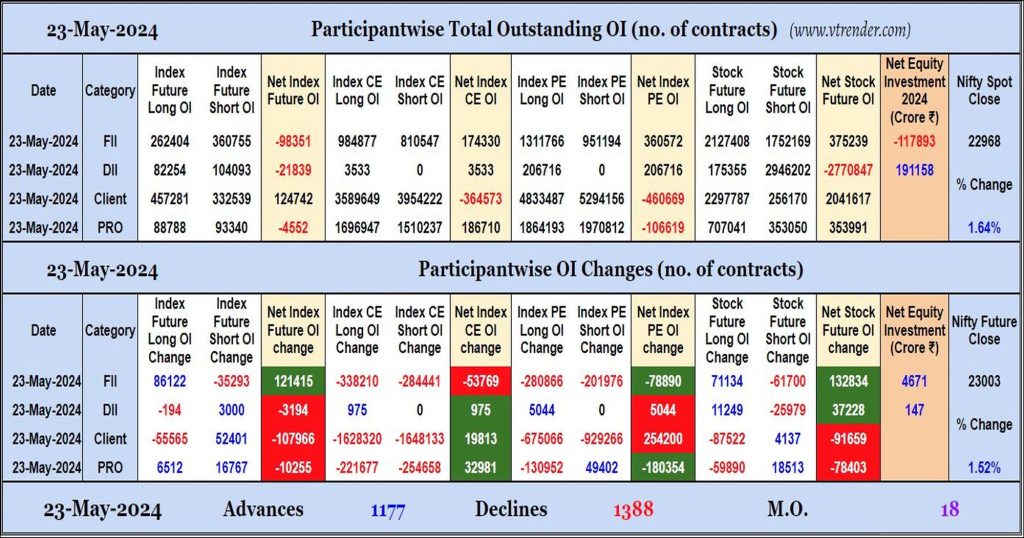

Participantwise Open Interest (Daily changes) – 23rd MAY 2024

FIIs have added longs in Index and Stocks Futures while shedding Open Interest in Index Options. They were net buyes in equity segment as well.

Desi MO (McClellans Oscillator for NSE) – 23rd MAY 2024

MO at 18

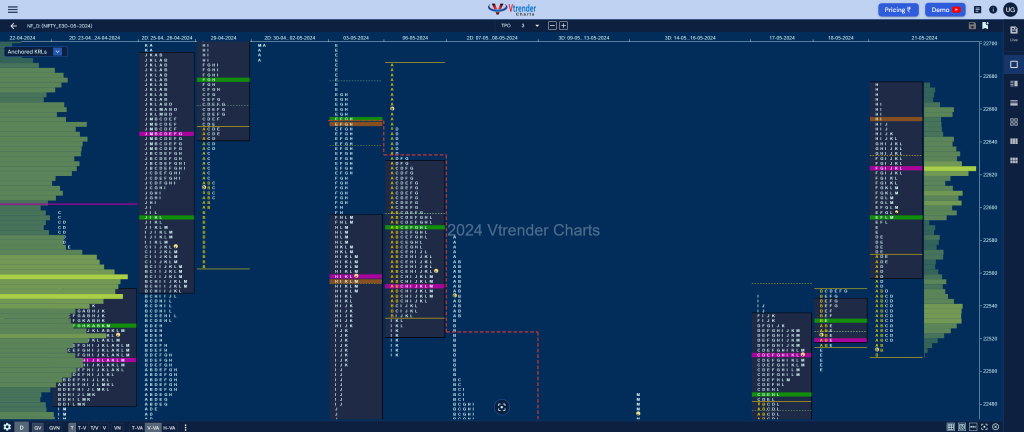

Market Profile Analysis dated 22nd May 2024

Nifty May F: 22658 [ 22683 / 22548 ] Open Type OAIR (Open Auction) Volumes of 10,511 contracts Poor Initial Balance 95 points (22643 – 22548) Volumes of 43,970 contracts Below average Day Type Normal – 135 pts Volumes of 1,45,086 contracts Below average NF made an OAIR start testing the DD zone from previous session […]

