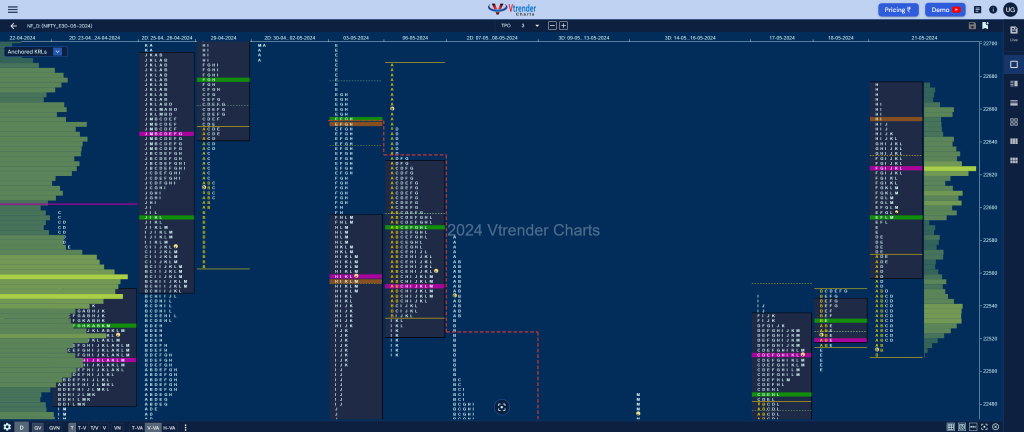

Nifty May F: 22590 [ 22677 / 22510 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 30,136 contracts |

| Initial Balance |

|---|

| 60 points (22570 – 22510) |

| Volumes of 47,978 contracts |

| Day Type |

|---|

| Double Distribution – 167 pts |

| Volumes of 1,85,970 contracts |

NF made an OL (Open=Low) start right above previous POC of 22509 and went on to tag the weekly VPOC of 22553 while making a high of 22570 in the A period but could not sustain as it probed back to test the lows but could not extend.

With the downside looking exhausted, the auction then went on to make an OTF (One Time Frame) move higher leaving an extension handle at 22583 in the E TPO as it got into 06th May’s selling singles from 22648 to 22686 but could only manage to tag 22677 in the H period marking the end of the upmove and saw profit booking by the longs triggering a retracement back to 22590 into the close.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22625 F and VWAP of the session was at 22594

- Value zones (volume profile) are at 22558-22625-22676

- NF has immediate support at AVWAP of 22307 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05. This FA is currently on ‘T+6’ day.

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at 22638 / 22778 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 22nd May 2024

| Up |

| 22617 – L TPO VWAP (21 May) 22653 – HVN (21 May) 22690 – E singles mid (03 May) 22740 – Ext Handle (03 May) 22778 – Weekly HVN (26Apr-02May) |

| Down |

| 22595 – VWAP (21 May) 22550 – SOC (21 May) 22509 – VPOC (17 May) 22469 – PBL (17 May) 22409 – Buy Tail (17 May) |

