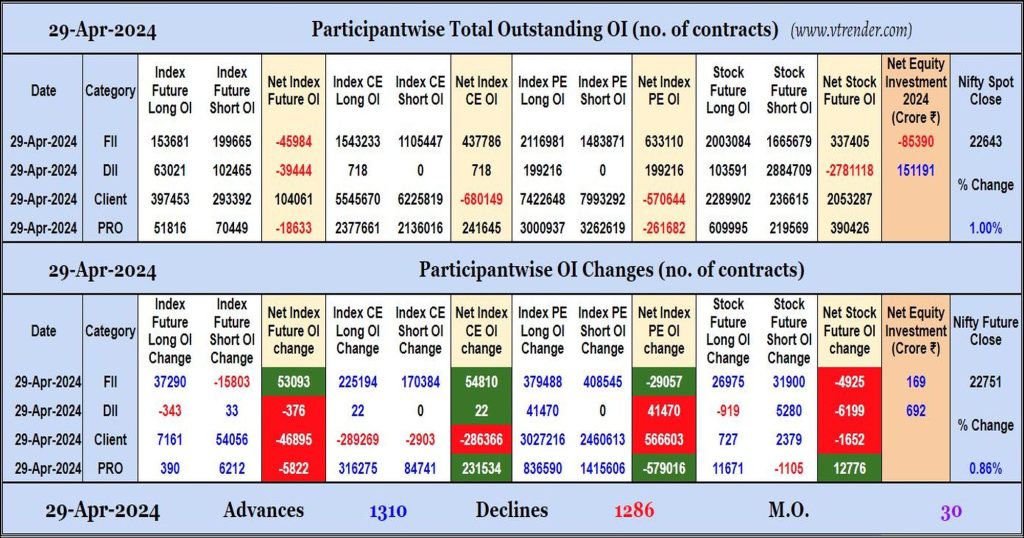

Participantwise Open Interest (Daily changes) – 29th APR 2024

FIIs have added net longs in Index Futures and Index CE while adding net shorts in Index PE and Stocks Futures. They were net buyers in equity segment.

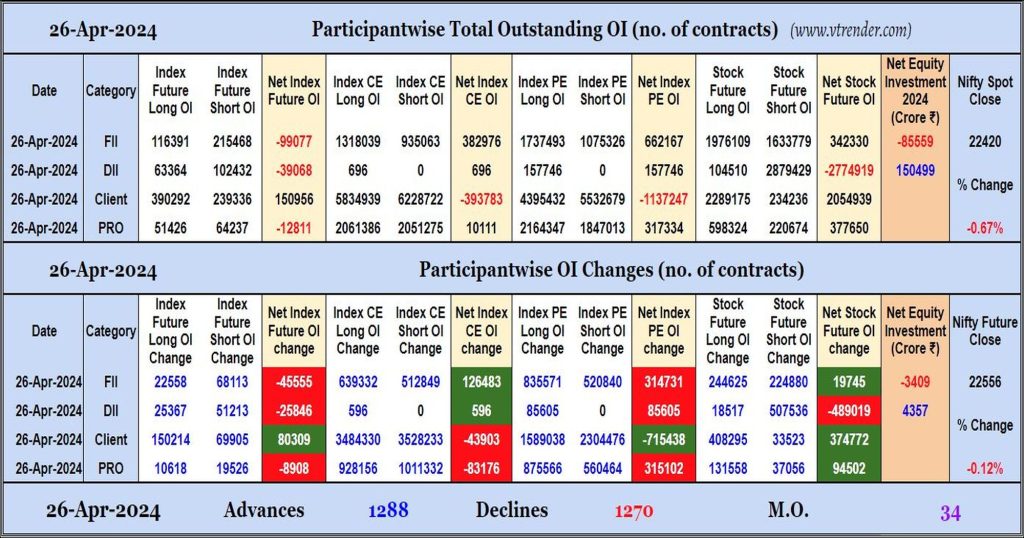

Participantwise Open Interest (Daily changes) – 26th APR 2024

FIIs have added net shorts in Index Futures while adding net longs in Index CE / Index PE and Stocks Futures. They were net sellers in equity segment.