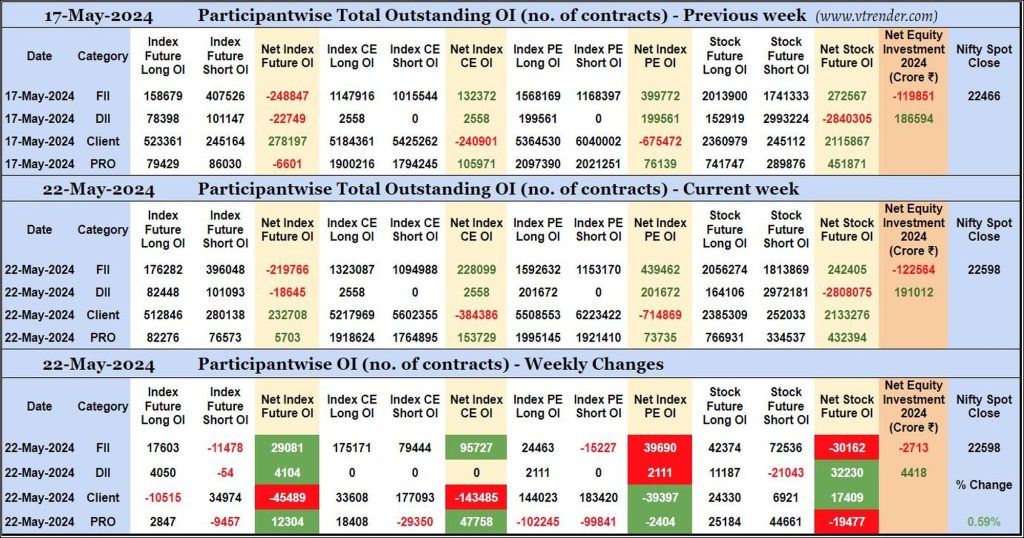

Participantwise Open Interest (Mid-week changes) – 22nd MAY 2024

FIIs have added 15K long Index Futures, net 9K short Index CE and net 31K short Stocks Futures contracts so far this week besides covering 11K short Index Futures contracts and shedding Open Interest in Index PE.

FIIs have been net sellers in equity segment for ₹2561 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 22nd MAY 2024

MO at 25

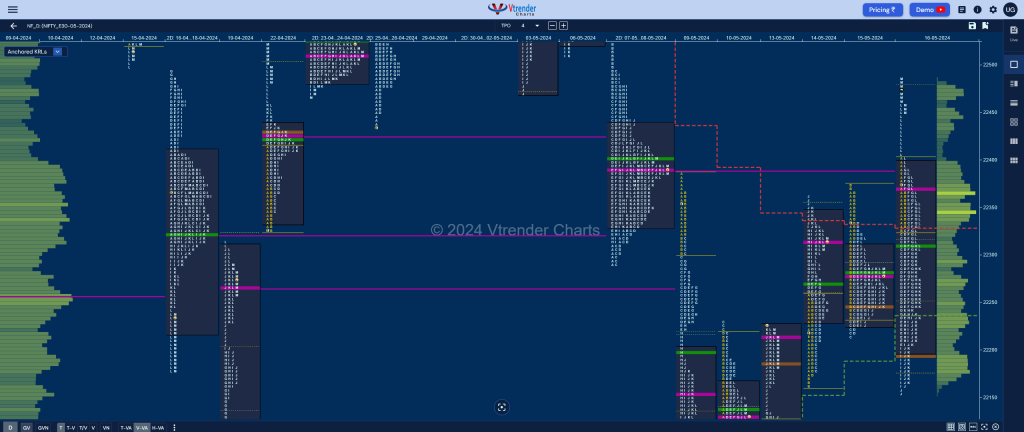

Market Profile Analysis dated 21st May 2024

Nifty May F: 22590 [ 22677 / 22510 ] Open Type OA (Open Auction) Volumes of 30,136 contracts Average Initial Balance 60 points (22570 – 22510) Volumes of 47,978 contracts Below average Day Type Double Distribution – 167 pts Volumes of 1,85,970 contracts Below average NF made an OL (Open=Low) start right above previous POC of […]

