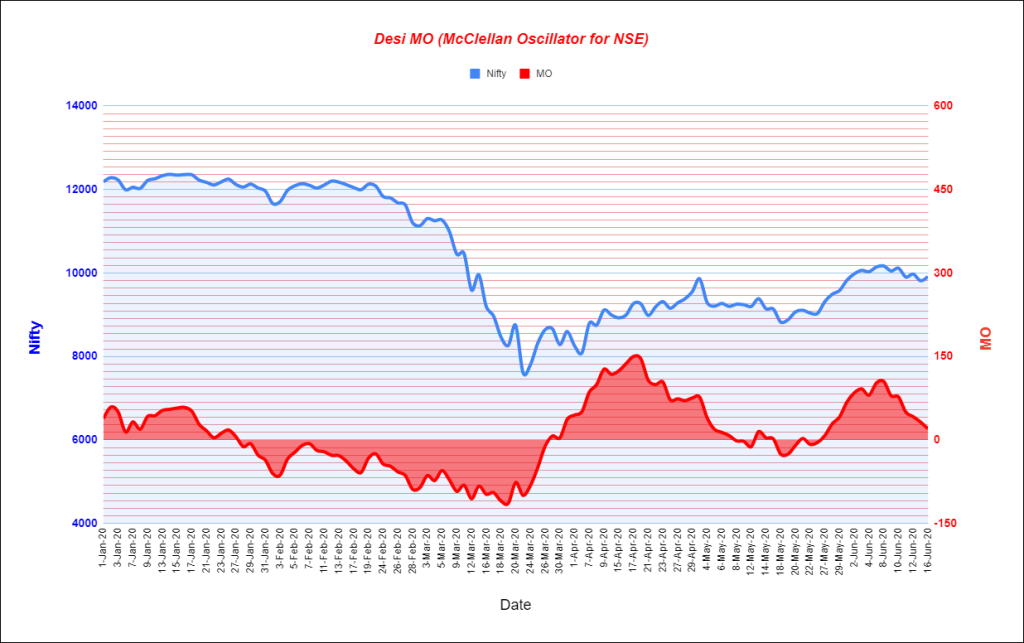

Desi MO (McClellans Oscillator For NSE) – 17th JUN 2020

MO at 20

Order Flow charts dated 17th June 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Order Flow charts dated 17th June 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF BNF

