A look at Market Structure ahead of the new October series

We did a webinar with team Vtrender on Thursday post close and looked at the structure of the Nifty and the Banknifty ahead of the new series of October. Here is a quick look at some clips from the webinar. Hope it helps

Of our working process through 2021 – with MarketProfile and Orderflow

We have had a great run through the year 2021 with our Order Flow charts and the trading process we have finetuned at Vtrender using the MarketProfile process. It has helped deliver in up, down and sideways markets. Here is a screenshot of the YTD performance There have been months in the year where the Nifty has […]

AMA on 23rd June in the VTR

The details of the #AMA in the Trading Room on 23rd June 2020 09:48 Shai: @everyone, since the market is quiet, we will do an open AMA session from 10.15 am to 10.45 am today. Ask me anything you want on MarketProfile, OrderFlow and the charts. LIve from 10.15 to 10.45, bring along your questions 10:14 Govind : […]

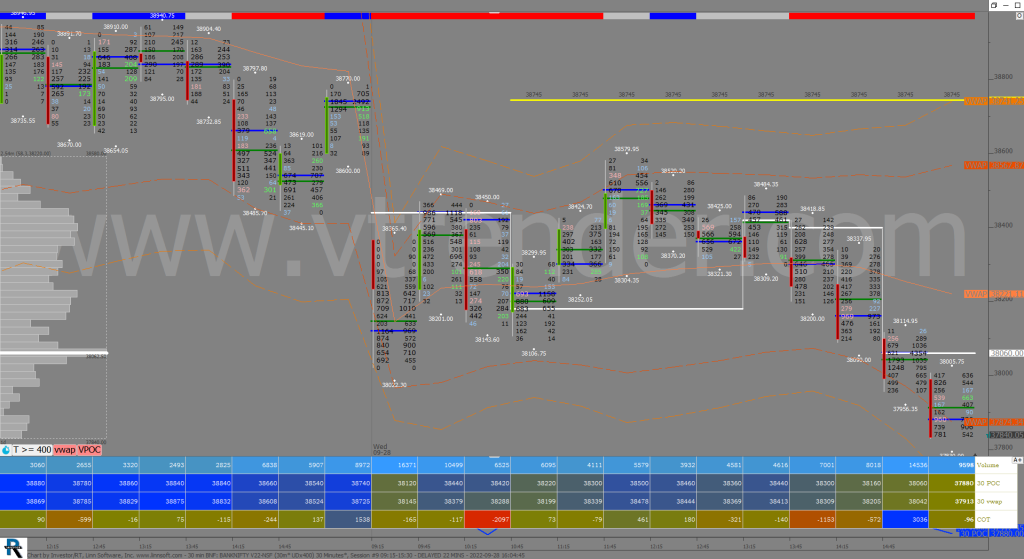

Order Flow charts dated 19th Oct

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF (30 […]

Market Profile Charts dated 19th Oct

Through a Market Profile chart , a trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Market Profile provides traders with vision into […]

Market Profile analysis dated 09th Oct

Yesterday we had noted the presence of a seller at 10415 and mentioned as much in yesterday’s report – https://vtrender.com/market-profile-analysis-dated-08th-oct/. What stood out yesterday also was the Failed auction at 10212. In today’s auction, we got a Failed Auction at 10424 and a very sharp responsive seller at 10421. I have seen this kind of […]

Market Profile analysis dated 08th Oct

The early morning auction was a hint that the Buyers were more keen on a fight this week and would not allow the Sellers to walk over them easily, as what happened last week. So from a low of 10232 early in the day the Buyers looked confident and took the auction over to 10415 where […]

Order Flow charts dated 03rd Oct ( 5 mins)

Many traders are used to viewing volume as a histogram beneath a price chart. But the OrderFlow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of price the market traded […]

Market Profile analysis dated 01st Oct

The second day of the new series of October also saw an aggressive 2-way auction but there was a role reversal between the buyers and the sellers today. Today it was the turn of the responsive buyers who struck out against the aggressive sellers of the Open and managed to turn the intra day trend […]

Market Profile analysis dated 28th Sept

The first day of the new series of October saw an aggressive 2-way auction with a seller at the open being countered by a responsive buyer who pushed the market back to session highs. But there was an inability to stay above the 11088 F zone and the sellers took control driving the market lower […]