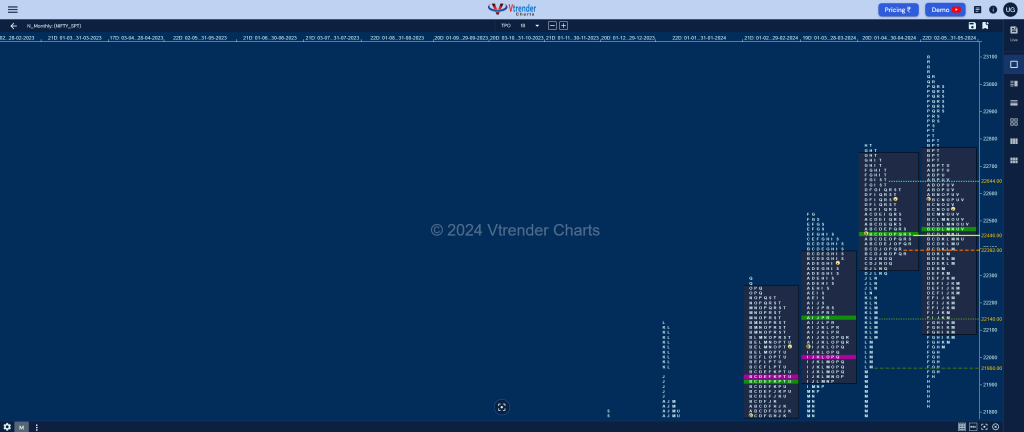

Weekly Spot Charts (10th to 14th Jun 2024) and Market Profile Analysis

Nifty Spot: 23465 [ 23490 / 23206 ] Monday – 23259 ( 23411 / 23227 ) – Normal Day [Nifty opened the week with a huge gap up of 807 points recording new ATH of 23338 but settled down into an OAOR forming a Normal Day and a nice Gaussian Curve with a prominent POC at […]

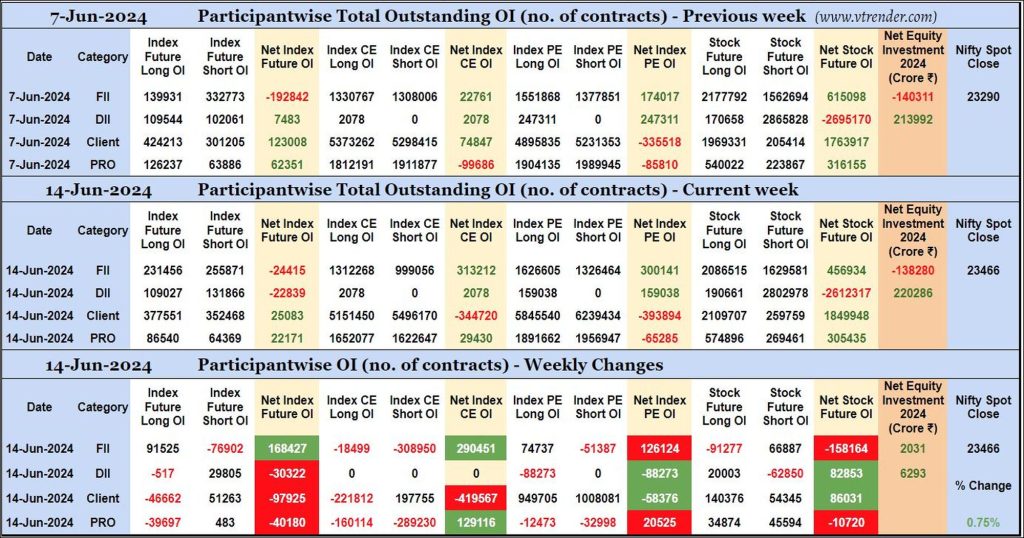

Participantwise Open Interest (Weekly changes) – 14th JUN 2024

FIIs have added 91K long Index Futures, 74K long Index PE and 66K short Stocks Futures contracts this week besides covering 76K short Index Futures and 51K short Index PE contracts. They have also liquidated 91K long Stocks Futures contracts and shed Open Interest in Index CE.