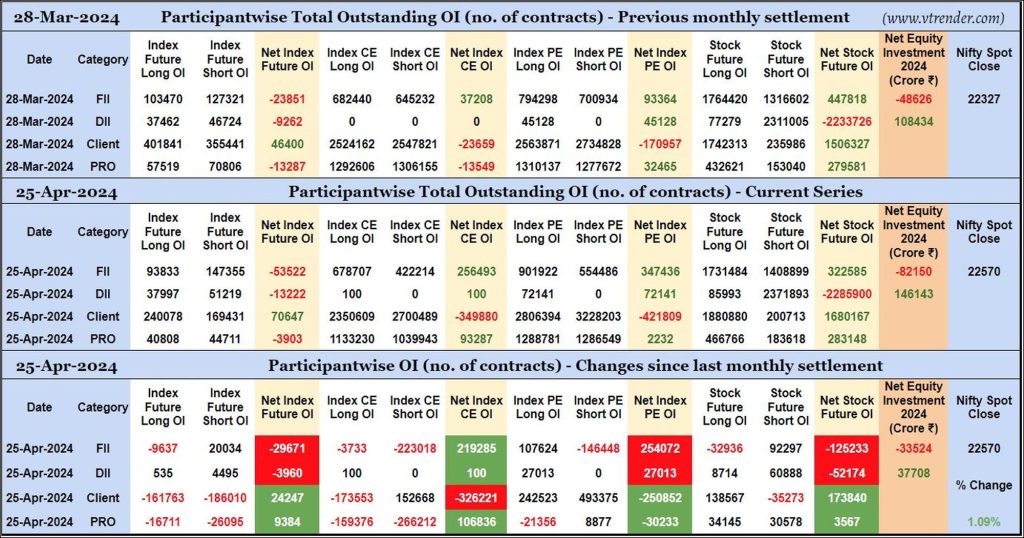

Participantwise Open Interest (Series changes) – 25th APR 2023

FIIs have added 20K short Index Futures, 107K long Index PE and 92K short Stocks Futures contracts duirng April series besides liquidating 9K long Index Futures and 32K long Stocks Futures contracts. They shed Open Interest in Index CE.

FIIs were net sellers in equity segment for ₹33524 crore during April series.

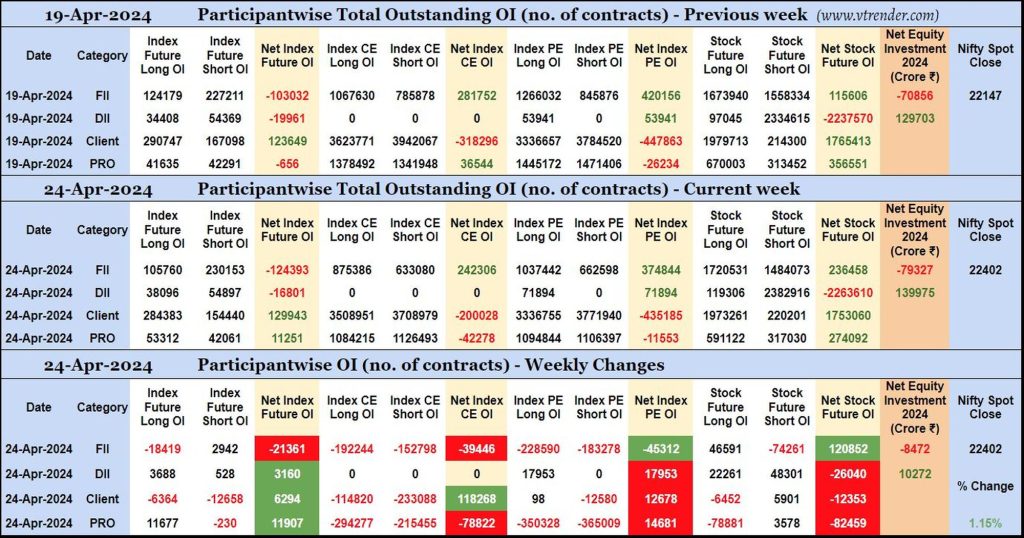

Participantwise Open Interest (Mid-week changes) – 24th APR 2024

FIIs have added 3K short Index Futures and 46K long Stocks Futures contracts so far this week besides liquidating 18K long Index Futures contracts and covering 74K short Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹8472 crore during the week.

