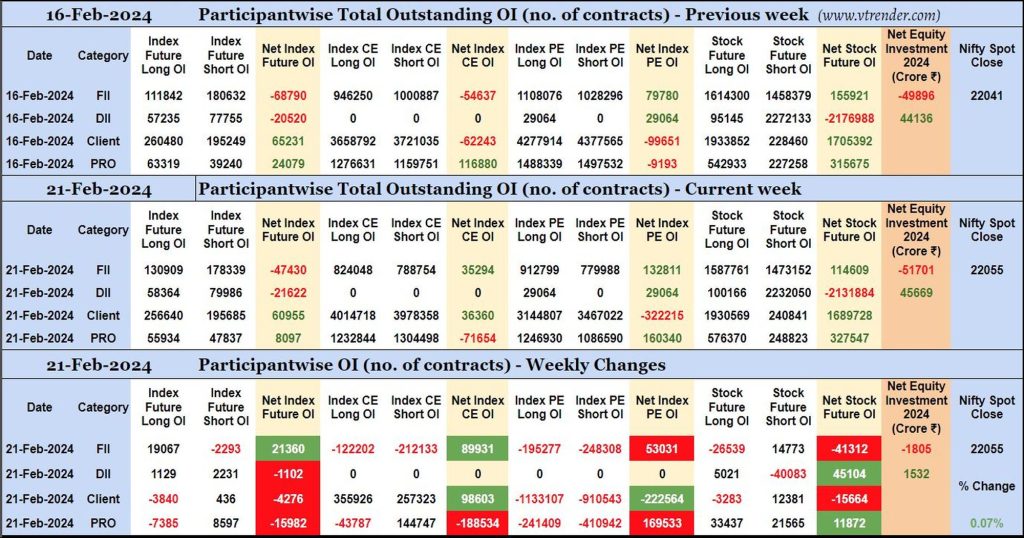

Participantwise Open Interest (Mid-week changes) – 21st FEB 2024

FIIs have added 19K long Index Futures and 14K short Stocks Futures contracts so far this week besides covering 2K short Index Futures contracts, liquidating 26K long Stocks futures contracts and shedding Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹1805 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 21st FEB 2024

MO at -13

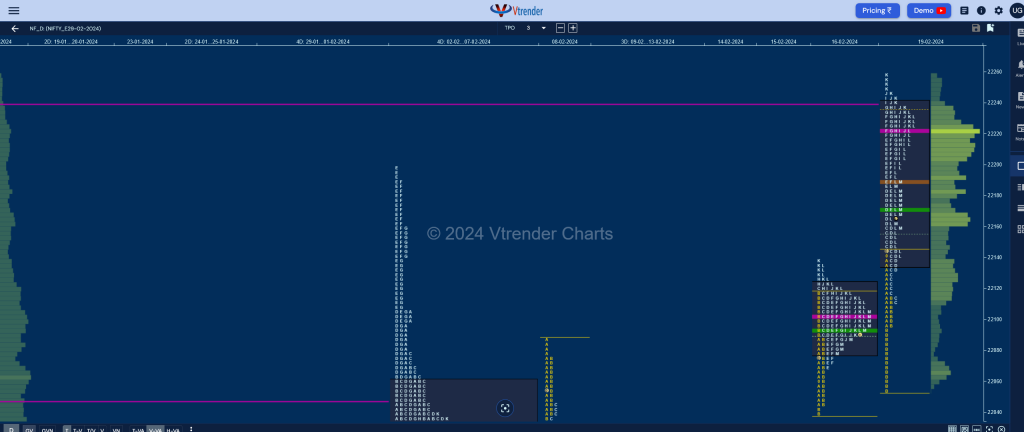

Market Profile Analysis dated 20th February 2024

Nifty Feb F: 22217 [ 22234 / 22078 ] Open Type OAIR (Open Auction In Range) Volumes of 11,119 contracts Below average Initial Balance 82 points (22158 – 22076) Volumes of 34,114 contracts Below average Day Type Normal Variation – 158 pts Volumes of 1,17,158 contracts Below average NF made an OAIR start but remained below […]