Decoding Market Profile: Mastering Trading Through Behavioral Insights

Introduction to Market Dynamics The trading landscape is a complex ecosystem, woven from the threads of psychological patterns, strategic analysis, and the relentless pursuit of understanding market behaviors. Recently, conversations initiated on my Twitter account (@Am_Shai) have illuminated the nuanced facets of Market Profile, sparking enriching discussions and leading to a cascade of email dialogues. […]

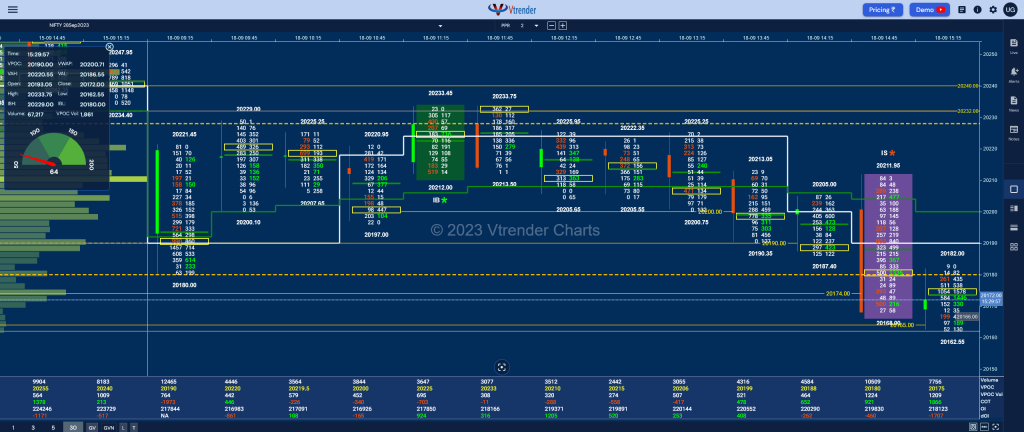

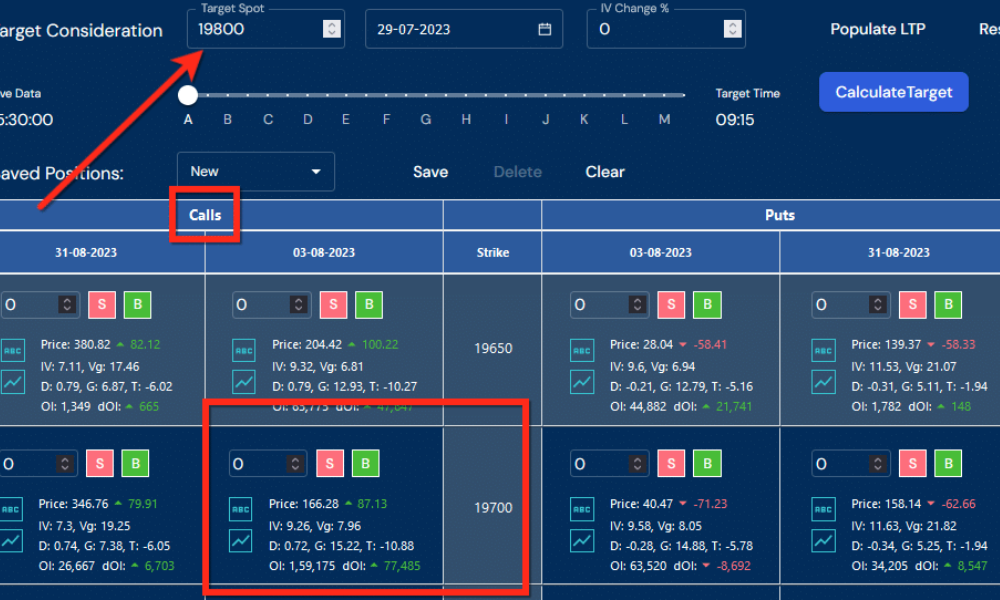

the Power of OrderFlow Charts: A Beginner’s Guide to Navigating NSE Options and Futures

Introduction: Welcome to the dynamic world of trading, where understanding the nuances of market data can significantly enhance your trading decisions. Today, we’re diving into an essential tool for any trader’s arsenal – the OrderFlow chart. Unlike traditional price charts, OrderFlow charts provide a deeper insight into the buying and selling pressure behind price movements, […]

Working with Market Orders in Orderflow: A Trader’s Guide

Unravel the mysteries of market orders in orderflow trading with our comprehensive guide. Dive into the dynamics of Delta, the aggressive nature of Initiative Buyers and Sellers, and the profound impact of market orders on price bars. Whether you’re a novice or a seasoned trader, this guide illuminates the path to mastering market movements and crafting winning strategies in the fast-paced world of trading.

What professional traders focus on!

