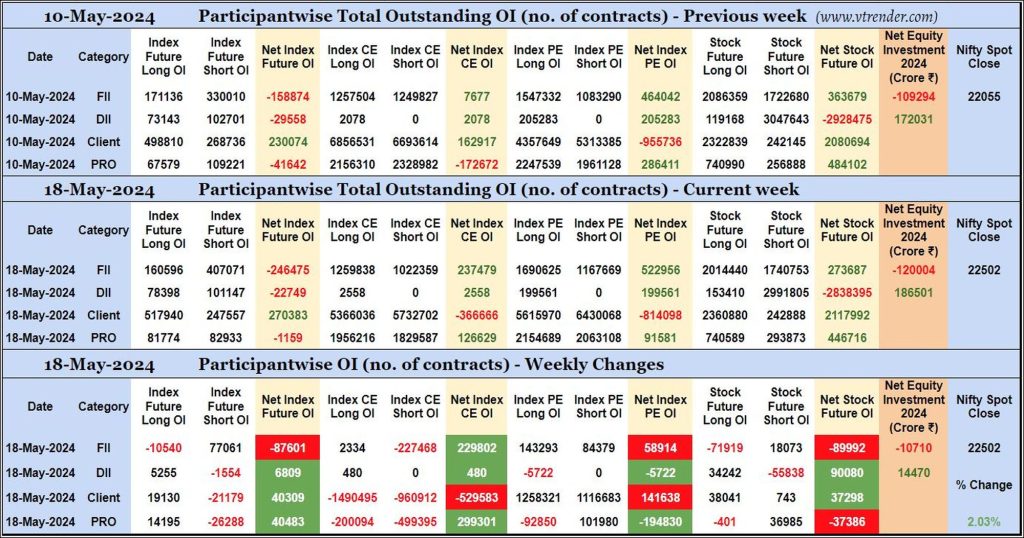

Participantwise Open Interest (Weekly changes) – 18th MAY 2024

FIIs have added 77K short Index Futures, 2K long Index CE, net 58K long Index PE and 18K short Stocks Futures contracts this week besides liquidating 10K long Index Futures and 71K long Stocks Futures contracts. They have also covered 227K short Index CE contracts.

FIIs have been net sellers in equity segment for ₹10710 crore during the week.

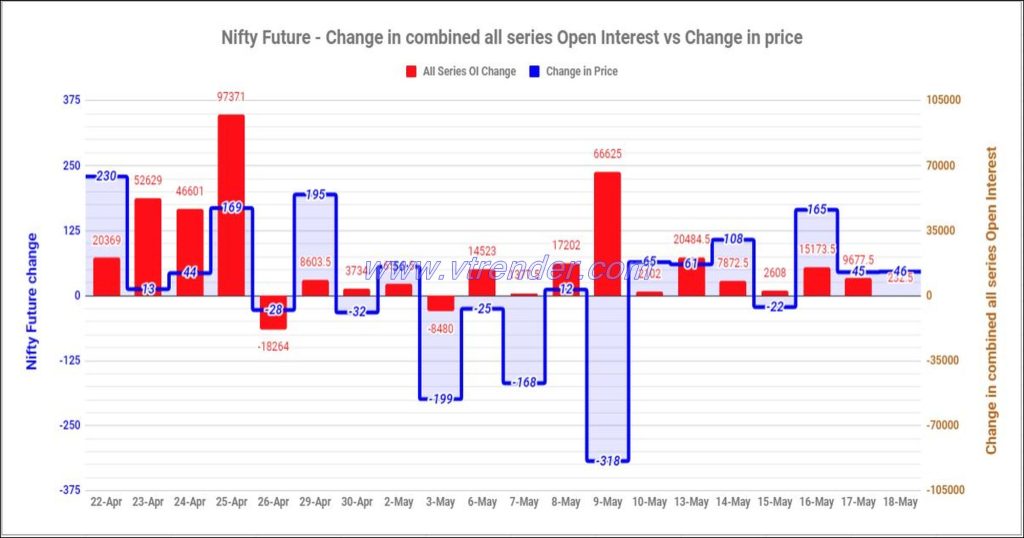

Nifty and Banknifty Futures with all series combined Open Interest – 18th MAY 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

