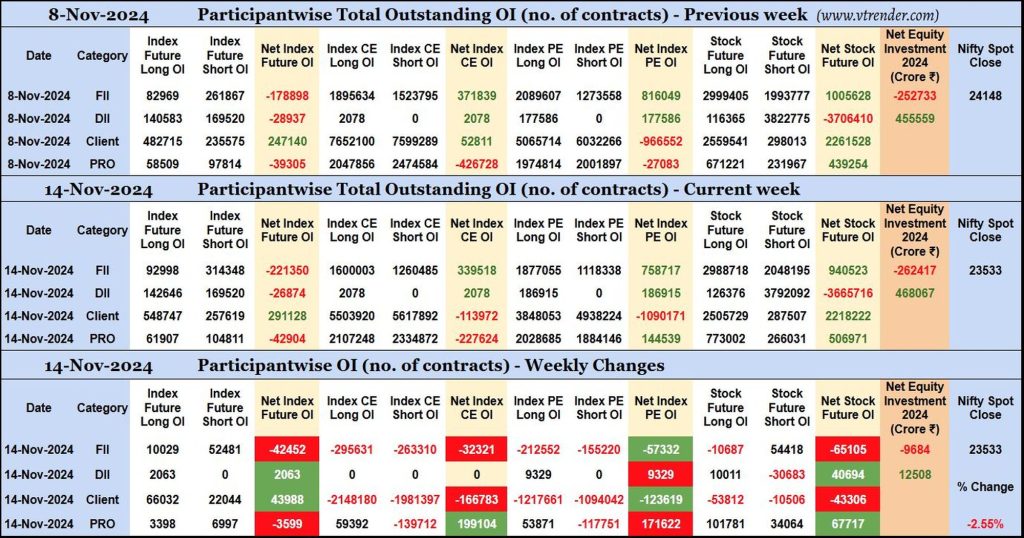

Participantwise Open Interest (Weekly changes) – 14th NOV 2024

FIIs have added net 42K short Index Futures and 54K short Stocks Futures contracts this week besides liqudating 10K long Stocks futures contracts and shedding Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹9684 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 14th NOV 2024

MO at -41

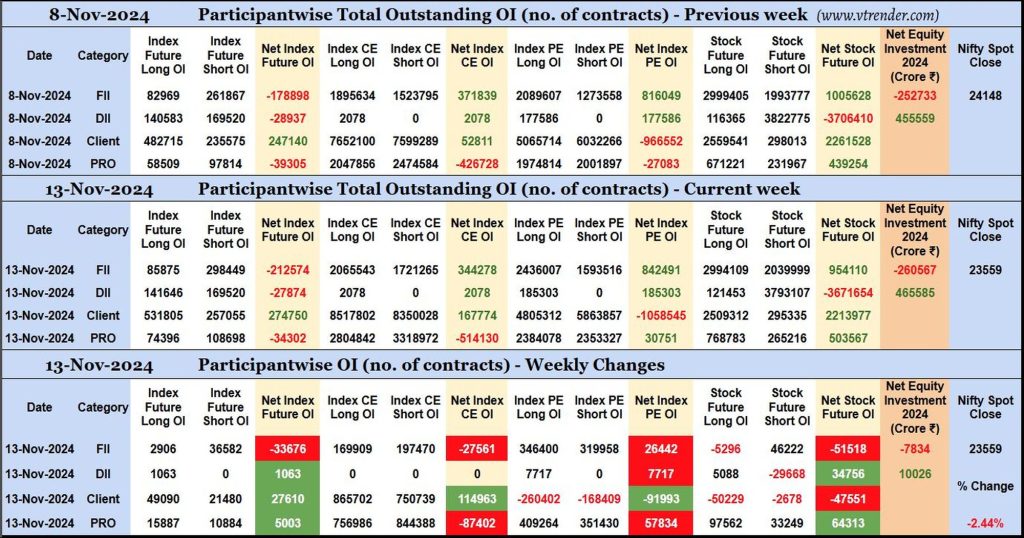

Participantwise Open Interest (Mid-week changes) – 13th NOV 2024

FIIs have added net 33K short Index Futures, net 27K short Index CE, net 26K long Index PE and 46K short Stocks Futures contracts so far this week while liquidating 5K long Stocks Futures contracts.

