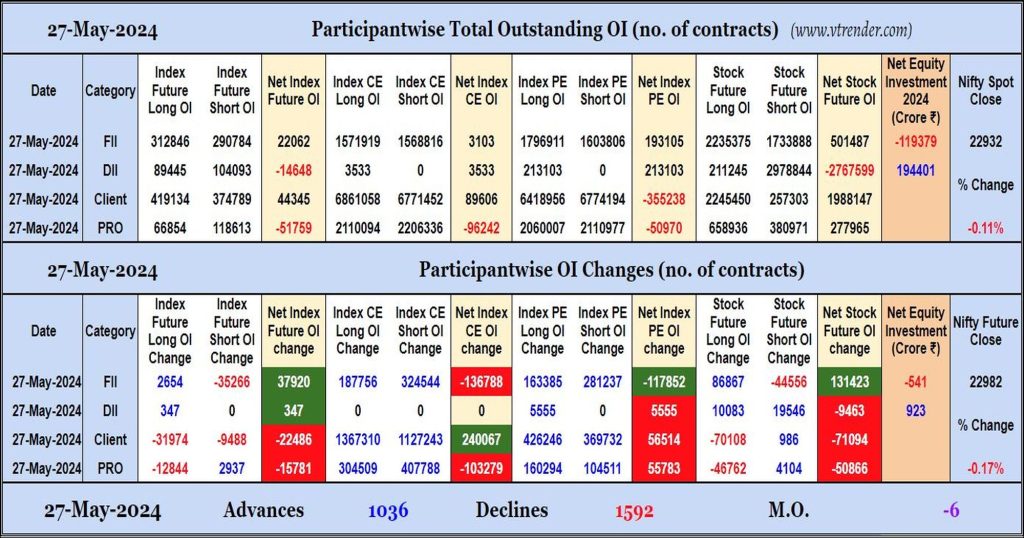

Participantwise Open Interest (Daily changes) – 27th MAY 2024

FIIs have added longs in Index & Stocks Futures while adding net shorts in Index Options. They are net longs in Index Futures now. FIIs were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 27th MAY 2024

