Nifty Spot: 22327 [ 22526 / 21710 ]

Previous month’s report can be viewed here

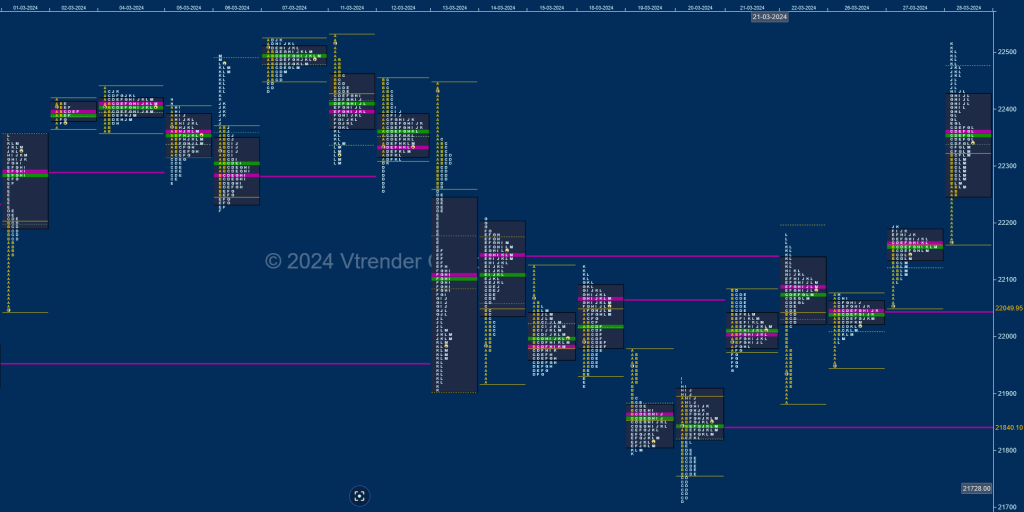

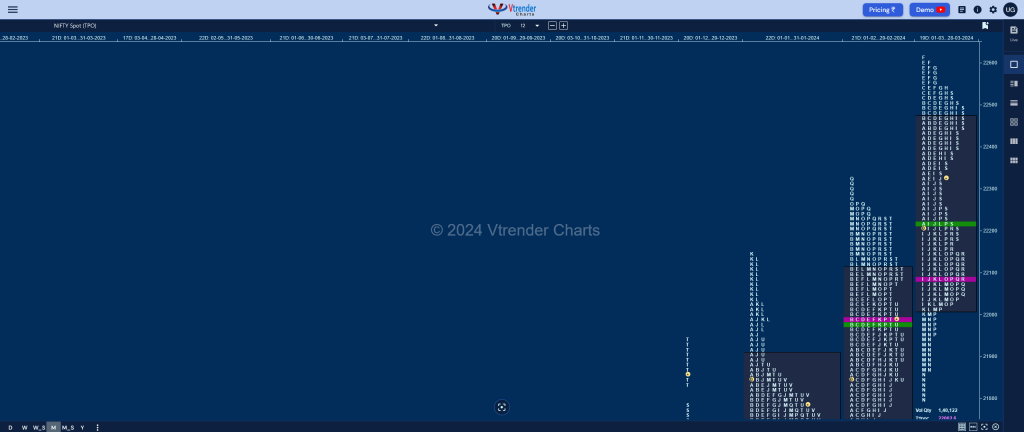

Nifty opened the month with a Trend Day Up not only leaving an A period buying tail but also another zone of singles at the monthly VAH of 22260 signalling the move away from previous Value as it even went on to make new ATH of 22526 but displayed exhaustion in form of poor highs at the top on 07th Mar which was followed by an A period selling tail on 11th Mar marking the start of a trending move lower over the next 7 sessions as it completed the 80% Rule in the monthly Value of February and tagged the VAL of 21793 while hitting 21710 on 20th Mar but left a responsive buying tail on the higher timeframe marking the end of the downside.

The auction then did the reverse 80% Rule in the monthly Value as it not only got back to 22260 but went on to close the month just as it started which is with a Trend Day Up leaving an extension handle at 22263 and falling just short of the ATH of 22526 as it made a high of 22516 where it saw huge profit booking considering the financial year close triggering a quick liquidation drop down to 22263 before closing the month at 22327 leaving a Neutral monthly profile with overlapping to higher Value at 21915-22001-22379 with the series VWAP at 22168 which will be the important support for the new month below which it could go for the daily VPOCs of 22050 & 21840 whereas on the upside, VAH of 22379 will be the immediate reference along with the Roll Over point for Apr futures being at 22607 which will be the main supply point which needs to be taken out.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19652 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

BankNifty Spot: 47124 [ 48161 / 45828 ]

