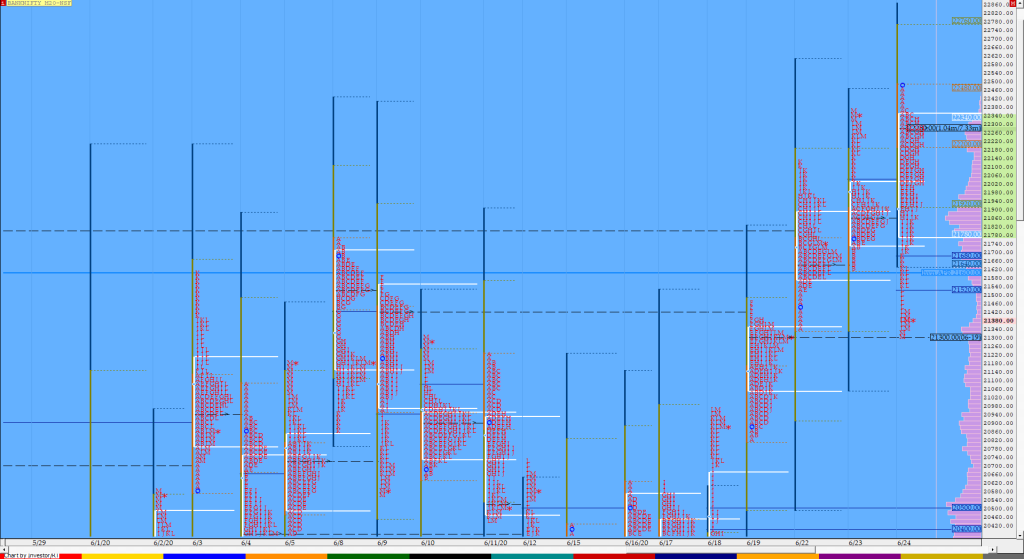

Order Flow charts dated 25th June 2020 (5 mins)

Volume Profile and Order Flow are very good tools to assist you in trading. You can also use it along with your existing setup. NF (Jul) BNF (Jul)

Market Profile Analysis dated 24th June 2020

Nifty Jun F: 10295 [ 10536 / 10274 ] HVNs – 9420 / 9785 / 9894 / 10094 / 10272 / 10320 NF opened higher but stayed in a very narrow range of just 51 points in the IB (Initial Balance) as it made a high-low of 10530-10479 & seemed to be taking support at […]

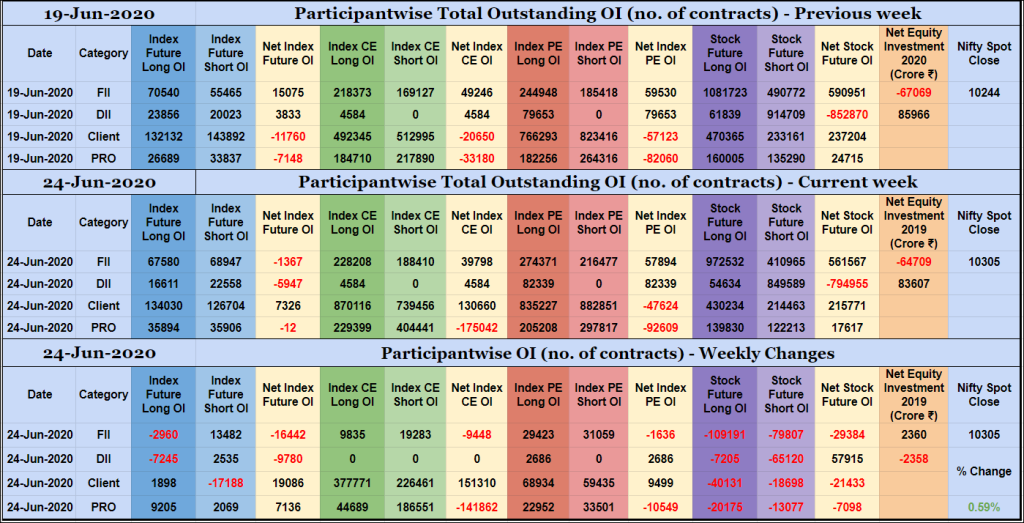

Participantwise Open Interest – 24th JUN 2020

Mid-week view FIIs have added 13K short Index Futures, net 9K short Index CE and net 1K short Index PE contracts this week while liquidating 2K long Index Futures contracts and reducing exposure in Stocks Futures. FIIs are once again net short in Index Futures. They have been net buyers in equity segment for ₹2360 […]