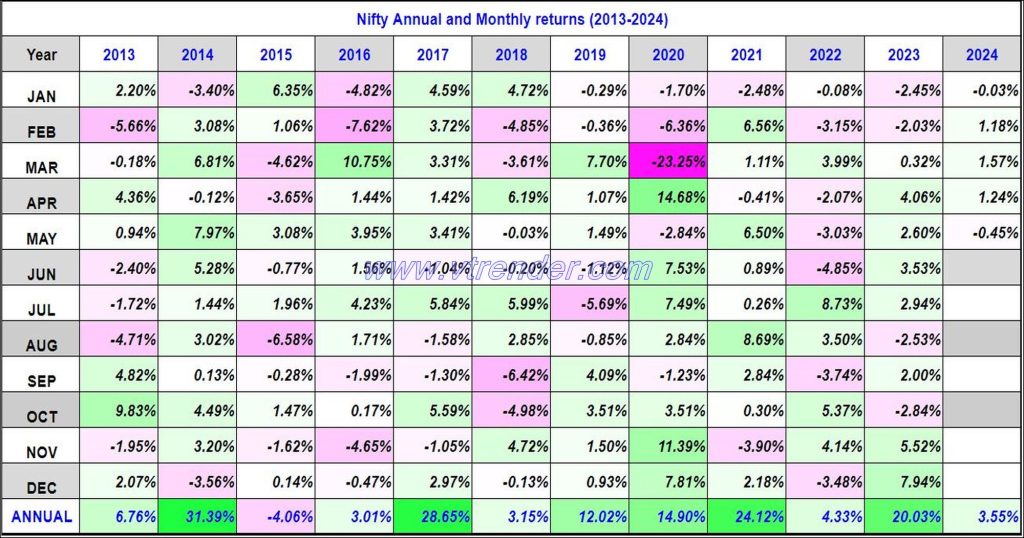

Nifty 50 Monthly and Annual returns (1991-2024) updated 18th MAY 2024

Nifty returns 2024 3.55% / Nifty returns MAY2024 -0.45%

Desi MO (McClellans Oscillator for NSE) – 18th MAY 2024

MO at 45

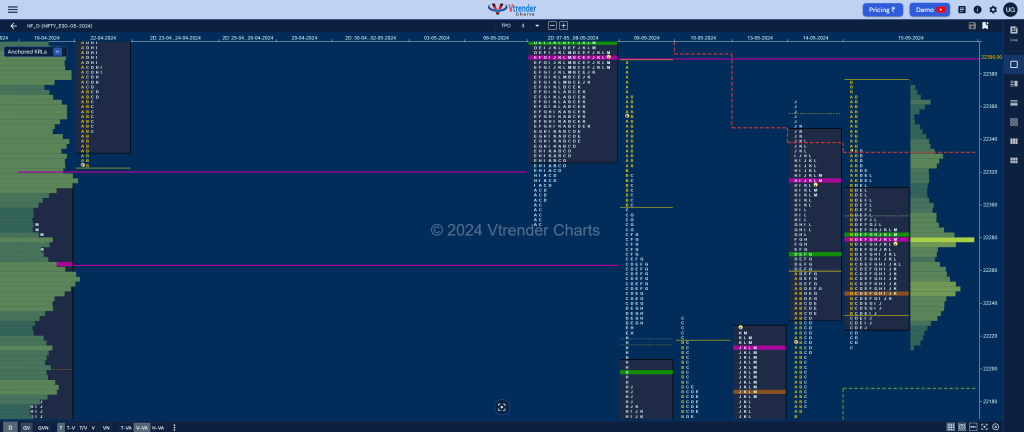

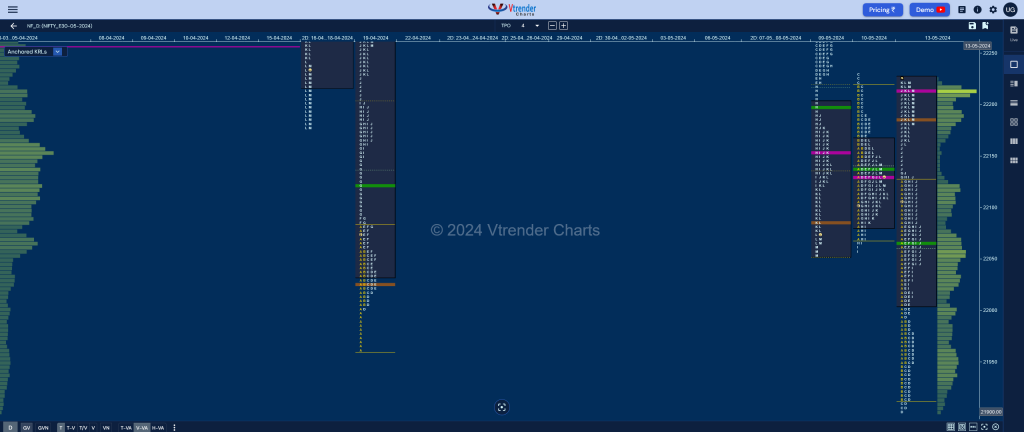

Market Profile Analysis dated 16th May 2024

Nifty May F: 22452 [ 22485 / 22154 ] Open Type ORR (Open Rejection Reverse) Volumes of 39,267 contracts Above average Initial Balance 78 points (22400 – 22322) Volumes of 81,936 contracts Above average Day Type Neutral Extreme – 331 pts Volumes of 5,54,977 contracts Above average NF opened higher tagging the VPOC of 22390 while […]

