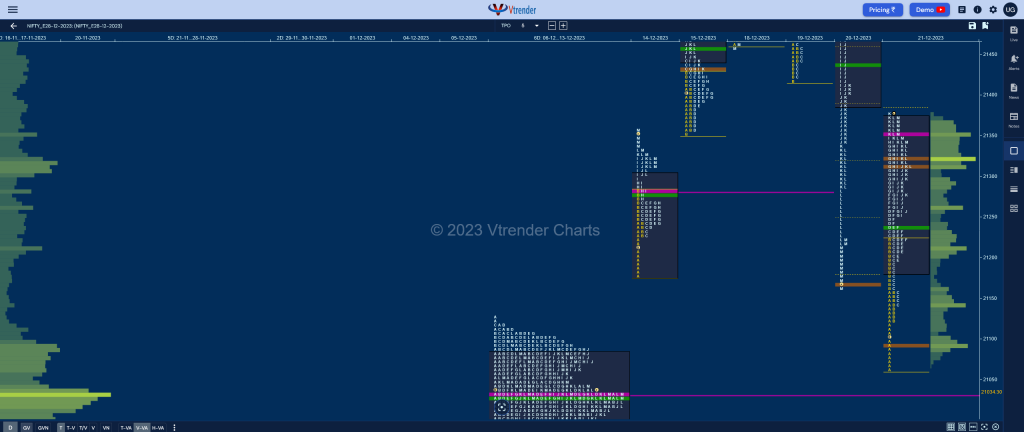

Nifty Dec F: 21350 [ 21379 / 21060 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 28,005 contracts |

| Initial Balance |

|---|

| 160 points (21220 – 21060) |

| Volumes of 62,923 contracts |

| Day Type |

|---|

| Trend Up – 320 points |

| Volumes of 1,96,078 contracts |

NF continued the previous session’s imbalance close with a lower open and a tag of previous week’s prominent POC of 21088 while making a low of 21060 forming a 98 point range in the first 5 minutes after which it consolidated in this range for the rest of the A period before showing some demand coming back in the B TPO which pushed it back into previous day’s range and resulted in new highs of 21220 at the close of the Initial Balance (IB).

The auction then made couple of REs in the C & D periods scaling above the first business area of 21240 as it made a high of 21258 and gave a pull back in the E TPO where it took support at day’s VWAP leaving a PBL at 21195 indicating that the PLR (Path of Least Resistance) was to the upside and more confirmation of this came in form of multiple REs from the F to the I periods taking out the extension handles of 21287 & 21342 while making a high of 21348 and expectedly gave a reaction making a quick retracement down to 21252.

NF then formed an inside bar in the J hinting that the reaction was over and paved way for the important K period to make a fresh RE almost completing the 2 IB objective of 21380 as it made a high of 21375 but failed to get fresh demand for a spike higher into the close and made a retracement down to test the dPOC of 21314 in the L TPO which held signalling return of buyers who then made one last push higher into the close making marginal new highs of 21379 leaving a not so ideal Trend Day Up but has more work ahead as needs to negate the selling zone of 21399 and 20th Dec’s VWAP of 21439 to continue higher.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21314 F and VWAP of the session was at 21238

- Value zones (volume profile) are at 21180-21314-21374

- NF confirmed a FA at 21680 on 20/12 and tagged the 2 ATR objective of 21385 on the same day

- HVNs are at 20377 / 21032** (** denotes series POC)

Weekly Zones

- (15-21 Dec 2023) – NF started the week with a narrow base of 110 points after which it went on to extend in a big way on either sides first hitting new ATH of 21680 where it left a daily FA marking the end of the upmove and then making a huge drop of 620 points down to 21060 testing previous week’s POC of 21088 where it left a buying tail to give a bounce back to 21379 forming a Neutral profile for the week with completely higher Value at 21295-21563-21588

- (08-14 Dec 2023) – NF left a Neutral Extreme weekly profile to the upside after making an attempt to move away from previous week’s prominent POC of 21032 to the downside which got stalled as it left similar lows of 20902 & 20900 while forming a 4-day balance with the composite POC at 21088 and the failed attempt to the downside triggered an initiative move higher on the last day as it left a buying tail from 21228 to 21177 and went on to hit new ATH of 21355 into the close. Value for the week was overlapping to higher at 20925-21088-21124 with the VWAP at 21101 and will be the new swing reference on the downside

- (01-07 Dec 2023) – The first week of the current series was a Trend One up with an initiative buying tail from 20345 to 20292 followed by another zone of singles from 20640 to 20402 as it went on to make a high of 21046 leaving a small selling tail at the top and saw the POC shift near the top to 21032 suggesting profit booking by the longs. Value was completely higher at 20697-21032-21045 with the Trend Up VWAP at 20800

- (Oct-Nov 2023) – NF had left 4 weekly VPOCs on the downside at 19077, 19248, 19800 & 20189 before the December series began indicating that the major trend was already to the upside

- Click here to view the weekly MarketProfile charts of NF

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 22nd Dec 2023

| Up |

| 21356 – M TPO POC (21 Dec) 21399 – J TPO VWAP (20 Dec) 21439 – NeuX VWAP (20 Dec) 21490 – Mid-profile singles (20 Dec) 21552 – Ext Handle (20 Dec) |

| Down |

| 21345 – L TPO VWAP (21 Dec) 21314 – dPOC from 21 Dec 21252 – PBL from 21 Dec 21213 – HVN from 21 Dec 21177 – LVN from 21 Dec |

