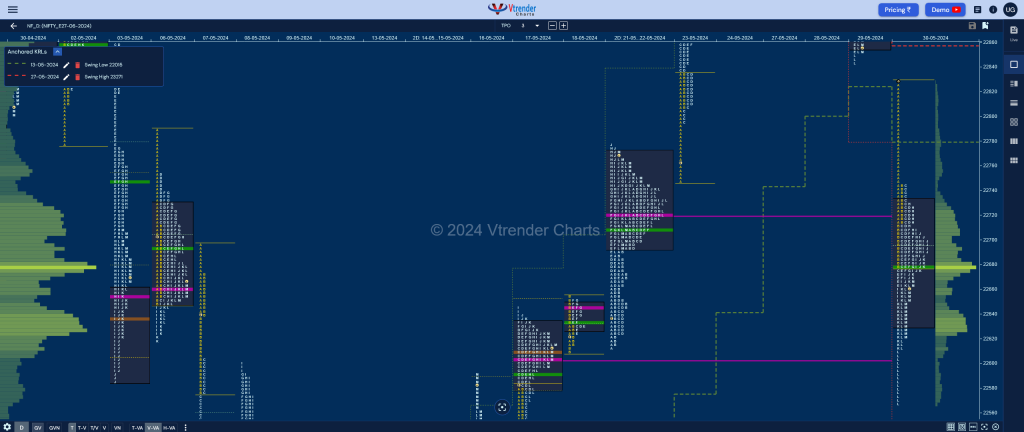

Nifty Jun F: 22627 [ 22828 / 22567 ]

| Open Type |

|---|

| OAOR (Open Auction + Drive) |

| Volumes of 35,852 contracts |

| Initial Balance |

|---|

| 151 points (22828 – 22567) |

| Volumes of 1,03,057 contracts |

| Day Type |

|---|

| NV (3-1-3) – 261 pts |

| Volumes of 4,81,032 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22677 F and VWAP of the session was at 22678

- Value zones (volume profile) are at 22631-22677-22731

- NF confirmed a FA at 23145 on 28/05 and completed the 2 ATR objective of 22691 on 30/05.

- NF confirmed a FA at 22015 on 13/04 and has not been tagged hence is a postional swing support

- HVNs are at 22680 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (24-30 May) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 31st May 2024

| Up |

| 22645 – M TPO POC (30 May) 22697 – 30 May Halfback 22744 – Sell Tail (30 May) 22800 – IB singles mid 22851 – Tail (29 May) |

| Down |

| 22611 – Buy tail (30 May) 22560 – B TPO POC (17 May) 22505 – Ext Handle (16 May) 22452 – VPOC (16 May) 22400 – K TPO POC (16 May) |

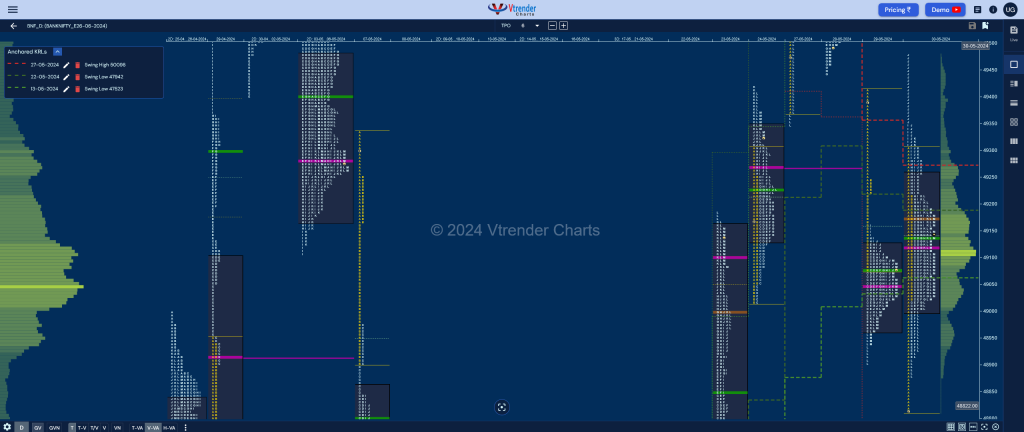

BankNifty Jun F: 49037 [ 49480 / 48810 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 27,462 contracts |

| Initial Balance |

|---|

| 508 points (49317 – 48810) |

| Volumes of 60,756 contracts |

| Day Type |

|---|

| Normal (3-1-3) – 670 pts |

| Volumes of 2,35,085 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49117 F and VWAP of the session was at 49139

- Value zones (volume profile) are at 49001-49117-49255

- BNF has supply at AVWAP of 49273 from Swing High of 27/05

- BNF has closed below AVWAP of 49062 from Swing Low from 13/05 and will now be the immediate supply point

- BNF confirmed a FA at 47523 on 13/04 which has not been tagged and is now a positional Swing support .

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 31st May 2024

| Up |

| 49062 – AVWAP (13 May) 49170 – HVN (30 May) 49273 – AVWAP (27 May) 49411 – 2-day tail (29-30 May) 49540 – VPOC (28 May) |

| Down |

| 49001 – VAL (30 May) 48877 – Buy tail (30 May) 48715 – C TPO tail (23 May) 48610 – B TPO POC (23 May) 48509 – Buy Tail (23 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.