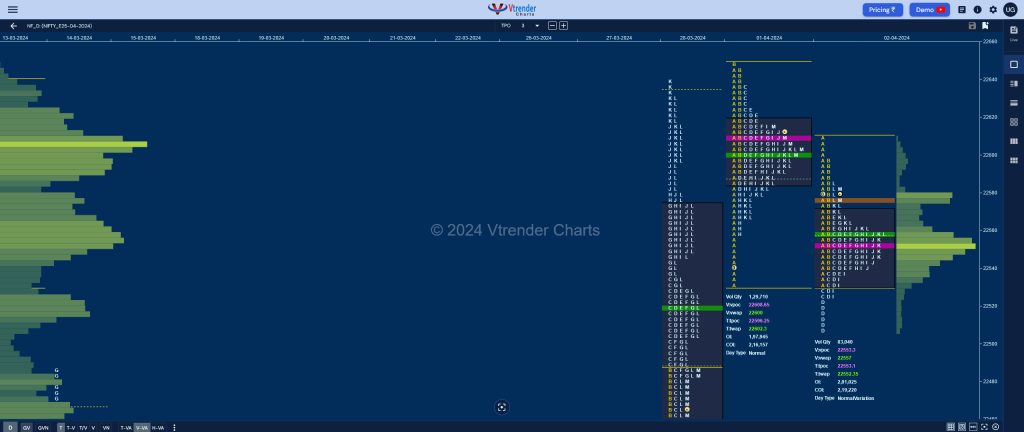

Nifty Apr F: 22577 [ 22611 / 22507 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,694 contracts |

| Initial Balance |

|---|

| 80 points (22611 – 22532) |

| Volumes of 31,294 contracts |

| Day Type |

|---|

| Normal – 104 pts |

| Volumes of 83,787 contracts |

NF opened lower getting into the buying tail from 22558 to 22515 from previous session and made a low of 22532 where it saw some demand pushing it back into previous Value triggering the 80% Rule in the nice balance but could only manage to tag 22611 stalling at the yPOC of 22608 indicating supply being active in this zone.

The rejection from yPOC triggered a test of 28th Mar’s VPOC of 22520 as the auction made couple of small REs (Range Extension) lower in the C & D TPOs where it made a low of 22507 but saw buyers coming back to defend this zone as they left a responsive buying tail till 22525 marking the end of the downside for the day.

The rest of the day saw low volume coiling happening with POC being built at 22553 with a small push higher into the close as NF hit 22584 but could not enter previous Value and saw a HVN forming at 22577 whcih was probably the longs booking profit leaving a 3-1-3 profile on the daily with completely lower value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22553 F and VWAP of the session was at 22557

- Value zones (volume profile) are at 22532-22553-22571

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 03rd Apr 2024

| Up |

| 22577 – HVN (02 Apr) 22608 – POC (01 Apr) 22645 – Sell tail (01 Apr) 22680 – 2-day VPOC (11-12 Mar) 22719 – POC (07 Mar) 22756 – FA (07 Mar) |

| Down |

| 22571 – L TPO h/b (02 Apr) 22525 – Buy tail (02 Apr) 22470 – M TPO POC (28 Mar) 22430 – Ext Handle (28 Mar) 22394 – A TPO VWAP (28 Mar) 22352 – POC (27 Mar) |

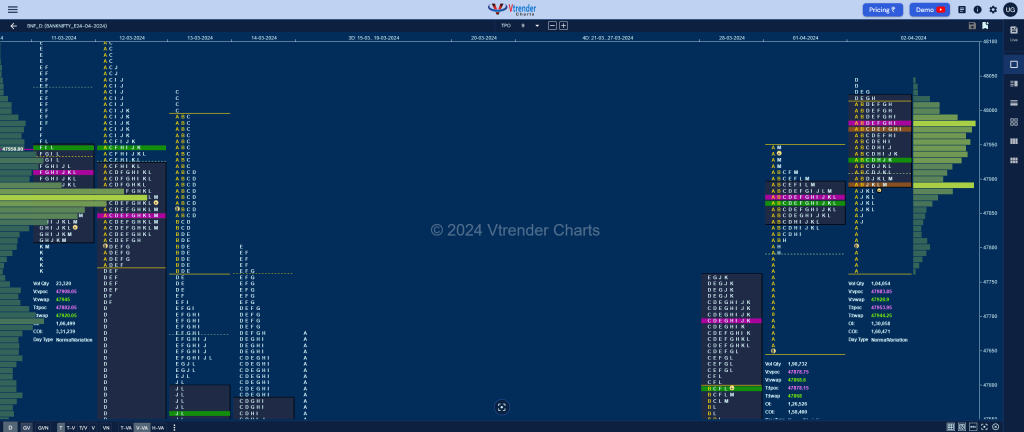

BankNifty Apr F: 47893 [ 48051 / 47750 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,510 contracts |

| Initial Balance |

|---|

| 265 points (48014 – 47750) |

| Volumes of 34,120 contracts |

| Day Type |

|---|

| Normal – 301 points |

| Volumes of 1,06,848 contracts |

BNF opened lower making a look down into the buying singles from 47790 to 47647 as it made a low of 47750 and was swiftly rejected triggering a swipe back in previous Value and range even scaling above it to make similar highs of 48009 & 48014 in the A & B periods.

The auction then formed a rare inside bar in the C side which was followed by a RE to the upside in the D as it tested 13th Mar’s FA (Failed Auction) of 48024 while making a high of 48051 but could not sustain above it indciating lack of fresh demand.

BNF then settled down into a narrow range forming yet another ‘p’ shape profile for the day with a prominent POC at 47983 but saw another swipe lower in the J TPO as it made a reverse 80% Rule in previous value making a low of 47838 before closing around the HVN of 47894 forming higher value on the daily but closing at the lower end.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47983 F and VWAP of the session was at 47929

- Value zones (volume profile) are at 47895-47983-48018

- HVNs are at 47878 (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 03rd Apr 2024

| Up |

| 47929 – VWAP (02 Apr) 48025 – Sell tail (02 Apr) 48143 – C TPO VWAP (12 Mar) 48250 – SOC (12 Mar) 48373 – VPOC (07 Mar) 48474 – HVN (07 Mar) |

| Down |

| 47894 – POC (02 Apr) 47790 – Buying Tail (01 Apr) 47698 – POC (28 Mar) 47593 – VWAP (28 Mar) 47499 – L TPO POC (28 Mar) 47337 – HVN (28 Mar) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.