FIIs have been net buyers in equity segment for ₹2031 crore during the week.

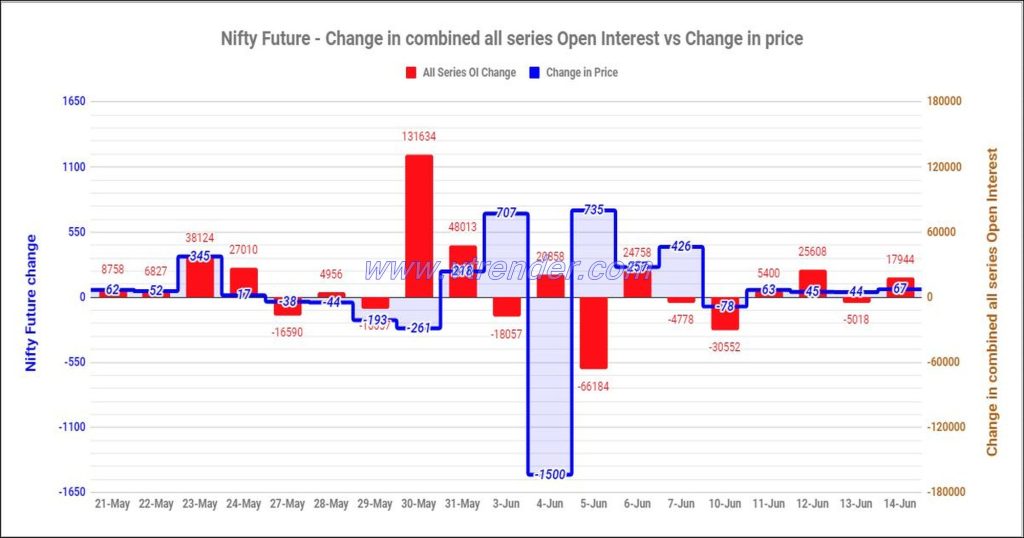

Nifty and Banknifty Futures with all series combined Open Interest – 14th JUN 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

