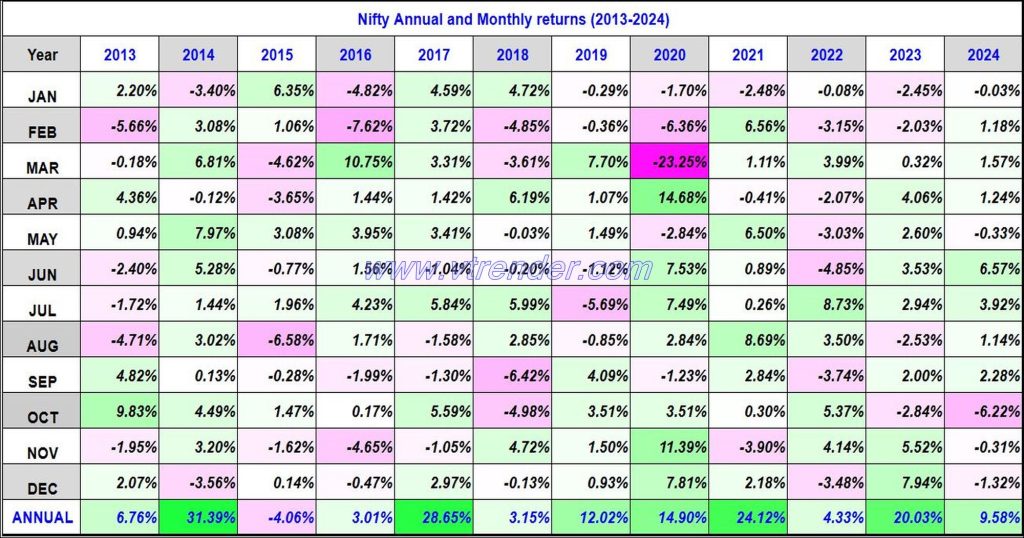

Nifty 50 Monthly and Annual returns (1991-2024) updated 27th DEC 2024

Nifty50 returns Year 2024 9.58% / Nifty50 returns DEC 2024 -1.32%

Desi MO (McClellans Oscillator for NSE) – 27th DEC 2024

MO at -43

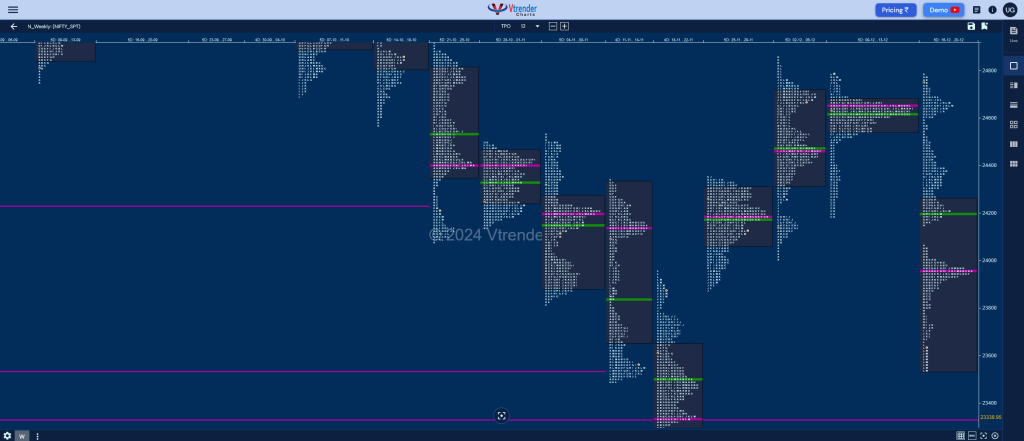

Weekly Spot Charts (23rd to 27th Dec 2024) and Market Profile Analysis

Nifty Spot: 23813 [ 23938 / 23647 ] Normal (Inside Bar) Previous week’s report ended with this ‘Nifty has formed an elongated 1244 point range Triple Distribution Trend Down weekly profile with extension handles at 24601, 24149 & 23796 and a close with a spike from 23676 to 23537 which will be the immediate zone to […]

Market Profile Analysis dated 26th Dec 2024

Nifty Jan F: 23919 [ 24026 / 23709 ] Open Type OAIR (Open Auction) Volumes of 15,736 contracts Below average Initial Balance 116 points (24026 – 23911) Volumes of 52,598 contracts Below average Day Type Normal Variation – 217 pts Volumes of 2,45,279 contracts Below average NF continued the balance mode as it remained inside last […]