MO at -6

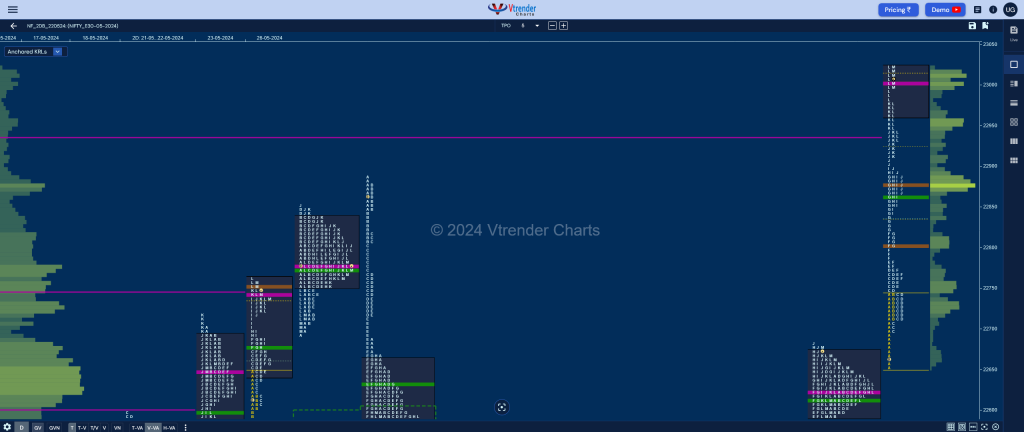

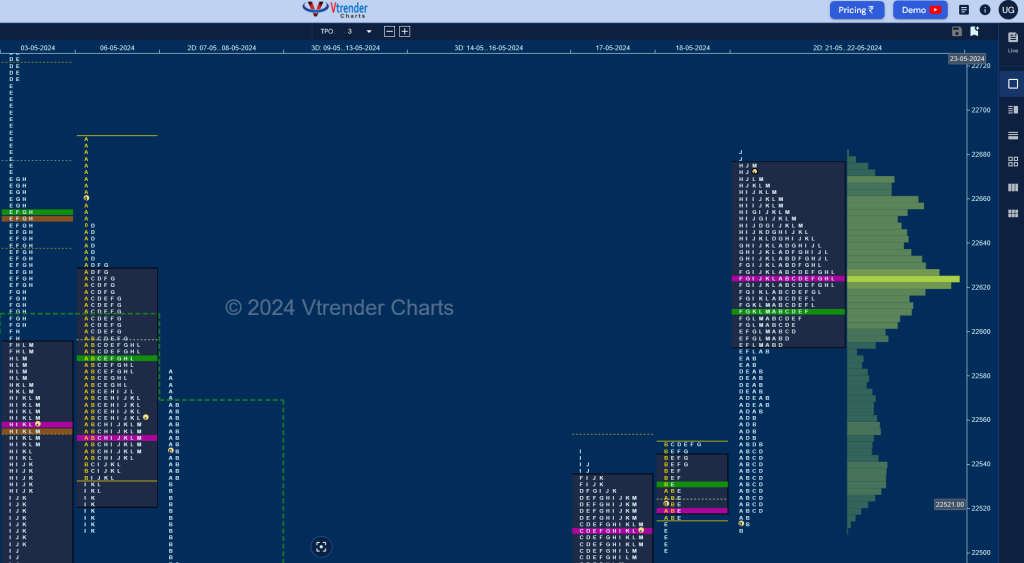

Market Profile Analysis dated 24th May 2024

Nifty May F: 23019 [ 23090 / 22953 ] Open Type OA (Open Auction) Volumes of 17,345 contracts Poor Initial Balance 87 points (23040 – 22953) Volumes of 56,261 contracts Below average Day Type Normal Variation – 137 pts Volumes of 2,19,961 contracts Below average NF got back to balance mode with an Open Auction start […]

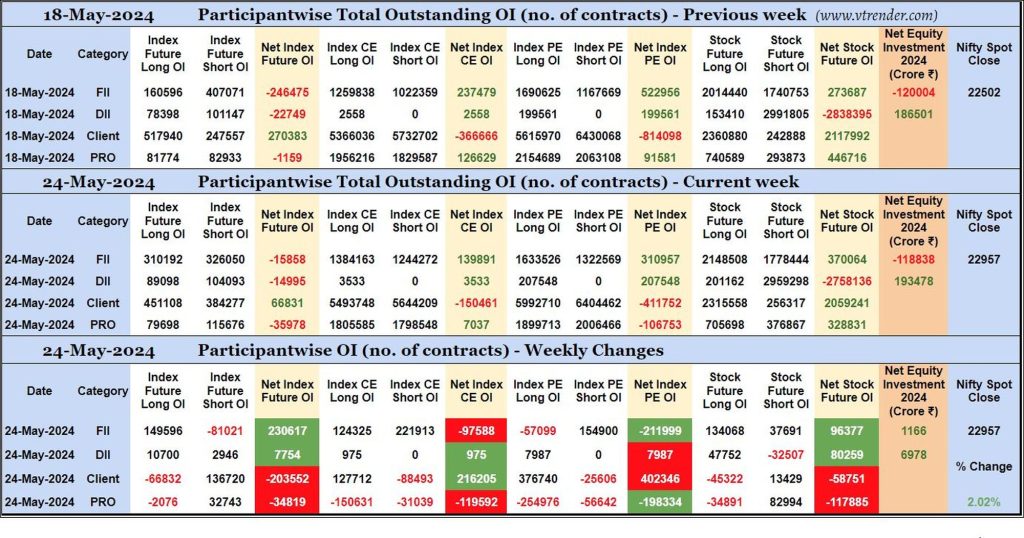

Participantwise Open Interest (Weekly changes) – 24th MAY 2024

FIIs have added 149K long Index Futures, net 97K short Index CE, 154K short Index PE and net 96K long Stocks Futures contracts this week besides covering 81K short Index Futures contracts and liquidating 57K long Index PE contracts.

FIIs have been net buyers in equity segment for ₹1166 crore during the week.

