Desi MO (McClellans Oscillator for NSE) – 3rd APR 2024

MO at 81

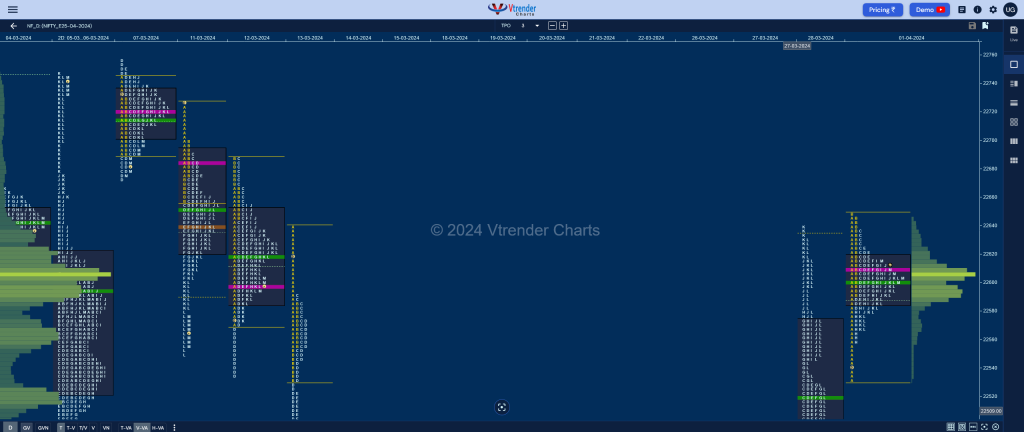

Market Profile Analysis dated 02nd April 2024

Nifty Apr F: 22577 [ 22611 / 22507 ] Open Type OAIR (Open Auction In Range) Volumes of 13,694 contracts Average Initial Balance 80 points (22611 – 22532) Volumes of 31,294 contracts Average Day Type Normal – 104 pts Volumes of 83,787 contracts Below average NF opened lower getting into the buying tail from 22558 to […]

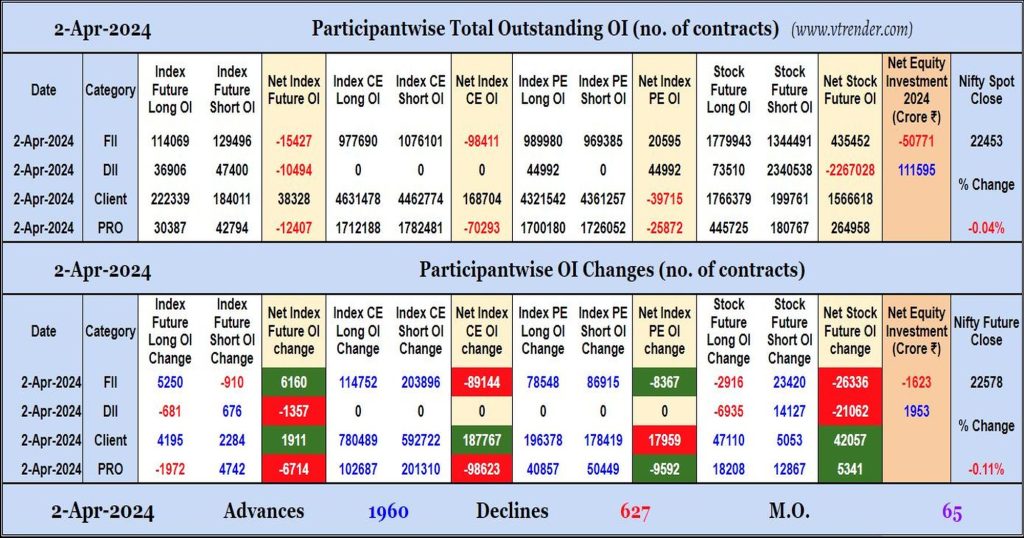

Participantwise Open Interest (Daily changes) – 2nd APR 2024

FIIs have added net longs in Index Futures while adding net shorts in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment as well.

