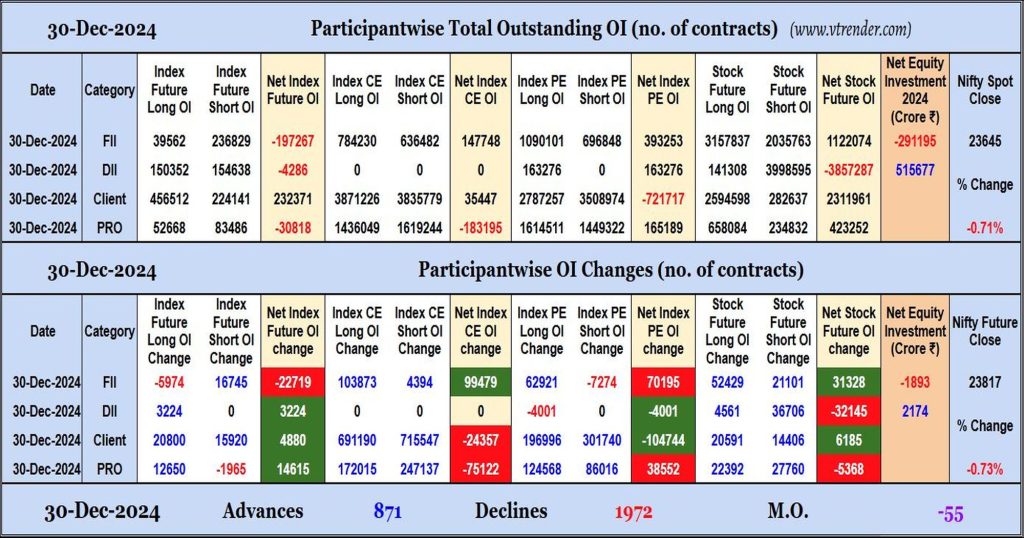

Participantwise Open Interest (Daily changes) – 30th DEC 2024

FIIs have added net shorts in Index Futures while adding net longs in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment.

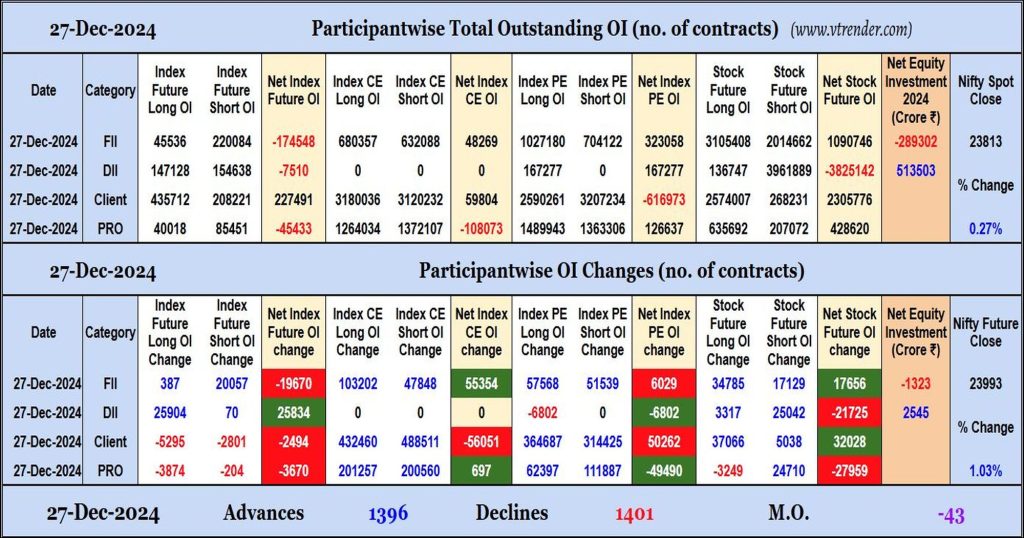

Participantwise Open Interest (Daily changes) – 27th DEC 2024

FIIs have added net shorts in Index Futures while adding net longs in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment.

