Desi MO (McClellans Oscillator for NSE) – 26th DEC 2023

MO at 16

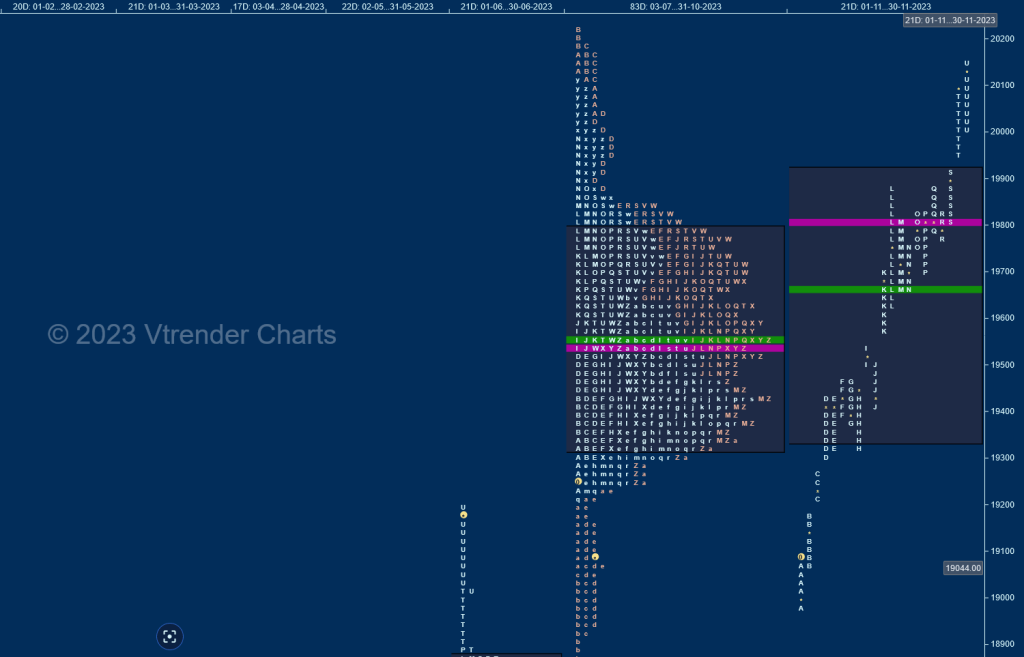

Weekly Spot Charts (18th to 22nd Dec 2023) and Market Profile Analysis

Nifty Spot: 21349 [ 21593 / 20976 ] Previous week’s profie was a Neutral Extreme one to the upside after it showed weakness on the downside leaving poor lows at 20769 in an attempt to probe below the prior weekly Value and this failure of sellers not only triggered a short covering probe higher but also […]

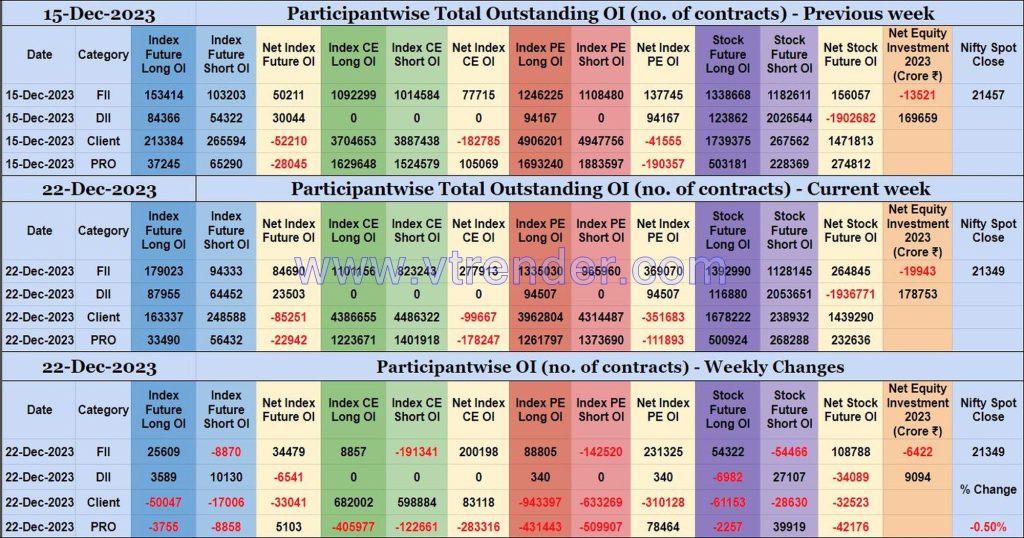

Participantwise Open Interest (Weekly changes) – 22nd DEC 2023

FIIs have added 25K long Index Futures, 8K long Index CE, 88K long Index PE and 54K long Stocks Futures contracts this week besides covering 8K short Index Futures, 191K short Index CE, 142K short Index PE and 54K short Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹6422 crore during the week.