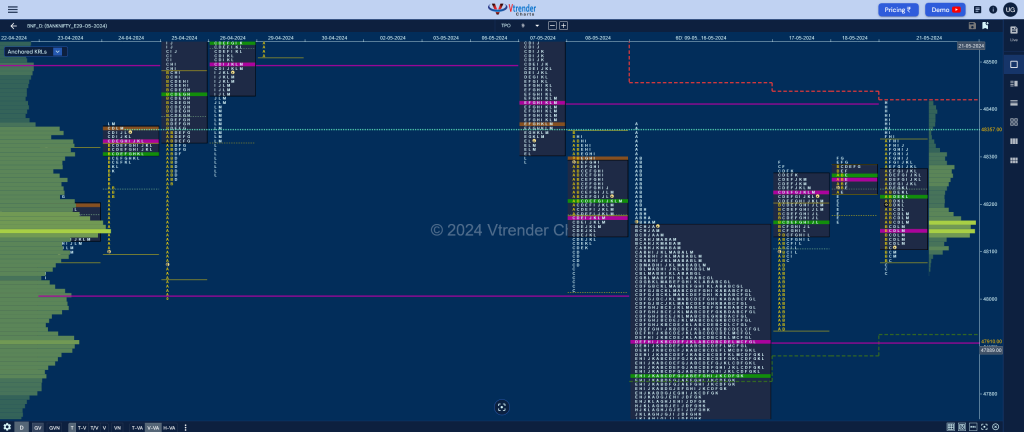

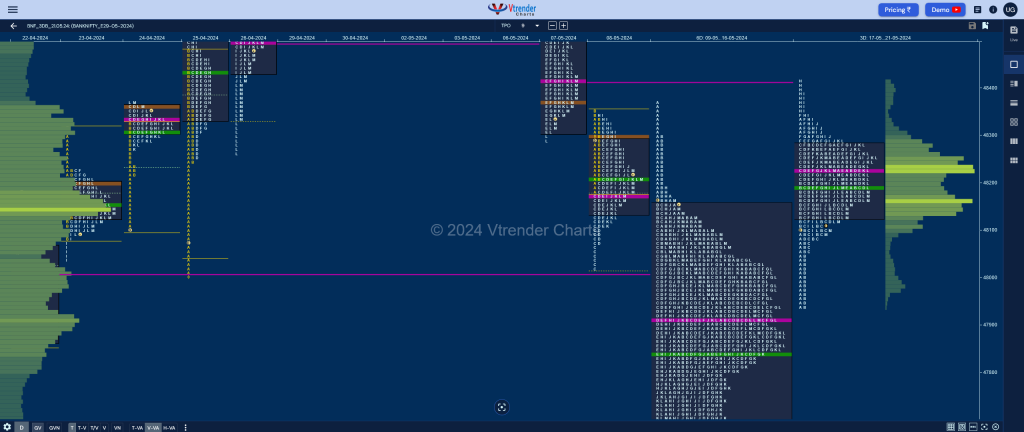

BankNifty May F: 48153 [ 48420 / 48054 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 9,140 contracts |

| Initial Balance |

|---|

| 254 points (48330 – 48076) |

| Volumes of 25,640 contracts |

| Day Type |

|---|

| Neutral Centre – 366 pts |

| Volumes of 1,23,612 contracts |

BNF made an attempt to probe into 09th May’s selling tail from 48300 to 48367 at the open but could only manage to hit 48330 stalling just below the RO (Roll Over) point of 48360 resulting in a probe down in search of demand as it swiped through Friday’s balance in the IB making new lows for the day at 48076.

The auction then made a C side extension to 48054 but was swiftly rejected indicating buyers coming back and went on to extend higher in the F & H TPOs confirming a FA (Failed Auction) at lows and completed a major objective of tagging 07th May’s VPOC of 48416 but fell just short of the 2 ATR target of 48425 from 13th May’s FA of 47200 as sellers started to come back and went on to retrace the entire upmove of the day almost tagging the IB low of 48076 before closing around the POC of 48147 leaving a Neutral Centre Day and a nice 3-day balance as shown in the below chart in between the 2 AVWAPs of 48427 & 47932 from 30th Apr & 13th May respectively.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48147 F and VWAP of the session was at 48213

- Value zones (volume profile) are at 48112-48147-48274

- BNF has immediate supply point at AVWAP of 48427 from Swing High of 49927 from 30/04

- BNF has immediate support at AVWAP of 47932 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 47200 on 13/04 and almost completed the 2 ATR objective of 48425 on 21/05. This FA is currently on ‘T+6’ day.

- BNF confirmed a FA at 48054 on 21/04 and 1 ATR objective comes to 48662

- HVNs are at 47910 / 48637 / 49555 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 22nd May 2024

| Up |

| 48182 – L TPO VWAP (21 May) 48330 – IBH (21 May) 48427 – AVWAP (30 Apr) 48553 – VWAP (07 May) 48665 – Ext Handle (07 May) |

| Down |

| 48147 – POC (21 May) 48054 – FA (21 May) 47910 – Weekly POC 47784 – K TPO VWAP (16 May) 47627 – VPOC (16 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.