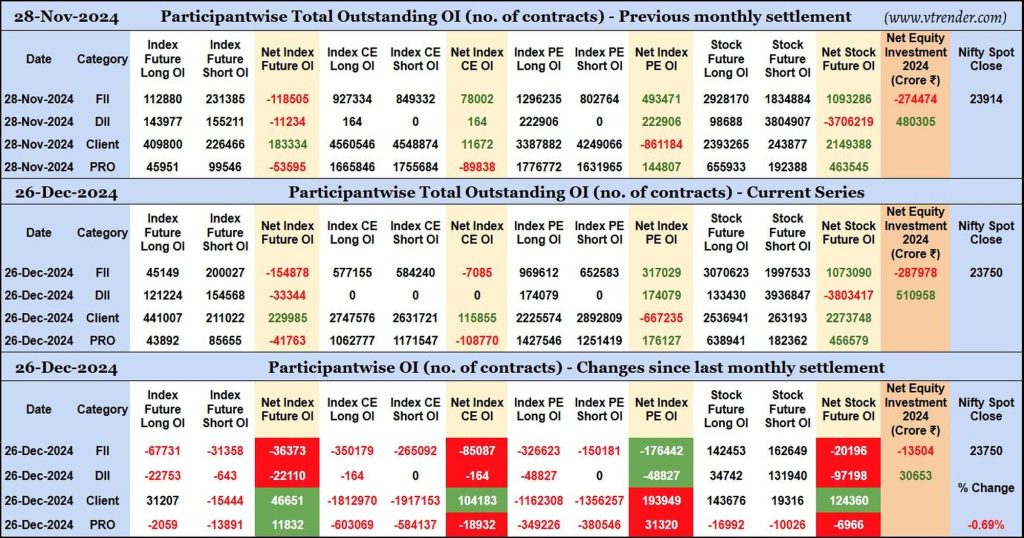

Participantwise Open Interest (Series changes) – 26th DEC 2024

FIIs have added net 20K short Stocks Futures contracts since November settlement while shedding Open Interest in Index Futures, Index CE and Index PE.

FIIs were net sellers in equity segment for ₹13504 crore during December series.

