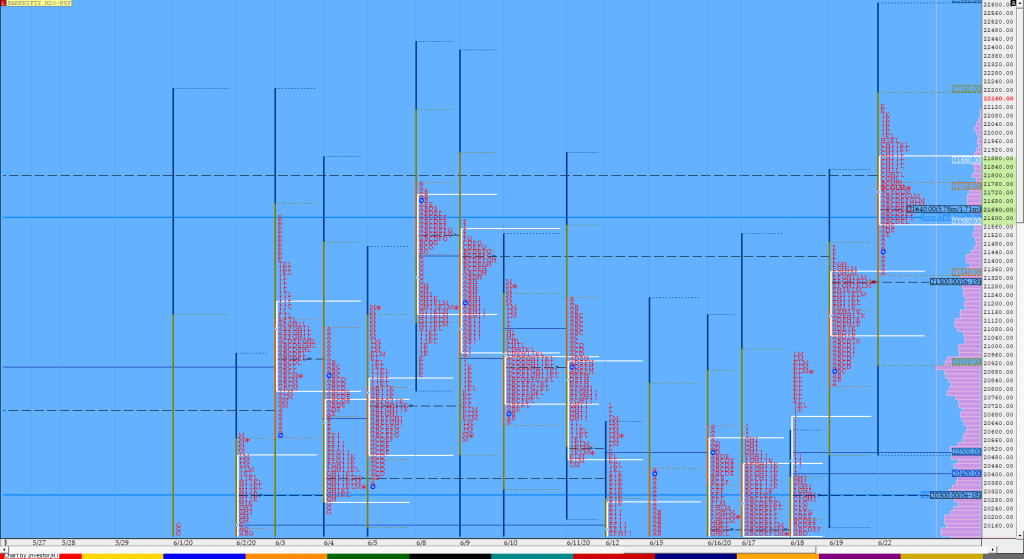

Order Flow charts dated 23rd June 2020 (5 mins)

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF BNF

AMA on 23rd June in the VTR

The details of the #AMA in the Trading Room on 23rd June 2020 09:48 Shai: @everyone, since the market is quiet, we will do an open AMA session from 10.15 am to 10.45 am today. Ask me anything you want on MarketProfile, OrderFlow and the charts. LIve from 10.15 to 10.45, bring along your questions 10:14 Govind : […]

Market Profile Analysis dated 22nd June 2020

Nifty Jun F: 10288 [ 10375 / 10236 ] HVNs – 9093 / 9275 / 9433 / 9785 / 9894 / 10064 / 10094 / 10140 / 10260 NF opened in the spike zone & moved higher giving a 111 point move in the Initial Balance as it made new highs for this series at […]

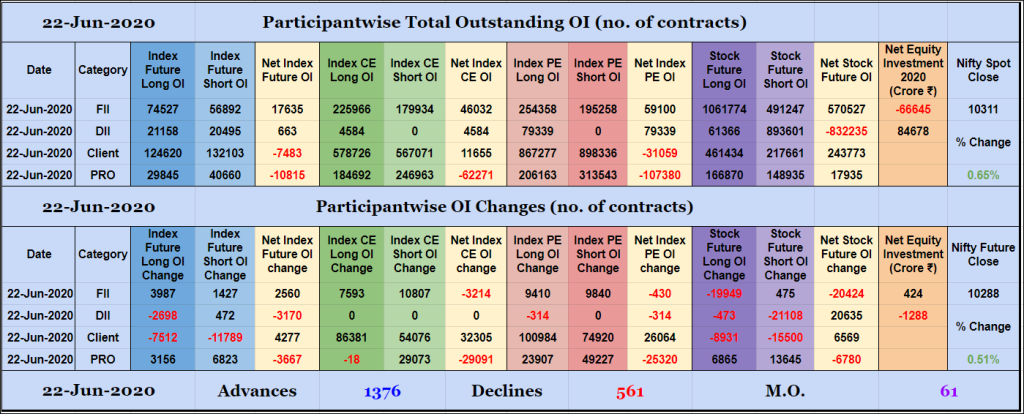

Participantwise Open Interest – 22nd JUN 2020

FIIs have added net 2K long Index Futures and net 3K short Index CE contracts today while liquidating 19K long Stocks Futures contracts. They were net buyers in equity segment for ₹424 crore. Clients have added net 32k long Index CE and net 26K long Index PE contracts while reducing exposure in Index and Stocks […]

