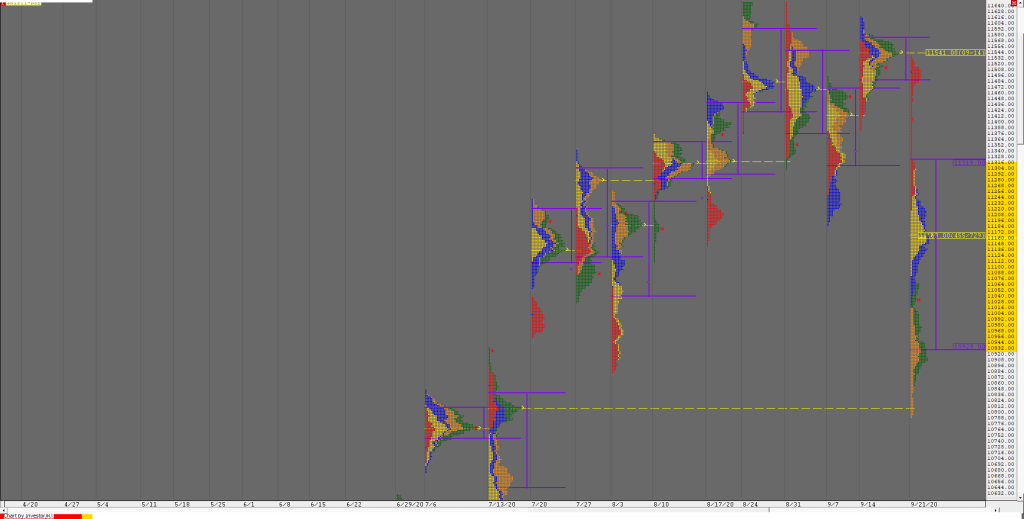

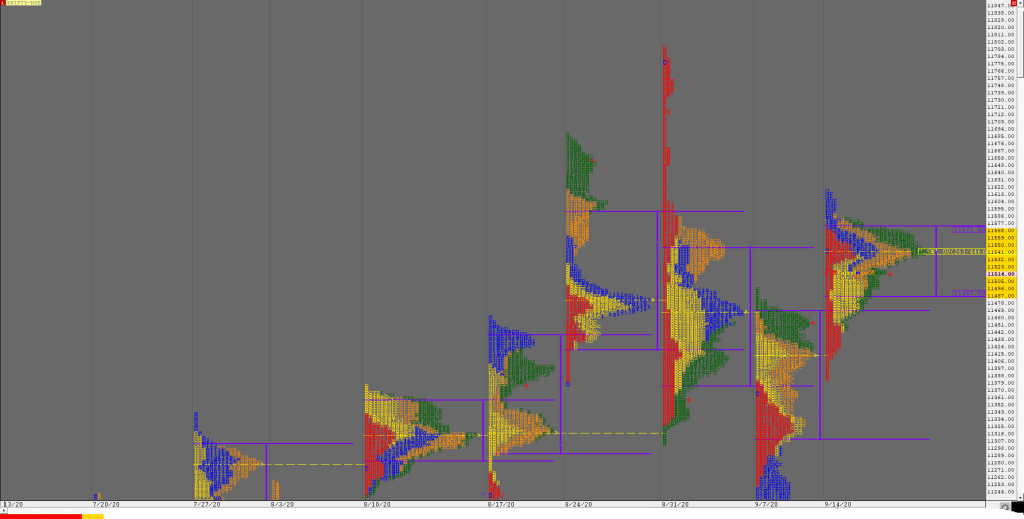

Order Flow charts dated 30th September 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Market Profile Analysis dated 29th September 2020

Nifty Oct F: 11235 [ 11298 / 11186 ] NF opened higher and went on to make a high of 11298 in the ‘A’ period but could not continue higher as it then broke below VWAP and trended lower getting back into previous day’s range and completing the 80% Rule in the Value Area as […]