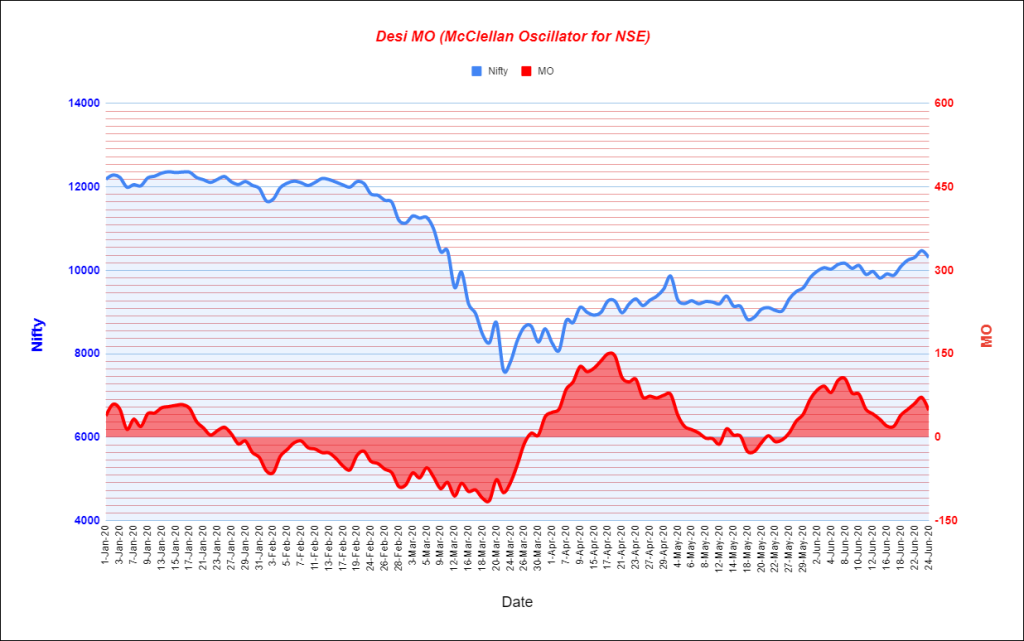

Desi MO (McClellans Oscillator For NSE) – 24th JUN 2020

MO at 48

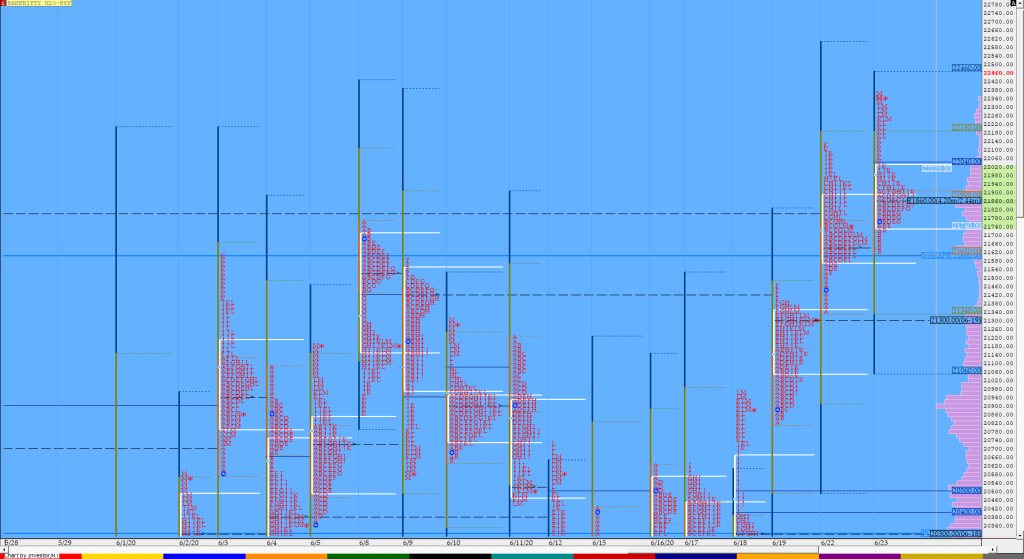

Order Flow charts dated 24th June 2020

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

Order Flow charts dated 24th June 2020 (5 mins)

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF BNF […]

