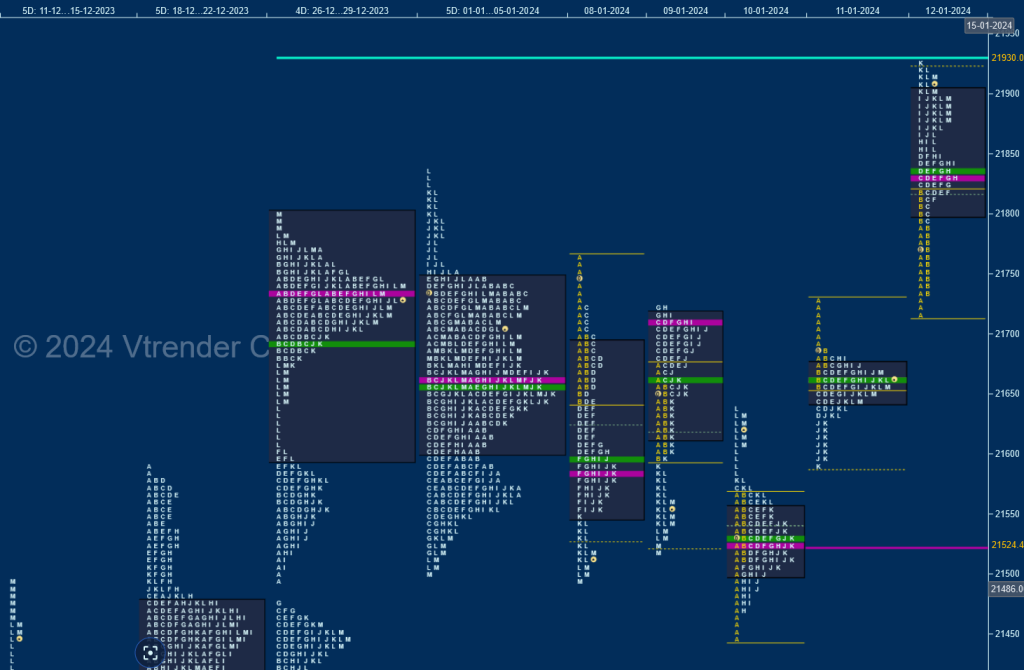

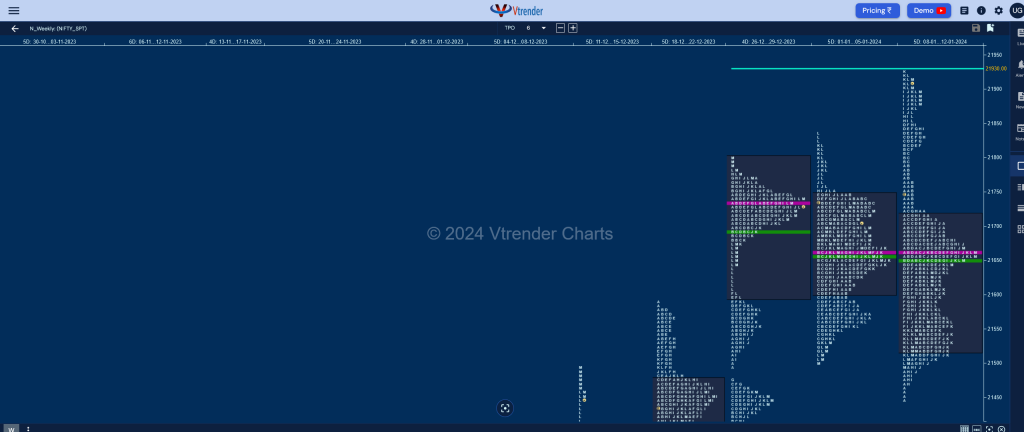

Nifty Spot: 21894 [ 21928 / 21448 ]

Previous week’s report ended with this ‘The weekly profile is a Neutral Centre One with completely inside Value at 21601-21663-21748 and can continue to remain in this range smoothening the balance further unless we get initiative activity at one end for a fresh imbalance to being either towards new ATH of 22000 plus on the upside or towards the daily VPOCs of 21445 & 21341 from 26th & 22nd Dec respectively on the downside in the coming week‘

Nifty opened the week on 08th with a look up above previous week’s Value and got rejected leaving an initiative selling tail from 21724 to 21763 triggering the 80% Rule which it duly completed and went on to form a Trend Day Down even looking below the lows of 21500 as it tagged 21492.

