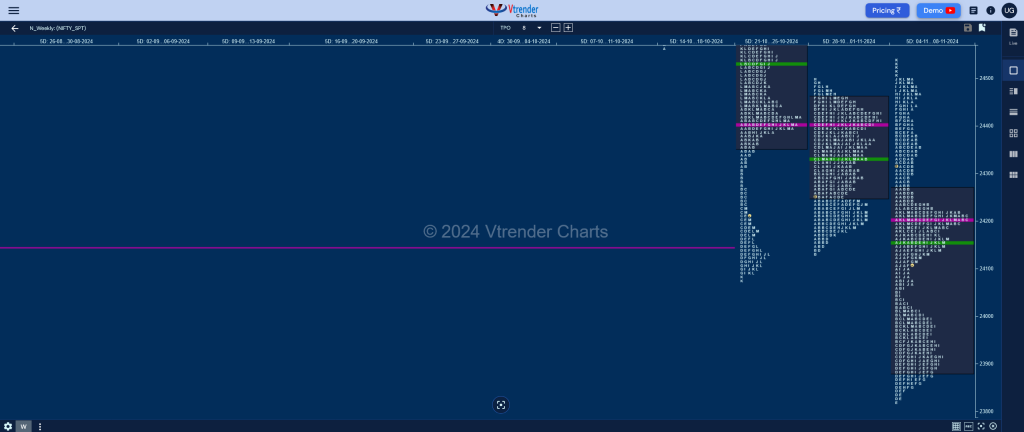

Weekly Spot Charts (11th to 14th Nov 2024) and Market Profile Analysis

Nifty Spot: 23532 [ 24336 / 23484 ] Double Distribution (Down) Previous week’s report ended with this ‘The weekly profile is an Outside Bar with mostly lower Value at 23886-24200-24267 and has left a probable Swing High on the bigger timeframe and will be weak in the coming week if stays below 24200 for a probable […]

Market Profile Analysis dated 08th Nov 2024

Nifty Nov F: 24219 [ 24415 / 24155 ] Open Type ORR (Open Rejection Reverse) Volumes of 40,992 contracts Above average Initial Balance 260 points (24415 – 24155) Volumes of 93,480 contracts Above average Day Type Normal (3-1-3) – 260 pts Volumes of 1,97,225 contracts Average NF opened lower and took support just above the NeuX […]