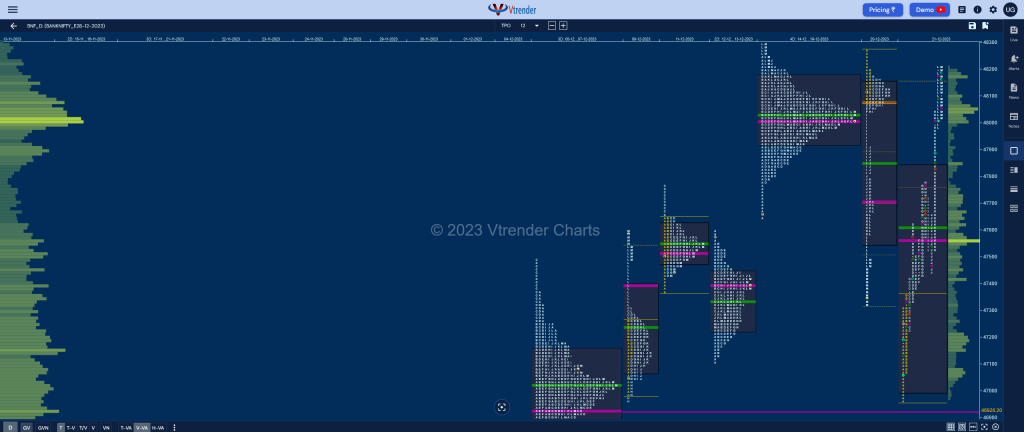

BankNifty Nov F: 48105 [ 48208 / 46964 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 28,852 contracts |

| Initial Balance |

|---|

| 399 points (47363 – 46964) |

| Volumes of 65,619 contracts |

| Day Type |

|---|

| Trend Up – 1243 points |

| Volumes of 2,64,686 contracts |

BNF also continued the Trend Day down imbalance close with a lower open and a further probe down to 46964 in the A period taking support just above this series’s swing reference and 08th Dec’s FA of 46961 and managed to get back into previous day’s range in the B TPO where it made a higher high of 47363 and left an initiative buying tail at the lows indicating that the PLR for the day would be to the upside.

The auction then made couple of REs in the C & D periods negating the lower most extension handle of 47589 while making a high of 47621 after which it made a small pause forming inside bars in the E & F TPOs and this coiling came to an end with a fresh RE in the G where it not only tagged the yPOC of 47706 but also completed the 2 IB target of 47761 to the dot which saw big profit booking by the longs triggering a quick drop down to 47436 in the J period where the buyers came back to defend their zone.

BNF then took off in the K period getting into beast mode as it first left an extension handle at 47780 and then negated the Trend Day VWAP of 47850 & got back into the weekly balanced Value of 47870 triggering the 80% Rule which it promptly completed in the L TPO while making a high of 48207 but this being the supply zone saw one more round of profit booking resulting in a pull back down to 48022 as that magnet of the weekly POC of 48006 held paving way for another rise back to 48205 in the M period completing a nice Trend Day Up of a massive range of 1243 points which was the highest for this series.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47558 F and VWAP of the session was at 47605

- Value zones (volume profile) are at 47000-47558-47834

- BNF confirmed a FA at 46961 on 08/12 and tagged the 2 ATR objective of 47913 on 14/12. This FA has not been tagged and is now a positional reference and came into play yet again on 21/12 when the probe lower stalled right at this point re-validating it’s importance

- HVNs are at 45127 / 47012 / 47145 / 48003** (** denotes series POC)

Weekly Zones

- (14-20 Dec 2023) – BNF formed a Neutral Extreme week to the downside after forming a balance for most part after it made a spike close on the 15th where it hit ATH of 48375 but made a move away from the Value of 47870-48006-48186 to the downside on the 20th with a Trend Day Down which saw it getting back into previous week’s 3-1-3 value & tagging the POC of 47393 and looks set to continue further as long as this week’s VWAP of 47975 is held

- (07-13 Dec 2023) – It was time for consolidation after the trending move in the previous week as BNF formed a relatively narrow range 3-1-3 profile for the week with overlapping to higher Value at 47125-47393-47621 and will need initiative activity to negate one of the tails to get back to imbalance mode in the coming week

- (01-06 Dec 2023) – The first week of the December series was an elongated triple distribution trend up one with an initiative buying tail from 44942 to 44762 signalling a move away from the larger timeframe balance it had been forming with the help of two more zone of singles, first one from 45856 to 45602 and then from 46860 to 46724 as it went on to record new ATH of 47494 but came in form of the dreaed C side extension on 05th Dec triggering a profit booking round as BNF closed the week right at the POC of 46927 with the VWAP at 46416 which will be the swing reference for longs going forward

- (Oct-Nov 2023) – BNF had left a lone VPOC on the downside in October at 43170 before moving away from this on the upside in November forming a Double Distribution Trend Up profile with a prominent TPO POC at 44048 and the volume POC at 44607

- Click here to view the weekly MarketProfile charts of BNF

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 22nd Dec 2023

| Up |

| 48105 – M TPO VWAP (21 Dec) 48220 – A TPO POC (20 Dec) 48337 – Sell tail mid (15 Dec) 48496 – 1 ATR (HVN 47955) 48617 – 1 ATR from 48003 |

| Down |

| 48050 – Closing HVN (21 Dec) 47980 – Mid-profile singles (21 Dec) 47853 – K TPO VWAP (21 Dec) 47780 – Ext Handle (21 Dec) 47605 – Trend Day VWAP (21 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.