Market Profile Analysis dated 20th Jun 2022

Nifty Jun F: 15347 [ 15384 / 15202 ] NF made an OAIR (Open Auction In Range) start and remained largely in previous day’s range & Value forming an inside bar and another Gaussian Profile on the daily timeframe with failed attempts on both ends as it first broke below previouu week’s low of 15211 but […]

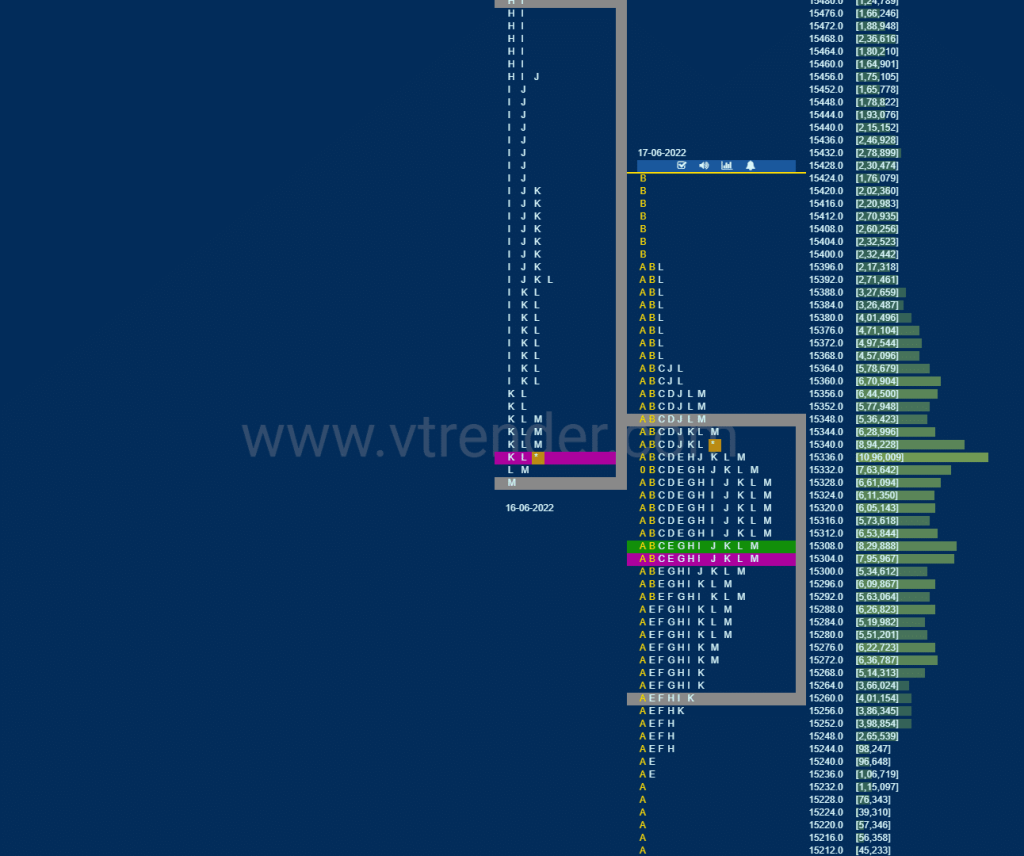

Market Profile Analysis dated 17th Jun 2022

Nifty Jun F: 15319 [ 15427 / 15211 ] NF continued the Trend Day imbalance at open as it made new lows of 15211 in the A period but gave a swift bounce back upto 15427 in the B forming a relatively large IB range of 216 points and remained the entire day inside this forming […]

