Market Profile Analysis dated 05th January 2022

Nifty Jan F: 17961 [ 17985 / 17786 ] NF opened in the spike zone zone of 17819 to 17871 and failed to find fresh demand which led to a probe lower to 17786 in the A period where the buyers came back to defend yesterday’s extension handle of 17783 and left a buying tail in […]

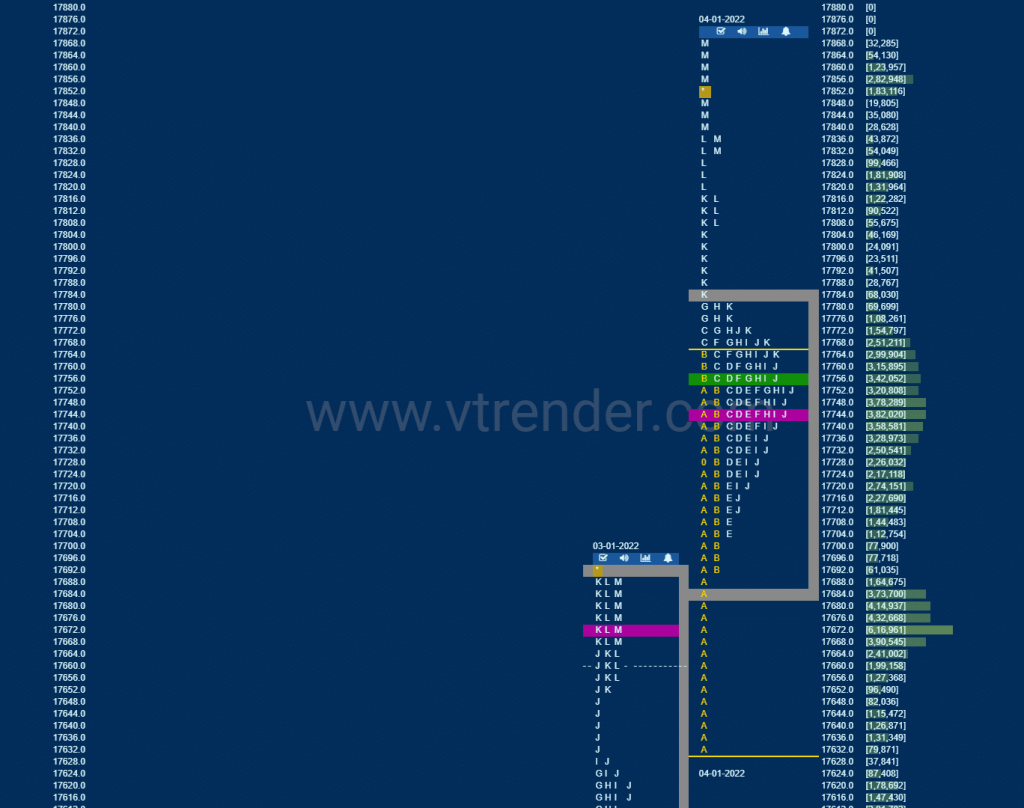

Market Profile Analysis dated 04th January 2022

Nifty Jan F: 17847 [ 17871 / 17632 ] NF opened higher and scaled above the 13th Dec swing high of 17737 but saw profit booking coming in which triggered a probe back into previous day’s range as the auction broke below the dPOC of 17675 and made a low of 17632 stalling right at the […]

Market Profile Analysis dated 03rd January 2022

Nifty Jan F: 17678 [ 17692 / 17410 ] NF continued the imbalance it started on Friday with an Open Test Drive Up as it entered the 13th Dec profile with an initiative tail from 17494 to 17410 and made an OTF (One Time Frame) probe higher as it first left an extension handle at the […]

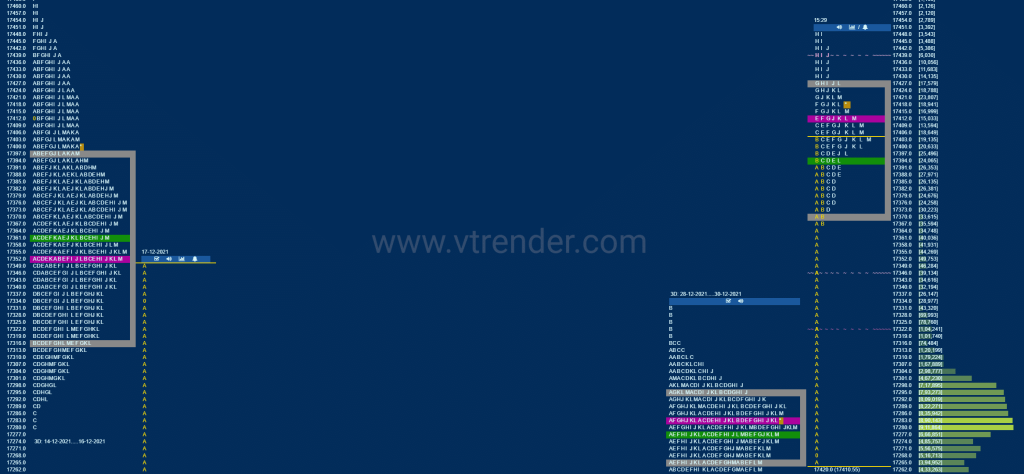

Market Profile Analysis dated 31st December 2021

Nifty Jan F: 17410 [ 17448 / 17265 ] As expected, NF gave the initiative move away from the 3-day balance as it left a long initiative tail from 17368 to 17265 and went on to make multiple REs higher forming similar highs of 17448 signalling short term exhauction as the auction remained in a narrow […]

