returns (1991-2024) updated 21st JUN 2024

Nifty50 returns Year 2024 8.15% / Nifty50 returns JUN 2024 4.31%

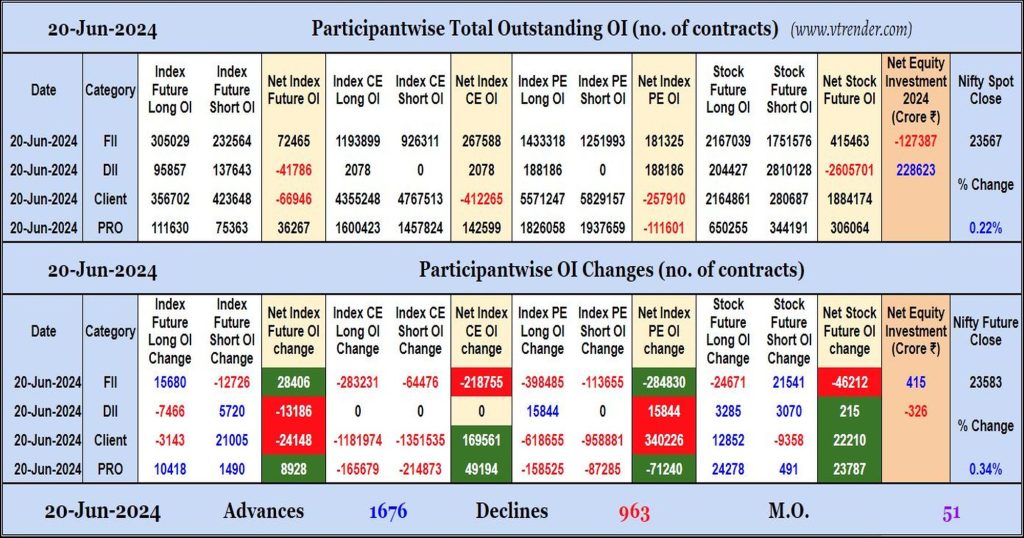

Participantwise Open Interest (Daily changes) – 20th JUN 2024

FIIs have added longs in Index Futures and shorts in Stocks Futures while shedding Open Interest in Index Options. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 20th JUN 2024

MO at 51

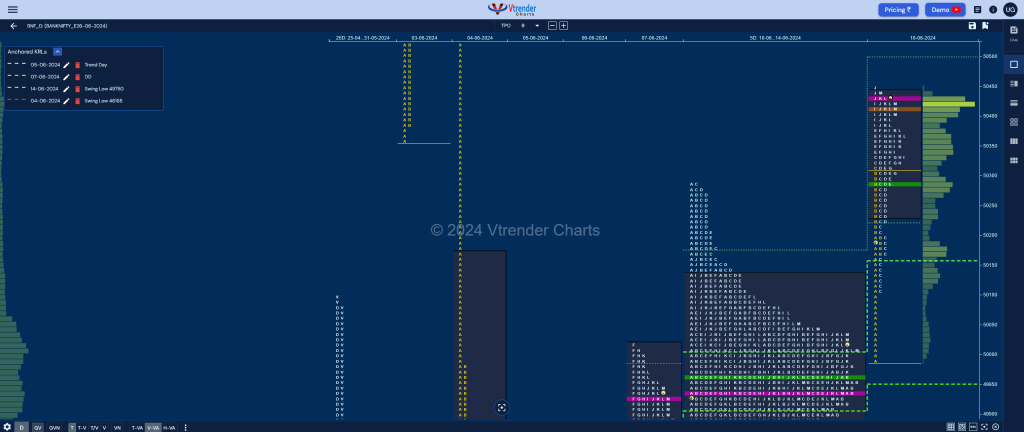

Market Profile Analysis dated 19th Jun 2024

Nifty Jun F: 23503 [ 23669 / 23432 ] Open Type OA (Open Auction) Volumes of 24,427 contracts Below average Initial Balance 94 points (23625 – 23531) Volumes of 59,846 contracts Below average Day Type Neutral Centre – 237 pts Volumes of 3,12,950 contracts Average NF opened with a look up above previous highs but could […]