FIIs have been net sellers in equity segment for 7834 crore during current week.

Desi MO (McClellans Oscillator for NSE) – 13th NOV 2024

MO at -54

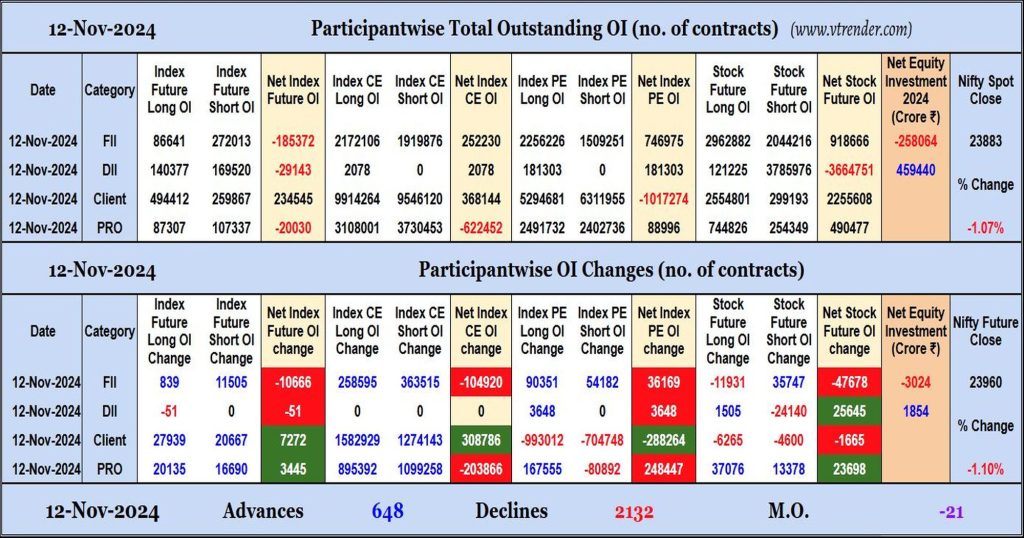

Participantwise Open Interest (Daily changes) – 12th NOV 2024

FIIs have added net shorts in Index Futures, Stocks Futures and Index CE while adding net longs in Index PE. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 12th NOV 2024

MO at -21

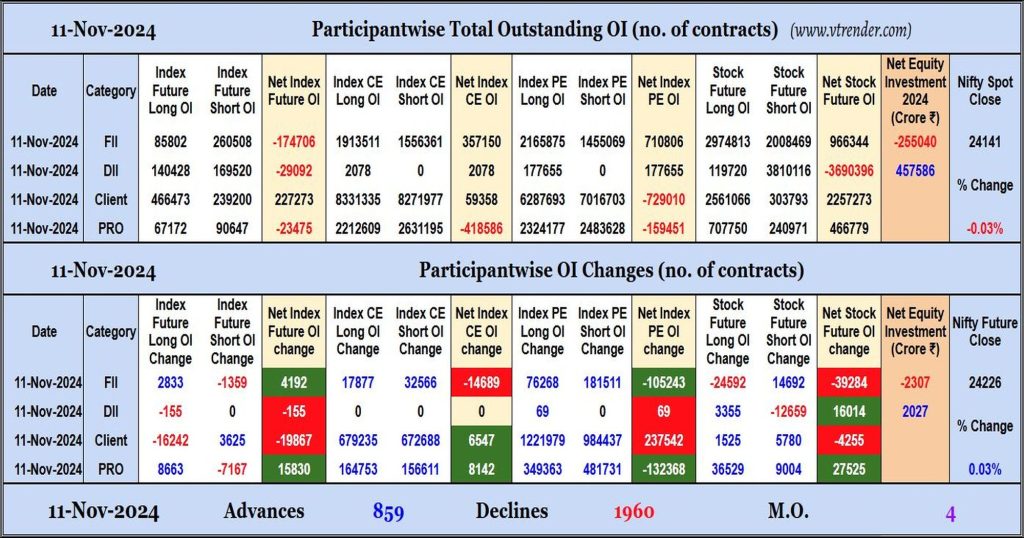

Participantwise Open Interest (Daily changes) – 11th NOV 2024

FIIs have added net longs in Index Futures while adding net shorts in Index CE, Index PE and Stocks Futures. They remained net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 11th NOV 2024

