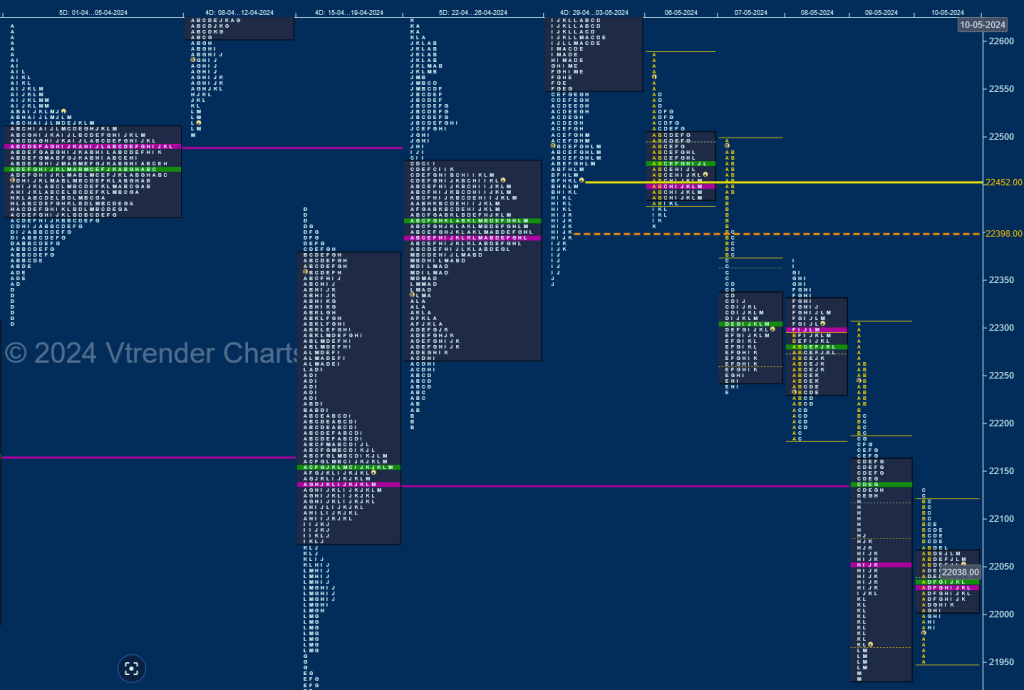

Nifty Spot: 22055 [ 22588 / 21932 ]

Monday – Nifty opened higher making an attempt to get back into previous week’s Value but got rejected leaving an A period selling tail from 22542 to 22588 indicating that the PLR (Path of Least Resistance) was to the downside and made lows of 22409 forming a Normal ‘b’ shape profile with a prominent POC at 22446

Tuesday – The auction tested previous value in the A period and signalled a continuation of the probe lower with a move away from yPOC of 22446 with an extension handle at 22441 in the B TPO which was followed by another one at 22376 in a rare C side RE which held as it went on to make lows of 22232 in the E after which it turned back to balance mode building a prominent POC around 22300

Wednesday – saw Nifty making new lows for the week at 22185 at open but could not sustain triggering a move back into previous Value where it completed the 80% Rule inspite of the C side playing a typical role of going against the IB (Initial Balance) making marginal new lows for the day which got rejected resulting in a fresh probe higher confirming a FA (Failed Auction) at lows as it made a high of 22368 stalling just below Monday’s lower extension handle of 22376 leaving a Neutral Day with overlapping value and a prominent POC at 22306

Thursday – opened lower but immediately got back to test the POC of 22306 where it left another A period selling tail displaying resumption of the main trend as it probed lower negating the FA of 22185 and promptly tagging the weekly VPOC of 22137 (15-19 Apr) while making a low of 22122 from where it gave a bounce which stalled right at the FA level in the G TPO making it the new swing reference as the sellers made a fresh move and went on to complete the 1 ATR objective of 21954 and even tested the buying extension handle of 21937 from 19th Apr while making a low of 21932 leaving a Trend Day Down.

Friday – saw a return to balance mode as Nifty formed an inside bar and a Normal Day leaving a nice Gaussian Curve with a prominent POC at 22030 with a small A period buying tail from 21985 to 21950 and a typical C side failed extension to 22131 as it reacted from Thursday’s extension handle of 22122.

