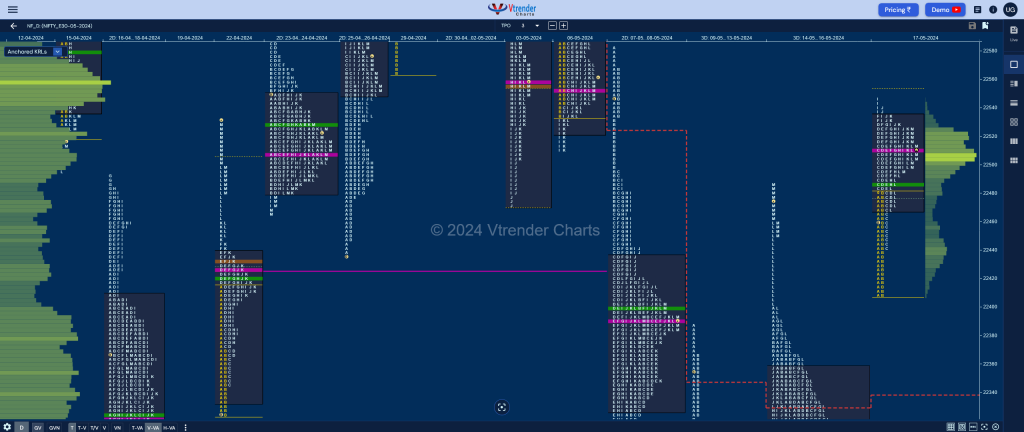

Nifty May F: 22497 [ 22546 / 22407 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 22,798 contracts |

| Initial Balance |

|---|

| 74 points (22481 – 22407) |

| Volumes of 55,838 contracts |

| Day Type |

|---|

| Normal Variation – 138 pts |

| Volumes of 1,98,597 contracts |

NF did not give a follow up to the NeuX profile making an OAIR start and testing the L TPO singles from 16th May as it made a low of 22407 taking support just above the extension handle of 22400 in the IB (Initial Balance) leaving similar lows.

With the downside looking exhausted, the auction then went on to make multiple REs (Range Extension) higher negating the selling extension handle of 22533 from 07th May but stopped short of the weekly VPOC of 22553 (03rd-09th May) as it made a high of 22546 forming a ‘p’ shape profile for the day with completely higher value and a prominent POC at 22509 which will be the opening reference for the next session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22509 F and VWAP of the session was at 22487

- Value zones (volume profile) are at 22469-22509-22534

- NF has closed above the AVWAP of 22331 from Swing High of 22888 from 03/05 for the first time on 16/05 and this level is expected to show change of polarity. This AVWAP is now at 22341

- NF has immediate support at AVWAP of 22274 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05.

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 21st May 2024

| Up |

| 22509 – POC (17 May) 22553 – Weekly VPOC (03-09 May) 22603 – G TPO h/b (06 May) 22648 – Sell Tail (06 May) 22690 – E singles mid (03 May) |

| Down |

| 22487 – VWAP (17 May) 22444 – B TPO h/b (17 May) 22400 – Ext Handle (16 May) 22368 – POC (16 May) 22311 – NeuX VWAP (16 May) |

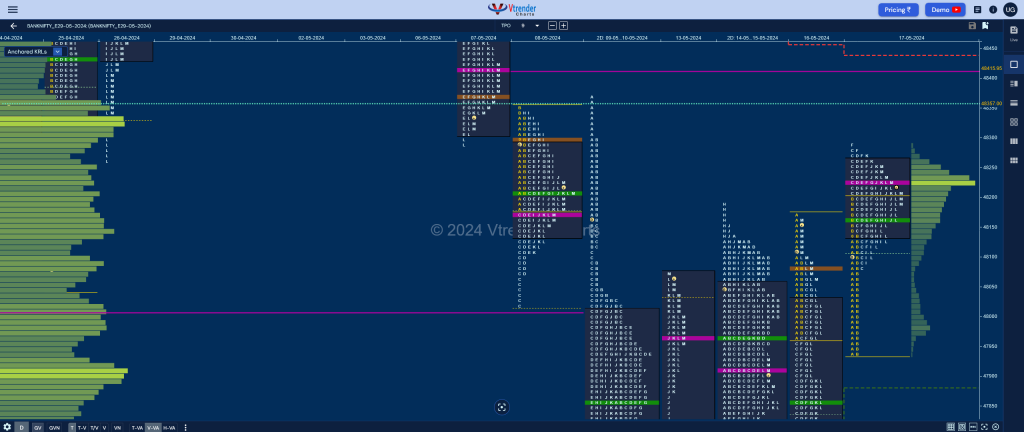

BankNifty May F: 48195 [ 48291 / 47930 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 9,217 contracts |

| Initial Balance |

|---|

| 270 points (48200 – 47930) |

| Volumes of 31,842 contracts |

| Day Type |

|---|

| Normal (‘p’ shape) – 362 pts |

| Volumes of 1,14,950 contracts |

BNF has formed a ‘p’ shape profile as it seemed to absorb the supply from the 48174 zone all day but could not negate the 09th May selling tail from 48300 building a prominent POC at 48229 with day’s VWAP at 48164 which will be the important levels on either side for the next open.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48229 F and VWAP of the session was at 48164

- Value zones (volume profile) are at 48136-48229-48262

- BNF has immediate supply point at AVWAP of 48441 from Swing High of 49927 from 30/04

- BNF has immediate support at AVWAP of 47882 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 47200 on 13/04 and completed the 1 ATR objective of 47813 on the same day. The 2 ATR target comes to 48425.

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 21st May 2024

| Up |

| 48275 – PBH (17 May) 48416 – VPOC (07 May) 48553 – VWAP (07 May) 48665 – Ext Handle (07 May) 48781 – B TPO VWAP (07 May) |

| Down |

| 48172 – L TPO VWAP (17 May) 48070 – B TPO h/b (17 May) 47910 – Weekly POC 47784 – K TPO VWAP (16 May) 47627 – VPOC (16 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.