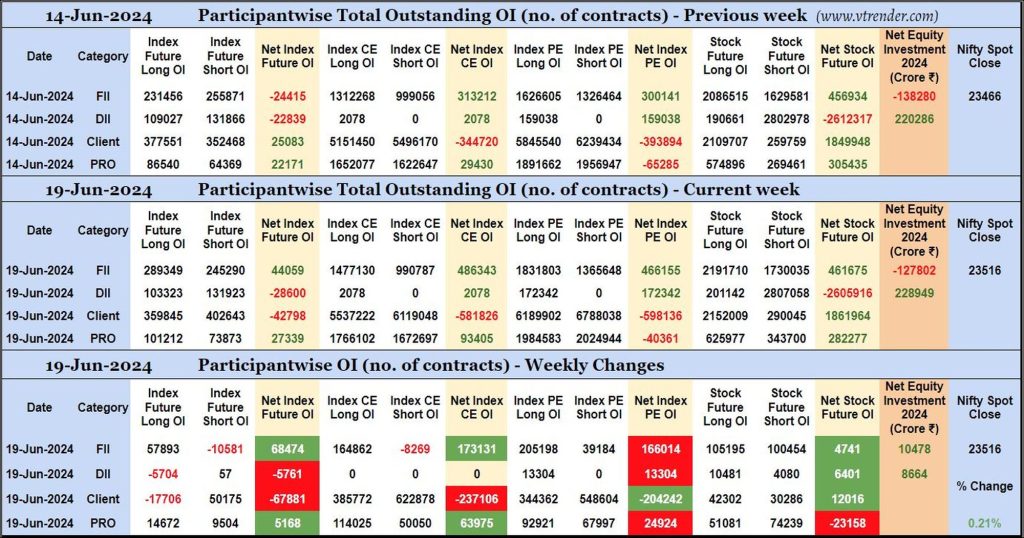

Participantwise Open Interest (Mid-week changes) – 19th JUN 2024

FIIs have added 57K long Index Futures, 164K long Index CE, net 166K long Index PE and net 4K long Stocks Futures contracts so far this week besides covering 10K short Index Futures and 8K short Index CE contracts. They have now turned net long in Index Futures.

FIIs have been net buyers in equity segment for ₹10478 crore during the current week.

