Market Profile Analysis dated 14th May 2024

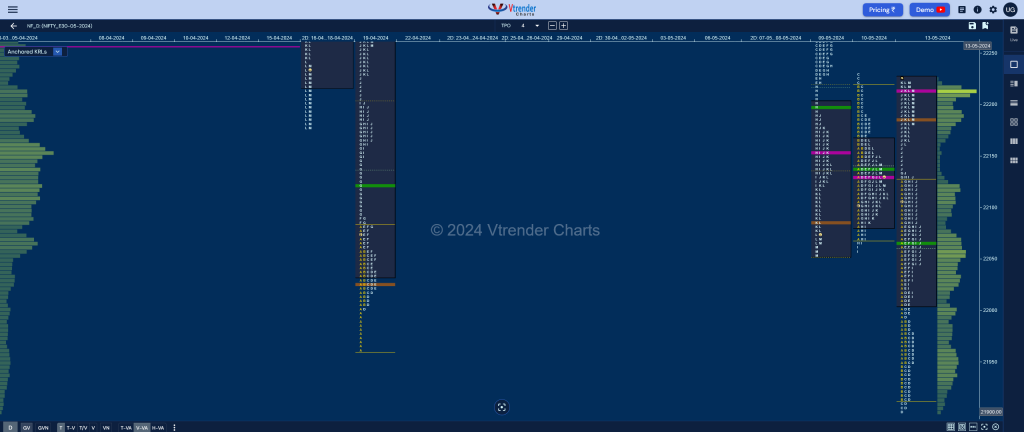

Nifty May F: 22308 [ 22364 / 22160 ] Open Type OA (Open Auction) Volumes of 32,200 contracts Average Initial Balance 100 points (22260 – 22160) Volumes of 72,517 contracts Average Day Type Trend – 205 pts Volumes of 2,66,745 contracts Below average to be updated… Click here to view the latest profile in NF on […]

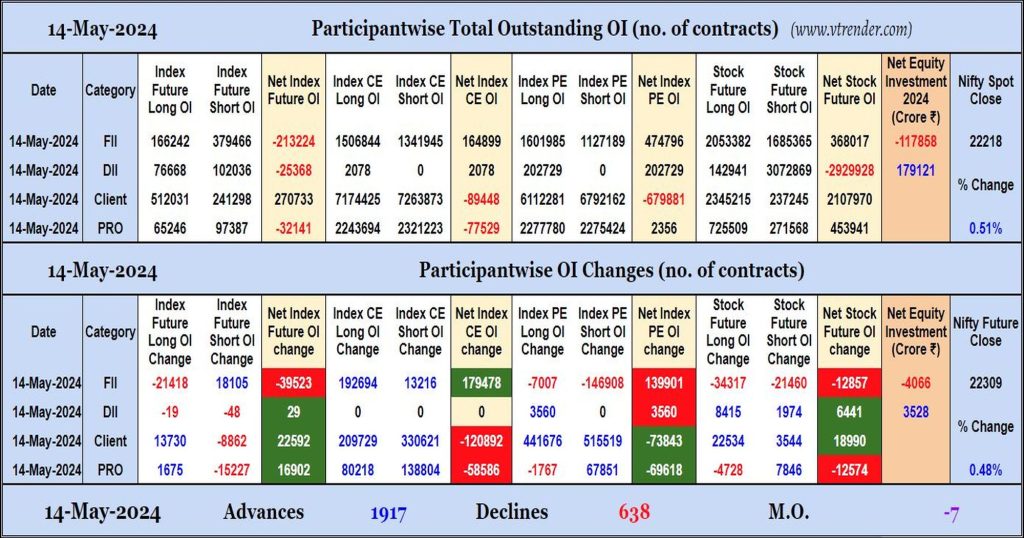

Participantwise Open Interest (Daily changes) – 14th MAY 2024

FIIs have added shorts in Index Futures but net longs in Index CE. They have been net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 14th MAY 2024