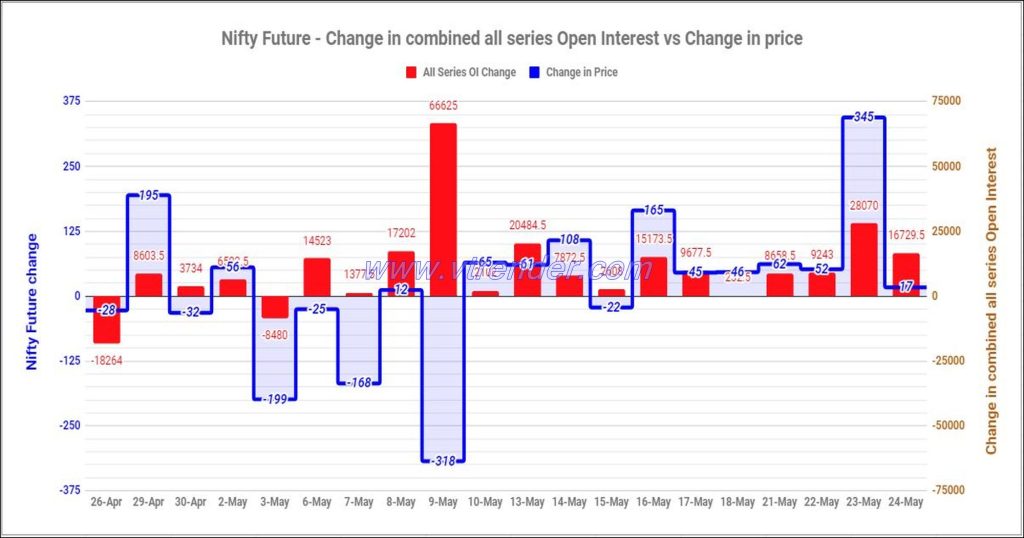

Nifty and Banknifty Futures with all series combined Open Interest – 24th MAY 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

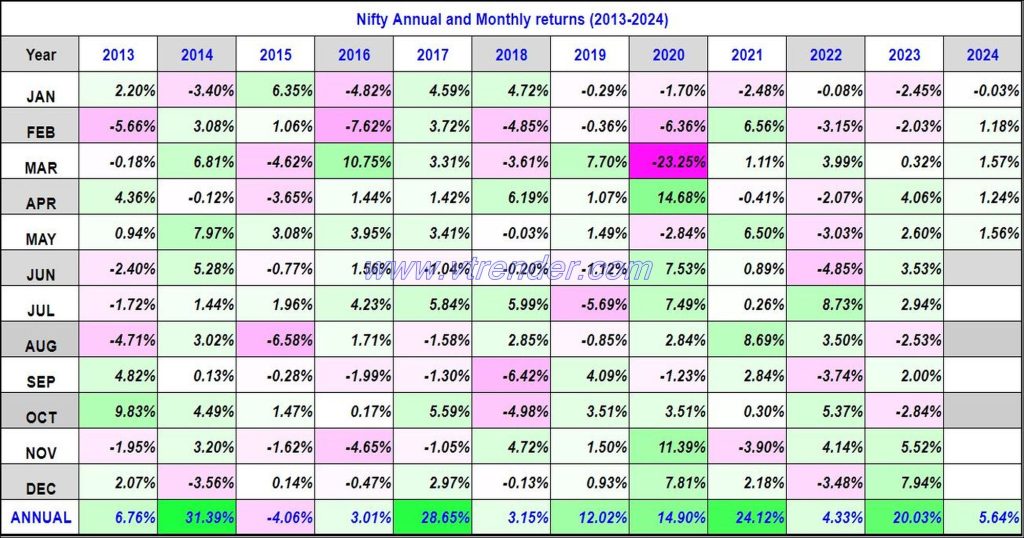

Nifty 50 Monthly and Annual returns (1991-2024) updated 24th MAY 2024

Nifty50 returns Year 2024 5.64% / Nifty50 returns MAY 2024 1.56%

Desi MO (McClellans Oscillator for NSE) – 24th MAY 2024

MO at 5

The Evolution of Market Profile: The Legacy of Pete Steidlmayer and the Liquidity Data Bank

Trading has always been an art, but with the right tools, it can also become a science. One of the most influential figures in modern trading is J. Peter Steidlmayer, whose innovative Market Profile has fundamentally changed the way traders analyze market data. This blog post delves into Steidlmayer’s journey, the creation of the Market […]