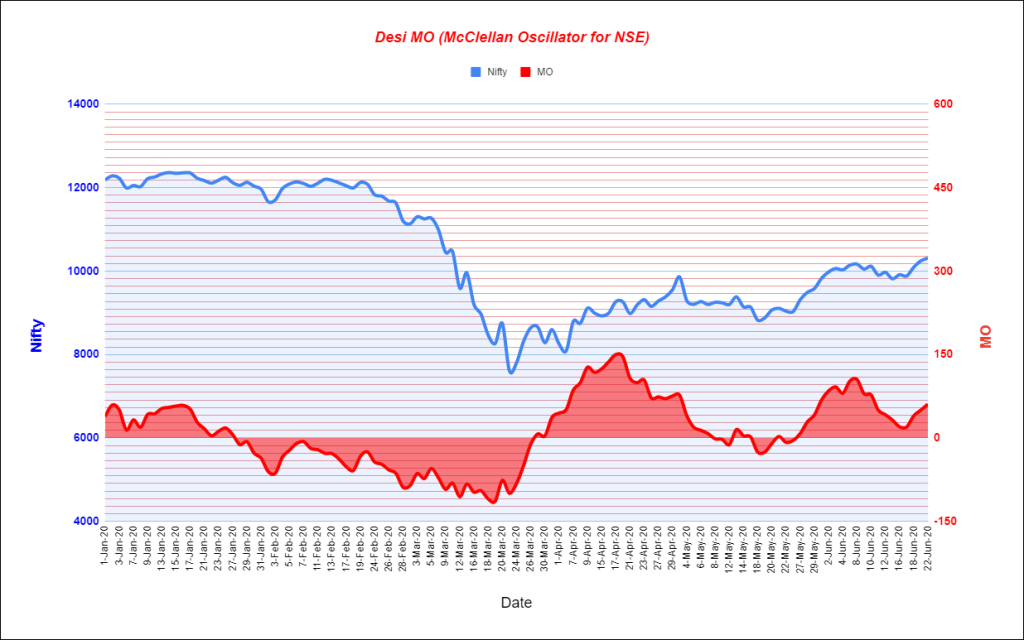

Desi MO (McClellans Oscillator For NSE) – 22nd JUN 2020

MO at 61

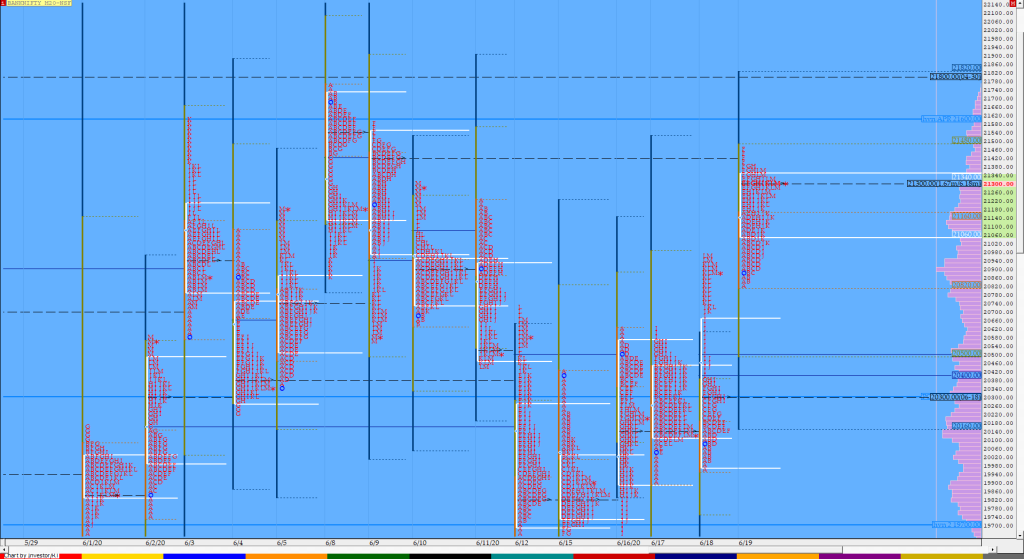

Order Flow charts dated 22nd June 2020

Timing is the key to successfully trade the markets in the shorter time frame. Order Flow is one of the most effective methods to time your trades by seeing exactly what the other traders are trading in the market and positioning your bias accordingly. Order Flow is the most transparent way to trade and takes […]

Order Flow charts dated 22nd June 2020 (5 mins)

Order Flow is the most transparent way to trade and takes away the guesswork from decision making. NF BNF