Desi MO (McClellans Oscillator for NSE) – 2nd APR 2024

MO at 65

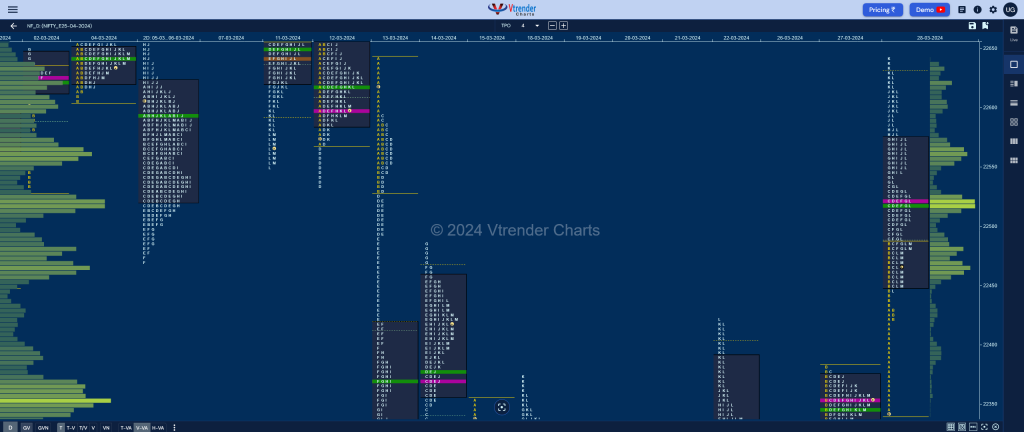

Market Profile Analysis dated 01st April 2024

Nifty Apr F: 22602 [ 22647 / 22515 ] Open Type OA (Open Auction) Volumes of 22,516 contracts Above average Initial Balance 132 points (22647 – 22515) Volumes of 43,554 contracts Above average Day Type Normal – 132 pts Volumes of 1,27,526 contracts Below average NF opened higher making a drive like start on very good […]

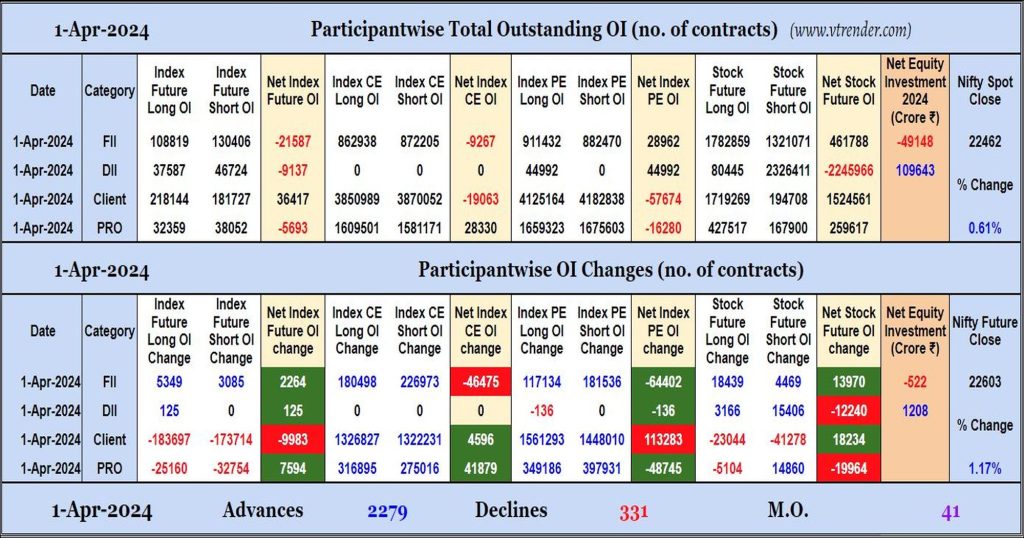

Participantwise Open Interest (Daily changes) – 1st APR 2024

Participantwise Open Interest – Daily changes

Desi MO (McClellans Oscillator for NSE) – 1st APR 2024

MO at 41, Declining volumes dip to 5%

Market Profile Analysis dated 28th March 2024

Nifty Apr F: 22488 [ 22640 / 22340 ] Open Type OTD (Open Test Drive) Volumes of 11,171 contracts Average Initial Balance 147 points (22487 – 22340) Volumes of 41,644 contracts Above average Day Type Trend – 345 pts Volumes of 2,52,094 contracts Above average to be updated… Click here to view the latest profile in […]

