Desi MO (McClellans Oscillator for NSE) – 4th DEC 2024

MO at 78

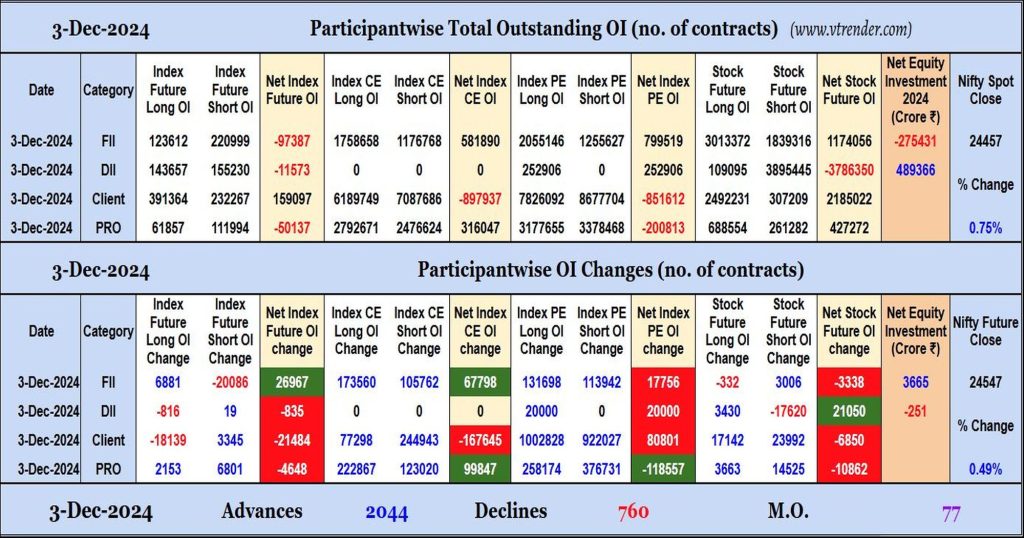

Participantwise Open Interest (Daily changes) – 3rd DEC 2024

FIIs have added net longs in Index Futures, Index CE and Index PE while adding shorts in Stocks Futures. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 3rd DEC 2024

MO at 77

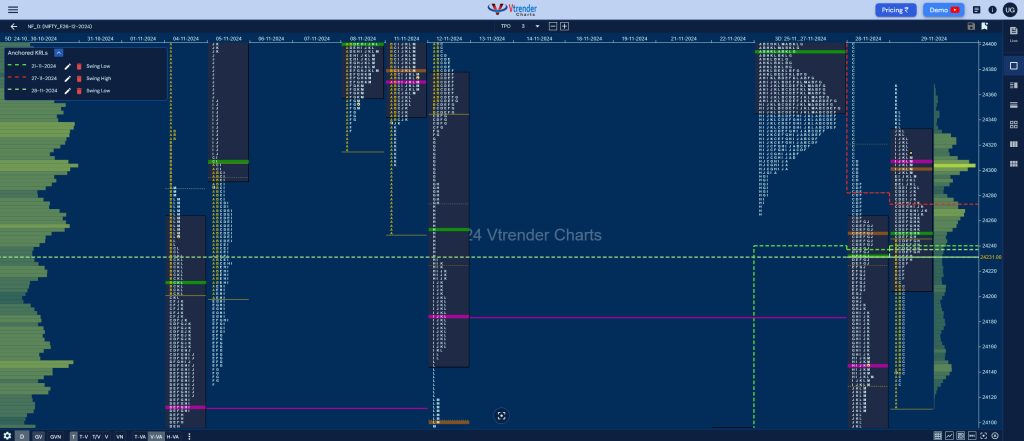

Market Profile Analysis dated 02nd Dec 2024

Nifty Dec F: 24428 [ 24475 / 24168 ] Open Type OAIR (Open Auction) Volumes of 36,322 contracts Above average Initial Balance 142 points (24310 – 24168) Volumes of 79,247 contracts Average Day Type Double Distribtion – 307 pts Volumes of 2,29,734 contracts Average NF made an OAIR start but took support right at previous session’s […]

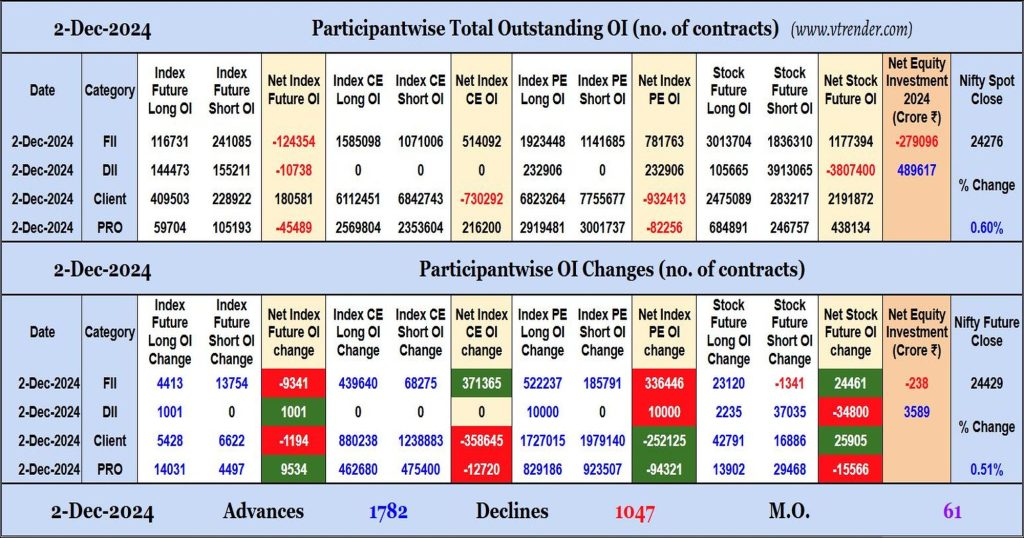

Participantwise Open Interest (Daily changes) – 2nd DEC 2024

FIIs have added net shorts in Index Futures while adding net longs in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 2nd DEC 2024