Market Profile Analysis dated 23rd June 2020

Nifty Jun F: 10468 [ 10480 / 10282 ] HVNs – 9420 / 9785 / 9894 / 10094 / 10272 / 10320 Previous day’s report ended with this ‘Value formed was completely higher for the day but the balanced profile and close suggests that auction could remain in this zone unless some initiative volumes come […]

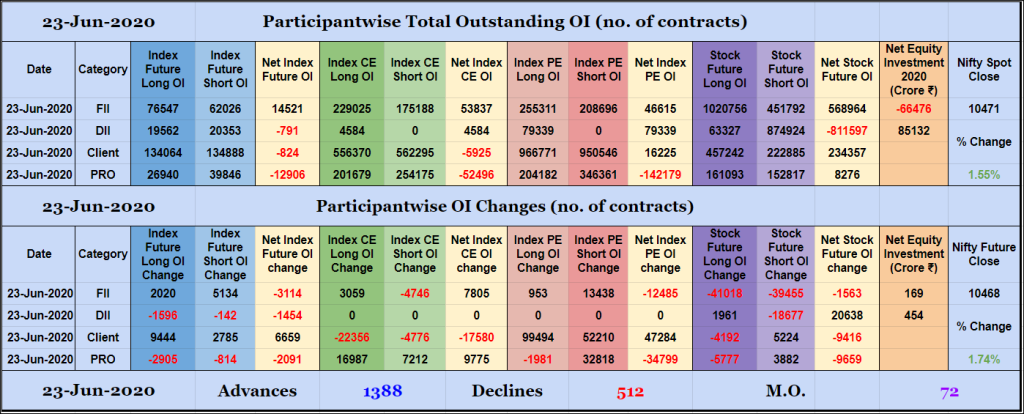

Participantwise Open Interest – 23rd JUN 2020

FIIs have added net 3K short Index Futures, 3K long Index CE and net 12K short Index PE contracts besides covering 4K short Index CE contracts and reducing exposure in Stocks Futures. They were net buyers in equity segment for ₹169 crore. Clients have added net 6K long Index Futures, net 47K long Index PE […]

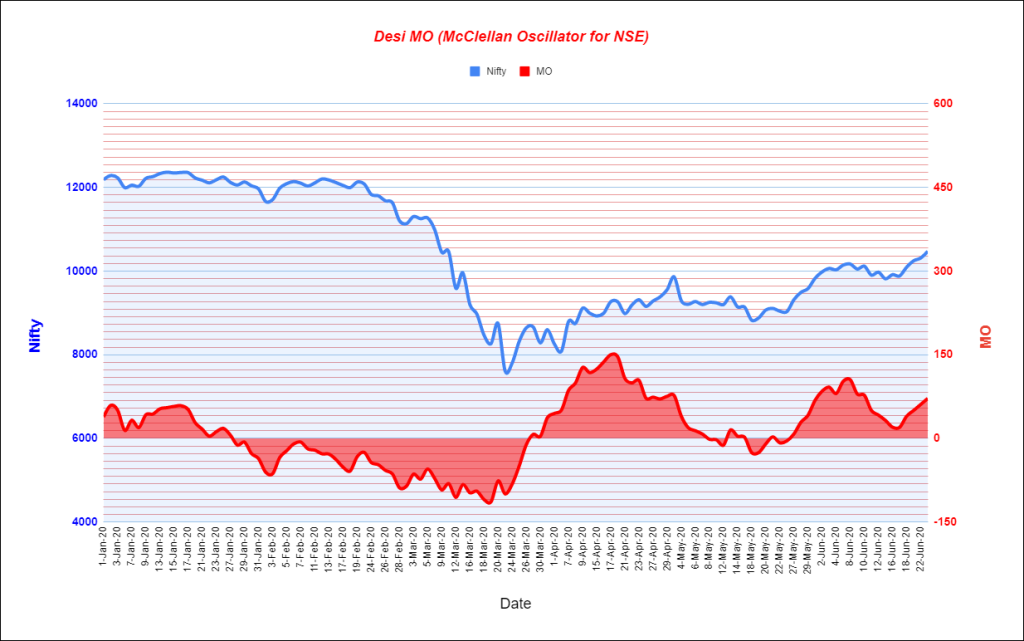

Desi MO (McClellans Oscillator For NSE) – 23rd JUN 2020

MO at 72

Order Flow charts dated 23rd June 2020

When we think about how to measure volume in the market one of the keys is Order Flow. It plays a role by telling us what the other traders have done in the market and are currently doing and this provides valuable clues and potential opportunities to trade. An Order Flow trader can actually see […]