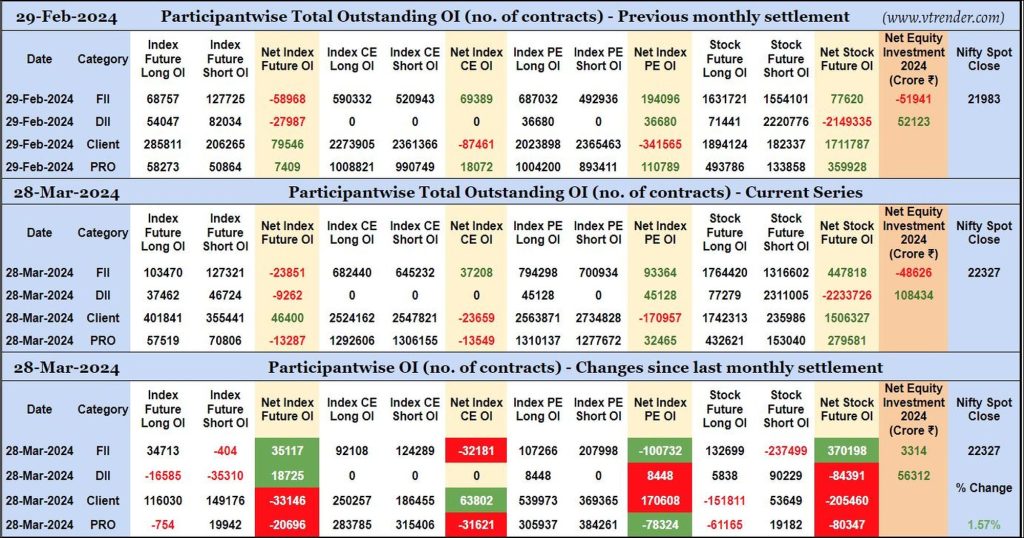

Participantwise Open Interest (Series changes) – 28th MAR 2023

FIIs have added 34K long Index Futures, net 32K short Index CE, net 100K short Index PE and 132K long Stocks Futures contracts since February settlement while covering 237K short Stocks Futures contracts.

FIIs were net buyers in equity segment for ₹3314 crore during March series.

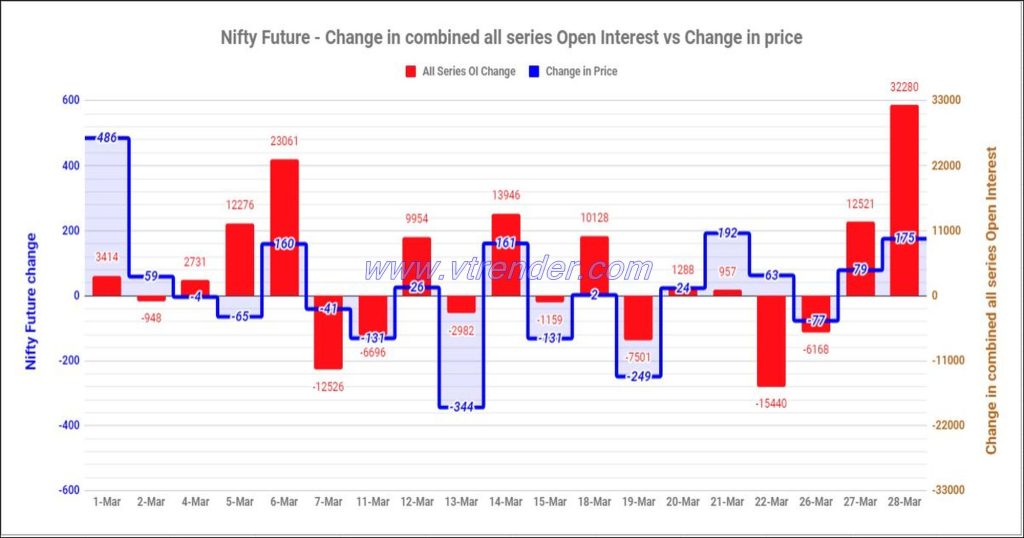

Nifty and Banknifty Futures with all series combined Open Interest – 28th MAR 2024

Nifty & Banknifty combined Open Interest across all series & change in OI