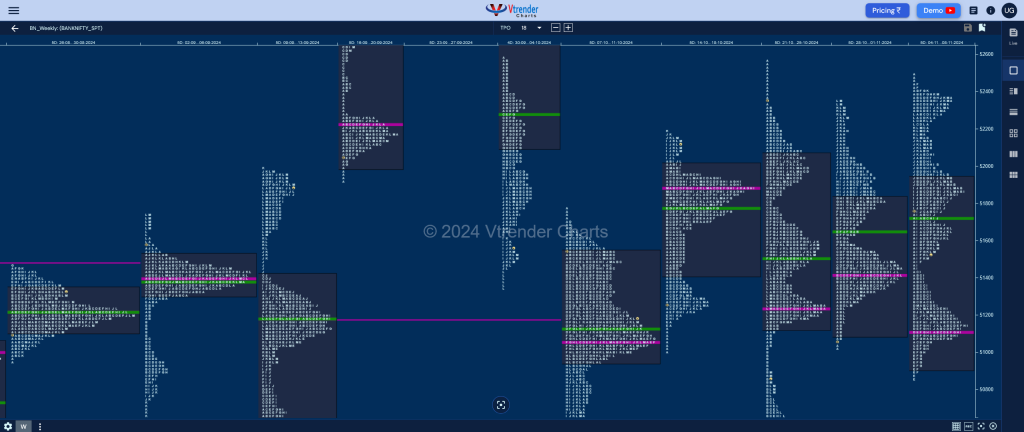

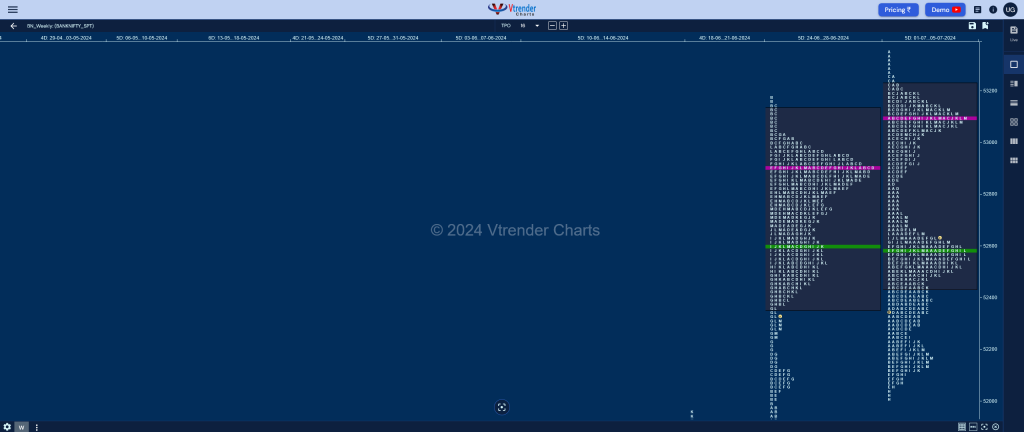

Weekly Spot Charts (08th to 12th Jul 2024) and Market Profile Analysis

Nifty Spot: 24323 [ 24401 / 23992 ] Previous week’s report ended with this ‘The weekly profile is a Normal Variation one to the upside with completely higher Value at 24104-24277-24309 though the range was relatively narrow at 408 points and has 3 important HVNs at 24351, 24277 & 24137 which will be on watch in […]

Understanding Market Profile: A 3-Dimensional Approach To Trading The Markets

A 3 Dimensional Approach adds an extra edge ! To build the auction, one has to understand clearly that Price — advertises opportunity. (and not all price is value) Time — regulates this opportunity Volumes — Measure whether the opportunity was a success or failed. What is the Market Profile? The Market Profile is a […]

Round 2 with Orderflow, MarketProfile, & Options

Did our Saturday session leave you buzzing with questions and curiosity? We’re hosting a follow-up webinar tonight to delve even deeper into the power-packed trio of Orderflow, MarketProfile, and the Options Suite. -️ Date: August 24th – Time: 8:30 pm Link – https://us06web.zoom.us/j/87802243360 And here’s the best part – it’s an “Open Mic” session! Got […]

2408 – Post Open look ahead

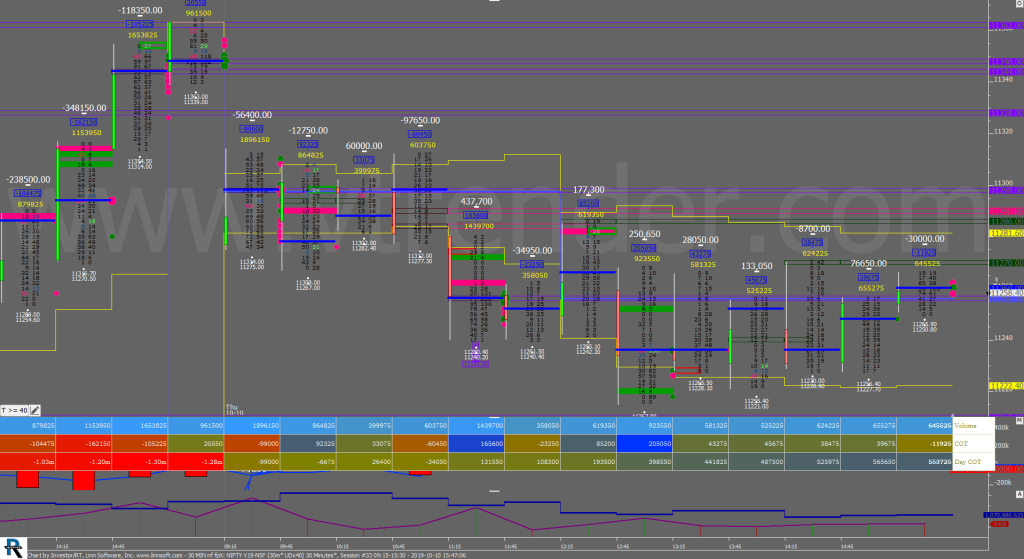

Unlocking Trading Excellence: A Deep Dive into Vtrender’s Enhanced Orderflow Charts