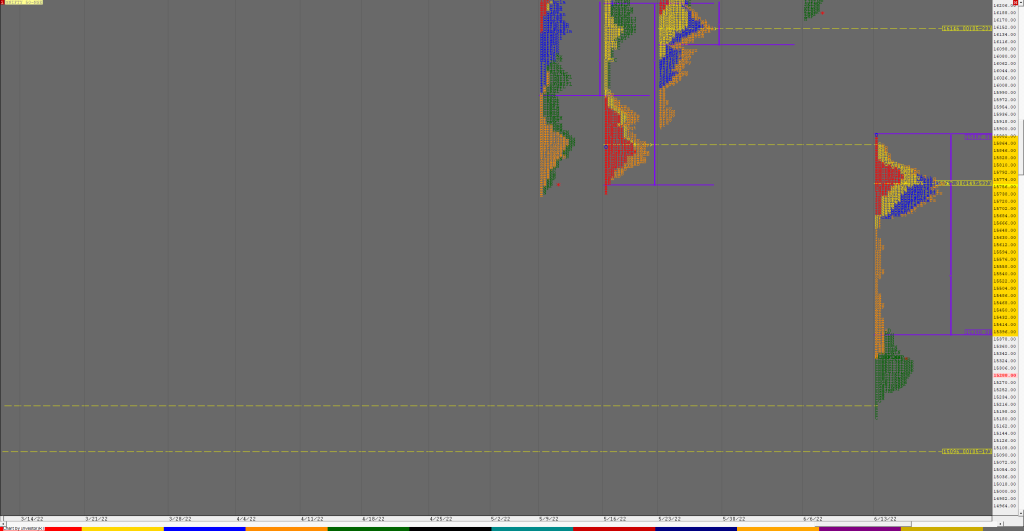

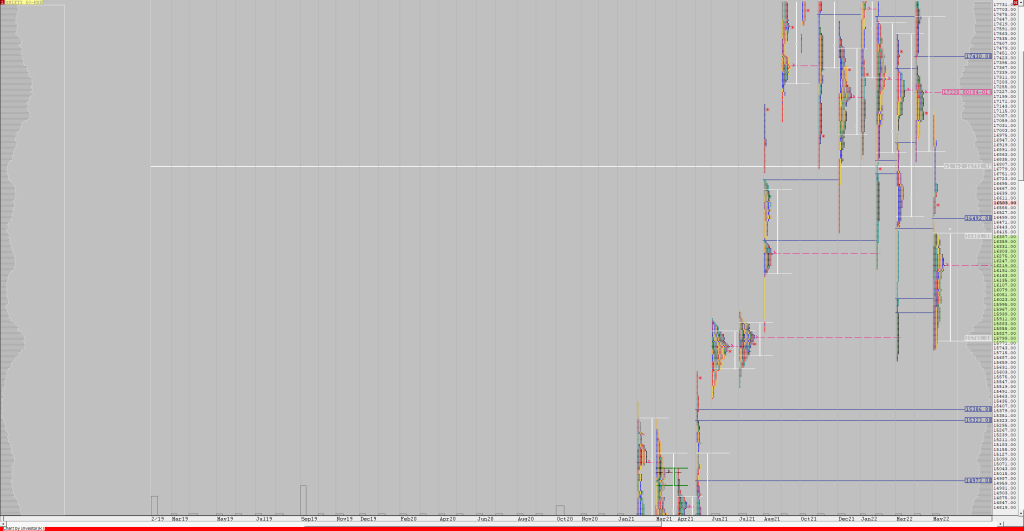

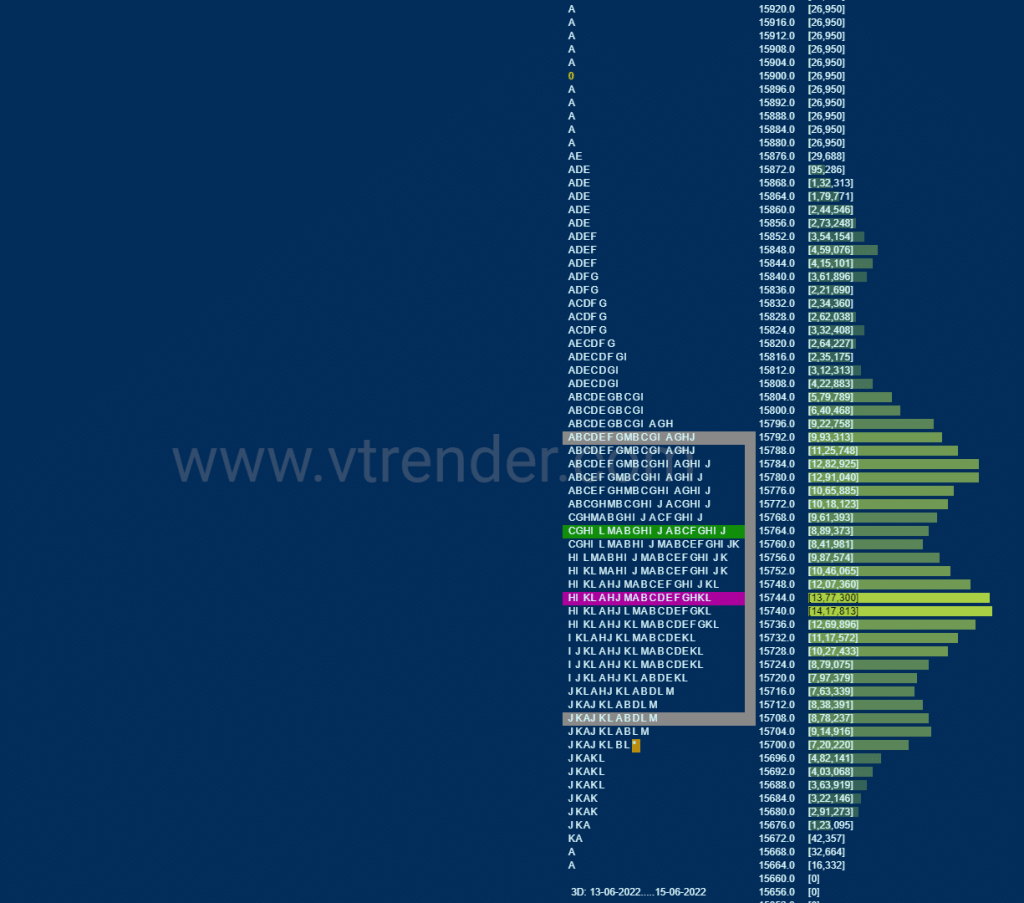

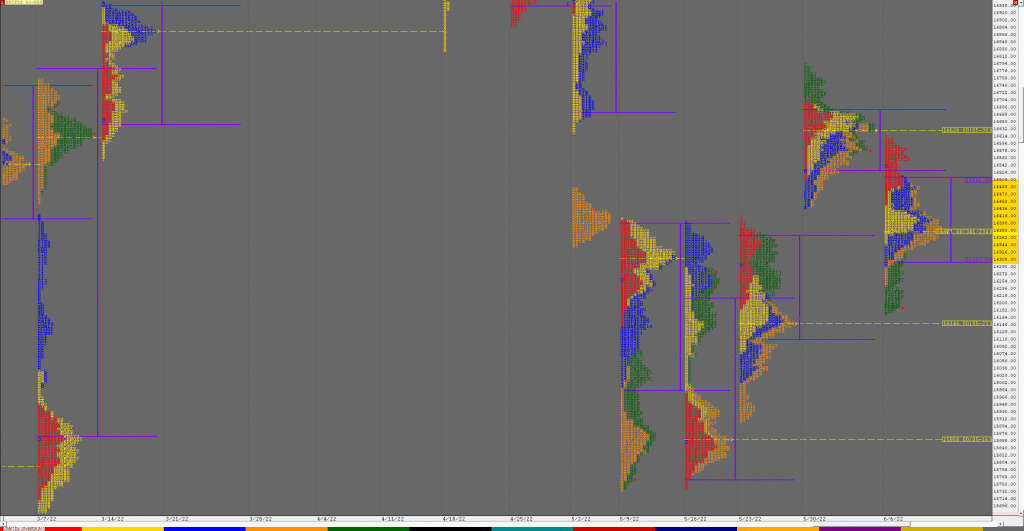

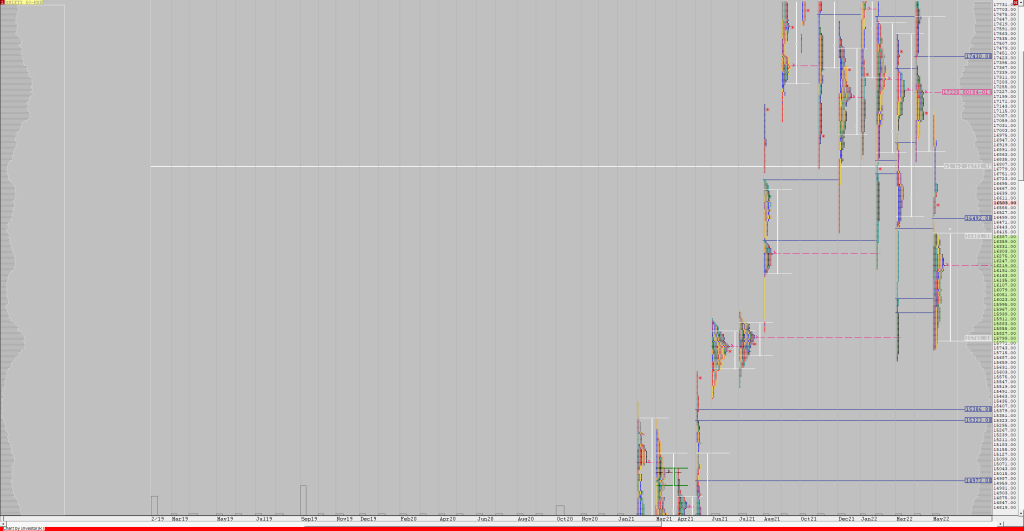

Weekly Charts (13th to 17th Jun 2022) and Market Profile Analysis

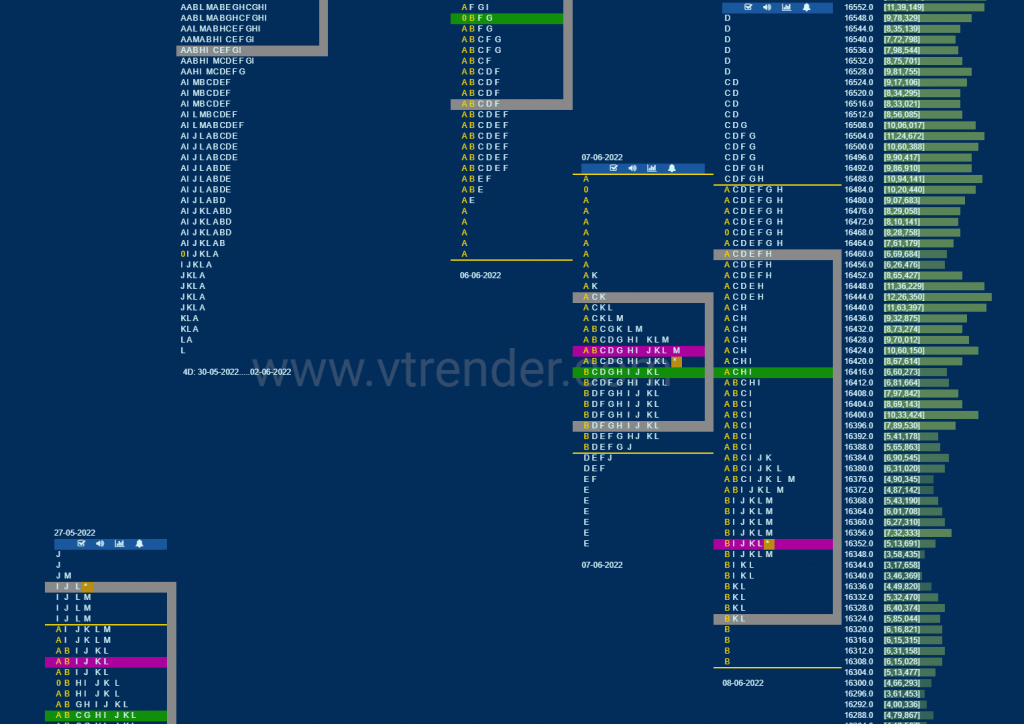

Nifty Spot Weekly Profile (13th to 17th Jun 2022) 15293 [ 15886 / 15183 ] Previous week’s report ended with this ‘The close has been in an imbalance as Nifty confirmed a fresh weekly VPOC at 16626 and staying below 16244 in the coming week could continue to probe lower towards the weekly VPOCs of 16146 […]

Market Profile Analysis dated 16th Jun 2022

Nifty Jun F: 15348 [ 15865 / 15328 ] NF opened with a gap up of 110+ points & re-visited 14th June’s SOC (Scene Of Crime) at 15844 as it made a high of 15865 but could not get above that day’s high of 15877 and confirmed a late ORR (Open Rejection Reverse) to the downside […]

Market Profile Analysis dated 15th Jun 2022

aNifty Jun F: 15708 [ 15799 / 15691 ] NF opened right at the yPOC of 15740 and as expected continued to build on the 2-day balance staying inside the composite Value for most part of the day forming the third most narrow range of this year of just 108 points with failed attempts to extend […]