MO at 61

VMR Audio Sessions (Dec 2024)

24 Dec 2024 23 Dec 2024 20 Dec 2024 19 Dec 2024 18 Dec 2024 17 Dec 2024 16 Dec 2024 13 Dec 2024 12 Dec 2024 11 Dec 2024 10 Dec 2024 09 Dec 2024 06 Dec 2024 05 Dec 2024 04 Dec 2024 03 Dec 2024 02 Dec 2024 VMR Audio Sessions Archive […]

Market Profile Analysis dated 29th Nov 2024

Nifty Dec F: 24304 [ 24368 / 24112 ] Open Type OAIR (Open Auction) Volumes of 28,263 contracts Average Initial Balance 135 points (24247 – 24112) Volumes of 70,992 contracts Below average Day Type NormalVariation(3-1-3)-256pts Volumes of 2,63,296 contracts Average NF formed an inside bar in terms of range post the Trend Day down of the […]

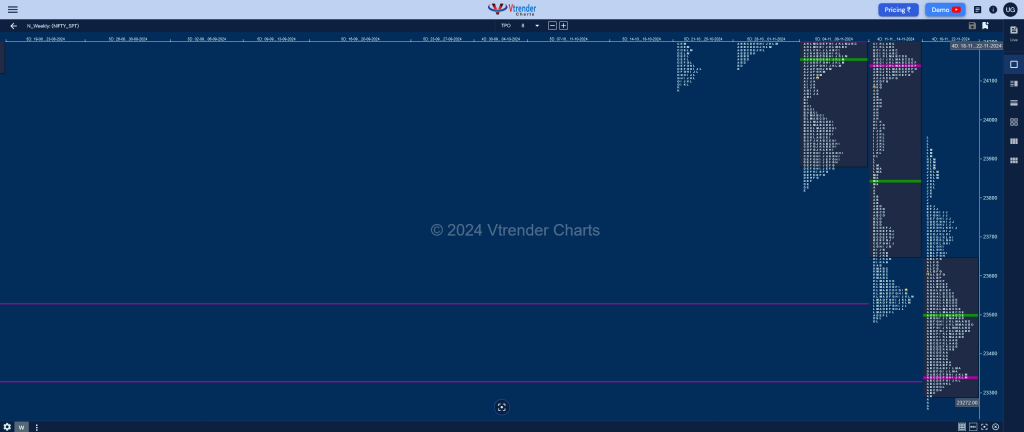

Weekly Spot Charts (25th to 29th Nov 2024) and Market Profile Analysis

Nifty Spot: 24131 [ 24354 / 23873 ] Neutral Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one to the Upside in a range of 693 points with completely lower Value at 23289-23339-23647 not only leaving a weekly FA (Failed Auction) at lows of 23236 but also completing the 1 ATR […]

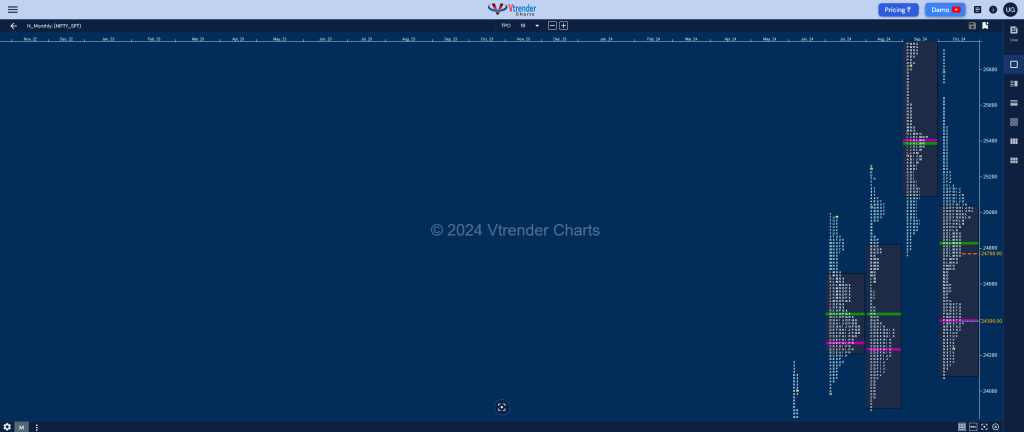

Monthly charts (November 2024) and Market Profile Analysis

Nifty Spot: 24131 [ 24537 / 23263 ] – Normal Variation (Down) Nifty made a follow up to previous month’s ‘b’ shape long liquidation profile with a Normal Variation one to the downside as it not only broke below previous month lows but went on to sustain below the August Swing Low of 23893 testing the […]