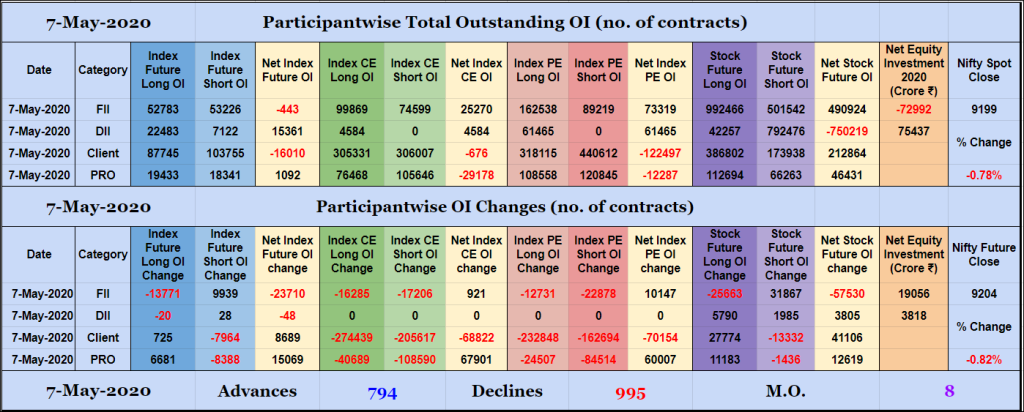

Participantwise Open Interest – 7th MAY 2020

FIIs have added 9K short Index Futures and 31K short Stocks Futures contracts while liquidating 13K long Index Futures and 25K long Stocks Futures contracts, their net Index Futures position is negative once again. They were net buyers in equity segment for ₹19056 crore today. Clients added 27K long Stocks Futures contracts today besides covering […]

Desi MO (McClellans Oscillator For NSE) – 7th MAY 2020

MO at 8

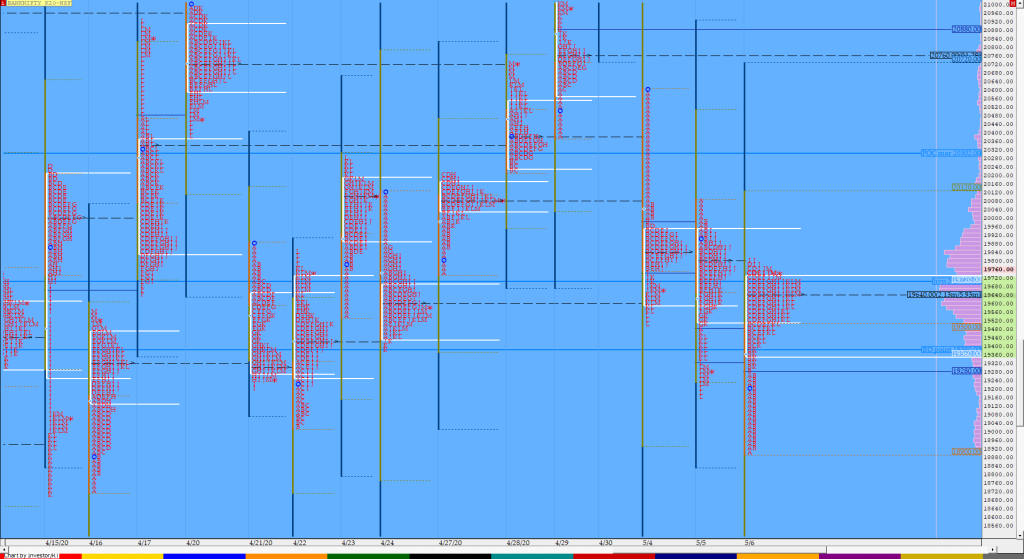

Order Flow charts dated 07th May 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Order Flow charts dated 07th May 2020 (5 mins)

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. NF BNF

Market Profile Analysis dated 06th May 2020

Nifty May F: 9280 [ 9373 / 9125 ] HVNs – 9285 / 9370 / (9475) / 9800 / 9822-40 NF opened in the spike and seemed to have given an ORR (Open Rejection Reverse) to the downside as it got rejected from 9240 and went on to break below PDL (Previous Day Low) which […]