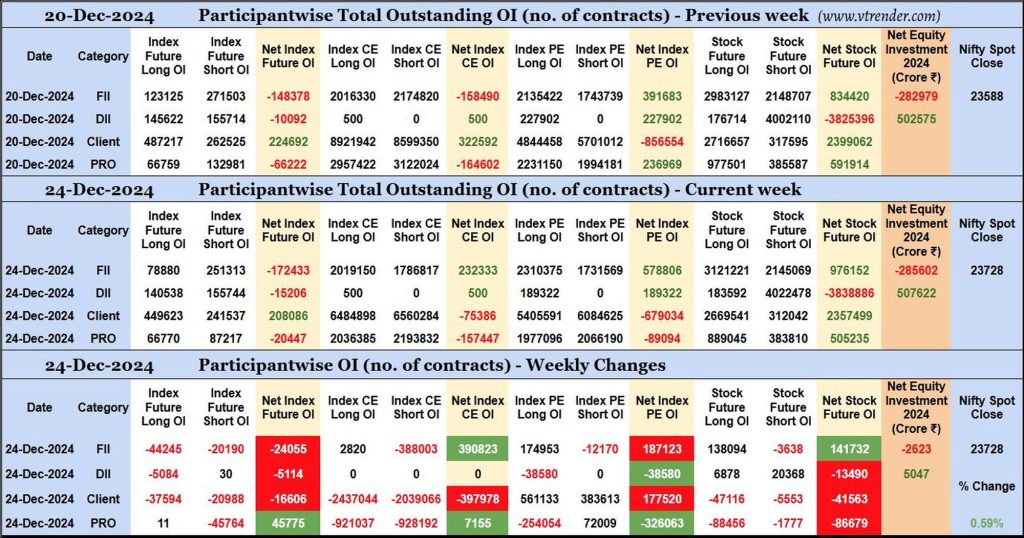

Participantwise Open Interest (Mid-week changes) – 24th DEC 2024

FIIs have added 2K long Index CE, 174K long Index PE and 138K long Stocks Futures contracts in this week so far besides covering 388K short Index CE, 12K short Index PE and 3K short Stocks Futures contracts. They have also shed Open Interest in Index Futures.

FIIs have been net sellers in equity segment for 2623 crore during the running week.

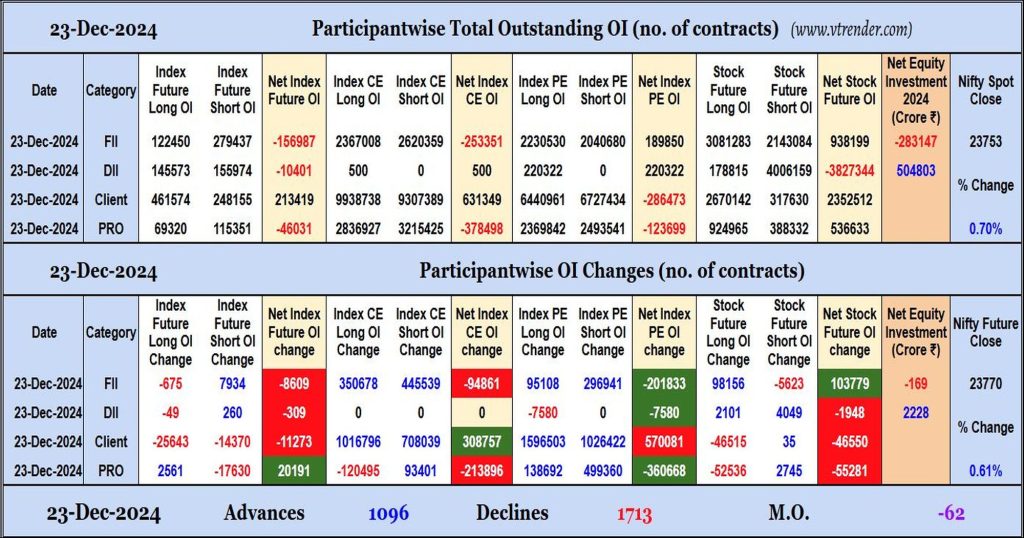

Participantwise Open Interest (Daily changes) – 23rd DEC 2024

FIIs have added net shorts in Index Futures, Index CE and Index PE while adding net longs in Stocks Futures. They were net sellers in equity segment.

