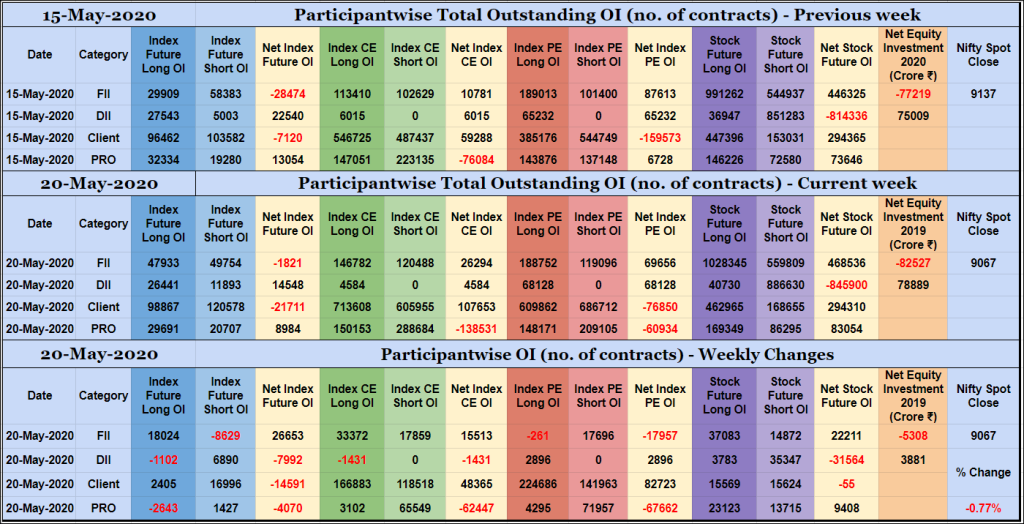

Participantwise Open Interest – 20th MAY 2020

Mid-week view FIIs have added 18K long Index Futures, net 15K long Index CE, 17K short Index PE and net 22K long Stocks Futures contracts this week besides covering 8K short Index Futures contracts. They have been net sellers in equity segment for ₹5308 crore during the week. Clients have added net 14K short Index […]

Desi MO (McClellans Oscillator For NSE) – 20th MAY 2020

MO at -10

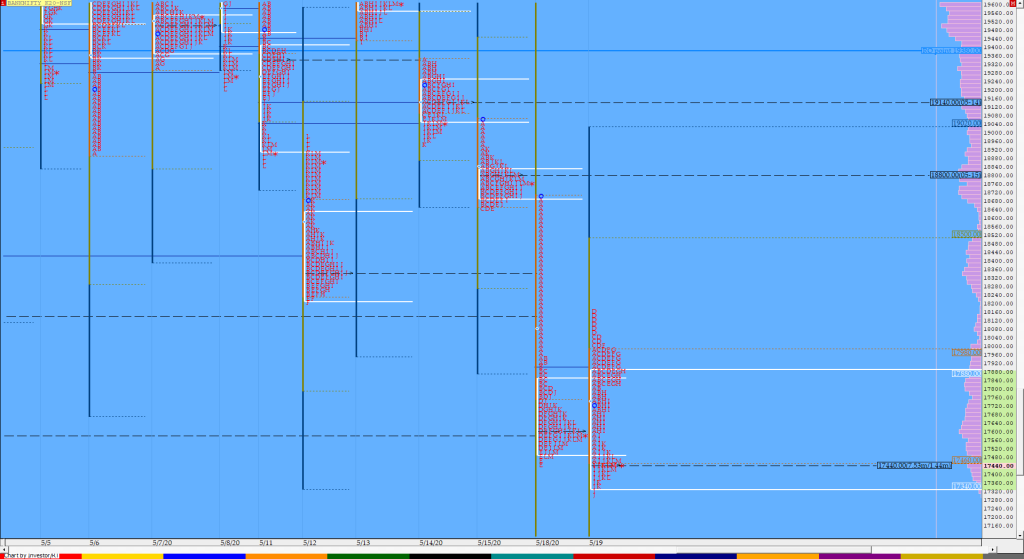

Order Flow charts dated 20th May 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Order Flow charts dated 20th May 2020 (5 mins)

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. NF BNF

Market Profile Analysis dated 19th May 2020

Nifty May F: 8884 [ 9035 / 8852 ] HVNs – (8884) / (9111) / (9180) / 9210 / 9306 / (9400) Previous day’s report ended with this ‘the dPOC for the day shifted to the lows at 8826 at close which would be an important reference for the rest of the week holding which […]