Market Profile Analysis dated 28th December 2020

Nifty Dec F: 13890 [ 13903 / 13802 ] NF made a big gap up open and stayed above the negated FA and previous swing high of 13785 as it left a buying tail in the IB (Initial Balance) from 13827 to 13802 confirming that the PLR (Path of Least Resistance) for the day remained […]

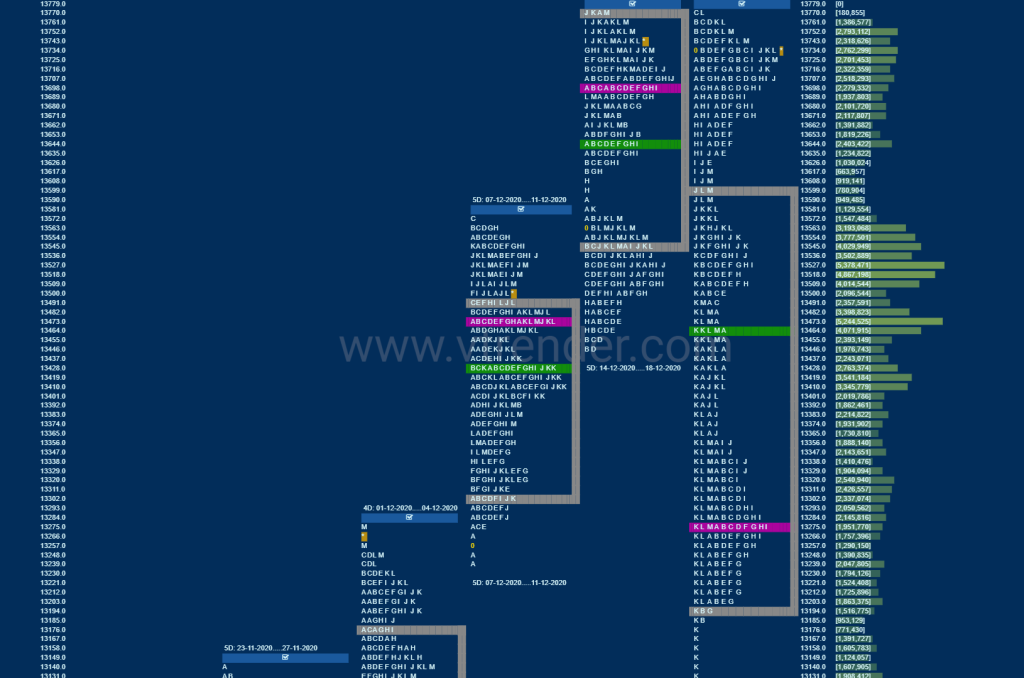

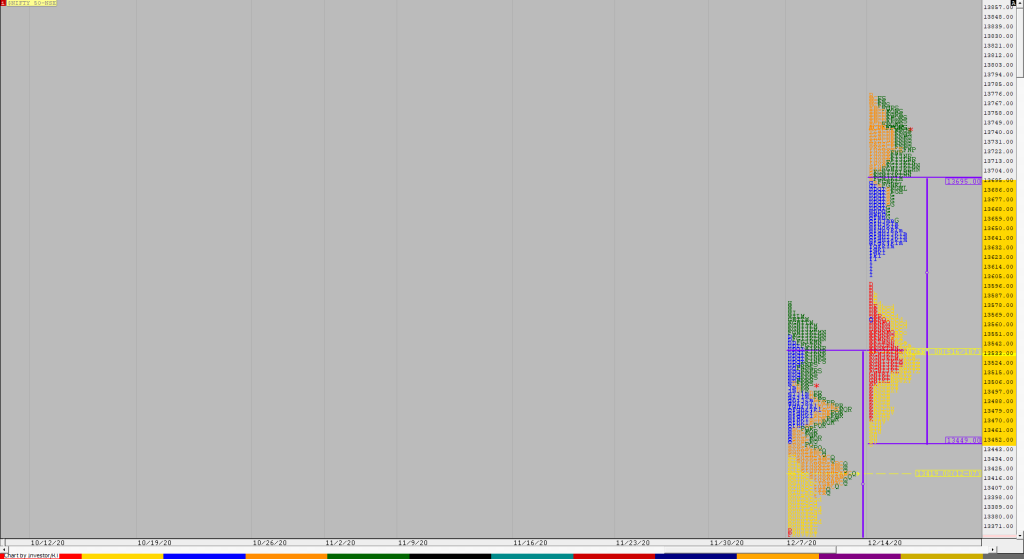

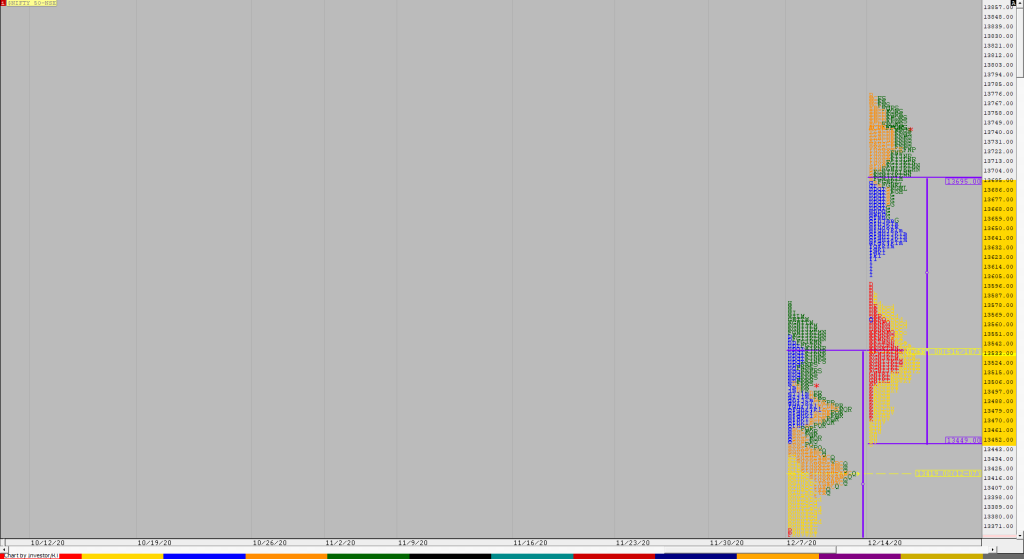

Order Flow charts dated 28th December 2020

When we think about how to measure volume in the market one of the keys is Order Flow. It plays a role by telling us what the other traders have done in the market and are currently doing and this provides valuable clues and potential opportunities to trade. An Order Flow trader can actually see […]

