Market Profile Analysis dated 19th Mar 2020

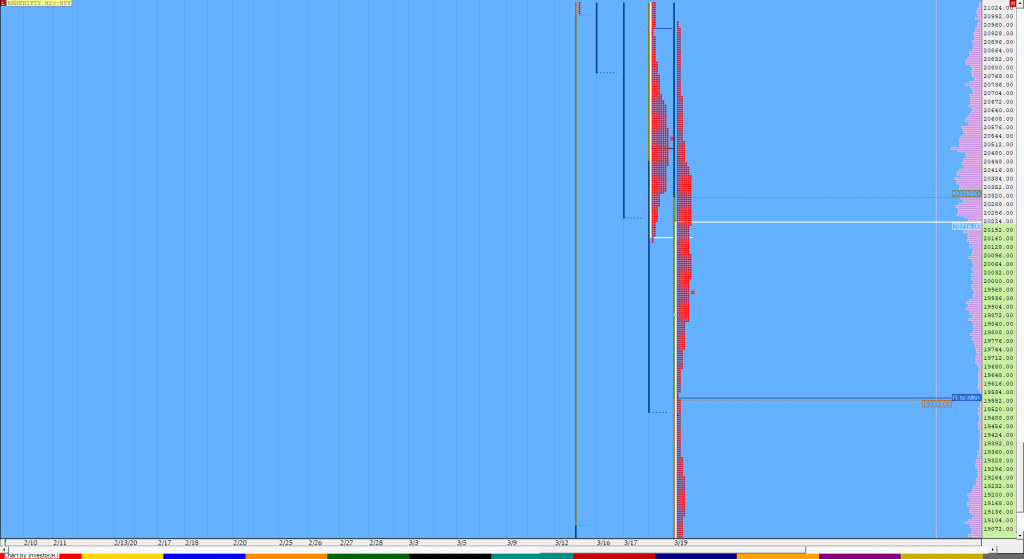

Nifty Mar F: 8206 [ 8531 / 7816 ] HVNs – (7900) / 8196 / 8550 / (8680) / (8900) / (9110-120) / 9200 / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544 NF reversed the 2-day streak of opening higher as it continued the imbalance […]