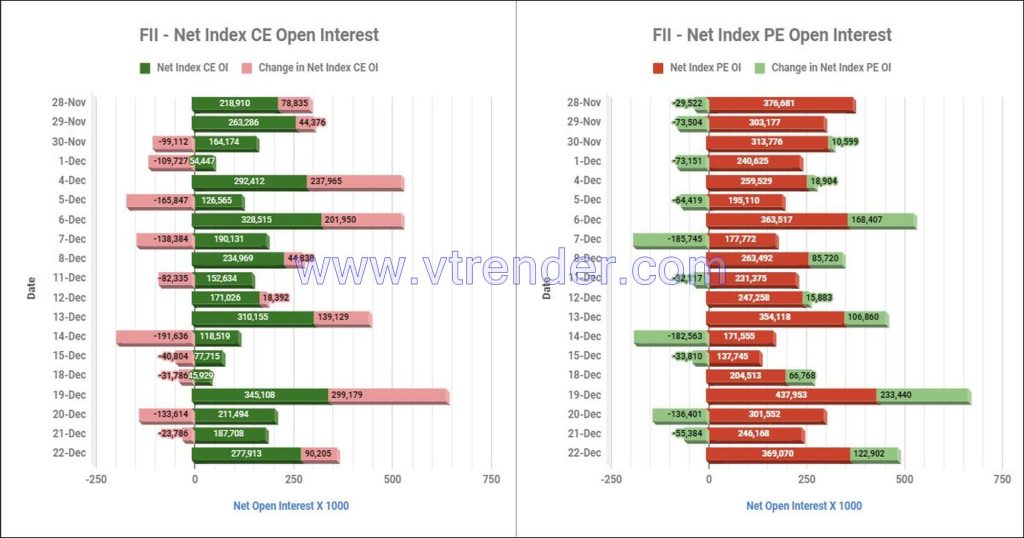

Participantwise net Open Interest and net equity investments – 22nd DEC 2023

Participantwise net Open Interest and change in net OI for Index/Stocks Options. Net equity investments updated 22nd Dec

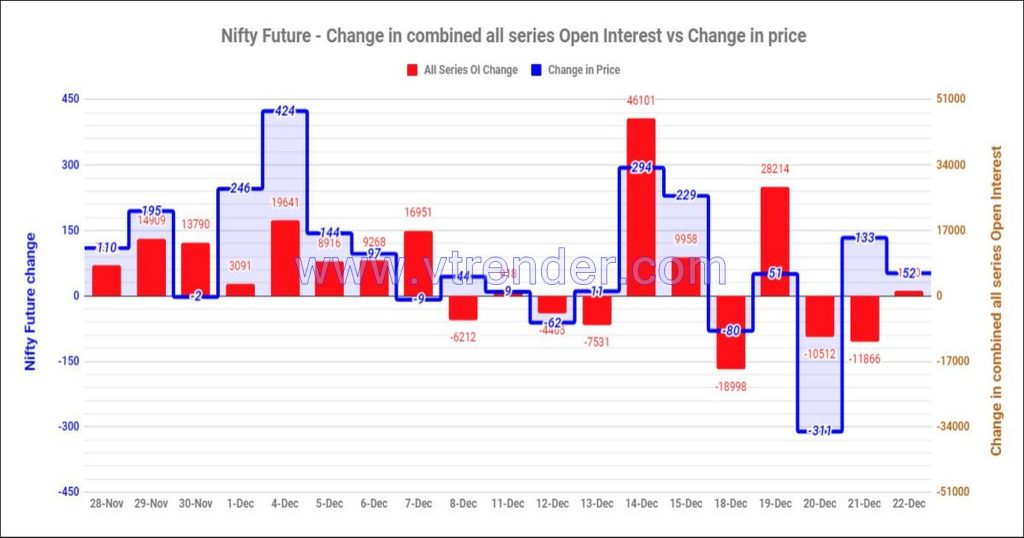

Nifty and Banknifty Futures with all series combined Open Interest – 22nd DEC 2023