Market Profile Analysis dated 24th December 2020

Nifty Dec F: 13764 [ 13784 / 13641 ] NF opened higher on Thursday getting above 13650 which was the SOC (Scene of Crime) of Monday and continued the imbalance to the upside in the IB as it hit 13747 and made the dreaded C side extension which got rejected leading to new lows for […]

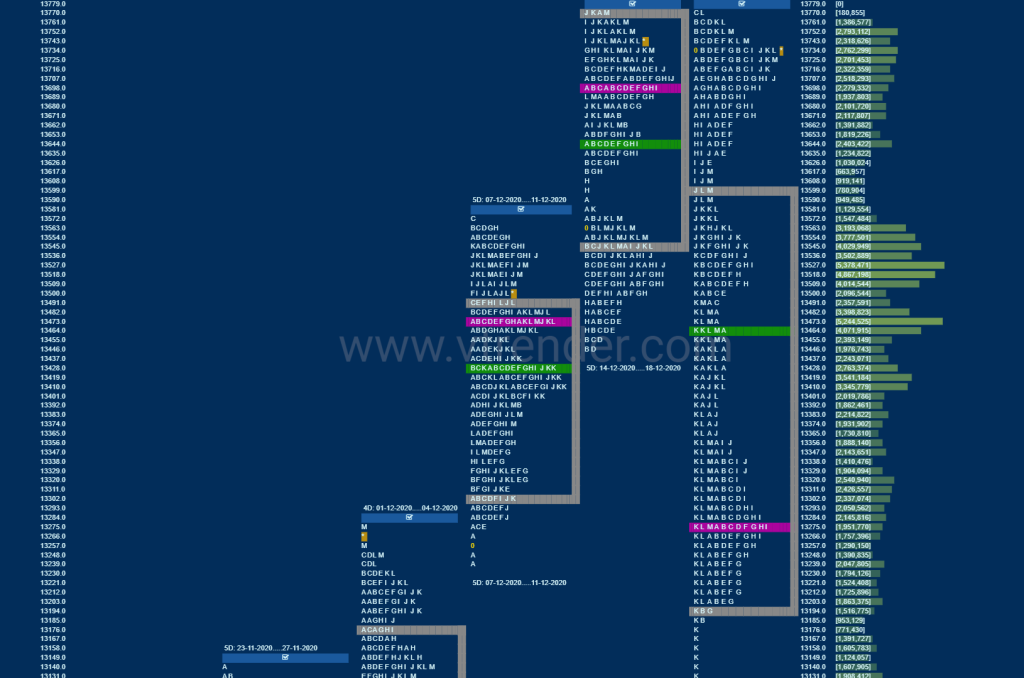

Weekly Charts (21st to 24th December 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (21st to 24th Dec 2020) Spot Weekly – 13749 [ 13777 / 13131 ] Previous week’s report ended with this ‘The weekly profile is a Double Distribution (DD) Trend Up one with overlapping to higher Value at 13449-13533-13695 and the DD zone from 13625 to 13580 which would be the support […]

