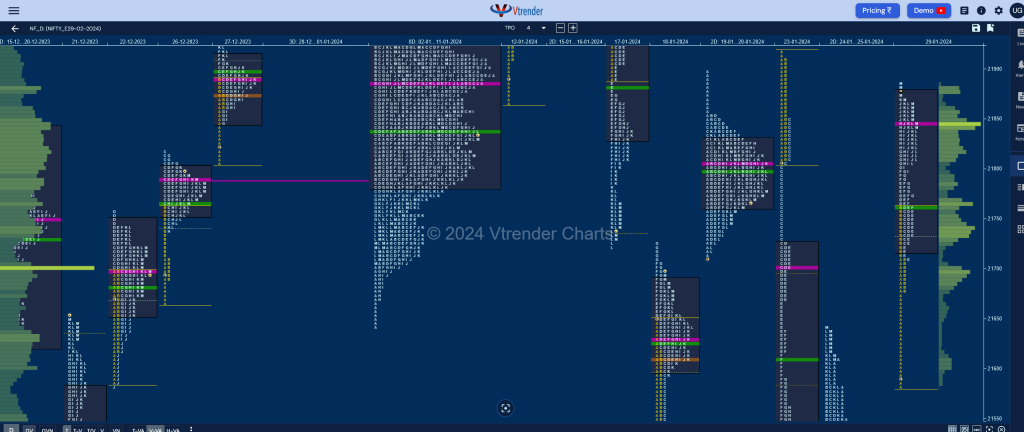

Nifty Feb F: 21855 [ 21885 / 21575 ]

| Open Type |

|---|

| OD (Open Drive Up) |

| Volumes of 32,910 contracts |

| Initial Balance |

|---|

| 185 points (21760 – 21575) |

| Volumes of 60,205 contracts |

| Day Type |

|---|

| Trend – 310 points |

| Volumes of 1,81,214 contracts |

NF made a higher open and took support right at Jan series VWAP of 21575 confirming an Open Drive Up and went on to leave a Trend Day as it went on to make a high of 21885 into the close but saw the dPOC shifting higher to 21845 indicating profit booking by the initiative buyers.

The auction stalled just below the selling tail of 21908 from 23rd Jan which will be the immediate reference above which the 17th Jan sell side references of 21940 (C TPO POC) & VPOC of 21986 could come into play along with the A period tail from 22003 to 22044 whereas on the downside, today’s PBL of 21809 along with VWAP of 21761 will be the important levels to hold below which the extension handle of 21709 can get tagged along with the buying tail from 21678 to 21575

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21845 F and VWAP of the session was at 21761

- Value zones (volume profile) are at 21716-21845-21879

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21575 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 30th Jan 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

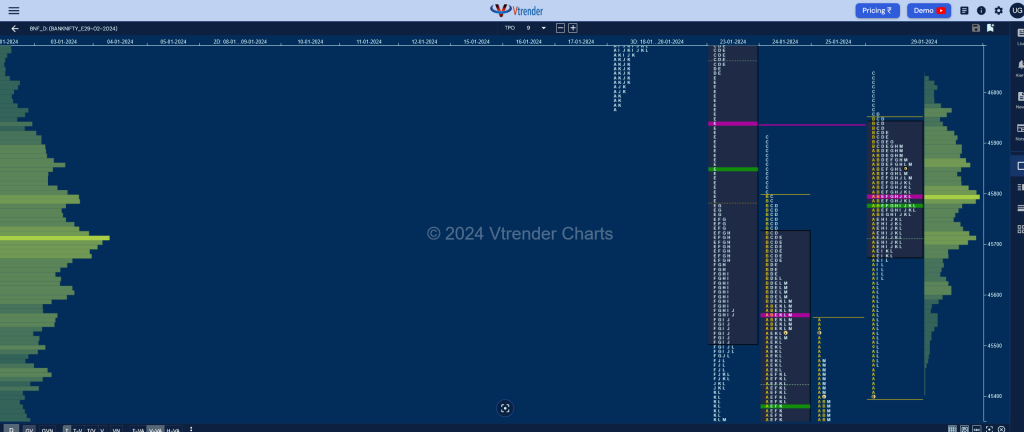

BankNifty Feb F: 45735 [ 46039 / 45453 ]

| Open Type |

|---|

| OD (Open Drive Up) |

| Volumes of 42,178 contracts |

| Initial Balance |

|---|

| 496 points (45949 – 45453) |

| Volumes of 96,144 contracts |

| Day Type |

|---|

| Normal – 585 points |

| Volumes of 2,77,800 contracts |

BNF continued previous session’s imbalance close with a gap up open of 195 points and continued to drive higher for the rest of the Initial Balance (IB) as it hit 45949 leaving a long A period buying tail from 45760 to 47453 but made the dreaded C side extension to 46039 marking the end of the upside leaving a responsive selling tail till 45962.

The auction then went on to probe lower getting into the A period singles almost negating it completely as it made a low of 45464 in the L TPO before making a swift bounce back to 45898 into the close leaving a Normal 3-1-3 profile with completely higher Value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45800 F and VWAP of the session was at 45778

- Value zones (volume profile) are at 45675-45800-45938

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46488 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 30th Jan 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.