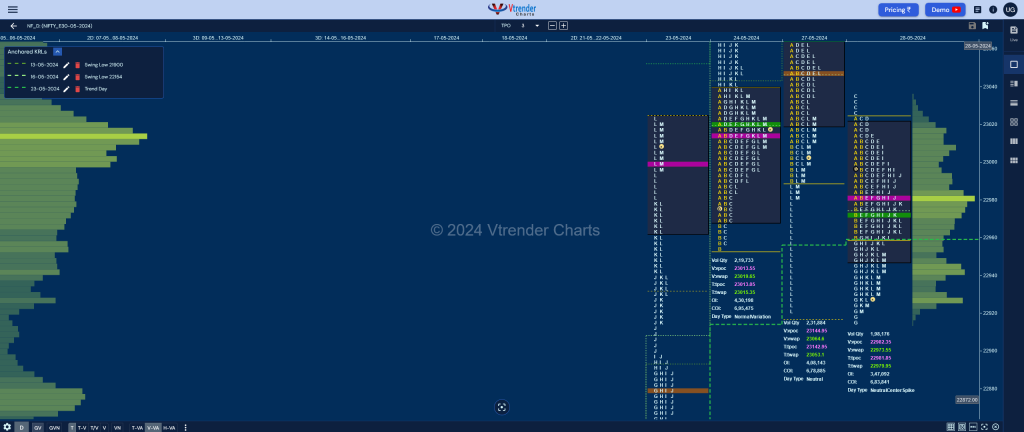

Nifty May F: 22937 [ 23037 / 22915 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 10,149 contracts |

| Initial Balance |

|---|

| 72 points (23030 – 22958) |

| Volumes of 35,999 contracts |

| Day Type |

|---|

| Neutral Extreme – 123 pts |

| Volumes of 1,98,257 contracts |

NF opened higher but could not clear previous closing’s selling reference of 23032 and settled down into an OAIR probing lower in the B period where it made a low of 22958 taking support right above the AVWAP of 22956 (23rd May) triggering a move higher and a dreaded C side extension to 23037 which got swiftly rejected due to lack of demand resulting in a fresh downmove and a RE (Range Extension) in the G TPO confirming a FA (Failed Auction) at top.

However, the auction could not break below the lows of 22915 displaying buyers defending the extension handle of 22914 from 23rd May’s Trend Day and formed a balance for the rest of the day leaving a PBH (Pull Back High) at 23007 in the I period before closing well below the IBL leaving a Neutral Extreme Day Down with completely lower value and a FA in play.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22982 F and VWAP of the session was at 22973

- Value zones (volume profile) are at 22950-22982-23019

- NF has immediate support at AVWAP of 22959 from Trend Day from 23/05

- NF has next support at AVWAP of 22692 from Swing Low of 22154 from 16/05

- NF has swing support at AVWAP of 22554 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 23037 on 28/05 and the 1 ATR objective comes to 22811

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05. This FA has not been tagged hence is a postional swing support

- HVNs are at 22638 / 22778 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 29th May 2024

| Up |

| 22950 – VAL (28 May) 23019 – VAH (28 May) 23064 – VWAP (27 May) 23096 – SOC (27 May) 23145 – VPOC (27 May) |

| Down |

| 22922 – Buy tail (28 May) 22861 – TD VWAP (23 May) 22811 – 1 ATR (FA 23037) 22748 – D TPO VWAP (23 May) 22699 – Buy Tail (23 May) |

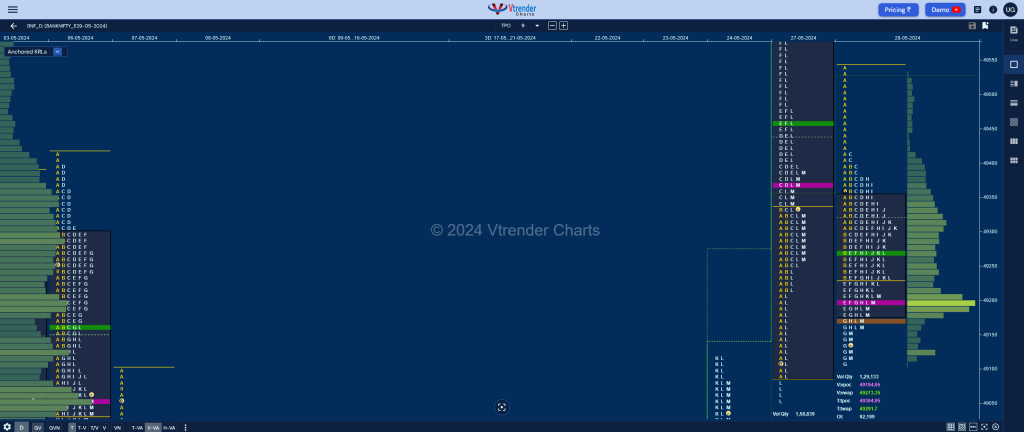

BankNifty May F: 49182 [ 49537 / 49106 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 9,725 contracts |

| Initial Balance |

|---|

| 311 points (49537 – 49225) |

| Volumes of 35,831 contracts |

| Day Type |

|---|

| NV (Inside bar) – 431 pts |

| Volumes of 1,29,177 contracts |

BNF also opened higher and went on to make a look up above previous day’s VWAP of 49459 leaving a high of 49537 but could not sustain as the sellers came back to leave an initiative selling tail and push it down to 49225 in the B period which was followed by a typical contra move with a C side PBH at 49418 which got rejected re-confirming that the supply was dominant in this zone.

The auction then made couple of REs to the downside in the E & G TPOs but could not take out the mini closing buying tail from 49090 to 49050 as it made a low of 49106 and settled down to close around the POC of 49195 leaving a ‘b’ shape profile as well as an Inside Day both in terms of range & value with the PLR (Path of Least Resistance) being to the downside courtesy the A period selling tail of today.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49195 F and VWAP of the session was at 49273

- Value zones (volume profile) are at 49176-49195-49350

- BNF has immediate support at AVWAP of 48894 from Trend Day of 23/05

- BNF has immediate support at AVWAP of 48708 from Swing Low of 47611 from 22/05

- BNF has immediate support at AVWAP of 48318 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 48702 on 24/05 and almost completed the 2 ATR objective of 49878 on 27/05.

- BNF confirmed a FA at 47200 on 13/04 and almost completed the 2 ATR objective of 48425 on 21/05. This FA has not been tagged and is now a positional Swing support .

- HVNs are at 47910 / 48637 / 49555 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 29th May 2024

| Up |

| 49195 – POC (28 May) 49273 – VWAP (28 May) 49418 – Sell Tail (28 May) 49575 – SOC (27 May) 49700 – HVN (27 May) 49843 – K TPO h/b (30 Apr) |

| Down |

| 49171 – HVN (28 May) 49090 – Buy tail (27 May) 48994 – AVWAP (23 May) 48858 – VPOC (24 May) 48702 – FA (24 May) 48560 – TD VWAP (23 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.