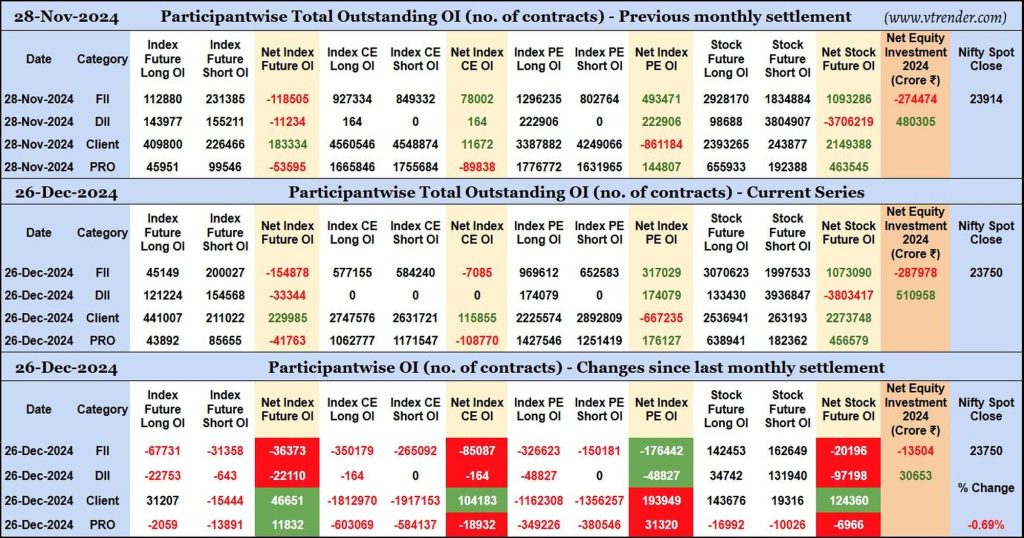

Participantwise Open Interest (Series changes) – 26th DEC 2024

FIIs have added net 20K short Stocks Futures contracts since November settlement while shedding Open Interest in Index Futures, Index CE and Index PE.

FIIs were net sellers in equity segment for ₹13504 crore during December series.

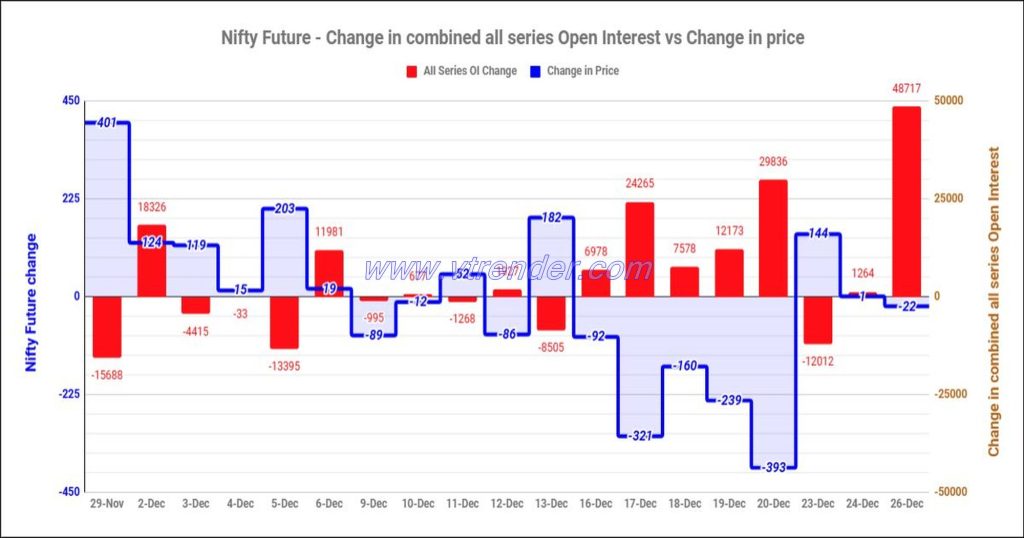

Nifty and Banknifty Futures with all series combined Open Interest – 26th DEC 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

