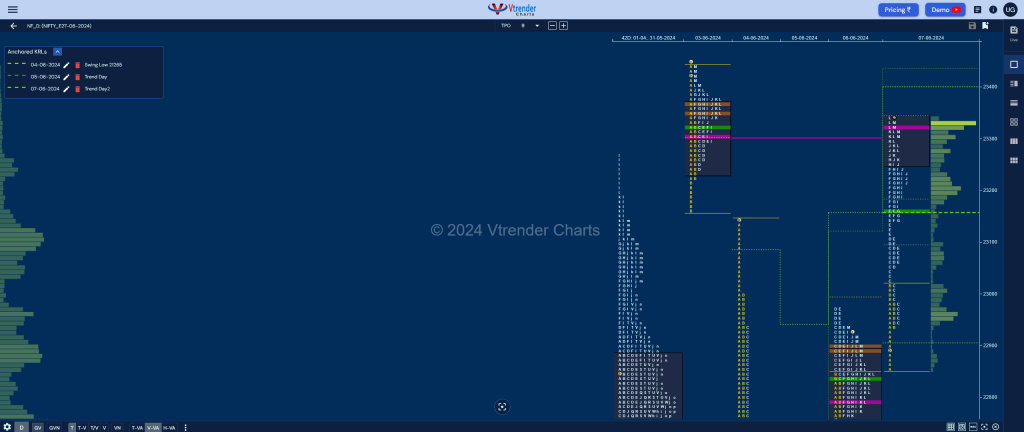

Nifty Jun F: 23325 [ 23341 / 22852 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 46,052 contracts |

| Initial Balance |

|---|

| 168 points (23020 – 22852) |

| Volumes of 1,06,464 contracts |

| Day Type |

|---|

| Trend – 489 pts |

| Volumes of 5,17,101 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23327 F and VWAP of the session was at 23158

- Value zones (volume profile) are at 23254-23327-23341

- HVNs are at 21960 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 10th Jun 2024

| Up |

| 23330 – L TPO POC (07 Jun) 23368 – Closing HVn (03 Jun) 23425 – M TPO POC (03 Jun) 23502 – 1.5 Weekly IB 23566 – 2 ATR (VPOC 22794) 23612 – 2 ATR (VWAP 22840) |

| Down |

| 23327 – POC (07 Jun) 23260 – Ext Handle (07 Jun) 23209 – I TPO VWAP (07 Jun) 23158 – VWAP (07 Jun) 23097 – 07 Jun H/B 23020 – Ext Handle (07 Jun) |

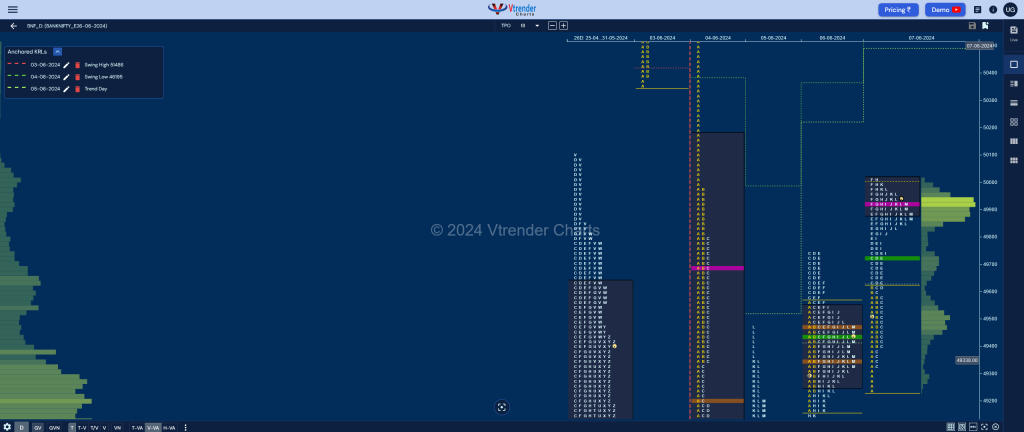

BankNifty Jun F: 49909 [ 50025 / 49240 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 20,104 contracts |

| Initial Balance |

|---|

| 379 points (49619 – 49240) |

| Volumes of 55,959 contracts |

| Day Type |

|---|

| Double Distribution – 785 pts |

| Volumes of 2,27,677 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49931 F and VWAP of the session was at 49732

- Value zones (volume profile) are at 49878-49931-50016

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – to be updated…

- (30 May – 05 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 10th Jun 2024

| Up |

| 49931 – POC (07 Jun) 50098 – Swing zone 50384 – A TPO tail (03 Jun) 50566 – B TPO h/b (03 Jun) 50725 – D TPO POC (03 Jun) 50920 – 03 Jun Halfback |

| Down |

| 49863 – M TPO low (07 Jun) 49732 – VWAP (07 Jun) 49541 – C TPO h/b (07 Jun) 49333 – Buy Tail (07 Jun) 49110 – Weekly POC 48993 – HVN (05 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.