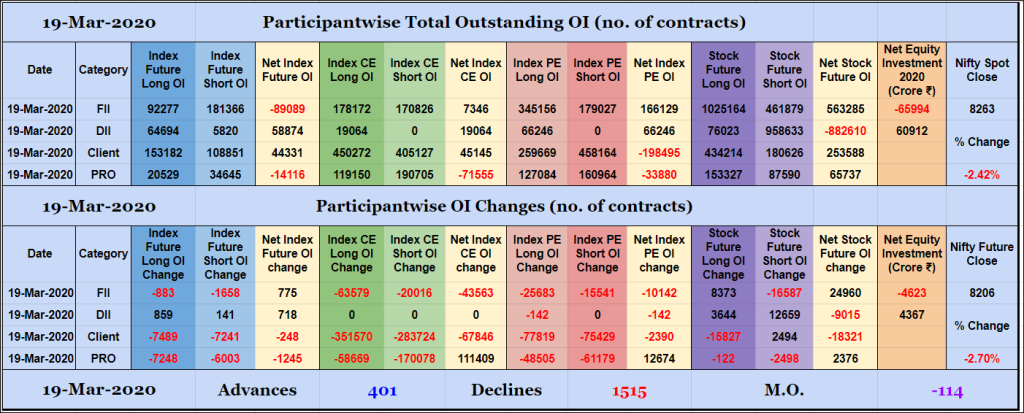

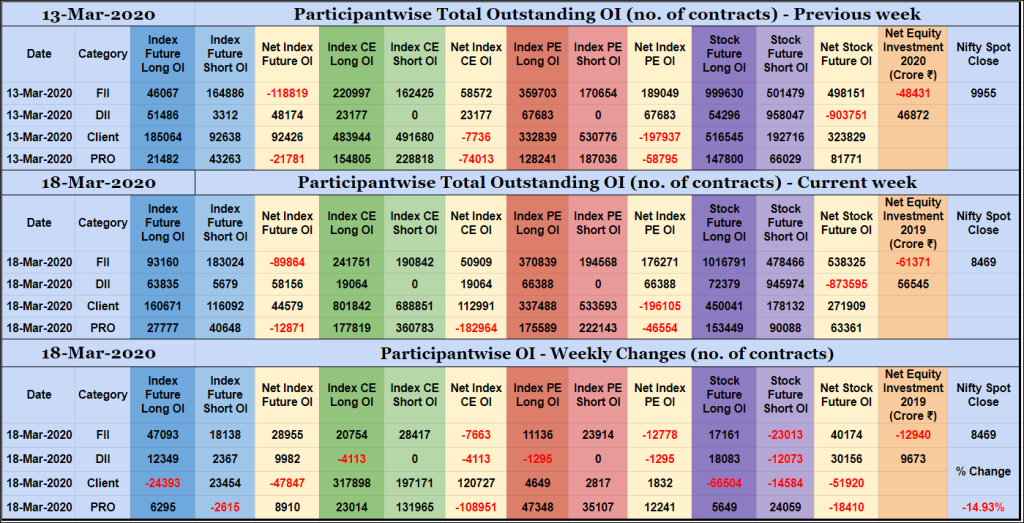

Participantwise Open Interest – 19th MAR 2020

FIIs added 8K long Stocks Futures contracts while reducing exposure in Index Futures and Index Options. They were net sellers in equity segment for ₹4623 crore. Clients also reduced exposure in Index Futures and Index Options while adding 2K long Stocks Futures contracts. Nifty MAR shed 11696 contracts with APR/MAY OI going up by 4963 […]