However, it did not give any follow up on 09th and in fact opened higher trapping the late shorts and forcing them out as it went on to make multiple REs to the upside but stalled right at 21724 marking the return of OTF sellers who then pushed back the auction to lows of 21517 leaving a Neutral Extreme Day Down and gave a rare follow up on 10th as it made new lows of 21448 at the open almost hitting this week’s objective of 21445 (VPOC from 26th Dec) which also marked the end of the downside for the week as it left an initiative buying tail and built a prominent POC at 21524 after which it went on to get back into previous week’s Value with the help of a spike from 21581 to 21641.

11th Jan saw the continuation of the imbalance with a higher open but yet again Nifty stopped in that initiative selling tail from 08th while making a high of 21726 and formed a narrow range ‘b’ shape profile giving a retracement down to 21593 with a close right at the prominent POC of 21661 which was also coinciding with previous week’s POC and gave a sign that it was finally ready to move away from this magnet with a higher open on 12th where it not only negated the selling tail but left A period buying singles from 21733 to 21715 marking the change of PLR (Path of Least Resistance) to the upside and went on to form a slow Trend Day Up hitting new highs for the week/month at 21928.which it went on to get back into previous week’s Value with the help of a spike from 21581 to 21641.

The weekly profile is a Neutral One to the upside with moslty overlapping Value at 21521-21661-21719 and exactly the same POC of 21661 from where it has made a move away taking out the daily swing high of 21834 from 01st Jan which will be the first support level to watch out in the coming week and also coincides with dPOC of 21828 from 12th below which we have the extension handle of 21789 along with the buying tail from 21733 as the important levels which need to hold whereas on the upside, NIfty will need to sustain above 21930 for a probe towards that BRN (Big Round Number) of 22000 and above it can go for 22269.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 17th Jan 2024

| Up |

| 22054 – 2-day POC (15-16 Jan) 22086 – 2-day VAH (15-16 Jan) 22124 – Failed Auction (16 Jan) 22168 – Monthly 2 IB 22206 – Weekly 2 IB |

| Down |

| 22021 – 2-day VAL (15-16 Jan) 21969 – PDL 21922 – Closing tail (12 Jan) 21876 – M TPO low (12 Jan) 21834 – Daily Ext Handle |