Previous month’s report can be viewed here

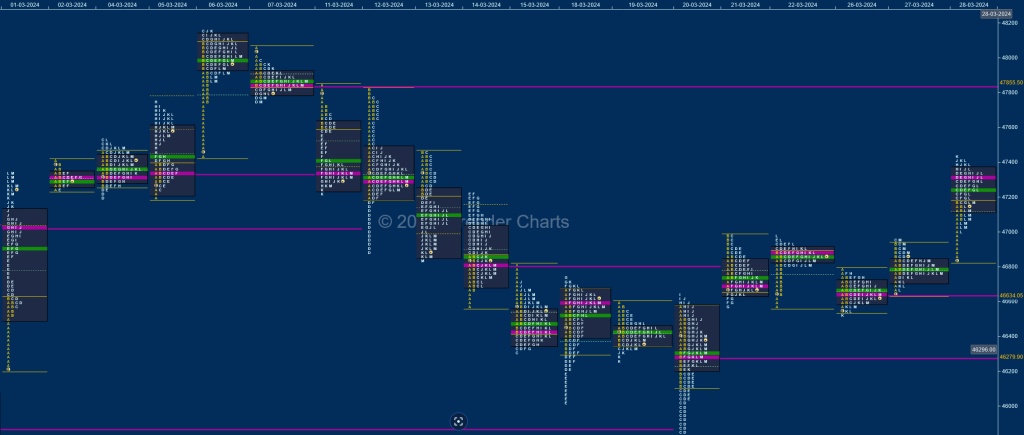

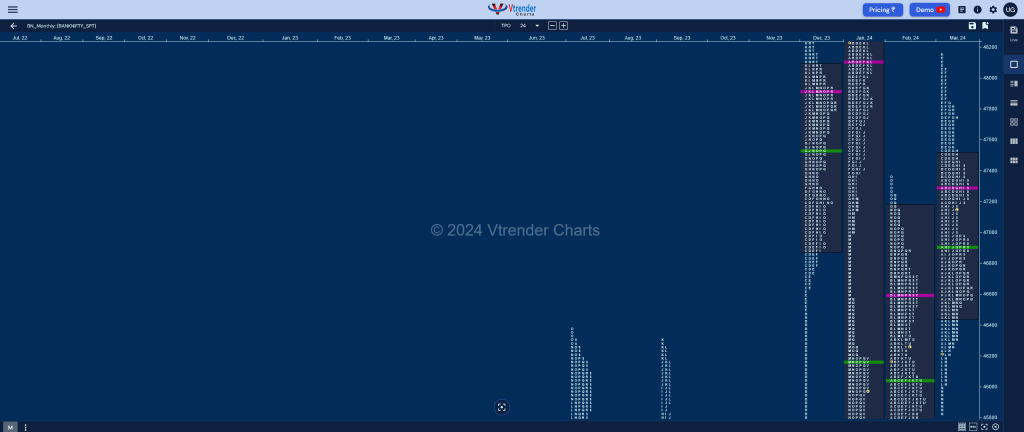

BankNifty also opened the month with a 1124 point range Trend Day Up signalling the start of a fresh imbalance as it moved away from previous month’s value and trended higher for the first 5 sessions making higher highs and completing a major objective as it tagged January’s VPOC of 48119 while making a high of 48161 where it formed a ledge signalling upside getting capped. The auction then confirmed reversal of PLR (Path of Least Resistance) to the downside as it left couple of A period selling tails on the daily timeframe and an One Time Frame probe lower along with a FA at 47468 on 13th as it not only completed the 2 ATR objective of 46227 but went on to make new lows of 46022 for the month on 18th.

The imbalance continued as BankNifty tagged 29th Feb’s VPOC of 45864 on 20th Mar while making a low of 45828 but the move came via a C side extension marking the end of the downmove as it formed a Neutral Centre Day with a prominent POC at 46280 followed by another Neutral Centre Day on 21st where it made another C side confriming a fresh FA at 46990 which then became the swing reference for the final week as the auction stayed below it forming a 4-day balance before taking it out on the last day with an A period buying tail as it went on to hit 47440 before closing at 47124 leaving a Neutral Centre and a 3-1-3 profile for the month with overlapping to higher Value at 46454-47300-47506. The Roll Over point for the April series is at 47190 and will be the immediate reference on the upside along with Mar’s POC & VAH of 47300 & 47506 respectively with the upper levels to watch being the SOC of 47747, daily VPOC of 47855 from 07th Mar and the monthly selling tail from 48071 whereas on the downside, this series VWAP of 47051 along with the negated FA of 46990 form the initial support zone below which we have the trifecta of daily VPOCs at 46788, 46634 & 46280 as probable objectives along with the monthly buying singles from 46022.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43716 & 44346 respectively