MO at -7

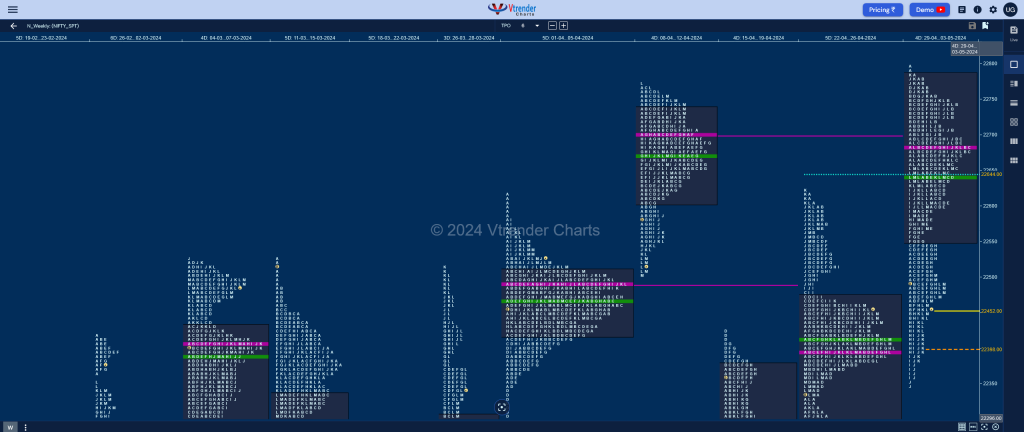

Market Profile Analysis dated 13th May 2024

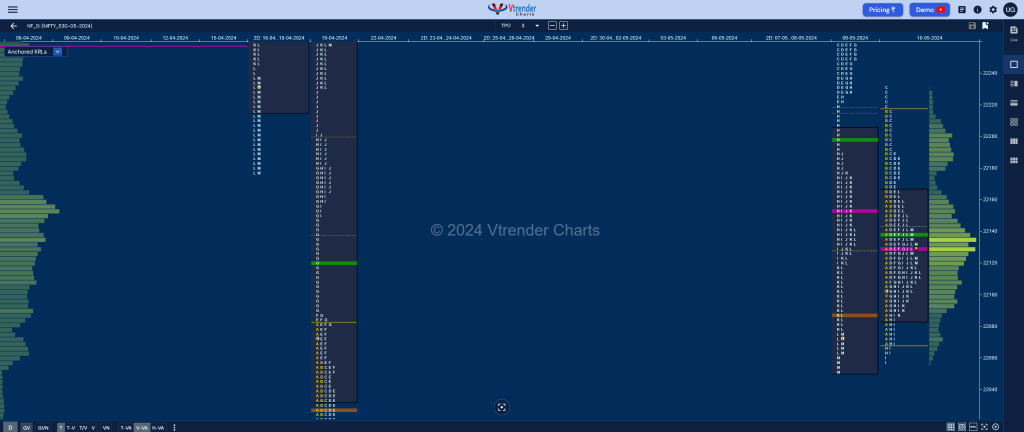

Nifty May F: 22140 [ 22230 / 22050 ] Open Type OTD (Open Test Drive) Volumes of 29,577 contracts Average Initial Balance 225 points (22140 – 21815) Volumes of 91,239 contracts Above average Day Type ‘Neutral Extreme‘ – 325 pts Volumes of 3,41,795 contracts Above average to be updated… Click here to view the latest profile […]