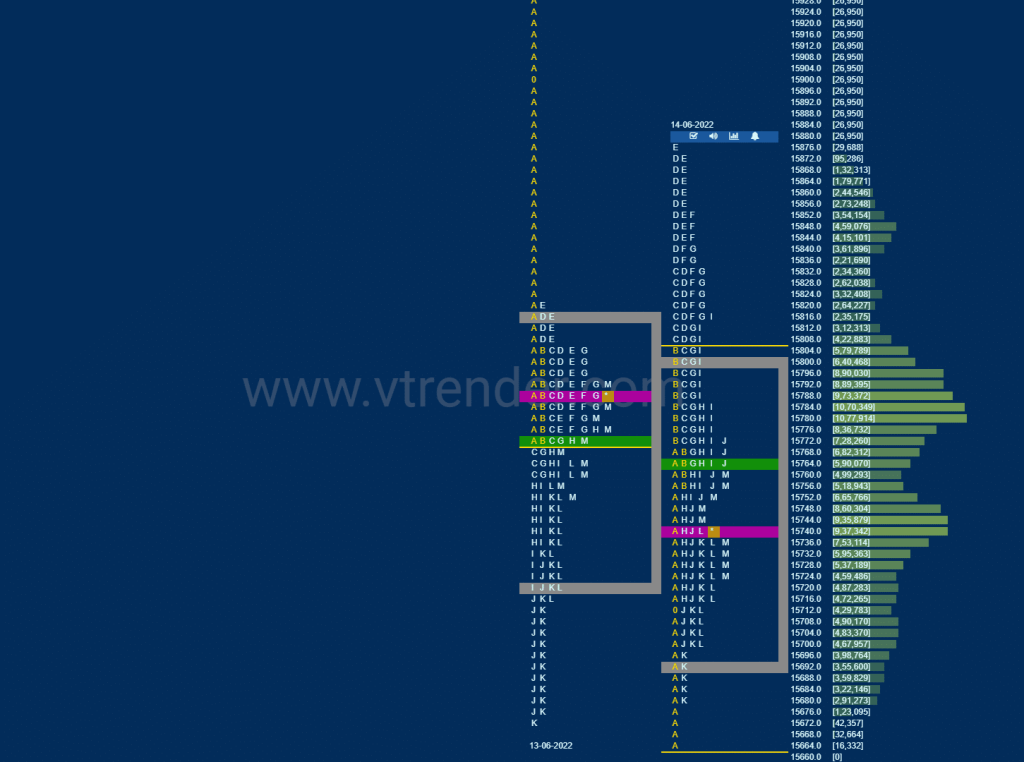

Market Profile Analysis dated 14th Jun 2022

aNifty Jun F: 15737 [ 15877 / 15666 ] NF opened lower & made a look down below PDL (Previous Day Low) in the A period as it made new lows for the series at 15666 but was rejected back into previous day’s range & value triggering an OTF (One Time Frame) probe to the upside […]

