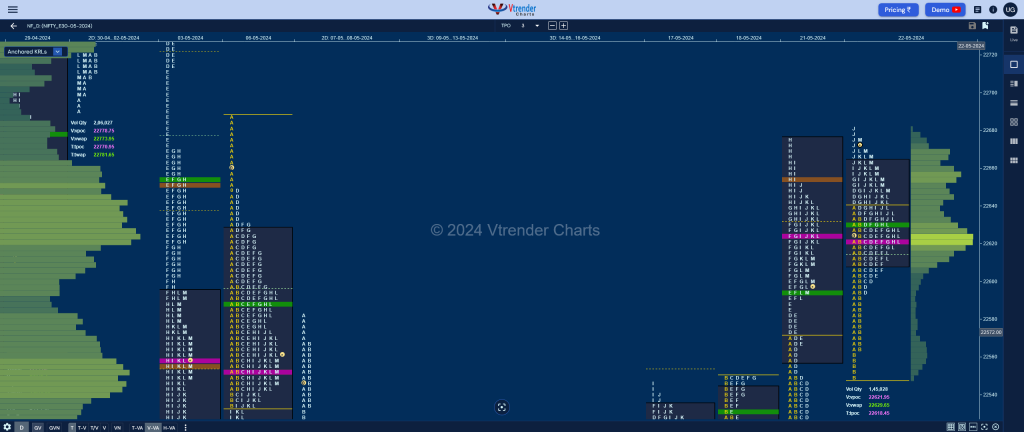

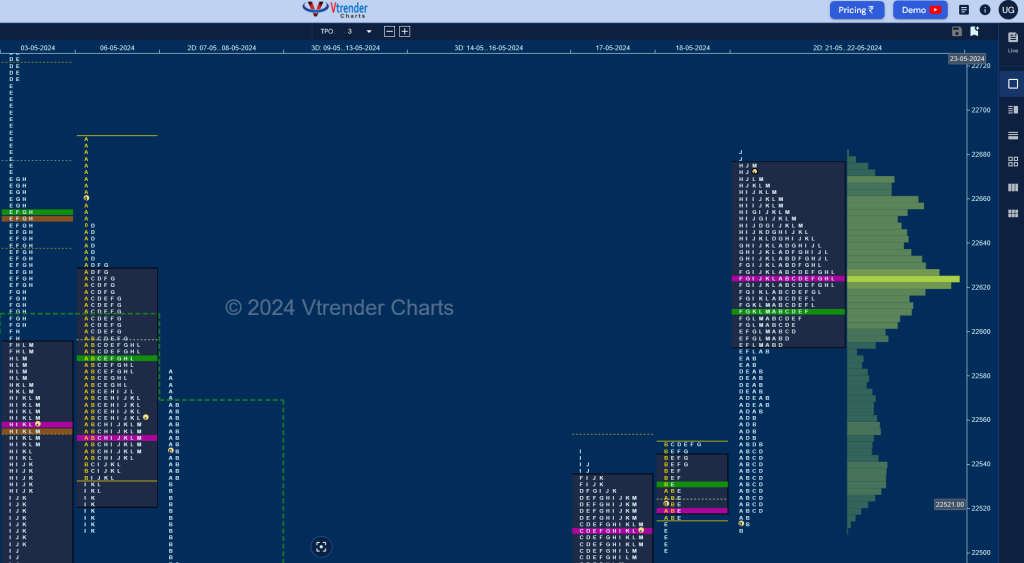

Nifty May F: 22658 [ 22683 / 22548 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 10,511 contracts |

| Initial Balance |

|---|

| 95 points (22643 – 22548) |

| Volumes of 43,970 contracts |

| Day Type |

|---|

| Normal – 135 pts |

| Volumes of 1,45,086 contracts |

NF made an OAIR start testing the DD zone from previous session as it negated the extension handle of 22583 & went on to test the SOC (Scene Of Crime) of 22550 while making new lows of 22546 in the B period where it saw demand coming back as could be seen in the small tail it left at lows.