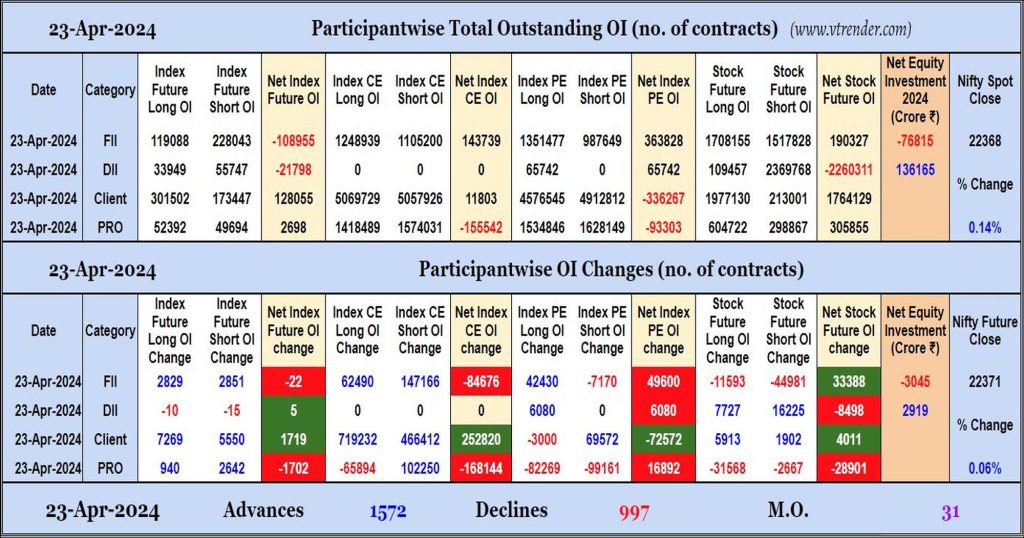

Participantwise Open Interest (Daily changes) – 23rd APR 2024

FIIs have added net shorts in Index CE while adding net longs in Index PE. They were net sellers in equity segment.

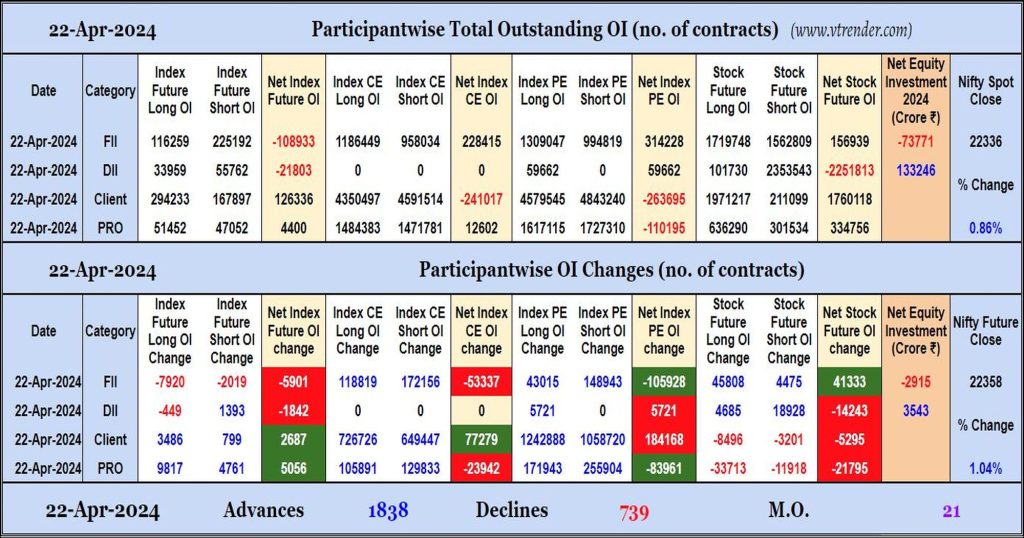

Participantwise Open Interest (Daily changes) – 22nd APR 2024

FIIs have added net shorts in Index Options but net longs in Stocks Futures. They were net sellers in equity segment.

