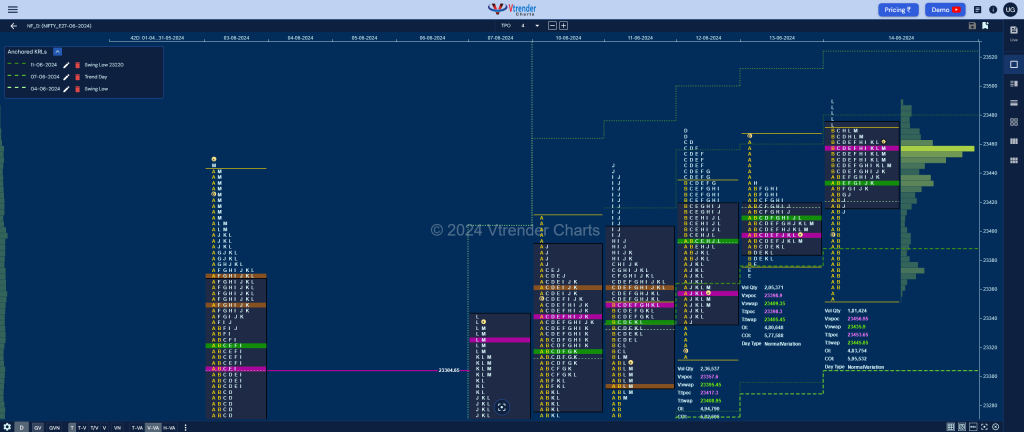

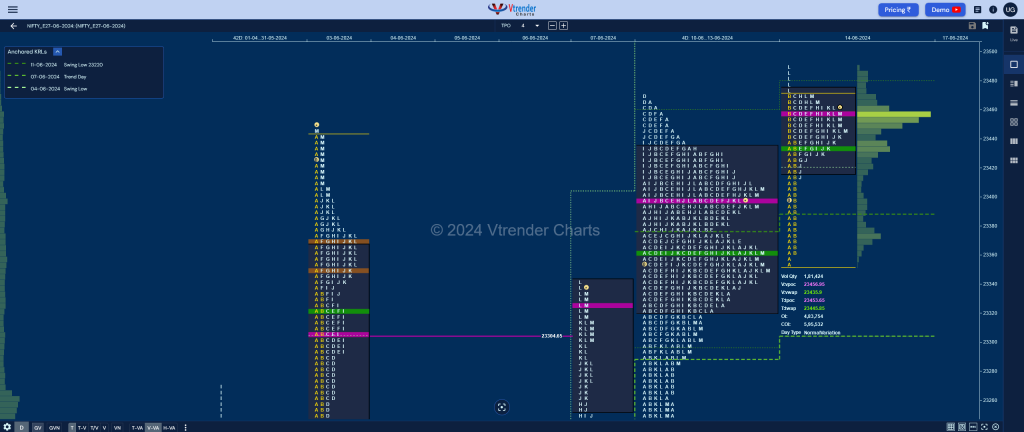

Nifty Jun F: 23466 [ 23489 / 23350 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 6,662 contracts |

| Initial Balance |

|---|

| 121 points (23472 – 23350) |

| Volumes of 65,328 contracts |

| Day Type |

|---|

| Normal – 139 pts |

| Volumes of 1,81,496 contracts |

NF opened higher but could not take out previous session’s selling tail and made a probe to the downside breaking below PDL and tagging 12th Jun’s VPOC of 23357 while making a low of 23350 in the A period but this fall came on very low volumes which encouraged the buyers to come back in the B TPO where the auction swiped through previous value and range making a high of 23472.

However, there was no further range extension to the upside as the C side left similar highs followed by a contraction of range for the rest of the day as NF made a test below day’s VWAP in the J period but took support at the B TPO’s halfback of 23415 triggering a small spike higher to 23490 in the L which could not sustain as it settled down around the prominent POC of 23456 leaving a ‘p’ shape profile for the day with mostly higher value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23456 F and VWAP of the session was at 23436

- Value zones (volume profile) are at 23418-23456-23472

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 18th Jun 2024

| Up |

| 23472 – L TPO tail (14 Jun) 23533 – 1.5 Weekly IB 23594 – Weekly 2 IB 23634 – 1 ATR (11 Jun IB POC) 23670 – 1 ATR (AVWAP 23291) 23716 – Weekly 3 IB |

| Down |

| 23436 – VWAP (14 Jun) 23388 – IB SOC (14 Jun) 23350 – Weekly IBL 23291 – Weekly VWAP (07-13 Jun) 23244 – A TPO POC (11 Jun) 23205 – I TPO VWAP (07 Jun) |