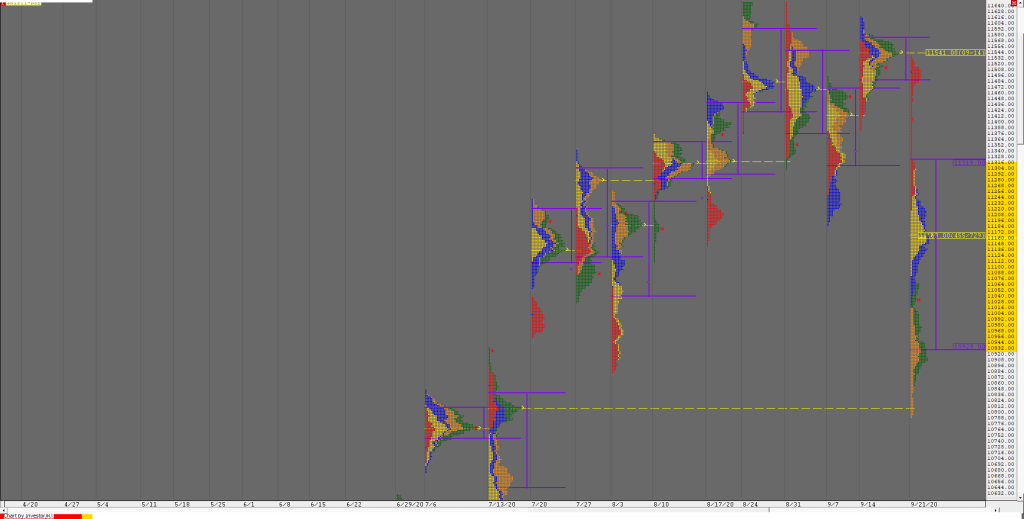

Order Flow charts dated 29th September 2020

A good trader is a one who can make money consistently over a longer period of time. But how to become one such trader, who can make money in any type of market condition? A good trader keeps a close watch on the current information of the market and assesses it for change against previous […]

Market Profile Analysis dated 28th September 2020

Nifty Oct F: 11238 [ 11249 / 11090 ] NF opened higher well above the Neutral Extreme reference of 11013 to 11077 as it made a low of 11090 in the ‘A’ period and continued to probe higher completing the 2 ATR target of 11165 from Friday’s FA of 10857 in the IB (Initial Balance) […]

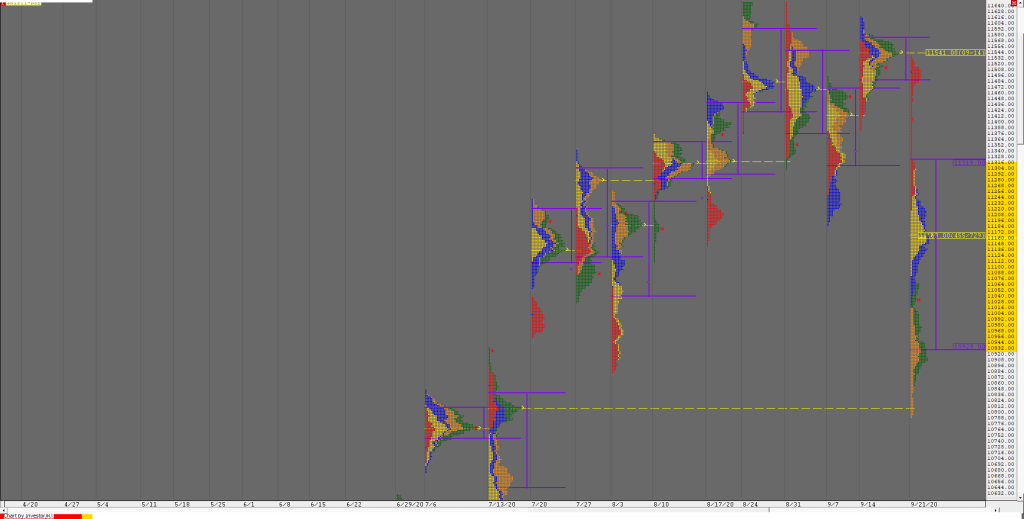

Order Flow charts dated 28th September 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

Market Profile Analysis dated 25th September 2020

Nifty Oct F: 11042 [ 11077 / 10857 ] NF rejected previous day’s spike with a higher open but got stalled just below the VAH of 10951 as it made a high of 10941 in the IB (Initial Balance) after which it probed lower and even made a C side extension lower as it made […]