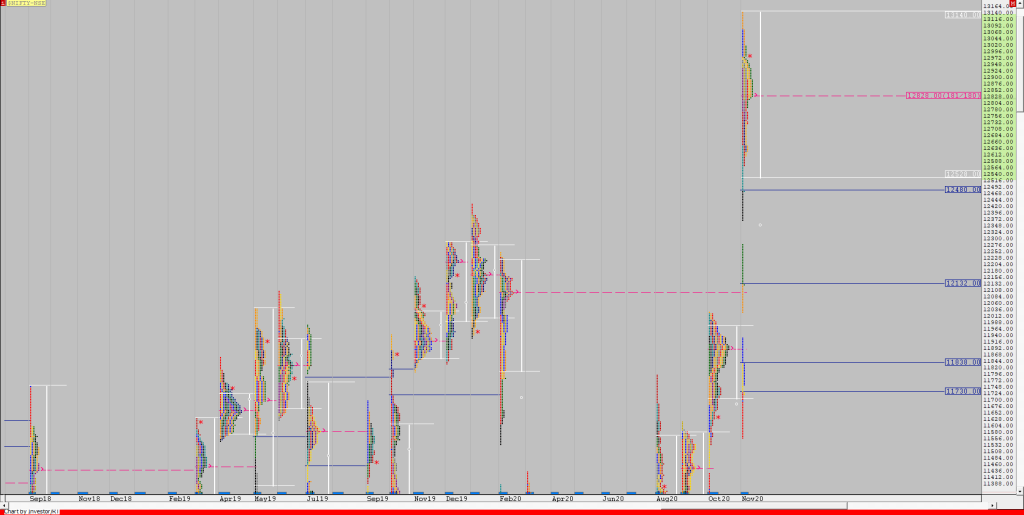

Order Flow charts dated 24th December 2020

Timing is the key to successfully trade the markets in the shorter time frame. Order Flow is one of the most effective methods to time your trades by seeing exactly what the other traders are trading in the market and positioning your bias accordingly. Order Flow is the most transparent way to trade and takes […]

Market Profile Analysis dated 23rd December 2020

Nifty Dec F: 13612 [ 13627 / 13448 ] NF probed lower at open staying below the yPOC of 13490 and took support at 13448 from where it was swiftly rejected higher as it not only for above 13490 but went on to scale above PDH (Previous Day High) as well and tagged the first […]

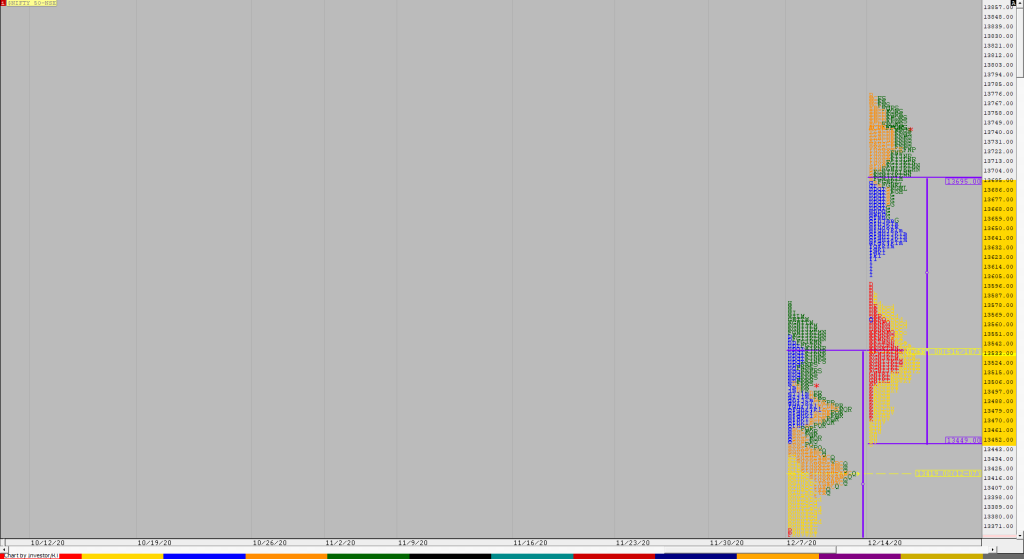

Order Flow charts dated 23rd December 2020

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

Market Profile Analysis dated 22nd December 2020

Nifty Dec F: 13487 [ 13508 / 13222 ] NF opened higher and got into the selling singles of 13407 to 13574 and made a quick high of 13450 where it got rejected from the same level as it did the previous afternoon which triggered a trending move lower in the IB (Initial Balance) of […]

Order Flow charts dated 22nd December 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Market Profile Analysis dated 21st December 2020

Nifty Dec F: 13330 [ 13784 / 13155 ] NF made an OAIR (Open Auction In Range) start and even made a dip below the 2-day composite Value but for the third consecutive day took support just above the extension handle of 13679 as it made a low of 13689 and got back into previous […]