Market Profile Analysis dated 10th May 2024

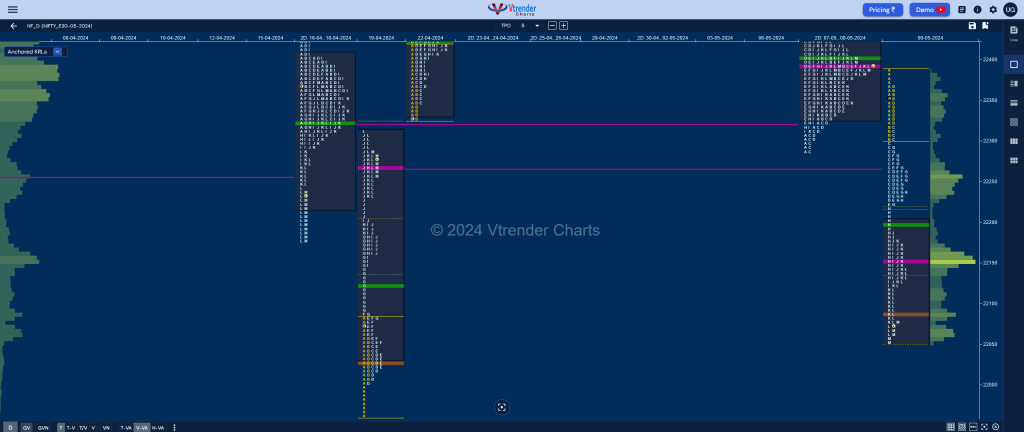

Nifty May F: 22140 [ 22230 / 22050 ] Open Type OAIR (Open Auction In Range) Volumes of 35,500 contracts Average Initial Balance 150 points (22217 – 22068) Volumes of 96,163 contracts Above average Day Type ‘Neutral Centre‘ – 179 pts Volumes of 2,86,527 contracts Below average to be updated… Click here to view the latest […]

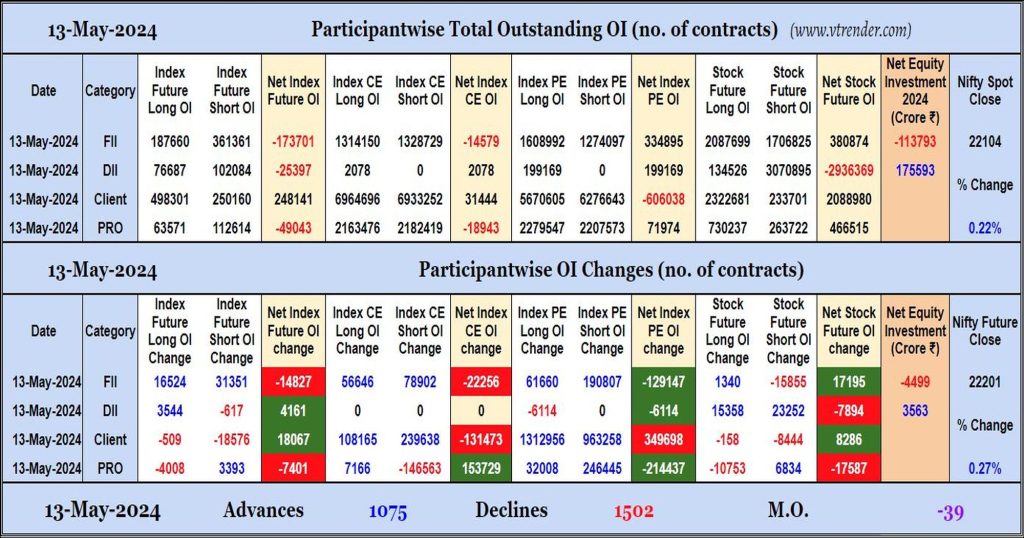

Participantwise Open Interest (Daily changes) – 13th MAY 2024

FIIs have added net shorts in Index Futures and Index Options. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 13th MAY 2024

MO at -39

Weekly Spot Charts (06th to 10th May 2024) and Market Profile Analysis

Nifty Spot: 22055 [ 22588 / 21932 ] Monday – Nifty opened higher making an attempt to get back into previous week’s Value but got rejected leaving an A period selling tail from 22542 to 22588 indicating that the PLR (Path of Least Resistance) was to the downside and made lows of 22409 forming a Normal […]