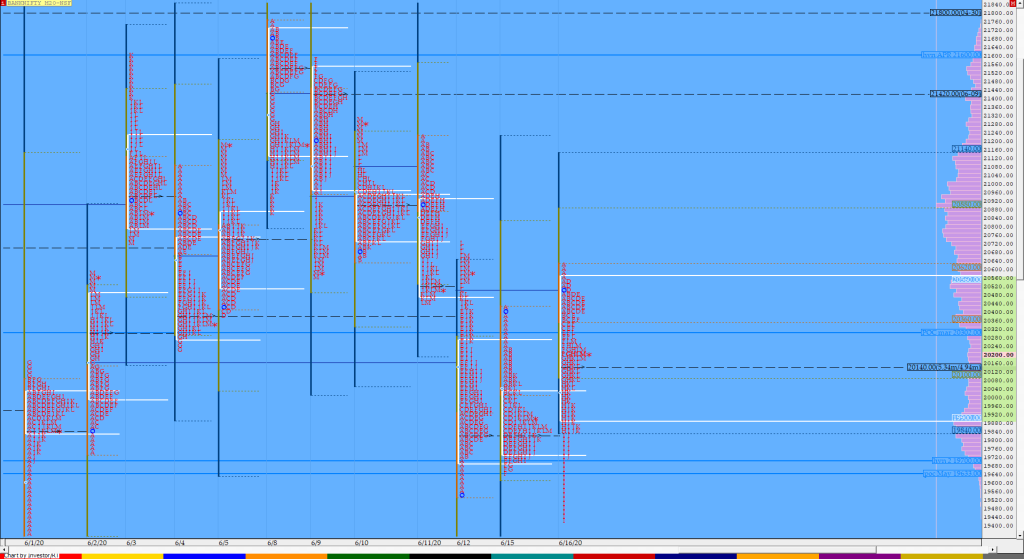

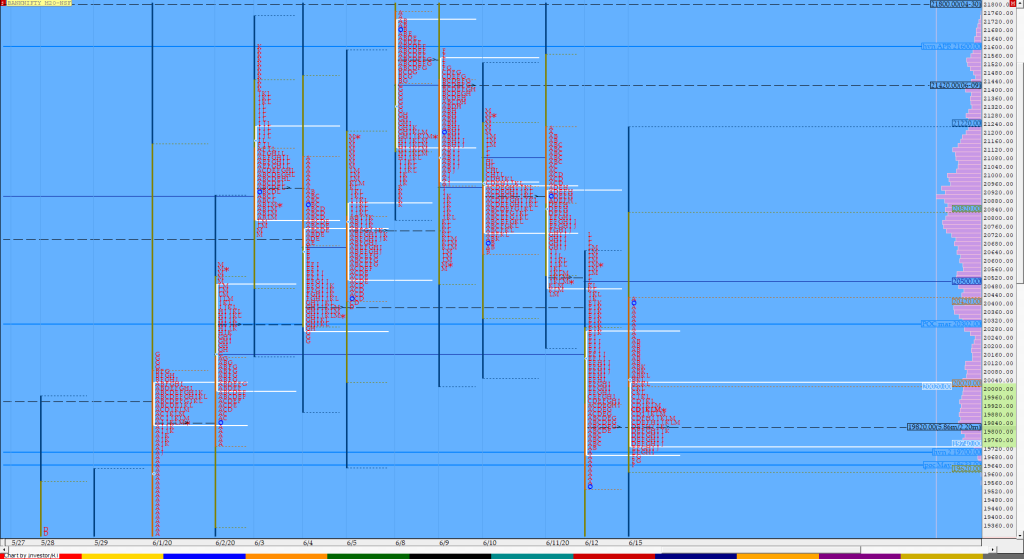

Market Profile Analysis dated 16th June 2020

Nifty Jun F: 9898 [ 10045 / 9704 ] HVNs – 9093 / 9275 / 9433 / 9785 / 9868 / 10020 / 10094 / 10140 / 10260 NF opened with a big gap up of 204 points but got rejected once again from that 10032-41 zone after making a high of 10045 in the […]

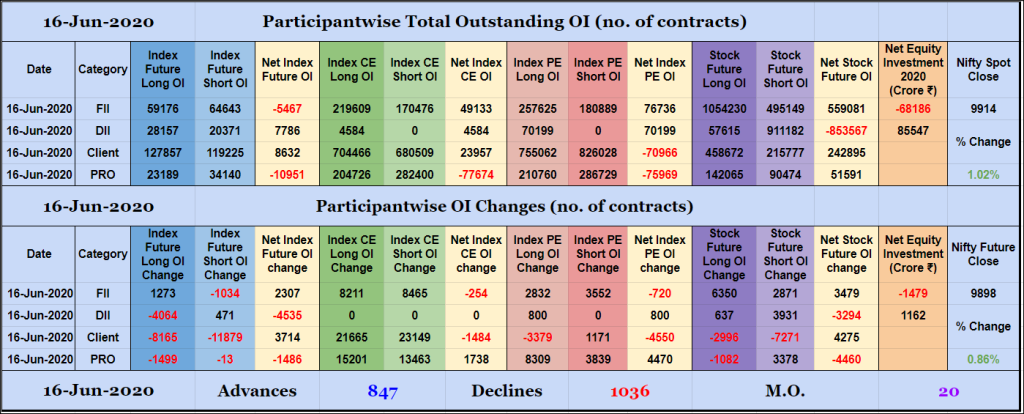

Participantwise Open Interest – 16th JUN 2020

FIIs have added 1K long Index Futures and net 3K long Stocks Futures contracts today while covering 1K short Index Futures contracts. They have been net sellers in equity segment for ₹1479 crore. Clients have reduced exposure in Index and Stocks Futures today. Nifty JUN shed 4981 contracts in Open Interest today. Banknifty JUN OI […]