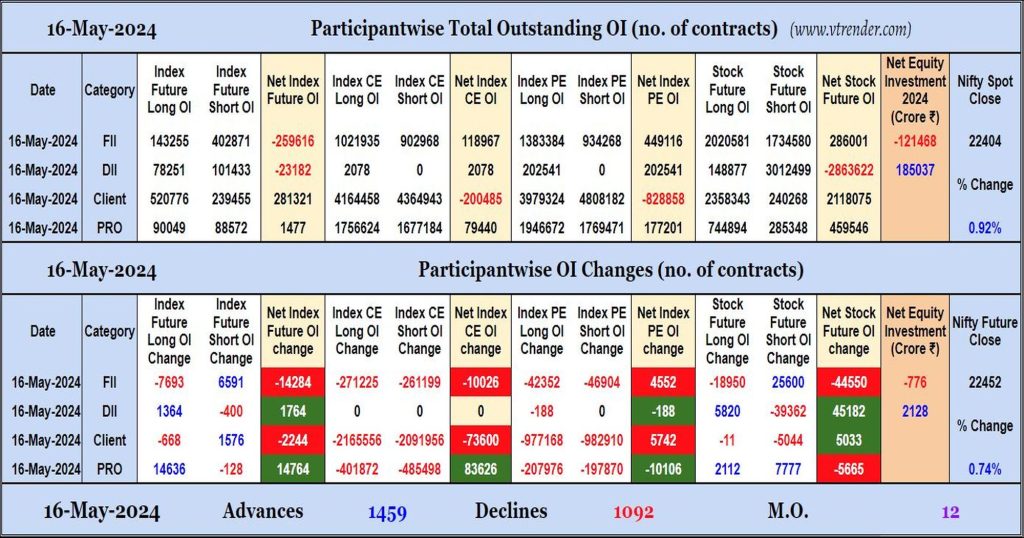

Participantwise Open Interest (Daily changes) – 16th MAY 2024

FIIs have added shorts in Index Futures and Stocks Futures while shedding Open Interest in Index Options. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 16th MAY 2024

MO at 12

Market Profile Analysis dated 15th May 2024

Nifty May F: 22287 [ 22375 / 22211 ] Open Type OA (Open Auction) Volumes of 16,522 contracts Poor Initial Balance 142 points (22374 – 22233) Volumes of 72,643 contracts Above average Day Type Normal (‘b’ shape) – 164 pts Volumes of 2,17,207 contracts Below average NF made an OA start on poor volumes as it […]

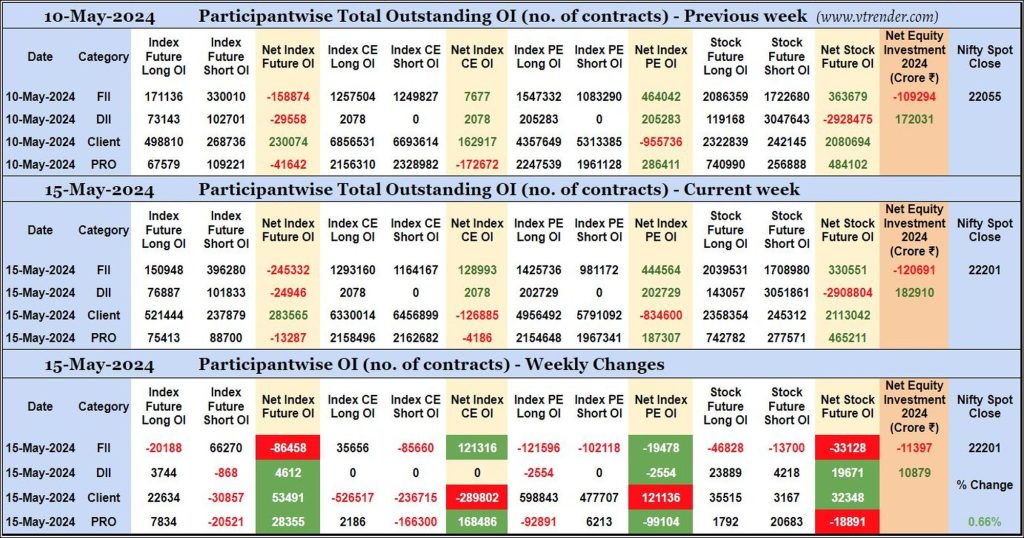

Participantwise Open Interest (Mid-week changes) – 15th MAY 2024

FIIs have added 66K short Index Futures and 35K long Index CE contracts so far this week besides liquidating 20K long Index Futures contracts and covering 85K short Index CE contracts. They have shed Open Interest in Index PE and Stocks Futures during the week.

FIIs have been net sellers in equity segment for ₹11397 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 15th MAY 2024

MO at 4