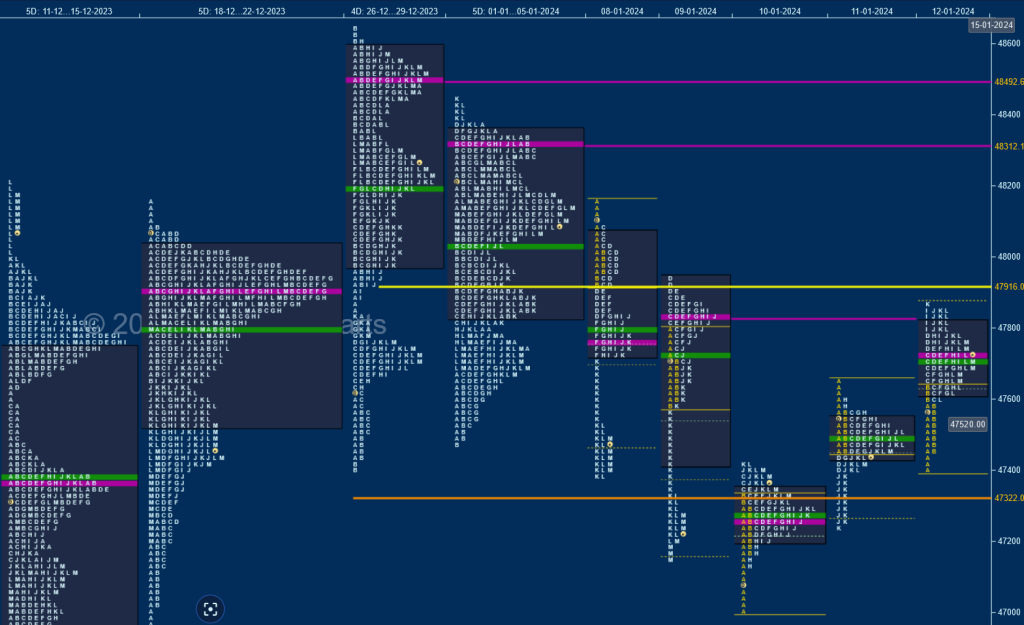

BankNifty Spot: 47709 [ 48154 / 47010 ]

Previous week’s report ended with this ‘The weekly profile is a Neutral Centre One with the range completely inside previous week as it formed Value below previous week’s POC of 48492 at 47835-48312-48361 with the immediate reference being the 2 opposite A period tails on the daily time frame which is 48344 to 48381 on the upside and 47823 to 47786 on the downside with a daily VPOC at 47726 from 03rd Jan‘

BankNifty opened right in the middle of previous week’s Value but left an A period selling tail from 48082 to 48154 as it first filled up the low volume zone from 48060 to 47880 leaving an extension handle at 47924 as it went on to negate the buying zone from 47823 to 47786 which was followed by another extension handle at 47719 which helped it make a look down below the lows of last 2 weeks where it formed similar lows of 47390 & 47387 indicating exhaustion to the downside.

Subsequently, the auction opened higher on 09th negating the extension handle of 47719 and getting back into previous value but stalled right at the first extension handle of 47924 as it made a high of 47939 and left a small responsive selling tail triggering another big drop after it left a new extension handle at 47590 and went on to make new lows for the month at 47156 leaving a Neutral Extreme (NeuX) Day Down and gave a rare follow up at open on 10th Jan where it made new lows for the month at 47010 testing the weekly buying tail from 47029 to 46919 (18-22 Dec) and finally found some initiative demand coming back as it left A period singles and formed a ‘p’ shape profile for the day with a prominent POC at 47251.

The upside continued with a higher open on 11th as it went on to hit 47662 but failed to attract any more demand resulting in a profit booking probe lower for the rest of the day as it went on to tag the prominent POC of 47251 while making a low of 47237 but left a small responsive buying tail marking the end of the downmove as BankNifty got back to tag the NeuX VPOC of 47833 on 12th Jan after leaving an initiative buying tail at open but once again stalled below that reference of 47924 which is incidentally also very close to December’s POC of 47918 and made a close around the dPOC of 47729.

The weekly profile is a Normal Variation one to the downside with completely lower Value at 47194-47492-47770 and has small zone of singles at both ends from 48082 to 48156 being the upside one and the lower one being from 47126 to 47010 which will be the references for either the buyers or sellers to take out respectively but the immediate references on watch would be the TPO HVNs at 47826 on the upside along with 47286 on the downside as BankNifty prepares for a move either towards the higher weekly VPOCs of 48312 & 48492 on the upside or probes lower for a test of the lower one at 46831 in the coming week(s).

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for the week 17th Jan 2024

| Up |

| 48154 – Halfback (16 Jan) 48254 – IBH from 16 Jan 48344 – Selling Tail (2-day composite) 48492 – VPOC from 28 Dec 48614 – Selling tail (28 Dec) |

| Down |

| 48118 – POC from 16 Jan 47973 – PBL from 15 Jan 47830 – Buying Tail (15 Jan) 47729 – VPOC from 12 Jan 47586 – Extension Handle (12 Jan) |