Market Profile Analysis dated 19th June 2020

Nifty Jun F: 10235 [ 10252 / 10051 ] HVNs – 9093 / 9275 / 9433 / 9785 / 9894 / 10064 / 10094 / 10140 / 10260 Previous day’s report ended with this ‘The profile has couple of extension handles at 9980 & 10008 plus a spike close of 10032 to 10104 and the spike […]

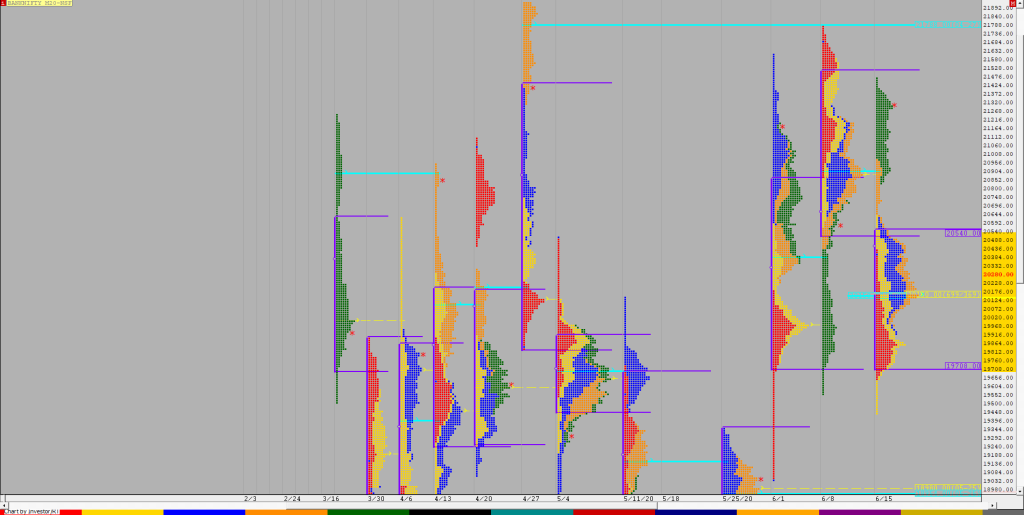

Weekly charts (15th to 19th June 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (15th to 19th June 2020) Spot Weekly – 10244 [ 10272 / 9726 ] Previous week’s report ended with this ‘On the daily front, we have a nice 7-day composite from 3rd to 11th June with Value at 10002-10109-10181 so entry into this Value in the coming week could trigger the […]

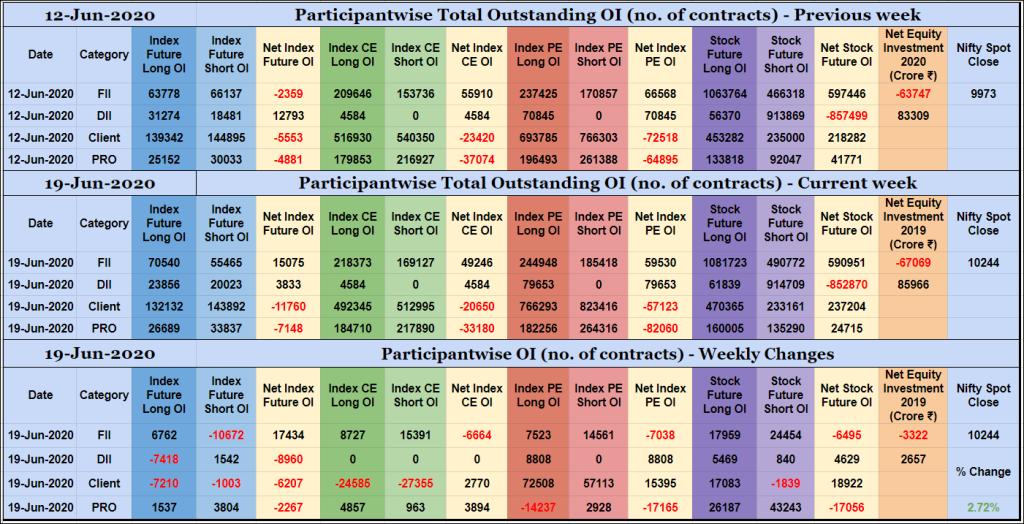

Participantwise Open Interest – 19th JUN 2020

Weekly view FIIs have added 6K long Index Futures, net 6K short Index CE, net 7K short Index PE and net 6K short Stocks Futures contracts this week while covering 10K short Index Futures contracts. They have been net sellers in equity segment for ₹3322 crore during the week. Clients have added net 15K long Index […]