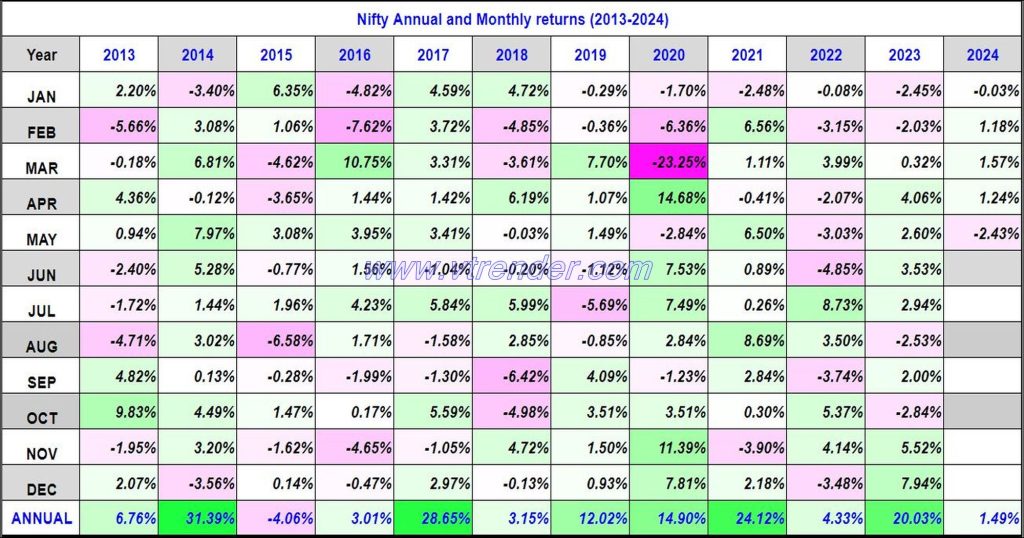

Nifty 50 Monthly and Annual returns (1991-2024) updated 10th MAY 2024

Nifty50 returns Year 2024 1.49% / Nifty50 returns MAY 2024 -2.43%

Desi MO (McClellans Oscillator for NSE) – 10th MAY 2024

MO at -38

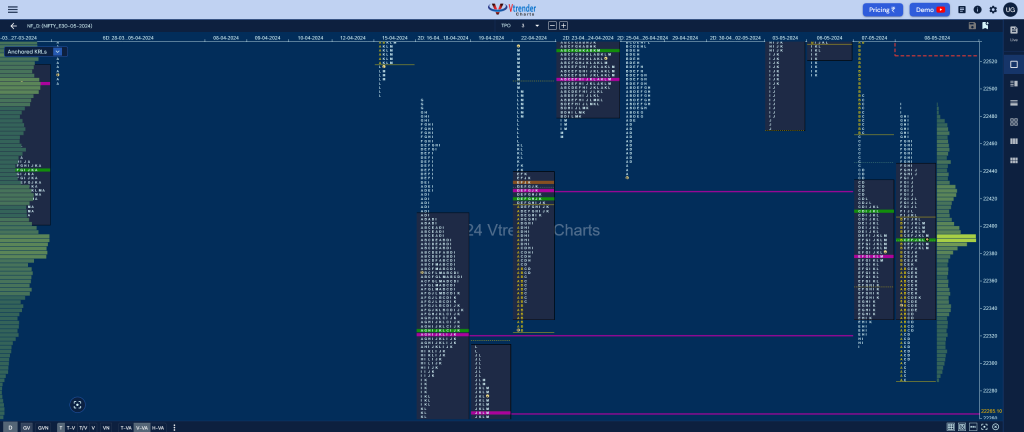

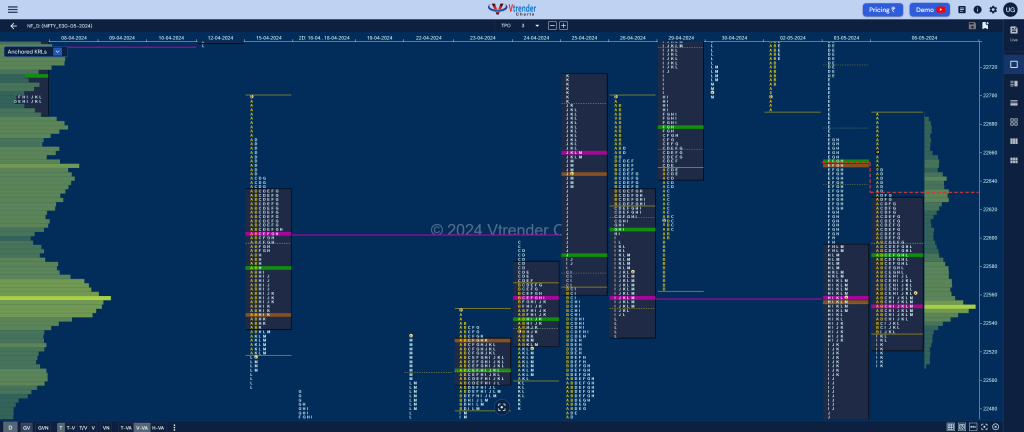

Market Profile Analysis dated 09th May 2024

Nifty May F: 22075 [ 22388 / 22051 ] Open Type OAIR (Open Auction In Range) Volumes of 31,370 contracts Average Initial Balance 88 points (22388 – 22051) Volumes of 77,990 contracts Average Day Type ‘Trend‘ – 337 pts Volumes of 4,65,931 contracts Above average to be updated… Click here to view the latest profile in […]

