Desi MO (McClellans Oscillator for NSE) – 28th OCT 2024

MO at -46

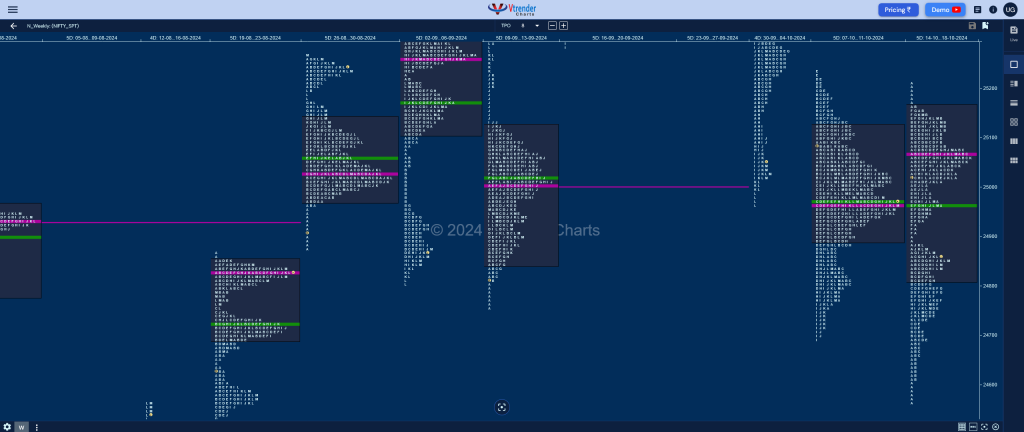

Weekly Spot Charts (21st to 25th Oct 2024) and Market Profile Analysis

Nifty Spot: 24180 [ 24978 / 24073 ] Trend (Down) Previous week’s report ended with this ‘Value was overlapping at both ends at 24815-25064-25160 as the auction failed to move away from previous week’s balance as seen with tails at both ends so will need to negate either 24611 on the downside for a probe towards […]

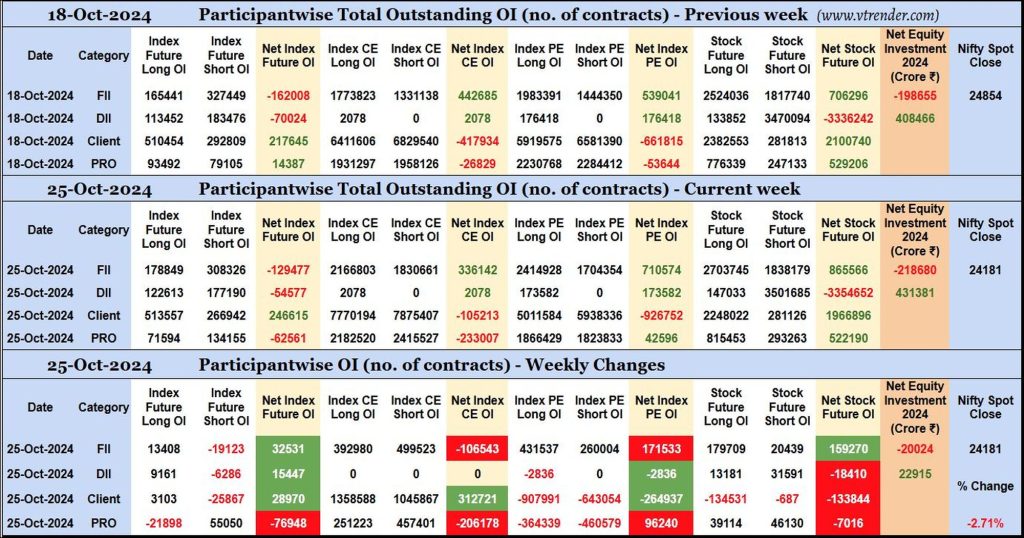

Participantwise Open Interest (Weekly changes) – 25th OCT 2024

FIIs have added 13K long Index Futures, net 106K short Index CE, net 171K long Index PE and net 159K long Stocks Futures contracts this week besides covering 19K short Index Futures contracts.

FIIs have been net sellers in equity segment for ₹20024 crore during the week.

