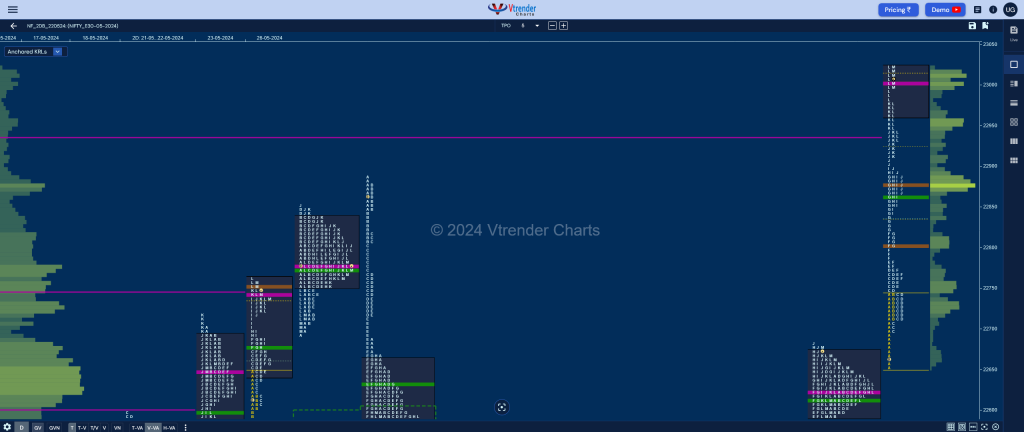

Nifty May F: 23002 [ 23023 / 22650 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,929 contracts |

| Initial Balance |

|---|

| 94 points (22744 – 22650) |

| Volumes of 57,163 contracts |

| Day Type |

|---|

| Trend – 373 pts |

| Volumes of 4,12,684 contracts |

NF made a slow OAIR start but with an OL (Open=Low) at 22650 indicating that it wanted to move away from the balance and the 2-day POC of 22625 to the upside and went on to form a massive Trend Day Up in a range of 373 points taking out the Swing reference of 22977 as it made new highs for the series at 23023 but saw good profit booking by the longs as the POC shifted higher to 23000 into the close.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23000 F and VWAP of the session was at 22861

- Value zones (volume profile) are at 22964-23000-23022

- NF has immediate support at AVWAP of 22468 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05. This FA has not been tagged hence is a postional swing support

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level. This FA was revisted on 23/05 with a close above it hence is no longer a valid reference.

- HVNs are at 22638 / 22778 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 24th May 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

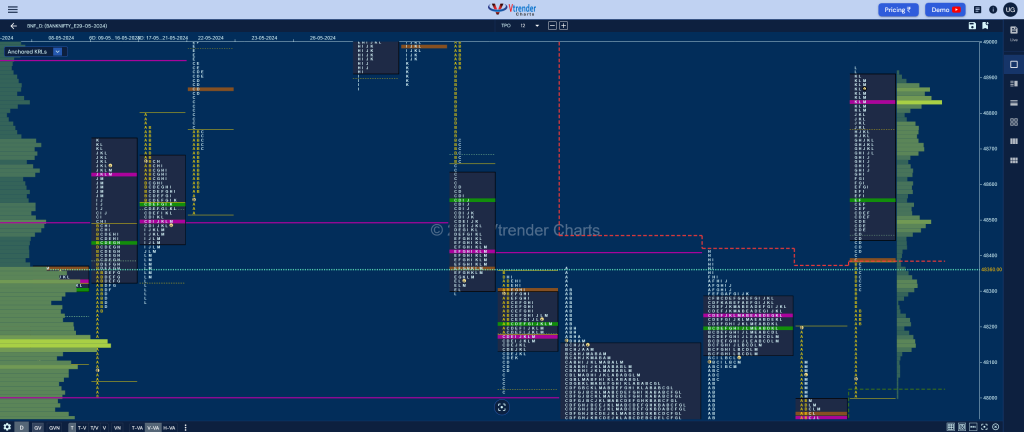

BankNifty May F: 48838 [ 48924 / 48000 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 18,636 contracts |

| Initial Balance |

|---|

| 375 points (48375 – 48000) |

| Volumes of 52,698 contracts |

| Day Type |

|---|

| Trend – 924 pts |

| Volumes of 2,22,373 contracts |

BNF made an Open Rejection Reverse start stalling right above previous Value and leaving an initiative buying tail as it swiped through the 3-day composite in the IB and went on to make multple REs to the upside leaving a Trend Day Up getting into the selling zone from 07th May and tagging the extension handle of 48924 and similar to NF saw the POC shift higher to 48832 indicating profit booking by the longs.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48832 F and VWAP of the session was at 48561

- Value zones (volume profile) are at 48447-48832-48908

- BNF has closed above the supply point of AVWAP of 48378 from Swing High of 49927 from 30/04 which will now serve as important support

- BNF has immediate support at AVWAP of 48032 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 47200 on 13/04 and almost completed the 2 ATR objective of 48425 on 21/05. This FA has not been tagged and is now a positional Swing support .

- BNF confirmed a FA at 48054 on 21/04 and 1 ATR objective comes to 48662. This FA got negated on 22/05

- HVNs are at 47910 / 48637 / 49555 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 24th May 2024

| Up |

| to be updated.. |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.