Order Flow Analysis: Open Mic Q&A Session

Join our Open Mic Q&A session to get all your queries answered by experts! Dive deeper into demand, supply, and smart trading. Following our previous in-depth webinar on order flow analysis, we are excited to present an interactive Open Mic Q&A session. This is your chance to dig deeper into the core concepts of demand, […]

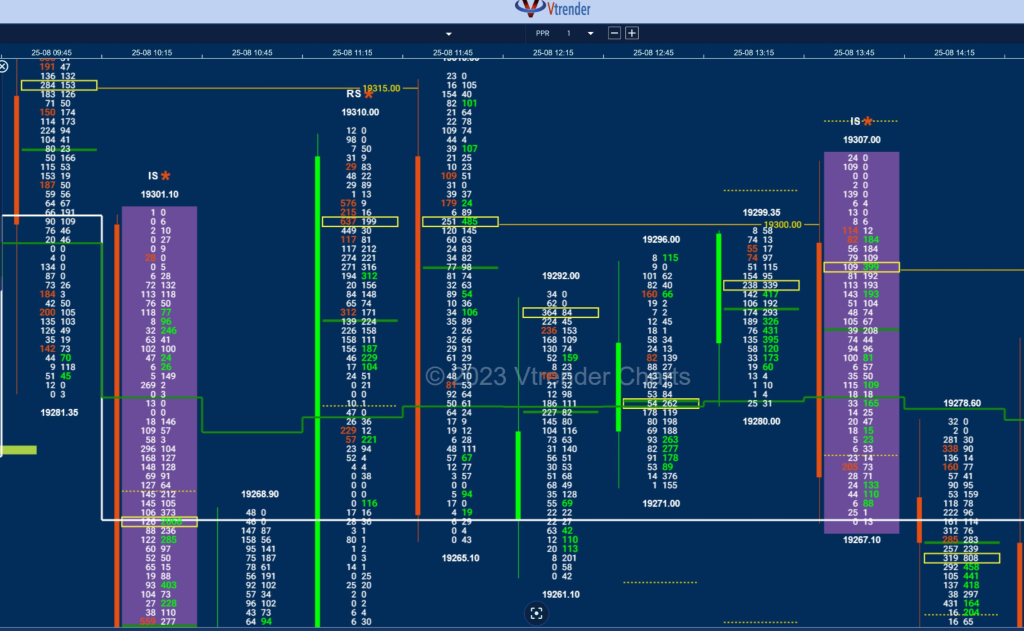

The Nuances of Traded Volumes in Order Flow

Traded Volumes in Order Flow – A New Perspective In the complex world of derivative trading, one cannot underestimate the role of traded volumes in predicting future market moves. Even seasoned traders occasionally find themselves “upside down,” a situation where their trading positions are at odds with the prevailing market direction. This article delves deep […]

Round 2 with Orderflow, MarketProfile, & Options

Did our Saturday session leave you buzzing with questions and curiosity? We’re hosting a follow-up webinar tonight to delve even deeper into the power-packed trio of Orderflow, MarketProfile, and the Options Suite. -️ Date: August 24th – Time: 8:30 pm Link – https://us06web.zoom.us/j/87802243360 And here’s the best part – it’s an “Open Mic” session! Got […]

