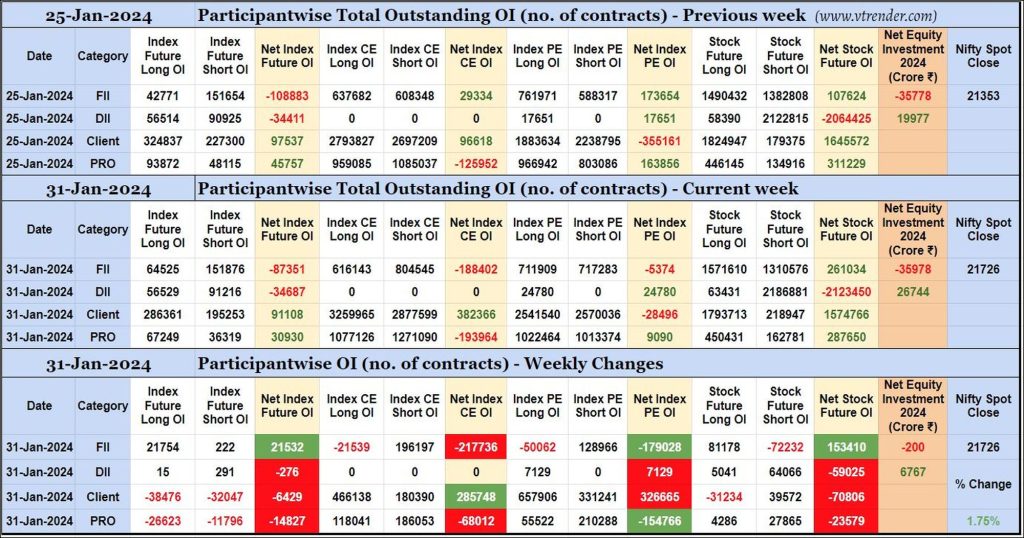

Participantwise Open Interest (Mid-week changes) – 31st JAN 2024

FIIs have added net 21K long Index Futures, 196K short Index CE, 128K short Index PE and 81K long Stocks Futures contracts during this week besides liquidating 21K long Index CE and 50K long Index PE contracts. They have also covered 72K short Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹200 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 31st JAN 2024

MO at 9

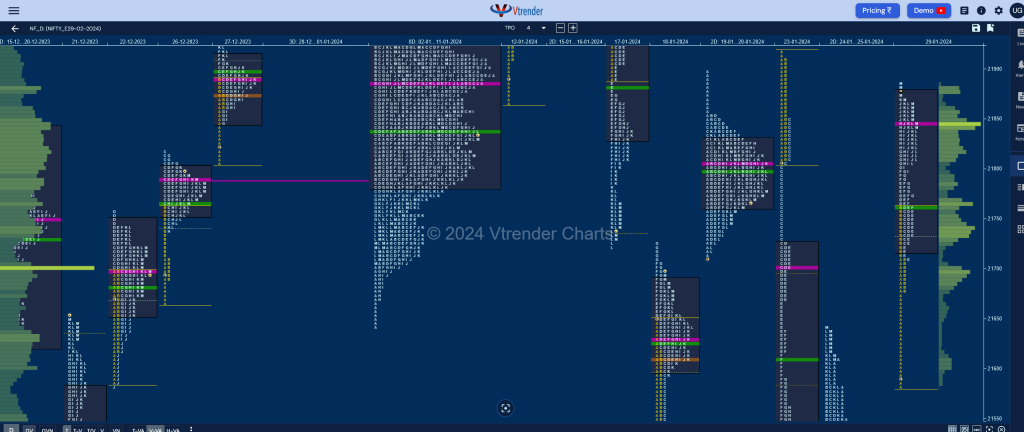

Market Profile Analysis dated 30th January 2024

Nifty Feb F: 21630 [ 21938 / 21607 ] Open Type OA (Open Auction) Volumes of 18,922 contracts Average Initial Balance 124 points (21938 – 21815) Volumes of 38,512 contracts Average Day Type Trend – 332 points Volumes of 1,63,520 contracts Above average NF continued previous day’s Trend Up imbalance with another higher open scaling above […]

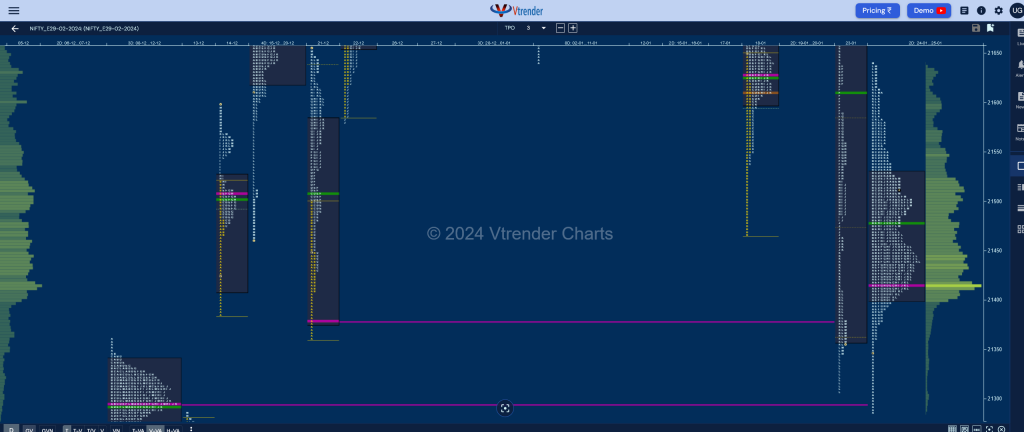

Market Profile Analysis dated 29th January 2024

Nifty Feb F: 21855 [ 21885 / 21575 ] Open Type OD (Open Drive Up) Volumes of 32,910 contracts Above average Initial Balance 185 points (21760 – 21575) Volumes of 60,205 contracts Above average Day Type Trend – 310 points Volumes of 1,81,214 contracts Above average NF made a higher open and took support right at […]