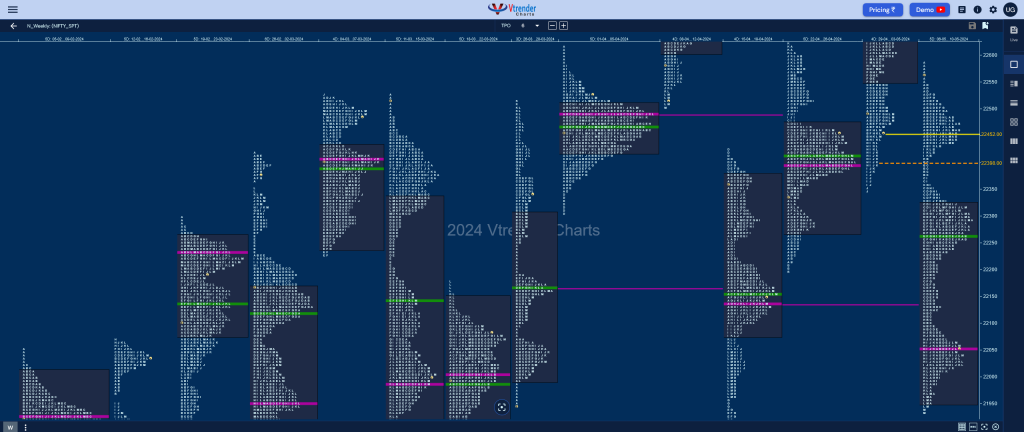

The weekly profile is a Triple Distribution Trend one Down with completely lower Value at 21950-22054-22325 with a close right at the POC which will be the opening reference for the coming week staying above which the auction could fill up the zone upto the negated FA of 22185 and the HVN of 222306 whereas sustaining above it could go in for the higher HVN of 22446 which will be an important level for the rest of the month along with this week’s initiative selling tail from 22542 to 22588. On the other hand, Friday’s buying tail from 21985 to 21950 will be the first support zone on the downside below which Nifty could go in for a test of the initiative buying tail from 21836 to 21777 (15-19 Apr) and the weekly VPOC of 21665 (12-16 Feb).

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 13th May – 22055 [ 22131 / 21950 ]

| Up |

| 22072 – PBH (10 May) 22120 – Sell tail (10 May) 22185 – Negated FA (08 May) 22221 – Ext Handle (09 May) 22260 – Sell Tail (09 May) |

| Down |

| 22033 – POC (10 May) 21985 – Buy Tail (10 May) 21932 – Swing Low (09 May) 21864 – VPOC (19 Apr) 21824 – A TPO h/b (19 Apr) |

Hypos for 14th May – 22104 [ 22131 / 21821 ]

| Up |

| 22132 – NeuX high (13 May) 22185 – Negated FA (08 May) 22221 – Ext Handle (09 May) 22260 – Sell Tail (09 May) 22306 – 2-day POC (07-08 May) |

| Down |

| 22092 – M TPO low (13 May) 22041 – SOC (13 May) 21974 – POC (13 May) 21934 – PBL (13 May) 21871 – D TPO h/b (13 May) |

Hypos for 15th May – 22217 [ 22270 / 22081 ]

| Up |

| 22226 – M TPO high (14 May) 22265 – Sell Tail (14 May) 22306 – 2-day POC (07-08 May) 22348 – Monthly IBL 22402 – Apr series VWAP |

| Down |

| 22214 – M TPO low (14 May) 22177 – POC (14 May) 22127 – C TPO h/b (14 May) 22067 – Ext Handle (13 May) 22027 – 2-day VPOC (10-13 May) |

Hypos for 16th May – 22200 [ 22297 / 22151 ]

| Up |

| 22214 – M TPO high (15 May) 22250 – 2-day VAH (14-15 May) 22306 – 2-day POC (07-08 May) 22348 – Monthly IBL 22402 – Apr series VWAP |

| Down |

| 22188 – 2-day POC (14-15 May) 22158 – 2-day VAL (14-15 May) 22127 – C TPO h/b (14 May) 22067 – Ext Handle (13 May) 22027 – 2-day VPOC (10-13 May) |

