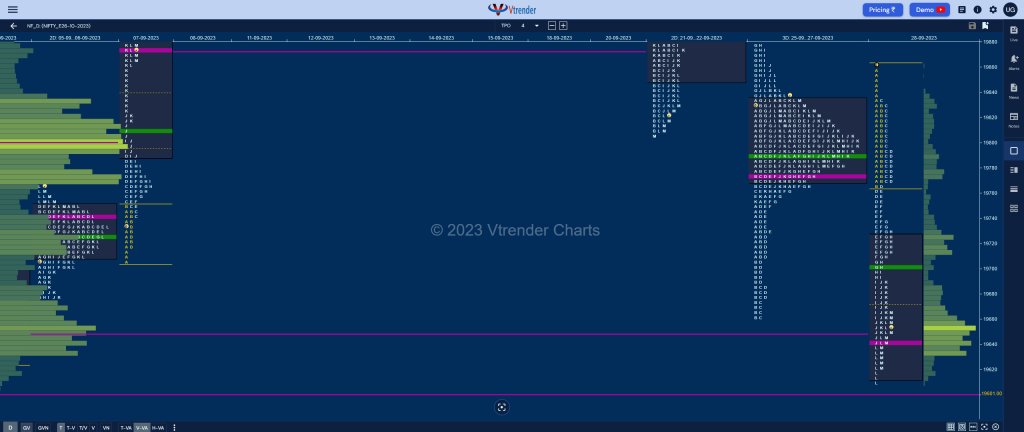

Nifty Oct F: 19637 [ 19860 / 19610 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 7,404 contracts |

| Initial Balance |

|---|

| 95 points (19860 – 19765) |

| Volumes of 26,475 contracts |

| Day Type |

|---|

| TD (Trend Down) – 251 points |

| Volumes of 1,84,346 contracts |

NF made a higher open above the 3-day VAH 19833 but started with an OH (Open=High) tag at 19860 and got back in the Gaussian Curve completing the 80% Rule in the Initial Balance as it made a low of 19765 and did the reverse 80% too in the C side where it made a high exactly at 19833 leaving a PBH there indicating lack of demand.

The auction then not only made another rotation down to the VAL of 19768 but left couple of extension handles at 19765 & 19752 in the D & E TPOs respectively marking the move away from balance which resulted in an One Time Frame probe lower till the L period leaving another set of extension handles at 19700 & 19692 in the H & I periods too as it went on to re-visit previous session’s FA of 19661 and made a low of 19610.

The closing TPOs saw profit booking by the sellers as the dPOC shifted lower to 19640 where NF eventually closed the Trend Day Down and will be the immediate reference as we begin the new series as the Roll Over point is also here at 19635 with the negated FA of 19661 & today’s VWAP of 19701 being the important references on the upside whereas on the downside, 01st Sep’s VPOC of 19601 and VWAP of 19550 would be the support levels to watch.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19640 F and VWAP of the session was at 19701

- Value zones (volume profile) are at 19615-19640-19727

- HVNs are at NA (** denotes series POC)

- NF confirmed a FA at 19661 on 27/09 and tagged the 1 ATR objective of 19789 on same day. This FA got re-visited on 28/09 & has closed below and is now a positional supply point

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19780 & 19677 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 29th Sep 2023

| Up |

| 19640 – dPOC from 28 Sep 19665 – PBH from 28 Sep 19701 – Trend Day VWAP (28 Sep) 19752 – Ext Handle (28 Sep) 19780 – Sep VWAP 19833 – Selling Tail (28 Sep) |

| Down |

| 19635 – Oct Rollover point 19601 – VPOC from 01 Sep 19575 – Mid-profile singles (01 Sep) 19526 – Ext Handle (01 Sep) 19480 – Buying Tail (01 Sep) 19454 – Buying Tail (25 Aug) |

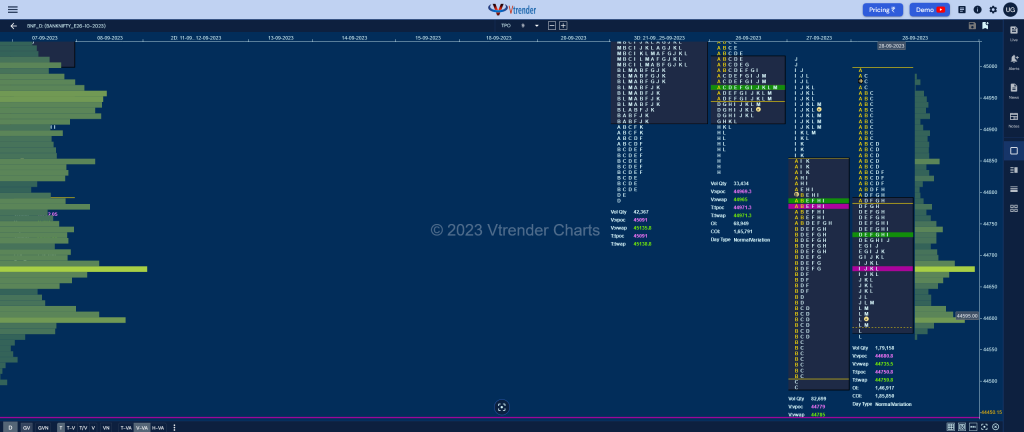

BankNifty Oct F: 44605 [ 44993 / 44568 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 7,151 contracts |

| Initial Balance |

|---|

| 201 points (44993 – 44792) |

| Volumes of 25,032 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 424 points |

| Volumes of 1,79,158 contracts |

BNF did not give any follow up to previous session’s Neutral Extreme profile making an OAIR start and filling up the upper part as it took support above the VWAP of 44785 & remained in a 201 point range of A period for the first couple of hours before making an extension lower at the fag end of the D period.

The auction then went on to complete the 2 IB objective of 44591 as it tested yesterday’s SOC of 44613 while making a low of 44568 taking support just above the FA of 4491 and VWAP of previous C side set up of 44547 forming an inside bar both in terms of Range & Value closing aroud the October series Rollover point of 44595.

BNF has formed a composite ‘b’ shape profile on the weekly timeframe with a nice balance and Value at 44620-44687-45060 which will be the zone to watch as we begin the new series with the immediate reference on the downside being the FA of 44491 from 27th Sep whereas on the upside, today’s VWAP of 44735 will need to be taken out by fresh buying for a probe higher.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44680 F and VWAP of the session was at 44735

- Value zones (volume profile) are at 44582-44680-44790

- HVNs are at NA (** denotes series POC)

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. The 2 ATR target comes to 45365

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 45023 & 44470 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 29th Sep 2023

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.