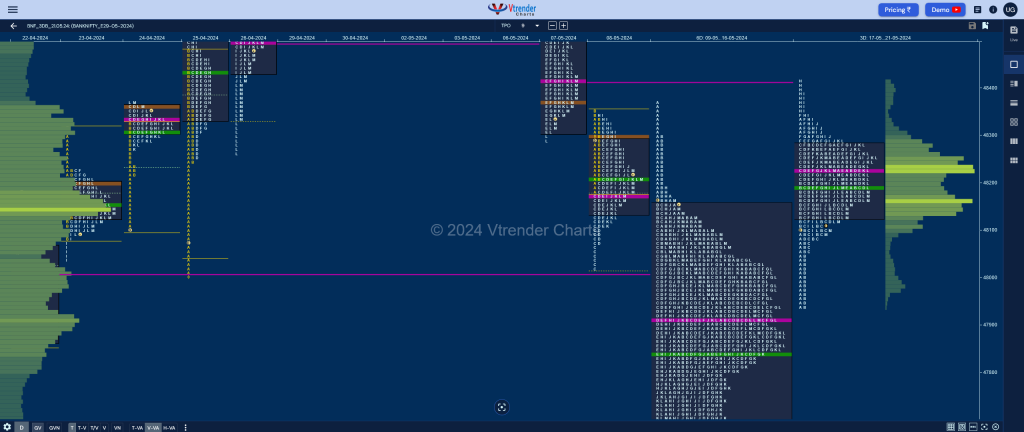

Weekly Spot Charts (20th to 24th May 2024) and Market Profile Analysis

Nifty Spot: 22957 [ 23026 / 22440 ] Monday – Holiday Tuesday – Nifty made an Open Auction start consolidation around previous week’s HVN of 22479 in the first half before leaving a SOC (Scene Of Crime) at 22485 & probed higher not only getting into the weekly selling tail from 22542 to 22588 (06-10 May) […]

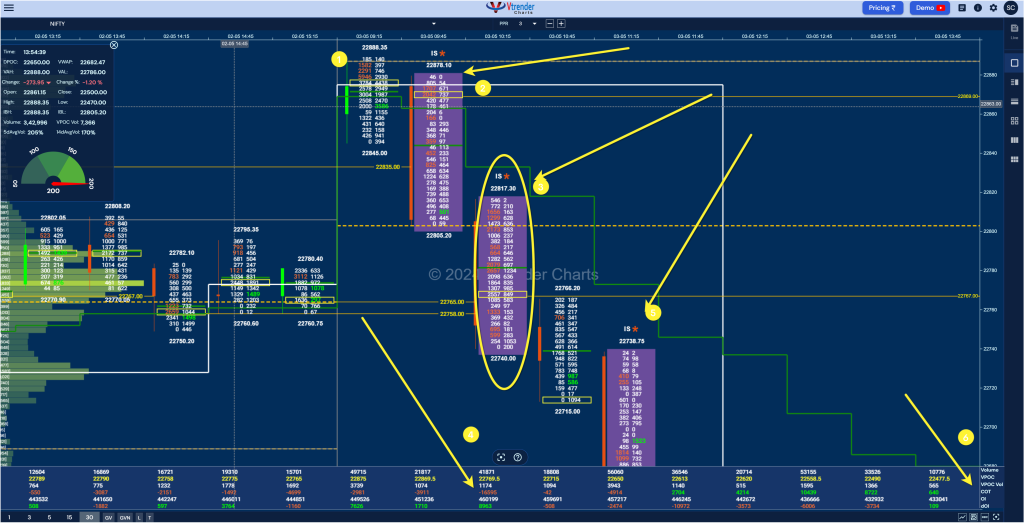

Market Profile Analysis dated 23rd May 2024

Nifty May F: 23002 [ 23023 / 22650 ] Open Type OA (Open Auction) Volumes of 15,929 contracts Poor Initial Balance 94 points (22744 – 22650) Volumes of 57,163 contracts Below average Day Type Trend – 373 pts Volumes of 4,12,684 contracts Above average NF made a slow OAIR start but with an OL (Open=Low) at […]