Hypos for 17th May – 22403 [ 22432 / 22054 ]

| Up |

| 22408 – Sell tail (16 May) 22446 – Weekly HVN (06-10 May) 22482 – Sell Tail (07 May) 22542 – Sell Tail (06 May) 22588 – Prev Week High |

| Down |

| 22388 – L TPO tail (16 May) 22348 – Monthly IBL 22303 – SOC (16 May) 22267 – 3-day VAH (14-16 May) 22216 – IBH (16 May) |

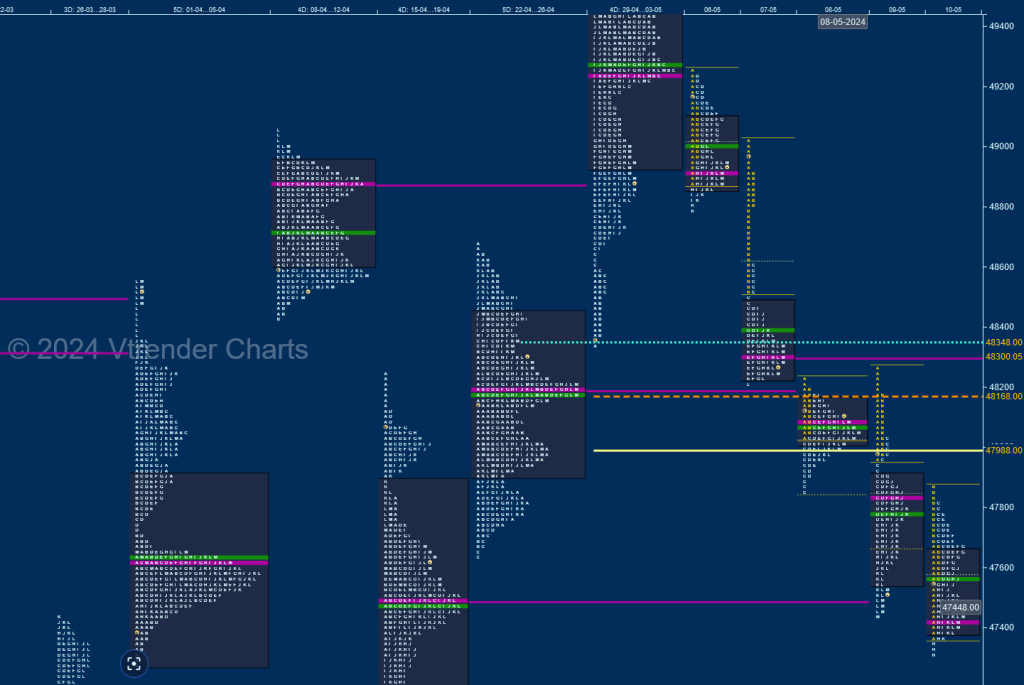

BankNifty Spot: 47421 [ 49252 / 47313 ]

Monday – BankNifty opened higher getting into previous week’s value but got rejected around the POC of 49244 as it left a small but significant selling tail and formed a Normal Day and a balance filling up the low volume zone while making a low of 48784 taking support just above the first support level of 48757

Tuesday – The auction signalled a move back to imbalance post an OAIR start as it left couple of extension handles at 48804 & 48522 forming a ‘b’ shape long liquidation profile where it made a low of 48213 almost tagging the ultra-prominent weekly VPOC of 48200 (22-26 Apr)

Wednesday – saw continuation of the downside with a lower open and a test of the VAL of 47904 (22-26 Apr) which came via a C side extension to 47851 and true to its character brought in a pause to the downside resulting in a narrow range Gaussian Curve being formed with completely lower value

Thursday – started with an attempt to move away from value to the upside which got stalled at 48258 as BankNifty left an A period selling tail and completed the 80% rule in the IB after which it left a fresh extension handle at 47964 signalling the resumption of the main trend making multiple REs and hitting the weekly VPOC of 47499 (15-19 Apr) while making a low of 47440

Friday – was a dual auction day with balance returning in form of a Normal profile with a big IB range of 506 points as the new weekly lows of 47362 in the A TPO getting rejected triggering a probe back to Thursday’s POC of 47839 in the B which the sellers defended with a small tail from 47824 to 47868 forcing a test of the lows again in the H period but could only manage marginal new lows of 47313 and closed around the POC of 47429