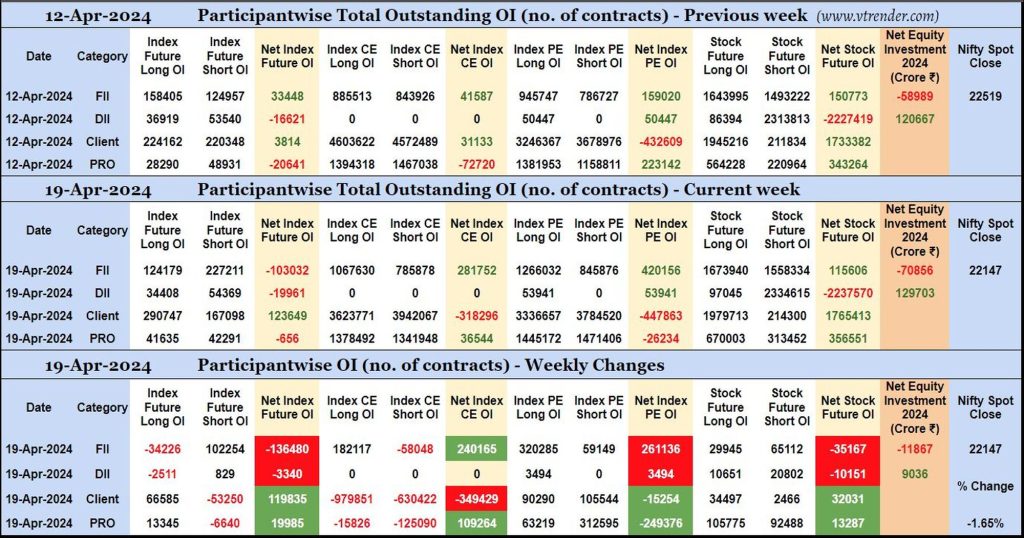

Participantwise Open Interest (Weekly changes) – 19th APR 2024

FIIs have added 102K short Index Futures, 182K long Index CE, net 261K long Index PE and net 35K short Stocks Futures contracts this week besides liquidating 34K long Index Futures contracts and covering 58K short Index CE contracts.

FIIs have been net sellers in equity segment for ₹11867 crore during the week.

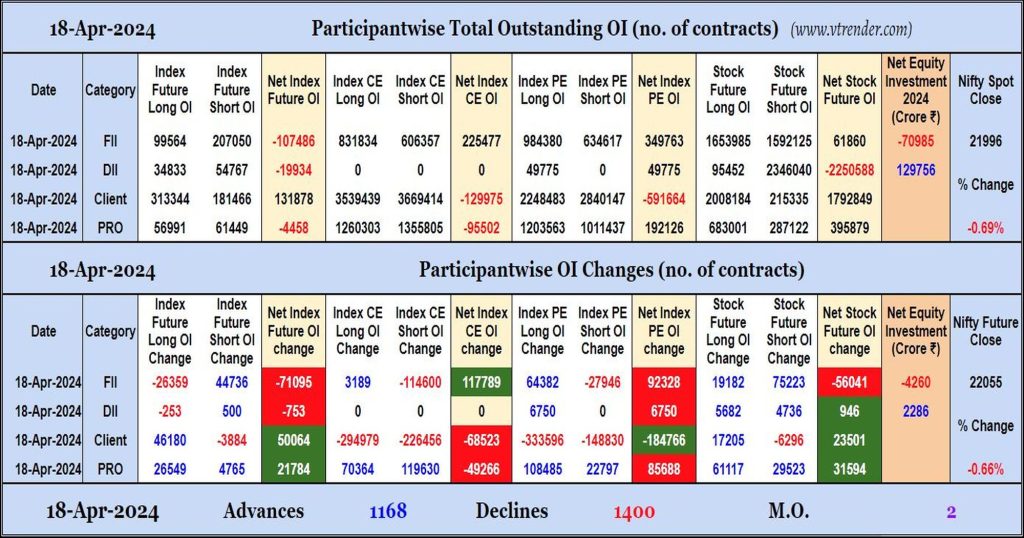

Participantwise Open Interest (Daily changes) – 18th APR 2024

FIIs have added net shorts in Index and Stocks Futures while adding net longs in Index Options. They have been net sellers in equity segment.