Despite trading in identical markets and adhering to similar timings, traders diverge significantly in their strategies. In simple terms, the world of trading splits into two groups: Amateur Traders and Professional Traders What sets amateur traders apart from the pros? Amateurs get get bogged down by intricate chart analysis. >> They struggle to identify clear […]

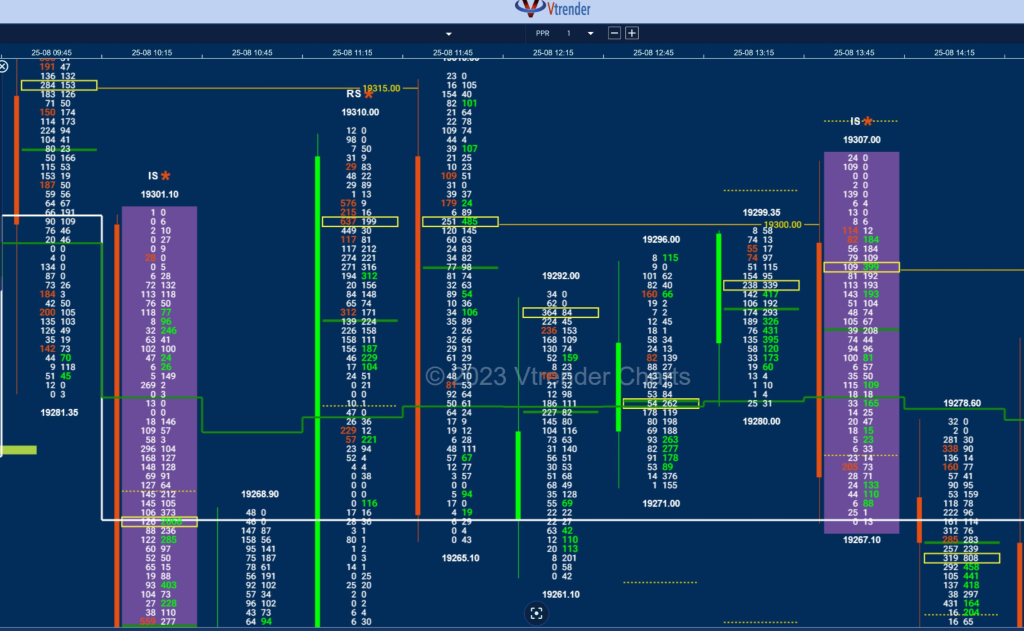

The Big Open Interest addition in Banknifty on 0410

Yesterday there was a large addition in the Banknifty Futures What happened? The bigger question for us as traders, where did it happen Check the video for more The Open Interest and the Orderflow charts can be seen at charts.vtrender.com Login to break free with charts with a real edge

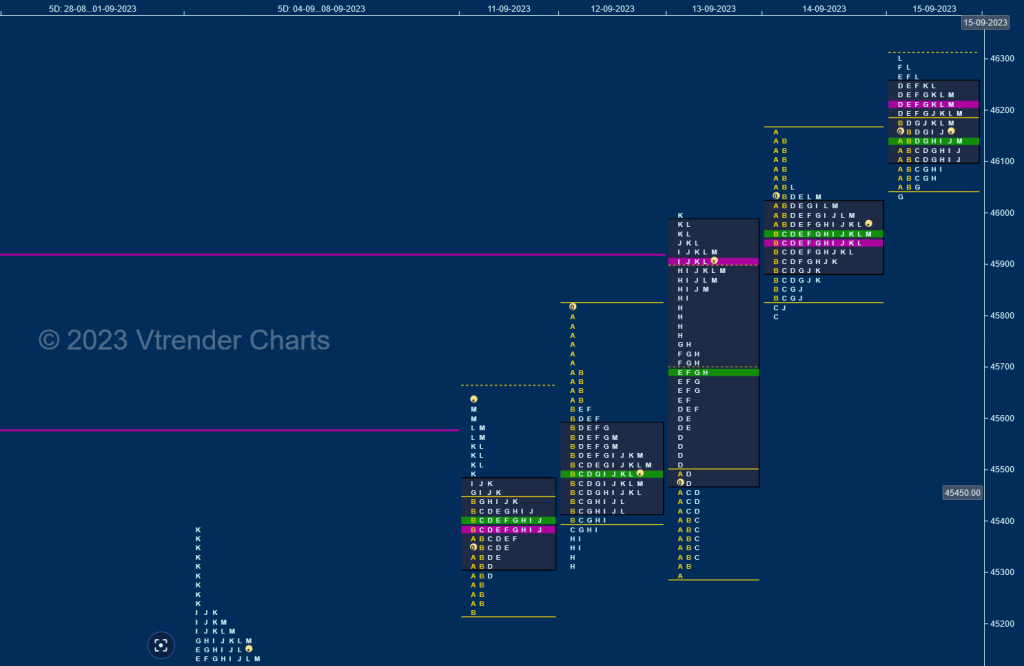

How to trade Midcap Nifty next week

There are 2 settlements for midcap nifty next week. This is what you need to know Trade well. The charts are at – https://charts.vtrender.com/ For a proper understanding of how to use the MarketProfile go to- https://vtrender.com/ecourse/

The Nuances of Traded Volumes in Order Flow

Traded Volumes in Order Flow – A New Perspective In the complex world of derivative trading, one cannot underestimate the role of traded volumes in predicting future market moves. Even seasoned traders occasionally find themselves “upside down,” a situation where their trading positions are at odds with the prevailing market direction. This article delves deep […]

Understanding Volatility: Historical vs. Implied and Deciphering the VIX

Volatility a key concept of Option Trading In the world of trading and finance, volatility is a key concept that every trader should be familiar with. It provides insights into the expected price fluctuations of the instrument you trade. In this post, we’ll delve into the differences between historical volatility and implied volatility, explain how […]

Unraveling the Mysteries of Open Interest: A Beginner’s Guide to Options Trading

Exploring Open Interest in Options Trading: A Beginner’s Guide In the world of Options Trading, one of the most fundamental terms you’ll come across is “Open Interest,” and the manner in which it interacts with delta, gamma, and volume can initially seem complicated. In this article, we’ll shed light on these concepts, simplifying them to […]

The Greeks: A Beginner’s Guide to Understanding Option Prices

Options: A powerful tool for managing risk and generating profit Options are a powerful tool that can be used to manage risk and generate profit. They give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. This means that […]