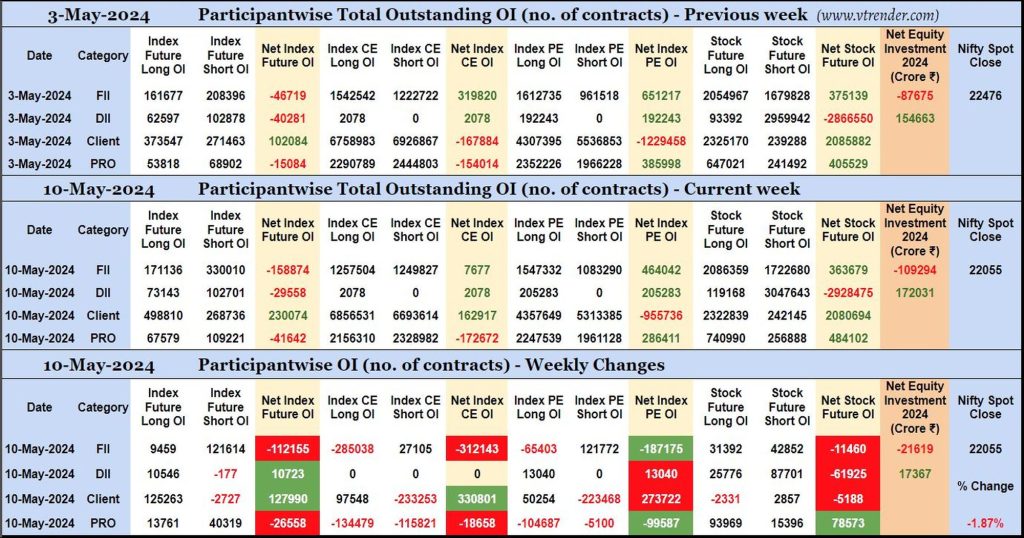

Participantwise Open Interest (Weekly changes) – 10th MAY 2024

FIIs have added net 112K short Index Futures, 27K short Index CE, 121K short Index PE and net 11K short Stocks Futures contracts this week besides liquidating 285K long Index CE and 65K long Index PE contracts.

FIIs have been net sellers in equity segment for ₹21619 crore during the week.

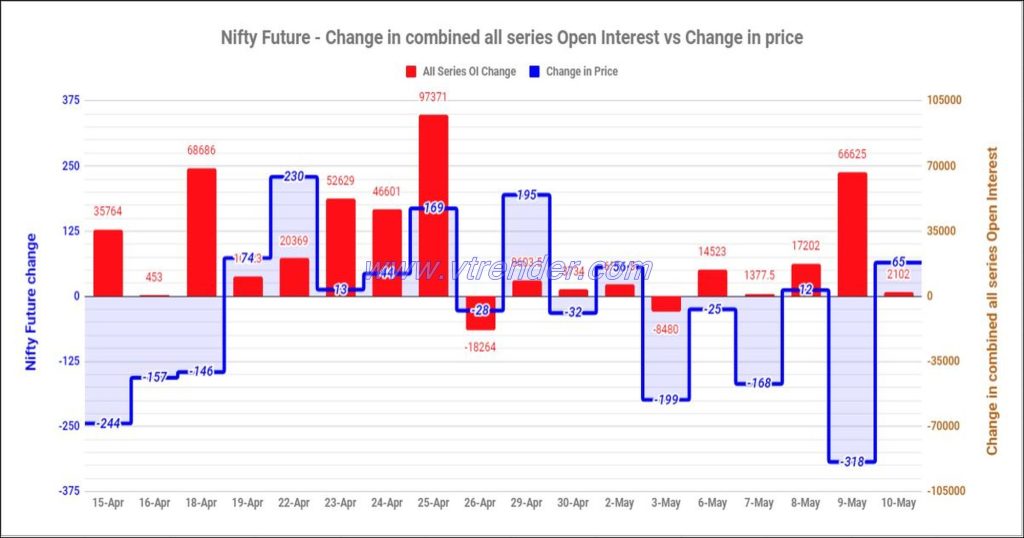

Nifty and Banknifty Futures with all series combined Open Interest – 10th MAY 2024

Nifty & Banknifty combined Open Interest across all series & change in OI