Desi MO (McClellans Oscillator for NSE) – 26th DEC 2024

MO at -52

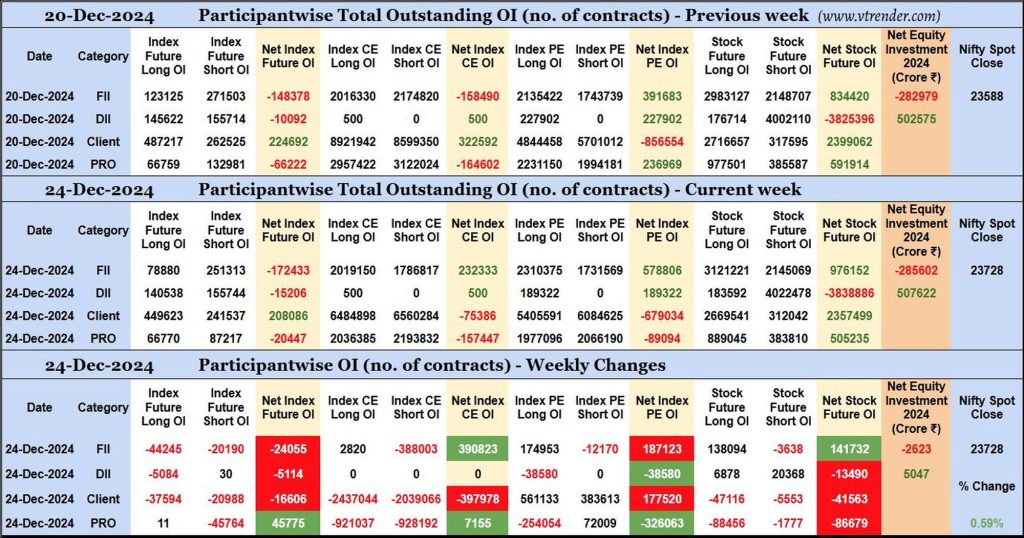

Participantwise Open Interest (Mid-week changes) – 24th DEC 2024

FIIs have added 2K long Index CE, 174K long Index PE and 138K long Stocks Futures contracts in this week so far besides covering 388K short Index CE, 12K short Index PE and 3K short Stocks Futures contracts. They have also shed Open Interest in Index Futures.

FIIs have been net sellers in equity segment for 2623 crore during the running week.

Desi MO (McClellans Oscillator for NSE) – 24th DEC 2024

MO at -52

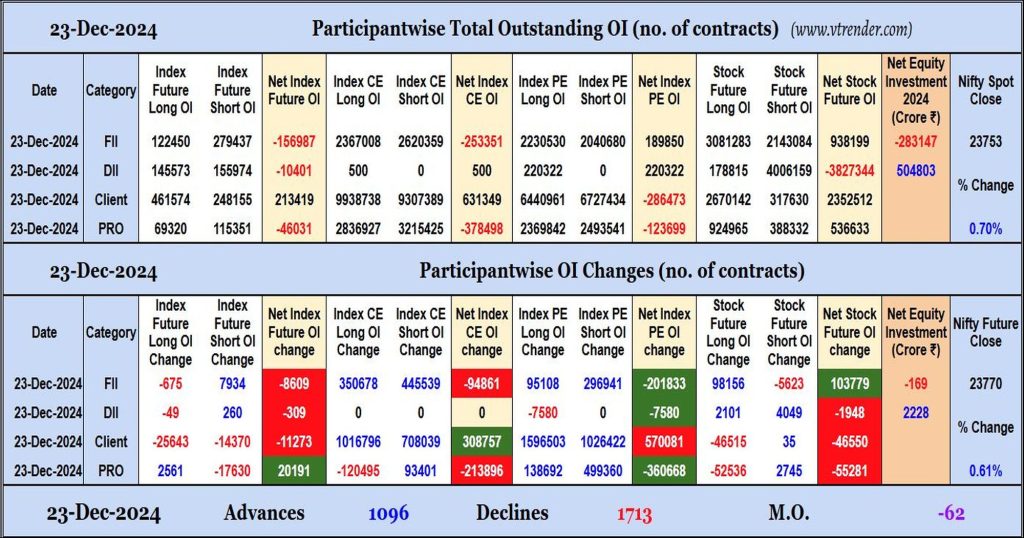

Participantwise Open Interest (Daily changes) – 23rd DEC 2024

FIIs have added net shorts in Index Futures, Index CE and Index PE while adding net longs in Stocks Futures. They were net sellers in equity segment.