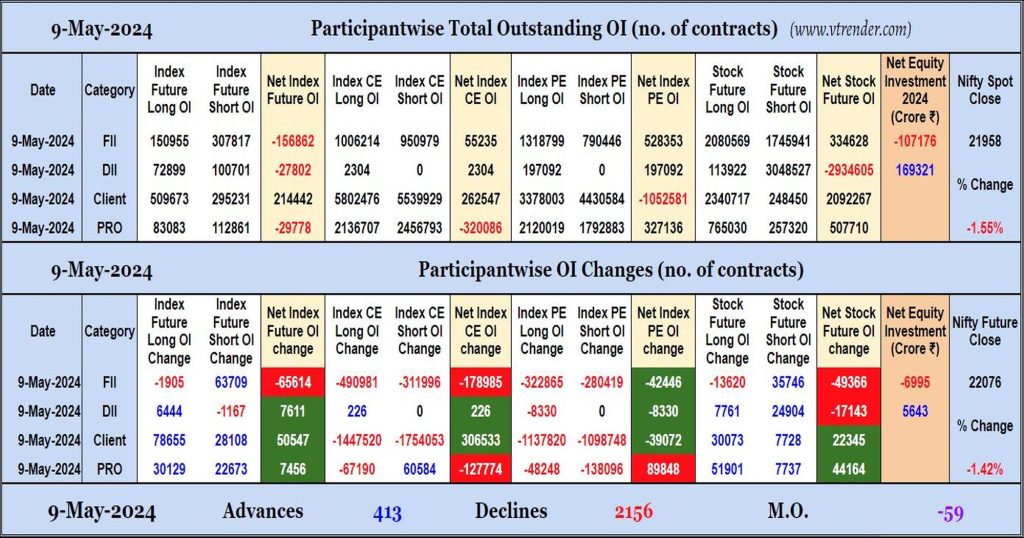

Participantwise Open Interest (Daily changes) – 9th MAY 2024

FIIs have added shorts in Index and Stocks Futures while shedding Open Interest in Index Options. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 9th MAY 2024

MO at -59

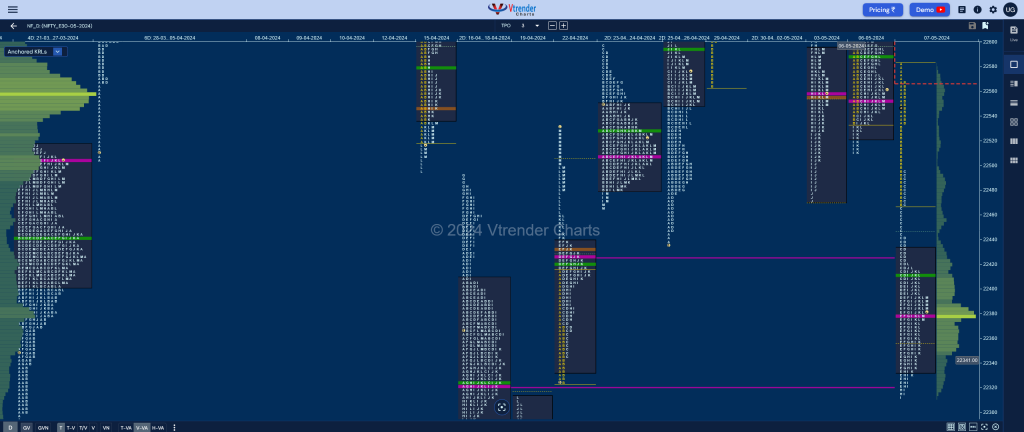

Market Profile Analysis dated 08th May 2024

Nifty May F: 22393 [ 22490 / 22286 ] Open Type OA (Open Auction) Volumes of 29,672 contracts Below average Initial Balance 110 points (22405 – 22285) Volumes of 62,255 contracts Average Day Type ‘Normal Variation‘ – 204 pts Volumes of 2,99,555 contracts Average It was back to balance in NF as it opened with a […]