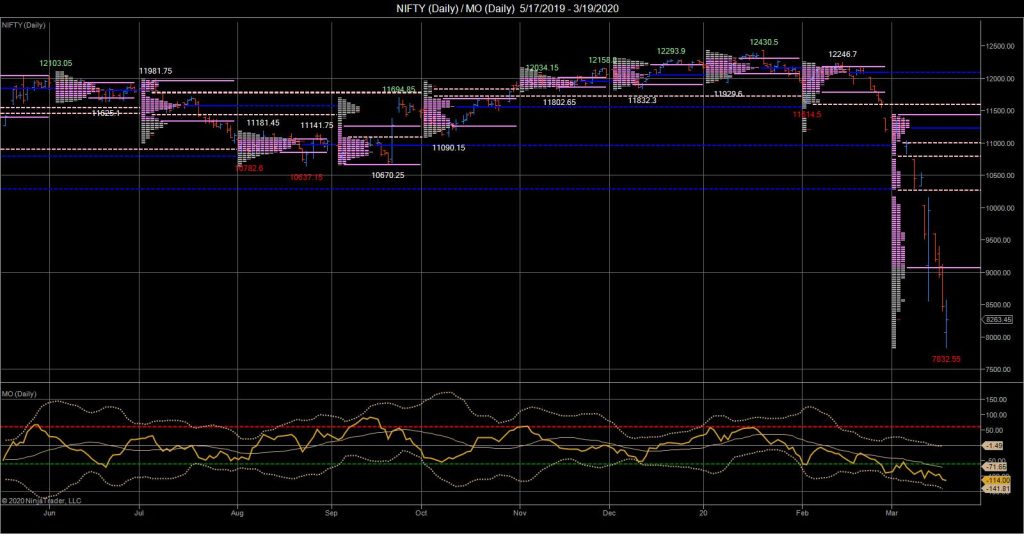

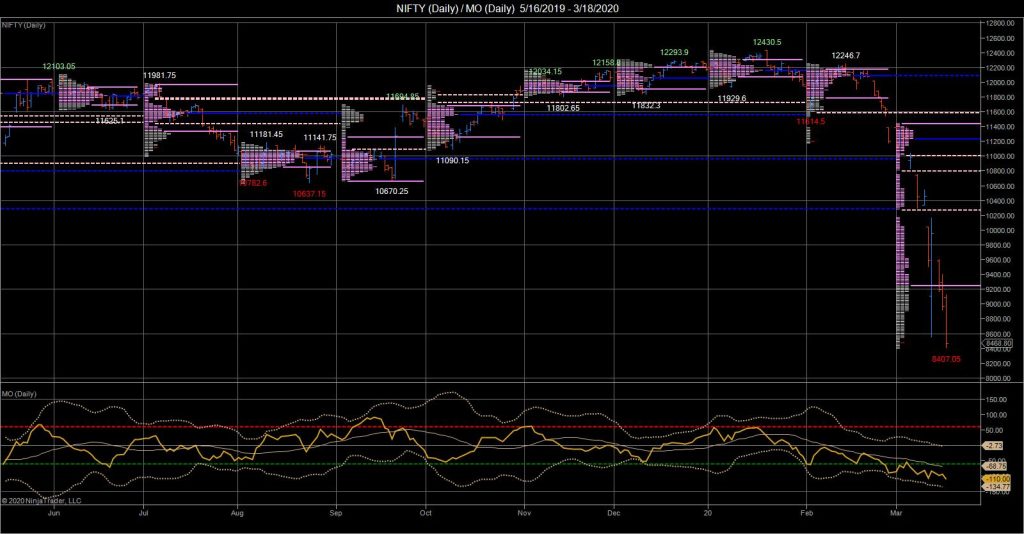

Desi MO (McClellans Oscillator For NSE) – 19th MAR 2020

MO at -114

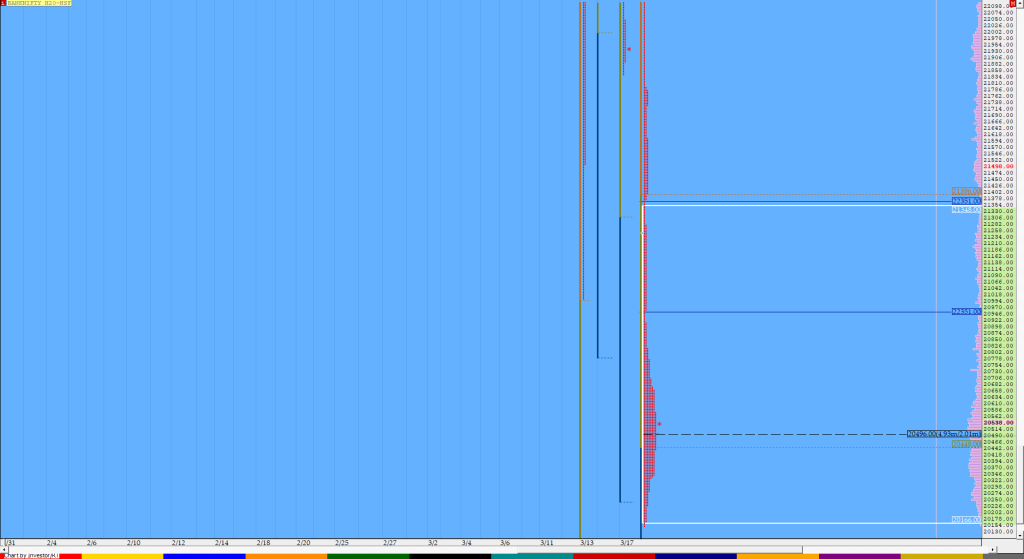

Order Flow charts dated 19th Mar 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Order Flow charts dated 19th Mar 2020 (5 mins)

Volume Profile and Order Flow are very good tools to assist you in trading. You can also use it along with your existing setup. NF BNF

Market Profile Analysis dated 18th Mar 2020

Nifty Mar F: 8434 [ 9071 / 8380 ] HVNs – 8550 / (8680) / (8900) / (9110-120) / 9200 / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544 NF opened higher for the second day running with a gap up of 125 points leaving yet […]

Participantwise Open Interest – 18th MAR 2020

Mid-week view FIIs have added net 28K long Index Futures, net 7K short Index CE, net 12K short Index PE and 17K long Stocks Futures contracts this week besides covering 23K short Stocks Futures contracts. They have been net sellers in equity segment for ₹12940 crore. Clients have added 23K short Index Futures, net 120K […]

Desi MO (McClellans Oscillator For NSE) – 18th MAR 2020

MO at -110

Order Flow charts dated 18th Mar 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Order Flow charts dated 18th Mar 2020 (5 mins)

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF BNF