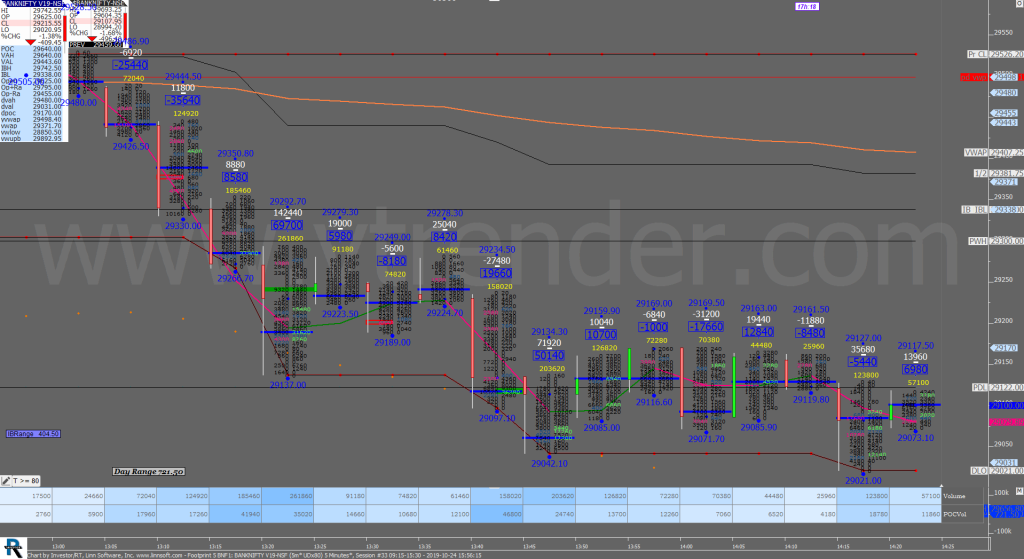

2408 – Post Open look ahead

Settlement Showdown: Nifty & Banknifty’s Next Moves Unveiled

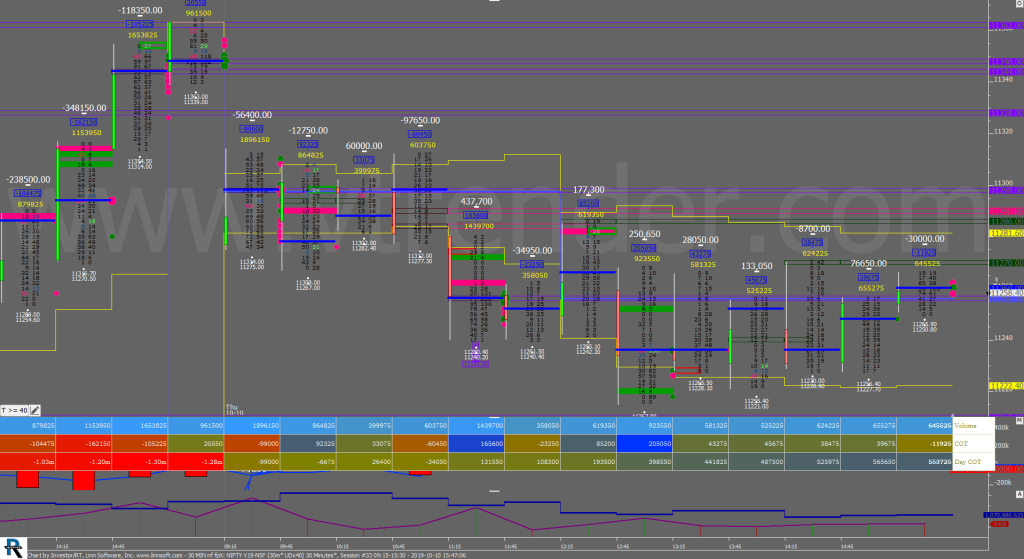

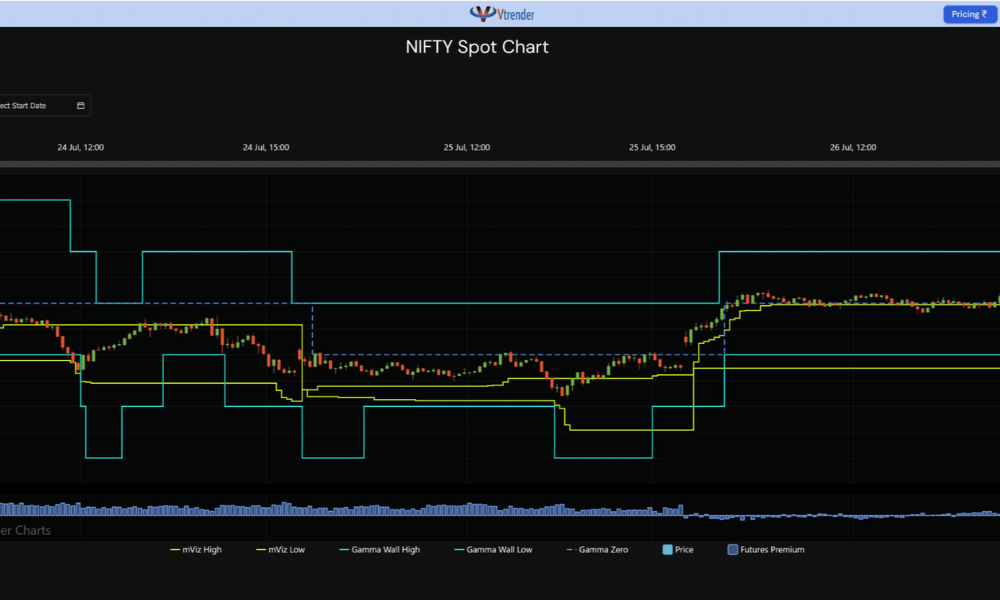

Unlocking Trading Excellence: A Deep Dive into Vtrender’s Enhanced Orderflow Charts

We’re thrilled to extend an exclusive invitation to our esteemed members and passionate traders like you. As the trading landscape continues to evolve, so does Vtrender. We’re always at the forefront, innovating to provide you with the most advanced and efficient trading tools available. Our upcoming webinar is a testament to that commitment. 📅 Date […]

Understanding Volatility: Historical vs. Implied and Deciphering the VIX

Volatility a key concept of Option Trading In the world of trading and finance, volatility is a key concept that every trader should be familiar with. It provides insights into the expected price fluctuations of the instrument you trade. In this post, we’ll delve into the differences between historical volatility and implied volatility, explain how […]

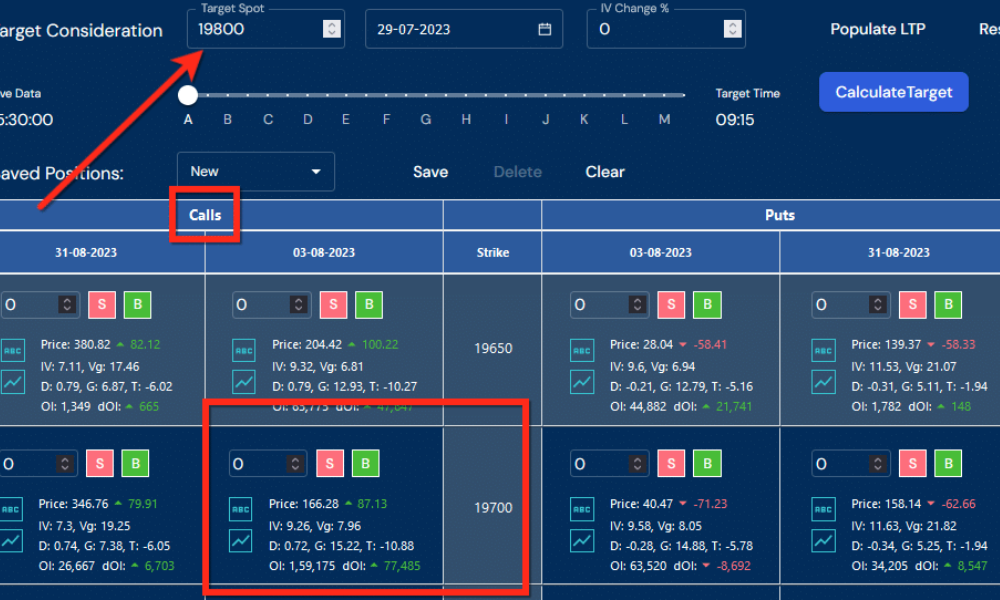

Unraveling the Mysteries of Open Interest: A Beginner’s Guide to Options Trading

Exploring Open Interest in Options Trading: A Beginner’s Guide In the world of Options Trading, one of the most fundamental terms you’ll come across is “Open Interest,” and the manner in which it interacts with delta, gamma, and volume can initially seem complicated. In this article, we’ll shed light on these concepts, simplifying them to […]

The Greeks: A Beginner’s Guide to Understanding Option Prices

Options: A powerful tool for managing risk and generating profit Options are a powerful tool that can be used to manage risk and generate profit. They give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. This means that […]

Delta Neutral vs. Gamma Neutral: Exploring Advanced Hedging Strategies in Options Trading

Delta Neutral Vs. Gamma Neutral Risk management serves as the backbone of successful trading, particularly in derivatives like options where market volatility can substantially influence profits and losses. Two prevalent hedging strategies in this context are the Delta Neutral and Gamma Neutral strategies. Despite both being used to manage risk, the latter is often perceived […]