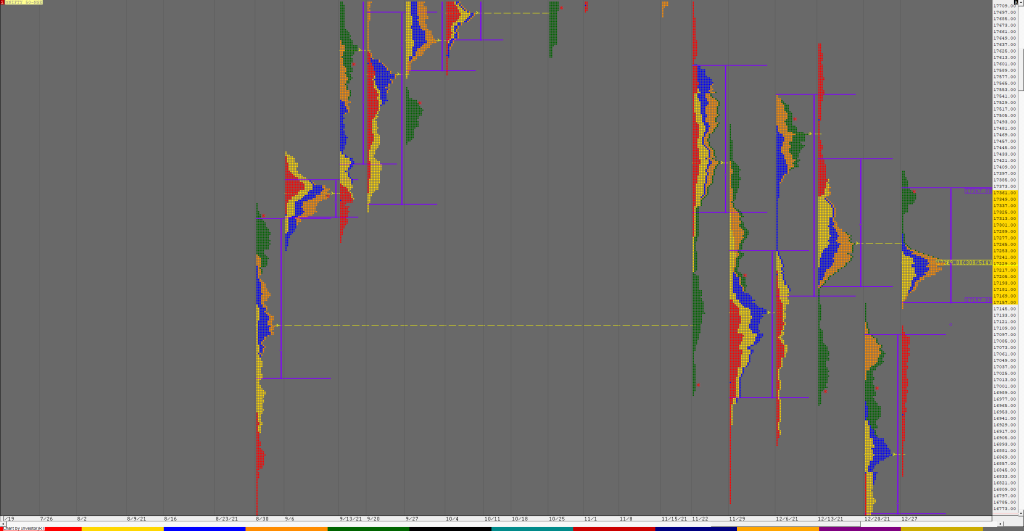

Weekly Charts (27th to 31st Dec 2021) and Market Profile Analysis

Nifty Spot Weekly Profile (27th to 31st Dec 2021) 17354 [ 17401 / 16833 ] Previous week’s report ended with this ‘This week’s profile started with a big fall which was retraced and has given a close around the same level as last week though Value has been completely lower at 16764-16872-17094 with a small tail […]

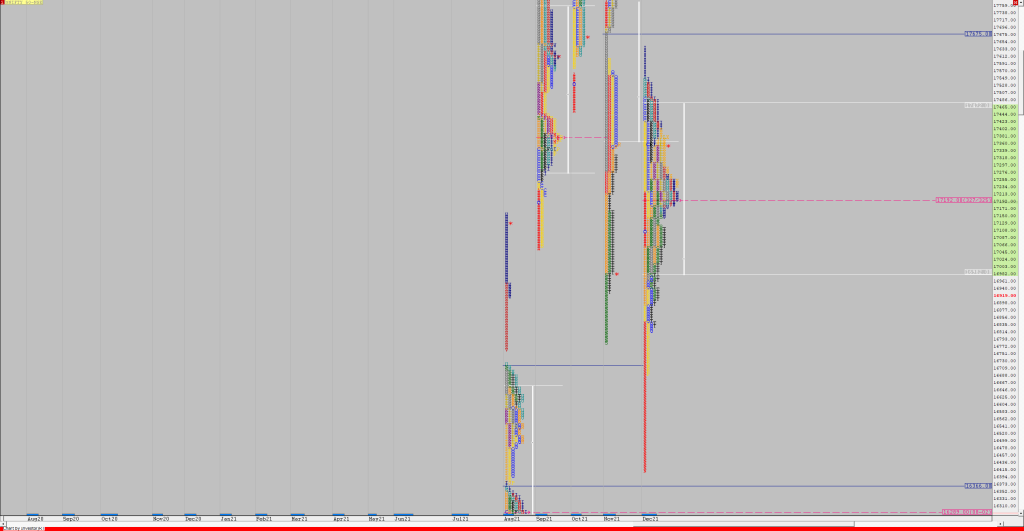

Monthly charts (December 2021) and Market Profile Analysis

Nifty Spot – 17354 [ 17639 / 16410 ] Monthly Profile (December 2021) Previous month’s report ended with this ‘The Monthly profile is a Neutral Extreme Down one with overlapping to lower Value at 17437-17961-18207 and has left an extension handle at 17688 which will be an important longer term reference and also has a small tail at […]

Of our working process through 2021 – with MarketProfile and Orderflow

We have had a great run through the year 2021 with our Order Flow charts and the trading process we have finetuned at Vtrender using the MarketProfile process. It has helped deliver in up, down and sideways markets. Here is a screenshot of the YTD performance There have been months in the year where the Nifty has […]

Market Profile Analysis dated 30th December 2021

Nifty Jan F: 17268 [ 17317 / 17200 ] NF made a probe below PDL (Previous Day Low) at open but was immediately rejected back as it remained mostly in the 2-day composite Value making mutliple rounds of the 80% Rule forming a hat-trick of narrow range days for this week and a nice 3-day composite […]

Market Profile Analysis dated 29th December 2021

Nifty Dec F: 17216 [ 17287 / 17186 ] NF opened with a probe lower with a swipe through previous Value as it tagged the HVN of 17195 while making a low of 17186 where it got swiftly rejected reversing the auction to the upside making couple of attempts to scale above the the composite VAL […]

Market Profile Analysis dated 28th December 2021

Nifty Dec F: 17247 [ 17259 / 17160 ] NF opened with a gap up above the 23rd Dec extension handle of 17152 making a low of 17160 and settled down into an OAOR (Open Auction Out of Range) as it formed a balanced profile inside a mere 100 point range with the mutliple REs (Range […]