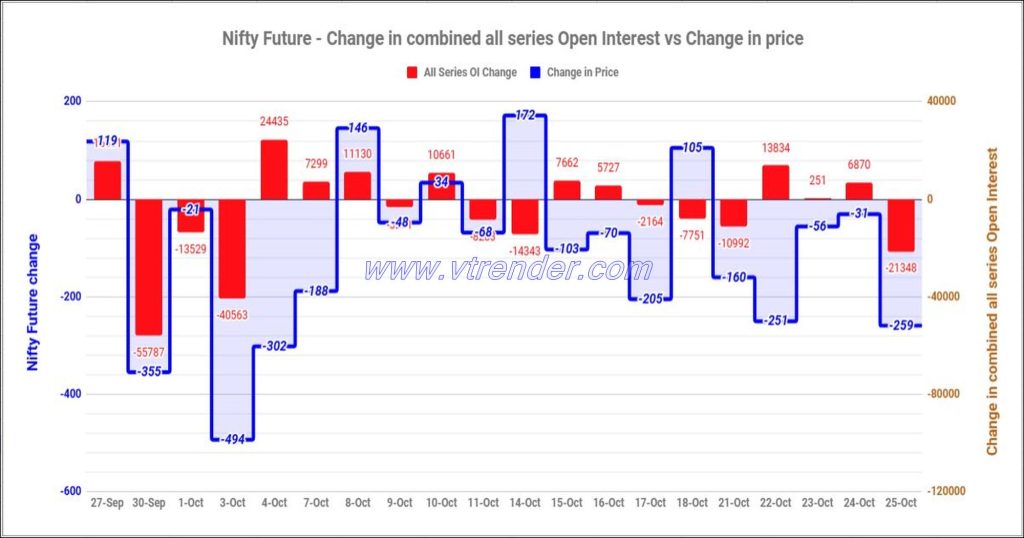

Nifty and Banknifty Futures with all series combined Open Interest – 25th OCT 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