MO at 4

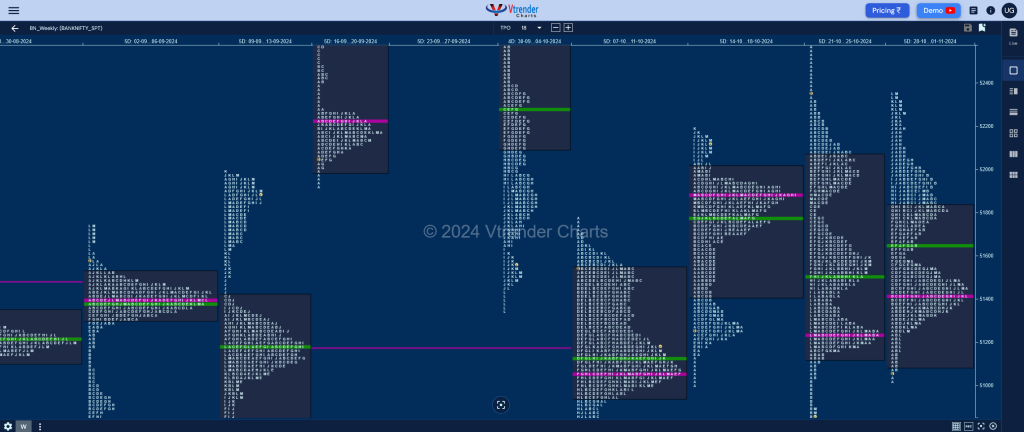

Weekly Spot Charts (04th to 08th Nov 2024) and Market Profile Analysis

Nifty Spot: 24148 [ 24537 / 23816 ] Outside Bar Previous week’s report ended with this ‘The weekly profile is a Normal Gaussian Curve of mere 363 points as the auction tested the 24400-24451 zone multiple times on the upside but could not sustain whereas on the downside it confirmed a FA (Failed Auction) at 24140 […]

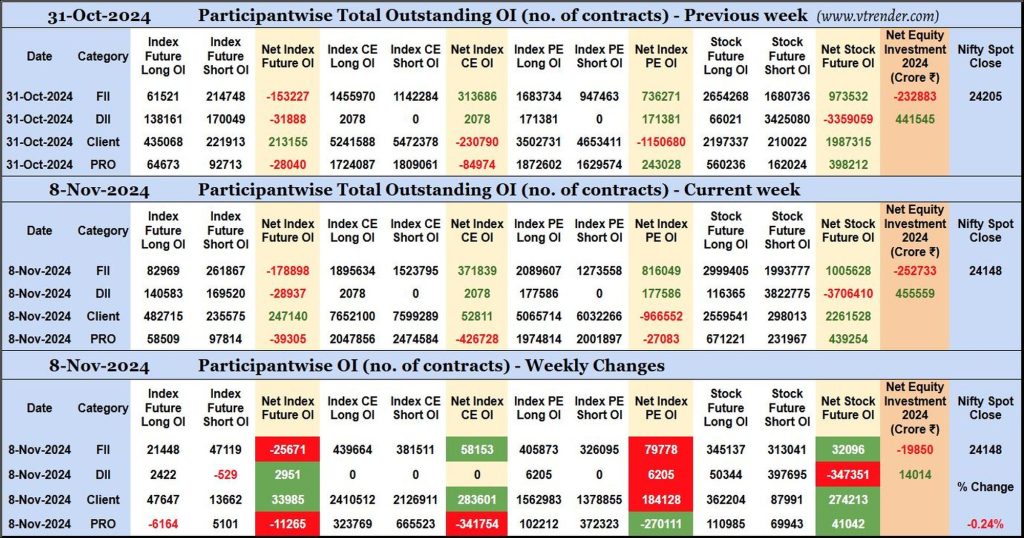

Participantwise Open Interest (Weekly changes) – 8th NOV 2024

FIIs have added net 25K short Index Futures, net 58K long Index CE, net 79K long Index PE and net 32K long Stocks Futures contracts this week.

FIIs have been net sellers in equity segment for ₹19850 crore during the week.