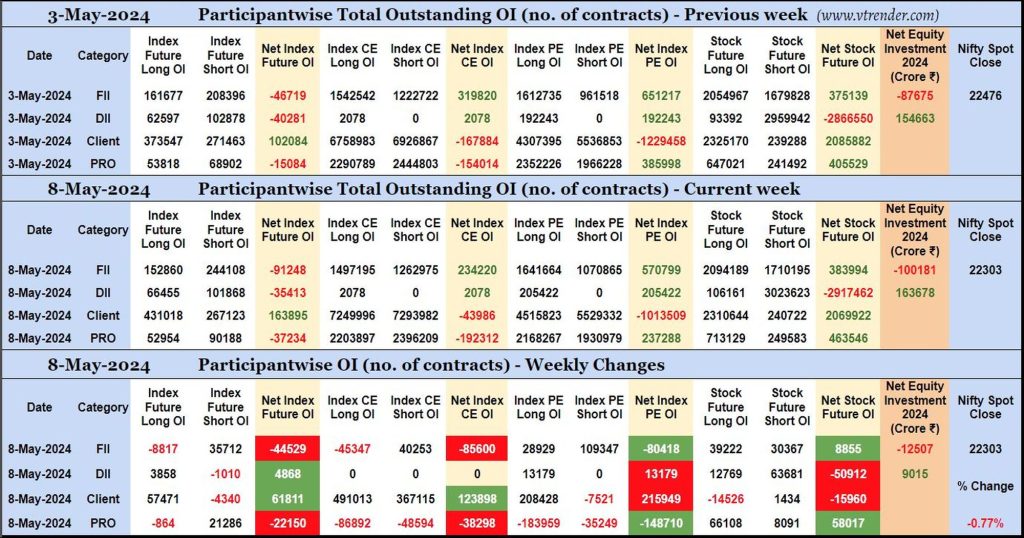

Participantwise Open Interest (Mid-week changes) – 8th MAY 2024

FIIs have added 35K short Index Futures, 40K short Index CE, net 80K short Index PE and net 8K long Stocks Futures contracts during the current week besides liquidating 8K long Index Futures and 45K long Index CE contracts.

FIIs have been net sellers in equity segment for ₹12507 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 8th MAY 2024

MO at -30

Market Profile Analysis dated 07th May 2024

Nifty May F: 22381 [ 22591 / 22312 ] Open Type OAIR (Open Auction In Range) Volumes of 13,534 contracts Below average Initial Balance 124 points (22591 – 22467) Volumes of 48,125 contracts Above average Day Type ‘Normal Variation‘ – 278 pts Volumes of 2,80,721 contracts Average NF resumed the imbalance after the pause in the […]

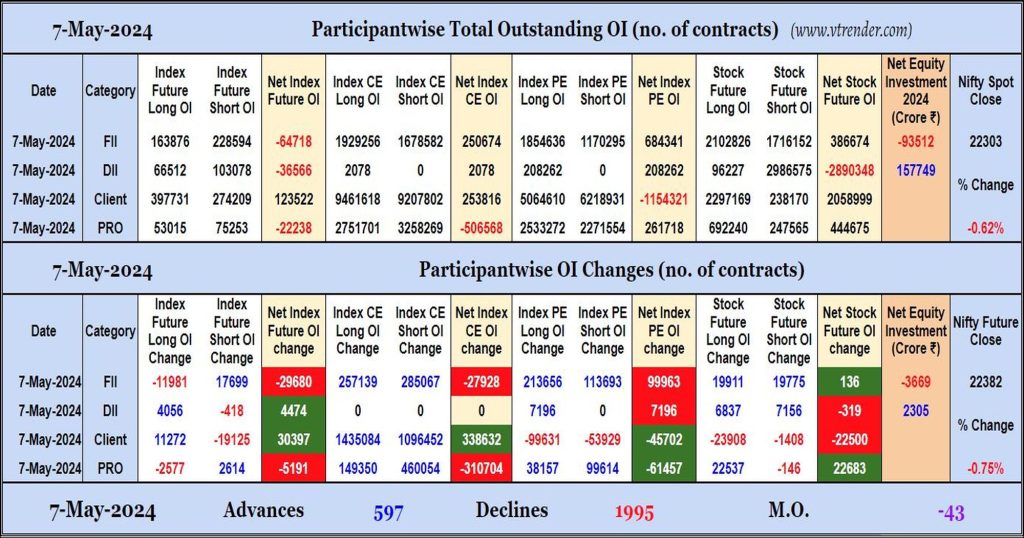

Participantwise Open Interest (Daily changes) – 7th MAY 2024

FIIs have added net shorts in Index Futures and Index CE while adding net longs in Index PE. They were net sellers in equity segment too.