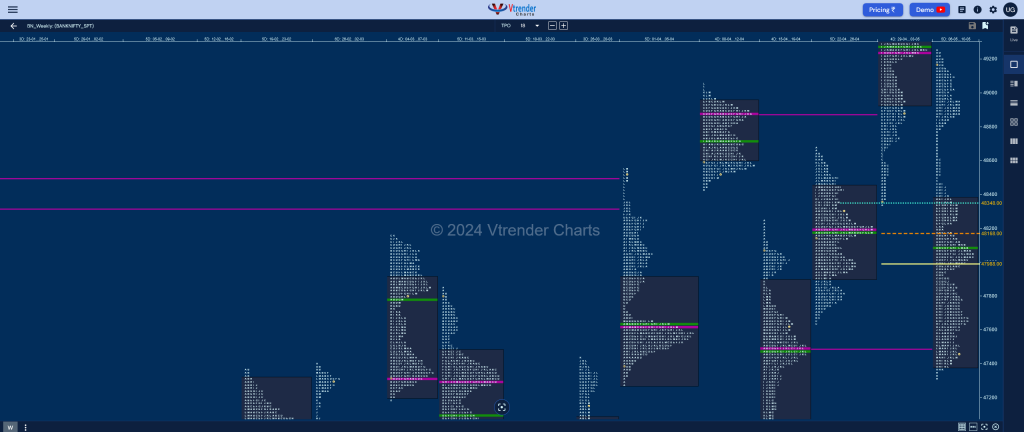

The weekly profile represents a Double Distribution (DD) Trend one down in an elongated range of 1939 points with completely lower value at 47380-48087-48375 with the DD zone from 48784 to 48465 and a close at the lower end so can expect more downside in the coming week with the immediate objectives being the weekly singles of 46750 to 46579 (15-19 Apr) and the VPOC of 46438 (18-22 Mar)

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 13th May – 47421 [ 47868 / 47313 ]

| Up |

| 47429 – POC (10 May) 47592 – PBH (10 May) 47717 – E TPO h/b (10 May) 47839 – POC (09 May) 47965 – Ext Handle (09 May) |

| Down |

| 47362 – Buy tail (10 May) 47200 – Mid-profile tail (19 Apr) 47045 – Ext Handle (19 Apr) 46952 – IBH (19 Apr) 46829 – VPOC (19 Apr) |

Hypos for 14th May – 47754 [ 47841 / 46983 ]

| Up |

| 47778 – M TPO h/b (13 May) 47923 – C TPO h/b (09 May) 48087 – Weekly POC 48173 – Sell Tail (09 May) 48300 – VPOC (07 May) 48406 – J TPO h/b (07 May) |

| Down |

| 47740 – POC (13 May) 47662 – Mid-profile singles (13 May) 47520 – Ext Handle (13 May) 47411 – 13 May H/B 47155 – PBL (13 May) 47098 – D TPO h/b (13 May) |

Hypos for 15th May – 47859 [ 47937 / 47607 ]

| Up |

| 47910 – Sell tail (14 May) 48024 – C TPO high (09 May) 48173 – Sell Tail (09 May) 48300 – VPOC (07 May) 48406 – J TPO h/b (07 May) |

| Down |

| 47842 – M TPO low (14 May) 47740 – May POC 47610 – Buy Tail (14 May) 47520 – Ext Handle (13 May) 47411 – 13 May H/B |

Hypos for 16th May – 47687 [ 47957 / 47534 ]

| Up |

| 47725 – 2-day POC (14-15 May) 47890 – 2-day VAH (14-15 May) 47965 – Ext Handle (09 May) 48087 – Weekly POC 48173 – Sell Tail (09 May) |

| Down |

| 47671 – 2-day VAL (14-15 May) 47520 – Ext Handle (13 May) 47411 – 13 May H/B 47220 – PBL (13 May) 47098 – D TPO h/b (13 May) |

Hypos for 17th May – 47977 [ 48053 / 47340 ]

| Up |

| 48001 – Sell tail (16 May) 48087 – Weekly POC 48173 – Sell Tail (09 May) 48300 – VPOC (07 May) 48406 – J TPO h/b (07 May) |

| Down |

| 47958 – M TPO low (16 May) 47880 – 3-day VAH (14-16 May) 47740 – 3-day HVN (14-16 May) 47588 – 3-day VAL (14-16 May) 47480 – POC (16 May) |