We’re thrilled to extend an exclusive invitation to our esteemed members and passionate traders like you. As the trading landscape continues to evolve, so does Vtrender. We’re always at the forefront, innovating to provide you with the most advanced and efficient trading tools available. Our upcoming webinar is a testament to that commitment. 📅 Date […]

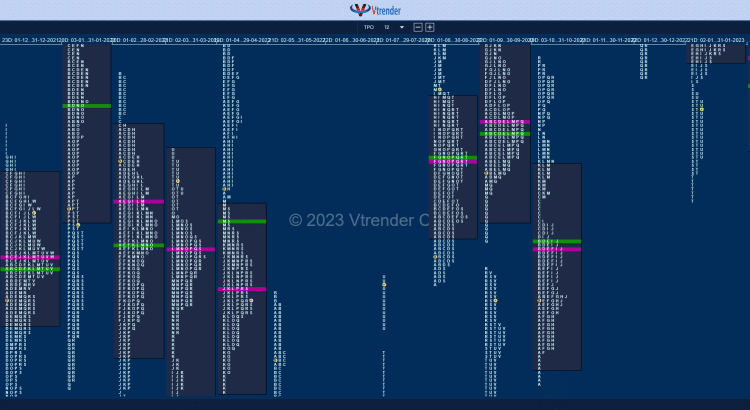

Market Profile Analysis dated 05th Sep 2022

Nifty Sep F: 17710 [ 17727 / 17540 ] NF opened with a move away from the yPOC of 17560 and the Double Inside Day Value with an initiative buying tail from 17641 to 17540 in the IB (Initial Balance) but settled down into a balance for the rest of the day as it made multiple […]

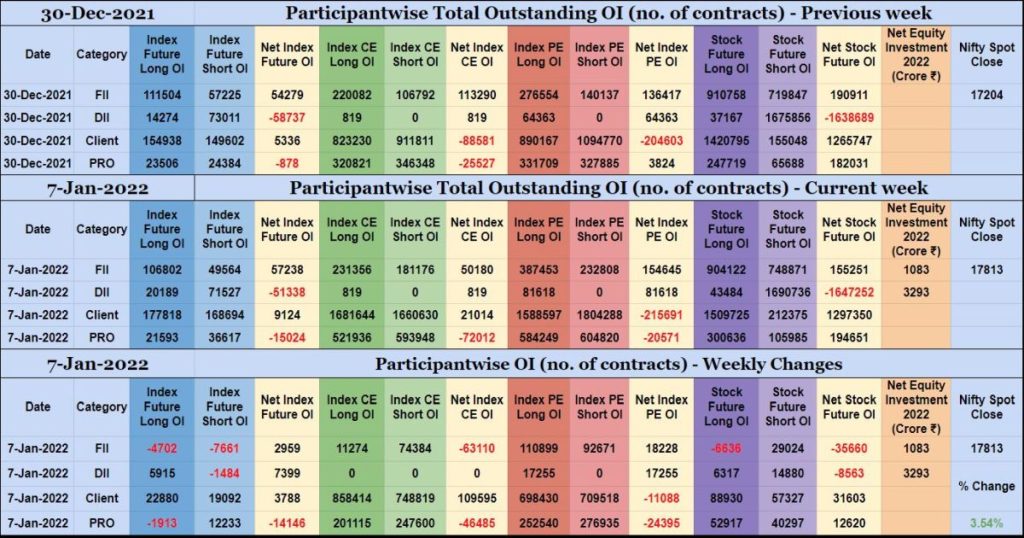

Participantwise Open Interest – 7th JAN 2022

Weekly changes in Participantwise Open Interest FIIs have added net 63K short Index CE, net 18K long Index PE and 29K short Stocks Futures contracts this week while shedding Open Interest in Index Futures and liquidating 6K long Stocks Futures contracts. FIIs have been net buyers in equity segment for ₹1083 crore during this week. […]

Participantwise Open Interest – 12th NOV 2021

Weekly view FIIs have added 12K long Index Futures, net 48K long Index CE, net 41K long Index PE and net 42K short Stocks Futures contacts this week besides covering 3K short Index Futures contracts. FIIs were net sellers in equity segment for ₹4902 crore during the week. Clients have added net 110K short Index […]