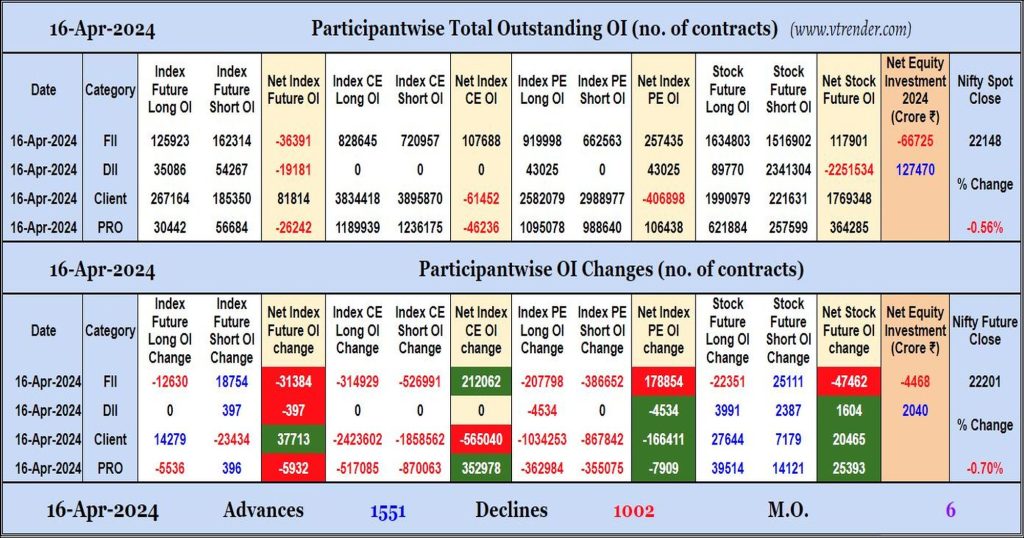

Participantwise Open Interest (Daily changes) – 16th APR 2024

FIIs have added shorts in Index Futures and Stocks Futures, they were also net sellers in equity segment.

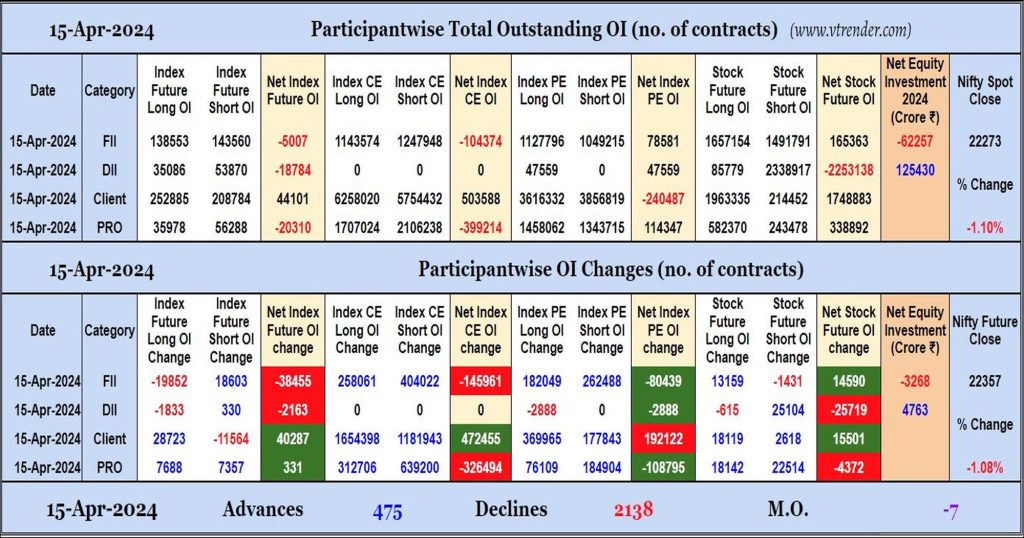

Participantwise Open Interest (Daily changes) – 15th APR 2024

FIIs have added shorts in Index Futures, Index CE and Index PE while adding longs in Stocks Futures. They were net sellers in equity segment.