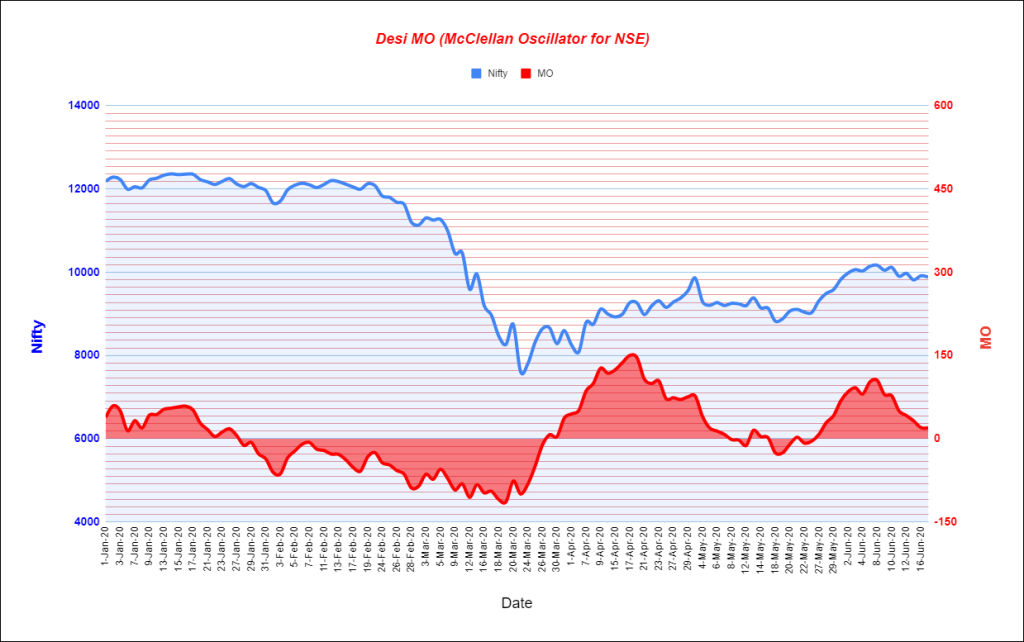

Desi MO (McClellans Oscillator For NSE) – 16th JUN 2020

MO at 20

Order Flow charts dated 16th June 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Order Flow charts dated 16th June 2020 (5 mins)

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. NF BNF

Market Profile Analysis dated 15th June 2020

Nifty Jun F: 9814 [ 9905 / 9682 ] HVNs – 9093 / 9275 / 9433 / 9785 / 9868 / 10020 / 10094 / 10140 / 10260 NF opened lower giving a retracement after the 3 IB day on Friday as it left a small selling tail in the IB (Initial Balance) from 9875 […]

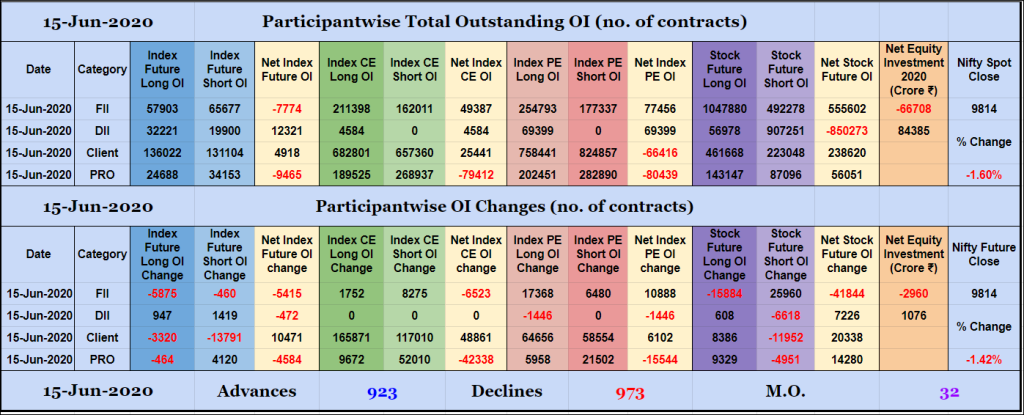

Participantwise Open Interest – 15th JUN 2020

FIIs have added net 6K short Index CE, net 10K long Index PE and 25K short Stocks Futures contracts today while liquidating 16K long Stocks Futures contracts. They were net sellers in equity segment for ₹2960 crore. Clients have added net 48K long Index CE, net 6K long Index PE and 8K long Stocks Futures […]