Desi MO (McClellans Oscillator for NSE) – 19th JUN 2024

MO at 44

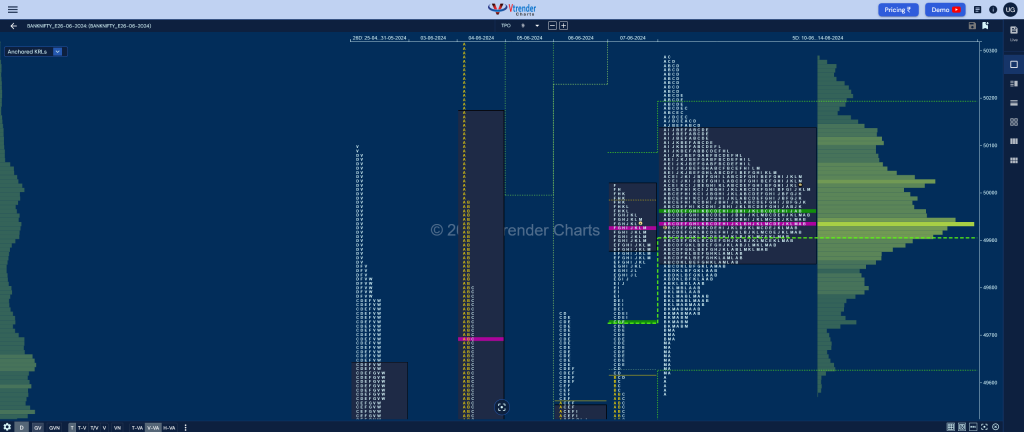

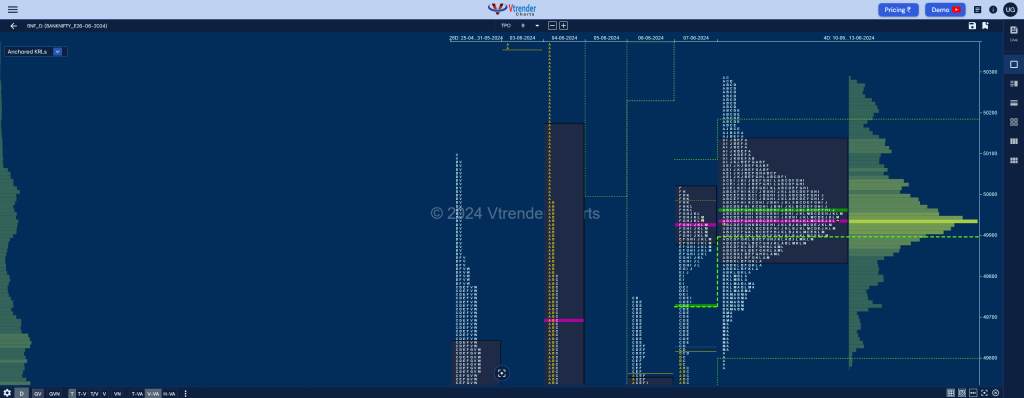

Market Profile Analysis dated 18th Jun 2024

Nifty Jun F: 23568 [ 23610 / 23511 ] Open Type OAOR (Open Auction) Volumes of 35,497 contracts Average Initial Balance 99 points (23610 – 23511) Volumes of 74,676 contracts Below average Day Type Normal – 99 pts Volumes of 1,60,903 contracts Below average NF continued the imbalance it started in the previous session with a […]

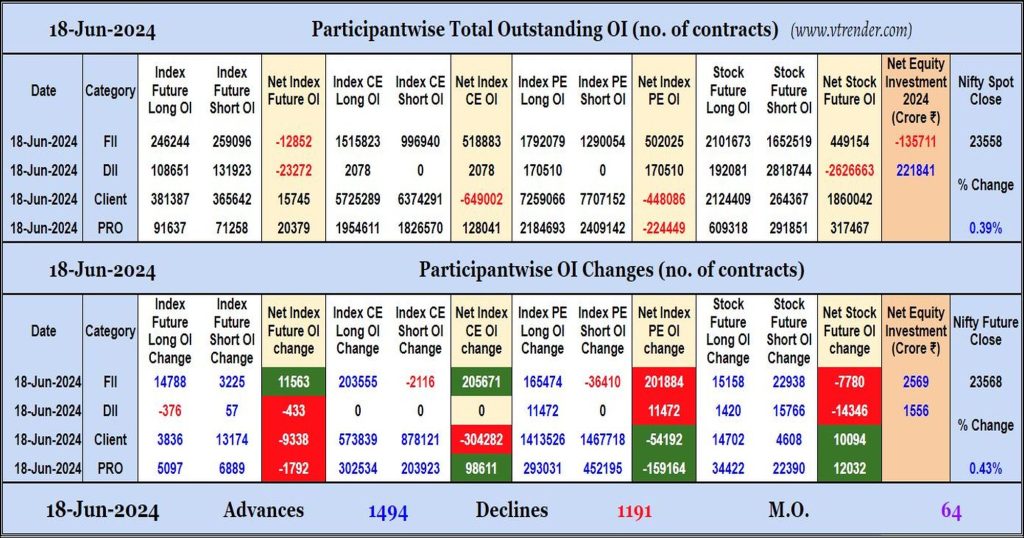

Participantwise Open Interest (Daily changes) – 18th JUN 2024

FIIs have added longs in Index Futures, Index CE and Index PE while adding net shorts in Stocks Futures. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 18th JUN 2024

MO at 64

Market Profile Analysis dated 14th Jun 2024

Nifty Jun F: 23466 [ 23489 / 23350 ] Open Type OA (Open Auction) Volumes of 6,662 contracts Very Poor Initial Balance 121 points (23472 – 23350) Volumes of 65,328 contracts Below average Day Type Normal – 139 pts Volumes of 1,81,496 contracts Below average NF opened higher but could not take out previous session’s selling […]