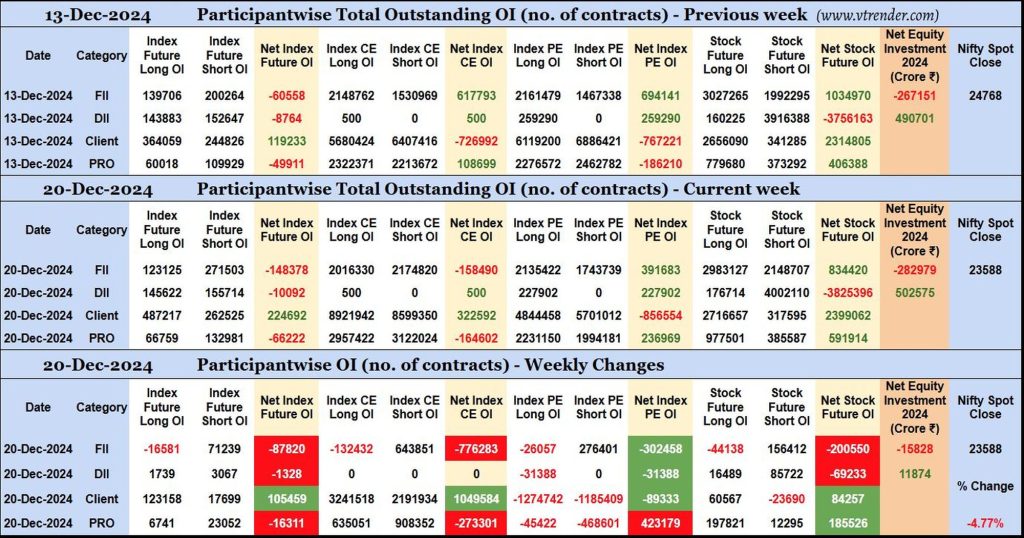

Participantwise Open Interest (Weekly changes) – 20th DEC 2024

FIIs have added 71K short Index Futures, 643K short Index CE, 276K short Index PE and 156K short Stocks Futures contracts this week while liquidating 16K long Index Futures, 132K long Index CE, 26K long Index PE and 44K long Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹15828 crore during the week.

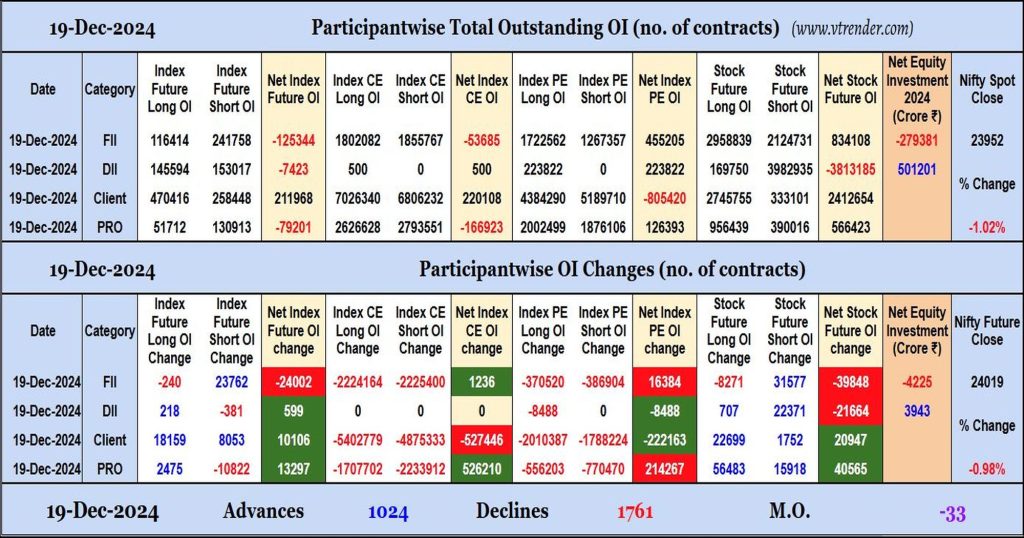

Participantwise Open Interest (Daily changes) – 19th DEC 2024

FIIs have added shorts in Index Futures and Stocks Futures while shedding Open Interest in Index Options. They were net sellers in eqity segment.

Participantwise Open Interest (Daily changes) – 17th DEC 2024

FIIs have added net shorts in Index Futures, Stocks Futures, Index CE and Index PE. They were net sellers in equity segment too.

Participantwise Open Interest (Daily changes) – 16th DEC 2024

FIIs have added net shorts in Index Futures, Index CE and Stocks Futures while adding net longs in Index PE. They were net sellers in equity segment.

Participantwise Open Interest (Weekly changes) – 13th DEC 2024

FIIs have added net 323K long Index CE, net 136K long Index PE and 96K short Stocks Futures contracts this week while liquidating 38K long Stocks Futures contracts and shedding Open Interest in Index Futures.

FIIs have been net sellers in equity segment for ₹227 crore during the week.