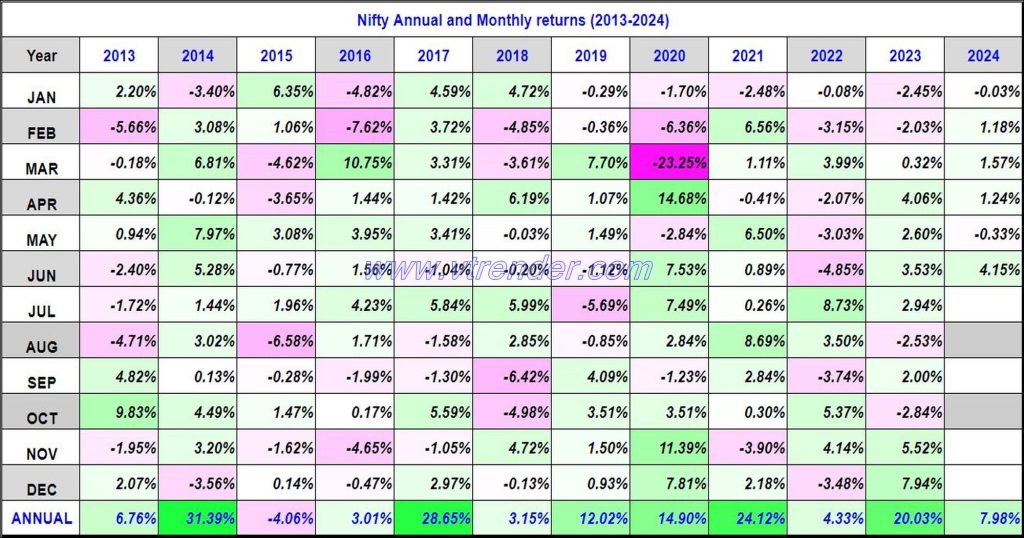

Nifty 50 Monthly and Annual returns (1991-2024) updated 14th JUN 2024

Nifty50 returns Year 2024 7.98% / Nifty50 returns JUN 2024 4.15%

Desi MO (McClellans Oscillator for NSE) – 14th JUN 2024

MO at 69

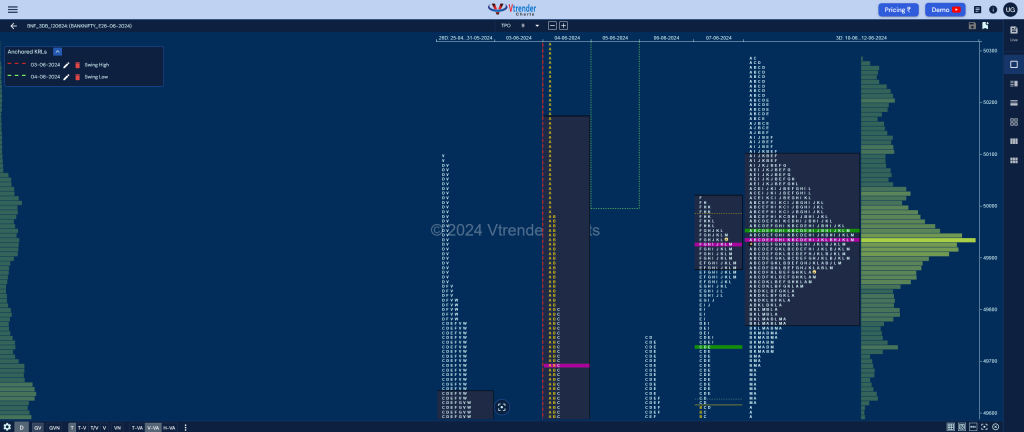

Market Profile Analysis dated 13th Jun 2024

Nifty Jun F: 23399 [ 23482 / 23371 ] Open Type OAIR (Open Auction) Volumes of 31,068 contracts Below average Initial Balance 105 points (23482 – 23376) Volumes of 65,059 contracts Below average Day Type Normal – 111 pts Volumes of 2,05,751 contracts Below average to be updated… Click here to view the latest profile in […]

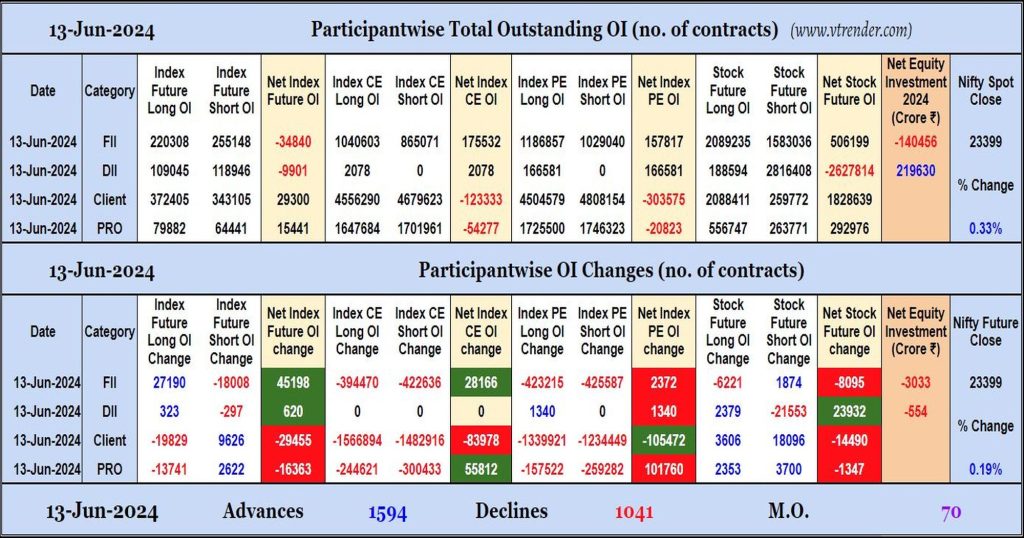

Participantwise Open Interest (Daily changes) – 13th JUN 2024

FIIs have added longs in Index Futures and some shorts in Stocks Futures, mostly Open Interest was shed on Nifty weekly expiry day. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 13th JUN 2024