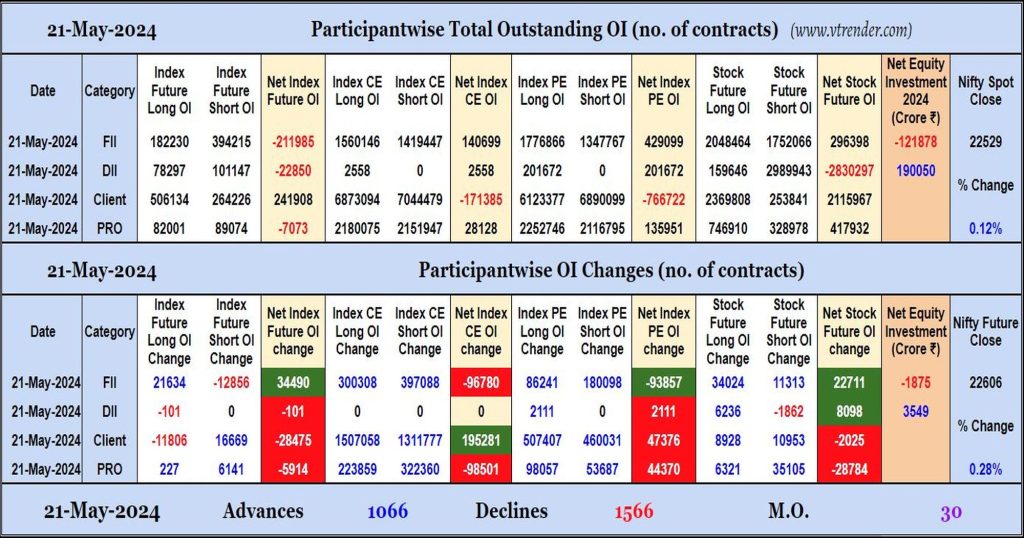

Participantwise Open Interest (Daily changes) – 21st MAY 2024

FIIs have added net longs in Index and Stocks Futures while adding net shorts in Index Options. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 21st MAY 2024

MO at 30

Market Profile Analysis dated 17th May 2024

Nifty May F: 22497 [ 22546 / 22407 ] Open Type OAIR (Open Auction) Volumes of 22,798 contracts Below average Initial Balance 74 points (22481 – 22407) Volumes of 55,838 contracts Below average Day Type Normal Variation – 138 pts Volumes of 1,98,597 contracts Below average NF did not give a follow up to the NeuX […]

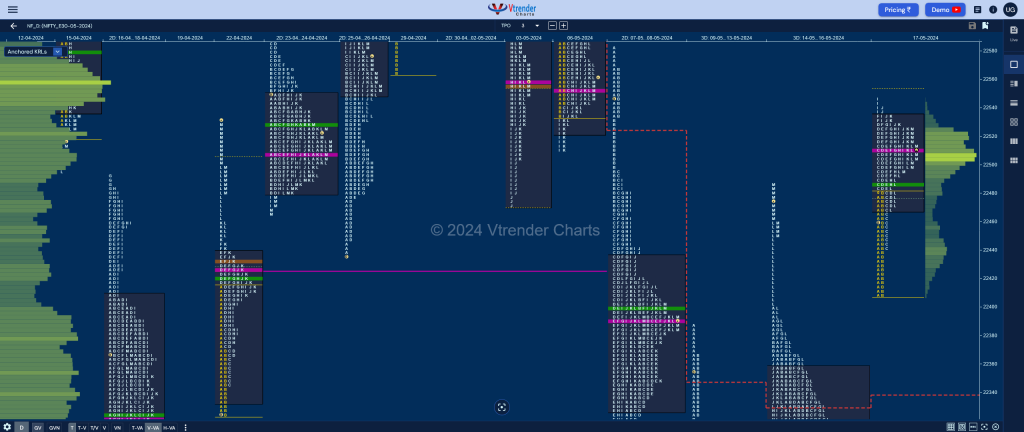

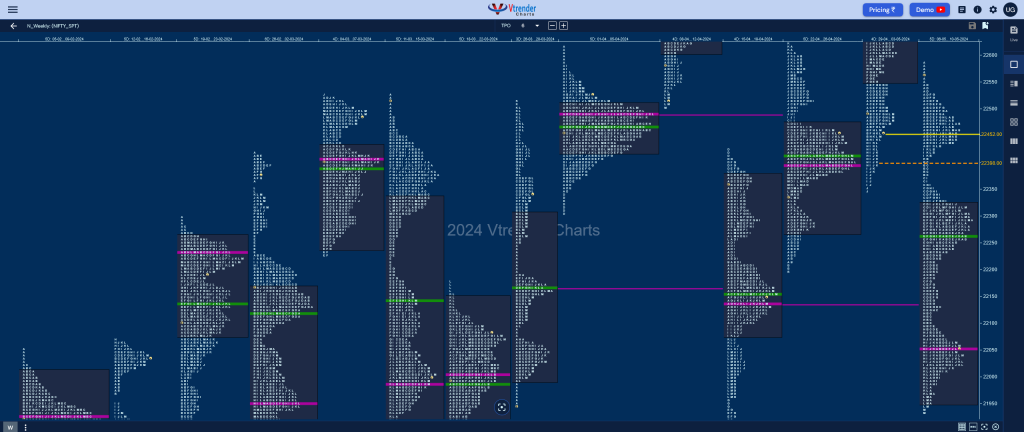

Weekly Spot Charts (13th to 17th May 2024) and Market Profile Analysis

Nifty Spot: 22466 [ 22502 / 21821 ] Monday – Nifty opened with a Test Drive lower from previous week’s POC of 22054 as it made new lows for the month leaving a big 239 point range Initial Balance which included an initiative selling tail from 22067 to 21897 along with a low of 21828. The […]