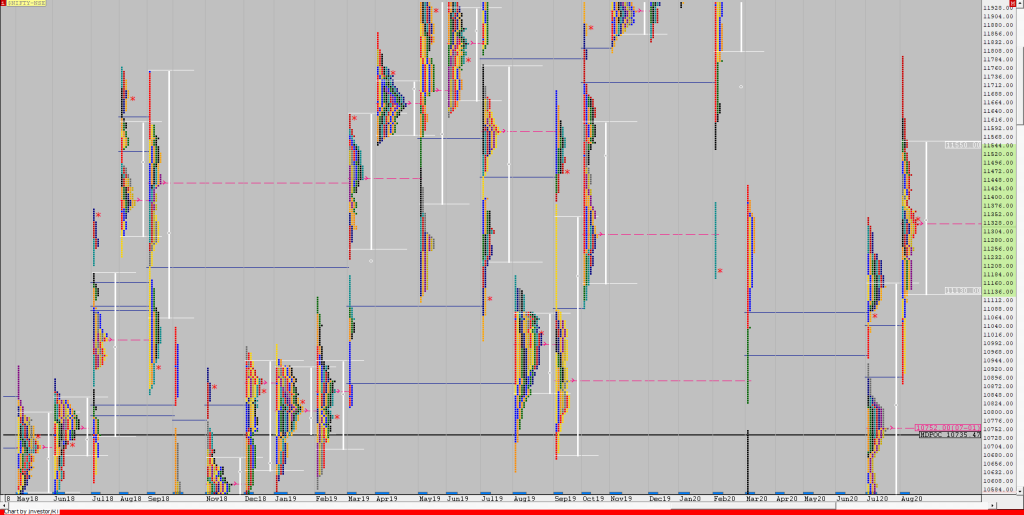

Weekly charts (21st to 25th September 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (21st to 25th Sep 2020) Spot Weekly – 11050 [ 11535 / 10790 ] Previous week’s report ended with this ‘The weekly profile is a well balanced one in a relatively narrow range of 235 points and saw two-way auction on most of the days which explains the Neutral Centre Close. […]

Order Flow charts dated 25th September 2020

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

Market Profile Analysis dated 24th September 2020

Nifty Oct F: 10836 [ 11040 / 10819 ] As expected, NF moved away from the 2-day balance in the form of a big gap down of 138 points after which if formed a balance over the first half of the day and typical of an OAOR start, the auction gave a big move in […]

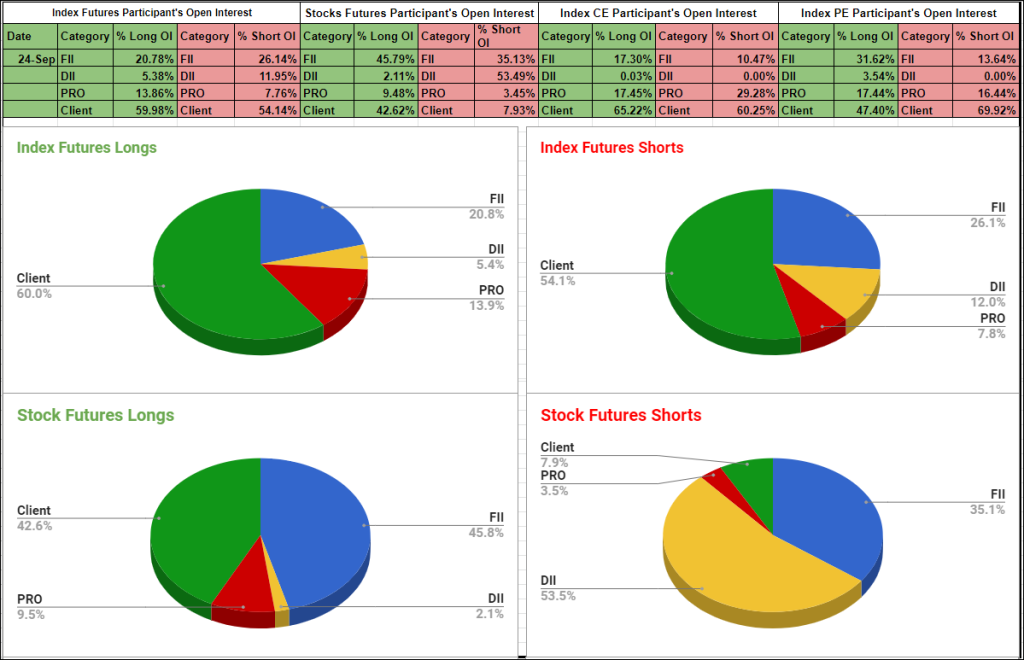

Participantwise Open Interest – 24th SEP 2020

Series view At the close of SEP series, FIIs are holding 21% of long and 26% of short Open Interest in Index Futures besides holding 46% long and 35% short Open Interest in Stocks Futures. Clients are holding 60% long and 54% short Open Interest in Index Futures, they are holding 43% long and 8% short […]