Nifty & Banknifty combined Open Interest across all series & change in OI

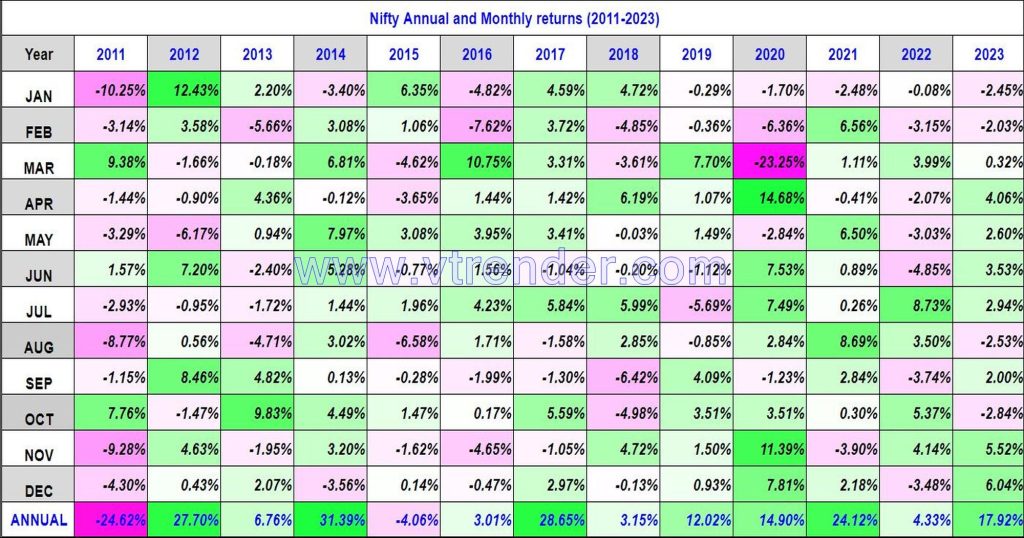

Nifty 50 Monthly and Annual returns (1991-2023) updated 22nd DEC 2023

Nifty50 returns Year 2023 17.92% / Nifty50 returns DEC 2023 6.04%

Desi MO (McClellans Oscillator for NSE) – 22nd DEC 2023

MO at 9

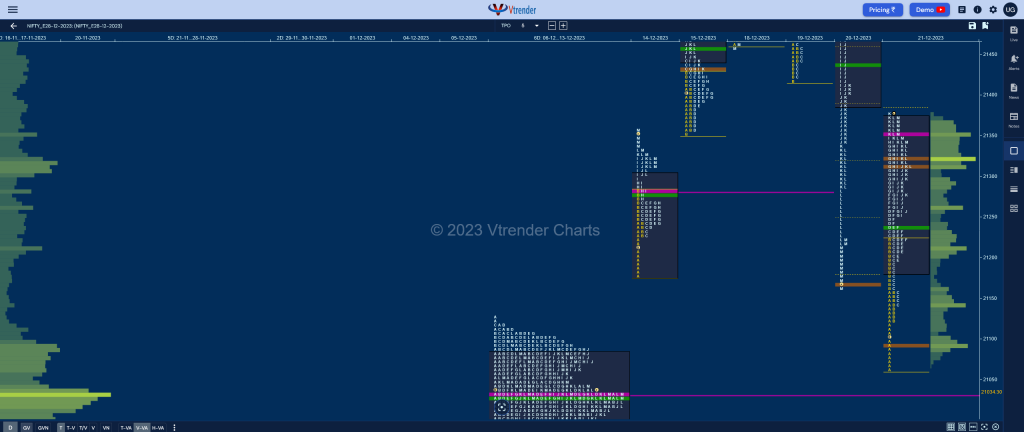

Market Profile Analysis dated 22nd December 2023

Nifty Dec F: 21402 [ 21474 / 21285 ] Open Type OA (Open Auction) Volumes of 12,279 contracts Below average Initial Balance 123 points (21220 – 21060) Volumes of 37,051 contracts Above average Day Type Neutral – 189 points Volumes of 1,66,585 contracts Above average NF opened above PDH but could not sustain and went on […]

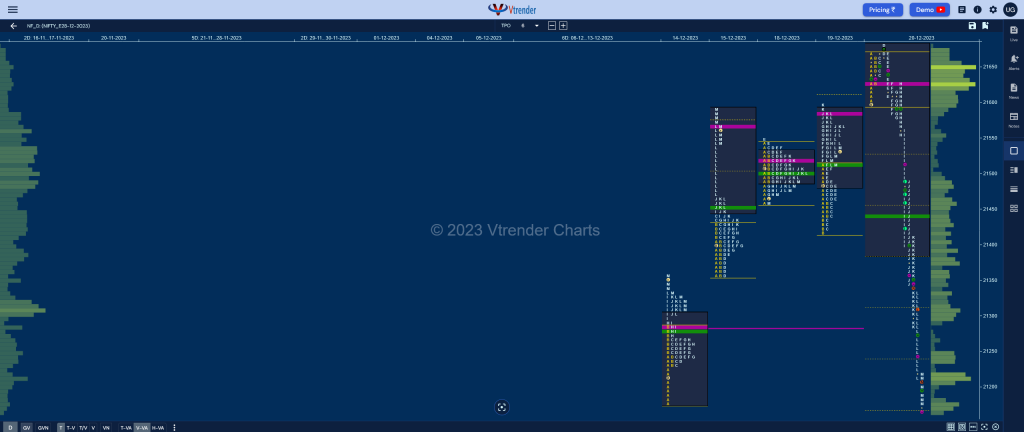

Market Profile Analysis dated 21st December 2023

Nifty Dec F: 21350 [ 21379 / 21060 ] Open Type OAOR (Open Auction Out of Range) Volumes of 28,005 contracts Above average Initial Balance 160 points (21220 – 21060) Volumes of 62,923 contracts Above average Day Type Trend Up – 320 points Volumes of 1,96,078 contracts Above average NF continued the previous session’s imbalance close […]

Desi MO (McClellans Oscillator for NSE) – 21st DEC 2023

MO at -8