MO at 70

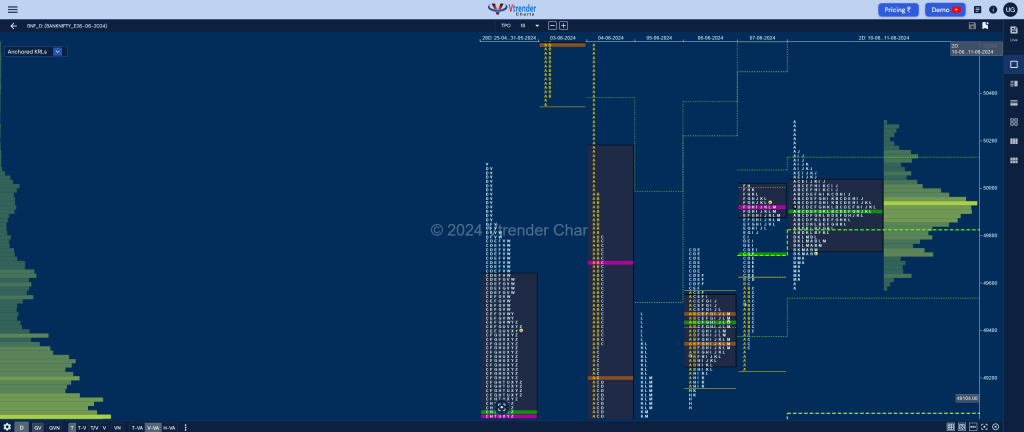

Market Profile Analysis dated 12th Jun 2024

Nifty Jun F: 23355 [ 23474 / 23303 ] Open Type OAIR (Open Auction) Volumes of 17,580 contracts Poor Initial Balance 130 points (23350 – 23220) Volumes of 62,205 contracts Below average Day Type Normal – 171 pts Volumes of 2,36,735 contracts Below average to be updated… Click here to view the latest profile in NF […]

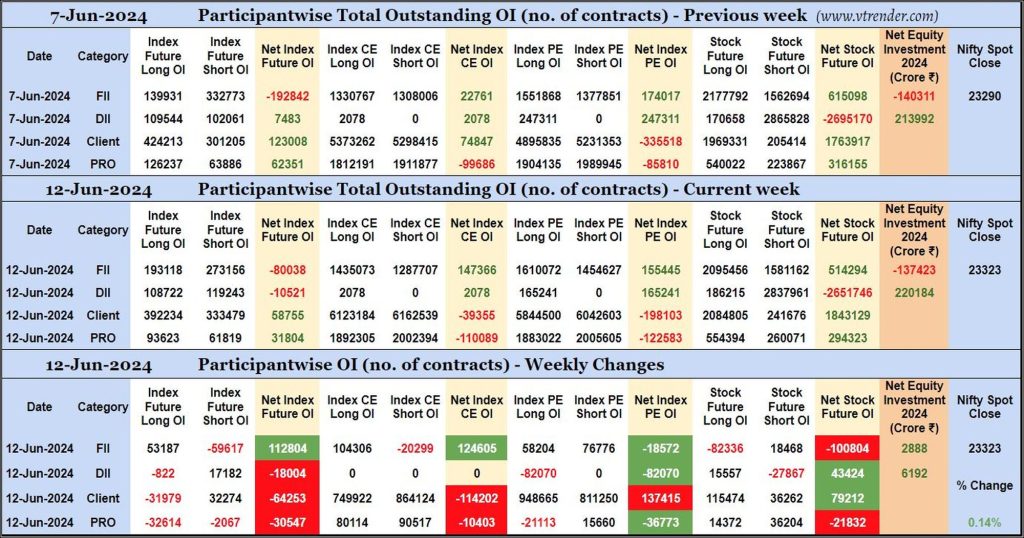

Participantwise Open Interest (Mid-week changes) – 12th JUN 2024

FIIs have added 53K long Index Futures, 104K long Index CE, net 18K short Index PE and 18K short Stocks Futures contracts so far this week besides covering 59K short Index Futures and 20K short Index CE contracts. They have also liquidated 82K long Stocks Futures contracts.

FIIs have been net buyers in equity segment for ₹2888 crore during the week.