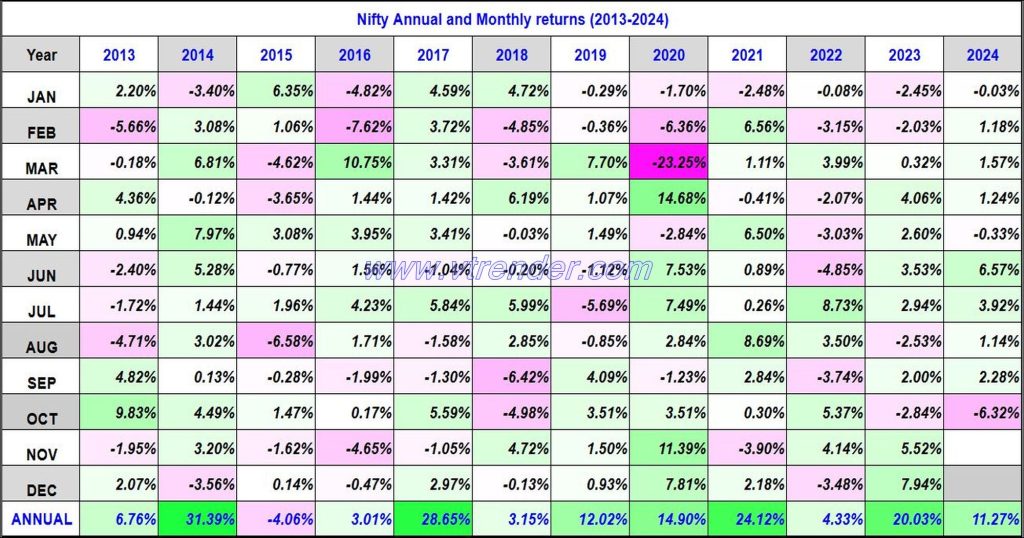

Nifty 50 Monthly and Annual returns (1991-2024) updated 25th OCT 2024

Nifty50 returns Year 2024 11.27% / Nifty50 returns OCT 2024 -6.32%

Desi MO (McClellans Oscillator for NSE) – 25th OCT 2024

MO at -78

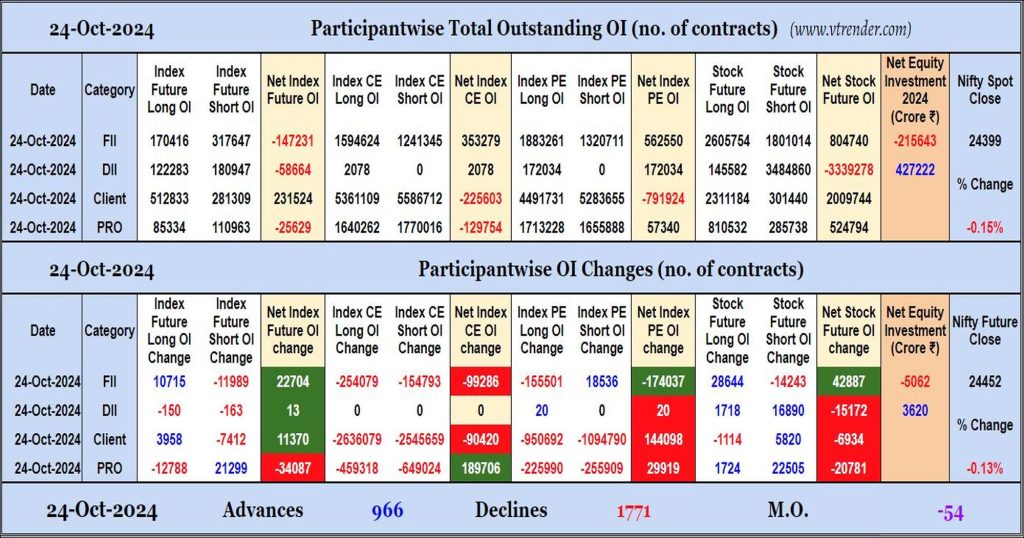

Participantwise Open Interest (Daily changes) – 24th OCT 2024

FIIs have added net longs in Index & Stocks Futures and net shorts in Index PE. They continued selling in equity segment.

Desi MO (McClellans Oscillator for NSE) – 24th OCT 2024

MO at -54

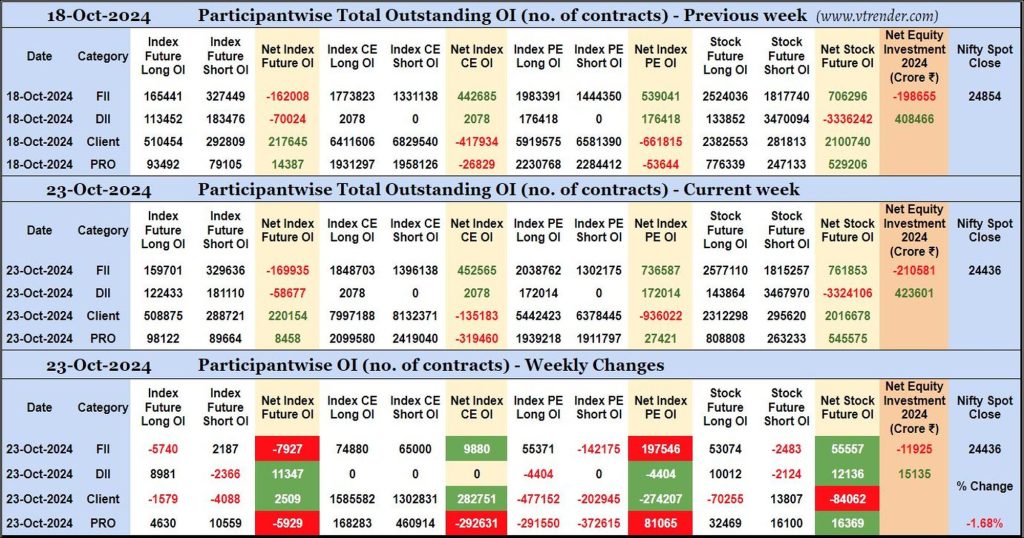

Participantwise Open Interest (Mid-week changes) – 23rd OCT 2024

FIIs have added 2K short Index Futures, net 9K long Index CE, 55K long Index PE and 53K long Stocks Futures contracts so far this week besides liquidating 5K long Index Futures contracts, covering 142K short Index PE contracts and 2K short Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹11925 crore during the running week.

Desi MO (McClellans Oscillator for NSE) – 23rd OCT 2024

MO at -50