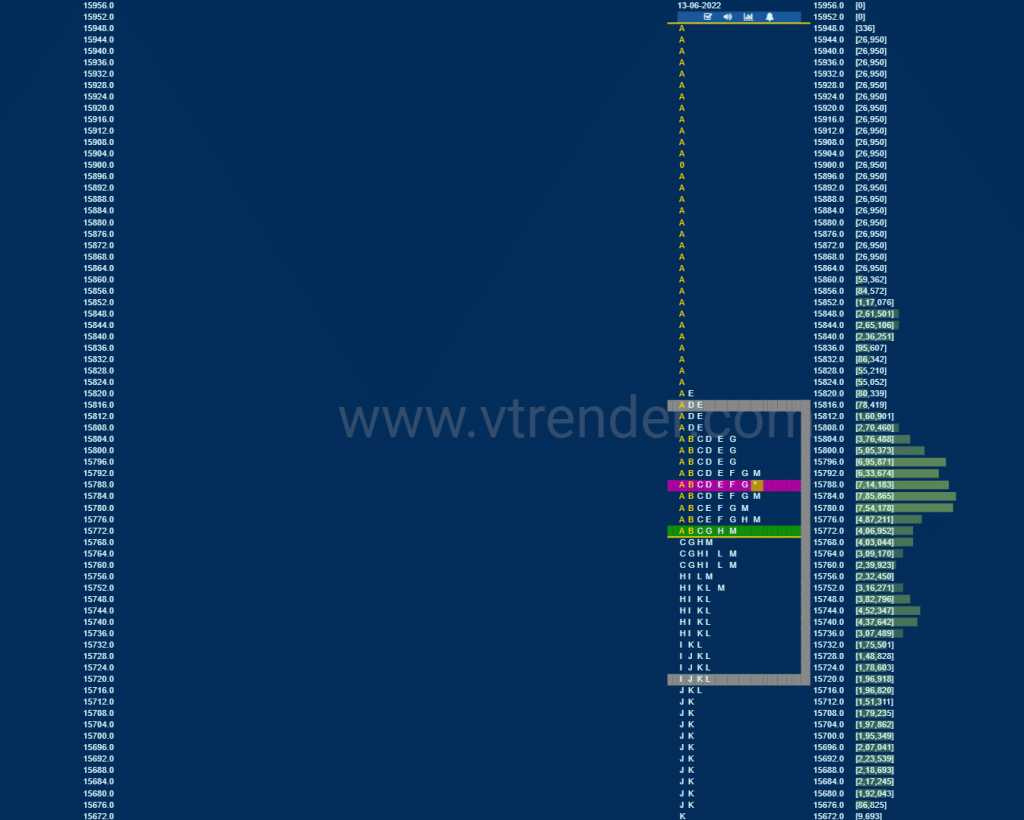

Market Profile Analysis dated 13th Jun 2022

Nifty Jun F: 15766 [ 15948 / 15673 ] NF opened with a huge 319 point gap down at 15900 and continued to probe lower in the A period as it made a low of 15775 and formed a relatively large IB (Initial Balance) range of 176 points which included an initiative selling tail from 15807 […]

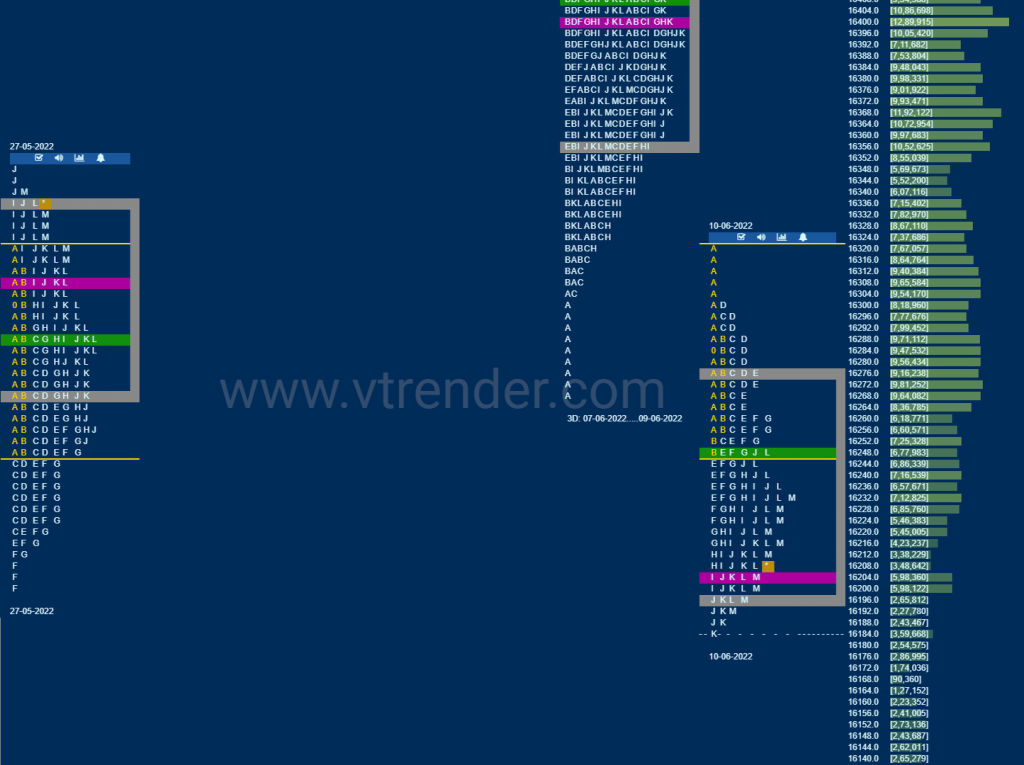

Market Profile Analysis dated 10th Jun 2022

Nifty Jun F: 16219 [ 16321 / 16185 ] NF signalled a move away from the 3-day balance it was forming with a big gap down open of 191 points and a slow probe lower all day as it left a PBH at 16300 in the D period and made multiple REs (Range Extension) from the […]

Weekly Charts (06th to 10th Jun 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (06th to 10th Jun 2022) 16201 [ 16611 / 16172 ] Previous week’s report ended with this ‘Nifty did give a move away from the 3-week bracket but has formed a Neutral Centre profile on the weekly within very narrow range of just 355 points with completely higher Value at 16530-16626-16674 and […]

Market Profile Analysis dated 09th Jun 2022

Nifty Jun F: 16475 [ 16496 / 16268 ] NF continued previous day’s closing imbalance with a gap down open where it took support at the May series VWAP of 16270 while making a low of 16268 and left an initiative buying tail to get back into previous day’s range after which it made couple of […]