The auction then made multiple REs to the upside but all of them were marginal ones as it mostly remained in previous range forming a nice Gaussian Curve and an inside bar in terms of value with overlapping POC at 22625 hence has a good chance of a move away from here in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22622 F and VWAP of the session was at 22629

- Value zones (volume profile) are at 22609-22622-22663

- NF has immediate support at AVWAP of 22331 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05. This FA has not been tagged hence is a postional swing support

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at 22638 / 22778 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 23rd May 2024

| Up |

| 22675 – Sell tail (22 May) 22740 – Ext Handle (03 May) 22778 – Weekly HVN (26Apr-02May) 22817 – B TPO single (03 May) 22845 – Ext Handle (03 May) 22878 – Sell Tail (03 May) |

| Down |

| 22640 – L TPO VWAP (22 May) 22595 – PBL (22 May) 22546 – SOC (21 May) 22509 – VPOC (17 May) 22469 – PBL (17 May) 22436 – A TPO h/b (17 May) |

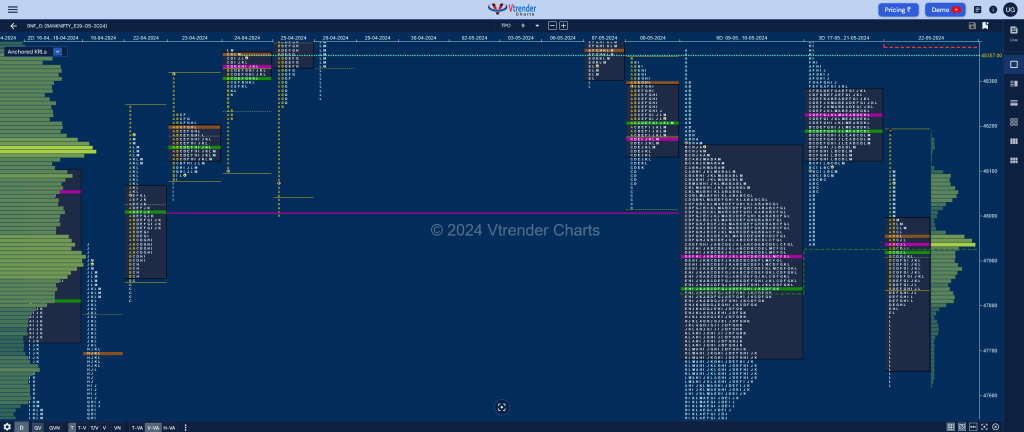

BankNifty May F: 47974 [ 48193 / 47611 ]

| Open Type |

|---|

| OD (Open Drive) |

| Volumes of 22,015 contracts |

| Initial Balance |

|---|

| 393 points (48193 – 47800) |

| Volumes of 95,701 contracts |

| Day Type |

|---|

| Normal Variation – 582 pts |

| Volumes of 2,39,308 contracts |

BNF made an Open Drive to the downside breaking below the AVWAP of 47932 and the 6-day POC (09-16 May) of 47910 as it made couple of REs lower in the D & E TPOs making a low of 47778 taking support at the 16th May’s K period VWAP of 47785.

The auction then seem to be settling down into a narrow range balance forming a ‘b’ shape profile for the day but a push back to day’s POC of 47950 saw a swift rejection indicating that the downside was mostly not done and after a rare inside bar in the K TPO it saw a swipe lower in the L as it completely the 80% Rule in the 6-day composite and went on to tag the VPOC of 47627 while making a low of 47611 which was also quickly rejected resulting in the reverse 80% Rule playing out as BNF went on to enter the A period selling tail making a high of 48104 leaving a 3-1-3 profile for the day.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47942 F and VWAP of the session was at 47924

- Value zones (volume profile) are at 47659-47942-47988

- BNF has immediate supply point at AVWAP of 48378 from Swing High of 49927 from 30/04

- BNF has immediate support at AVWAP of 47931 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 47200 on 13/04 and almost completed the 2 ATR objective of 48425 on 21/05. This FA has not been tagged and is now a positional Swing support .

- BNF confirmed a FA at 48054 on 21/04 and 1 ATR objective comes to 48662. This FA got negated on 22/05

- HVNs are at 47910 / 48637 / 49555 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 23rd May 2024

| Up |

| 47988 – VAH (22 May) 48104 – Sell Tail (22 May) 48229 – 3-day VPOC (17-21 May) 48378 – AVWAP (30 Apr) 48553 – VWAP (07 May) |

| Down |

| 47954 – HVN (22 May) 47778 – Buy tail (22 May) 47627 – VPOC (16 May) 47500 – Swing Low (16 May) 47383 – PBL (13 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.