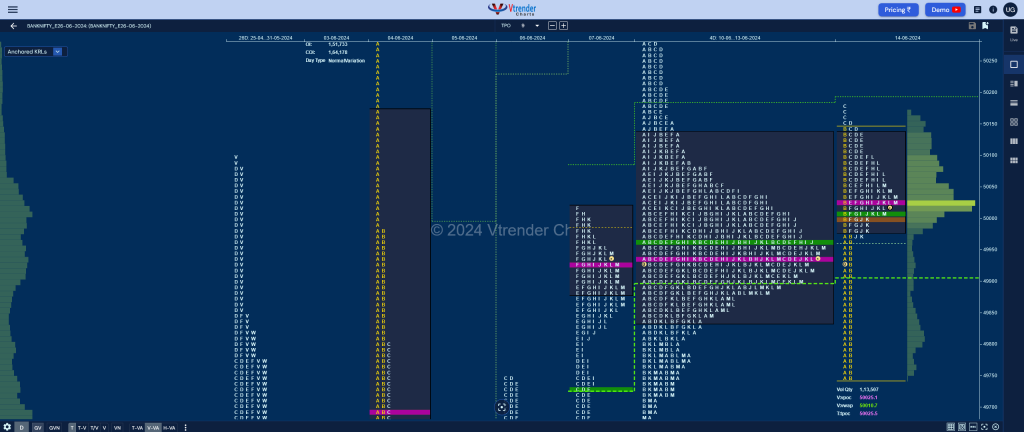

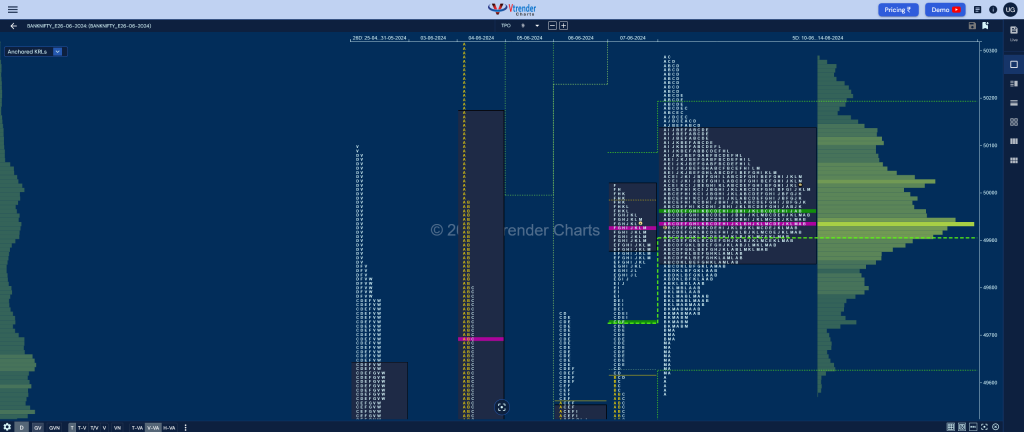

BankNifty Jun F: 50042 [ 50175 / 49750 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,978 contracts |

| Initial Balance |

|---|

| 390 points (50140 – 49750) |

| Volumes of 46,525 contracts |

| Day Type |

|---|

| Normal – 425 pts |

| Volumes of 1,13,522 contracts |

BNF also made a higher open above the 4-day composite POC & VWAP of 49938 & 49960 respectively but could not sustain and swiped lower probing below the VAL of 49837 as it made a low of 49750 looking like an Open Test Drive down but the volumes were pretty poor enabling the buyers to strike back in the B TPO which they did it in style by getting back into the composite Value and completing the 80% Rule while making a high of 50140.

However, the auction then made the dreaded C side extension to 50175 marking the highs of the day after which it made a slow probe back to the composite VWAP of 49960 leaving a PBL there indicating change of polarity before closing the day around the POC of 50025 with completely inside value hence giving a smoother 5-day balance with Value at 49853-49938-50133 with the VWAP at 49966 and the wait is still on for a move away from this zone which could start a fresh imbalance in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 50025 F and VWAP of the session was at 50010

- Value zones (volume profile) are at 49978-50025-50138

- HVNs are at 49110 / 49931** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – BNF has formed a Normal Variation weekly profile getting rejected from previous week’s POC of 49110 forming overlapping to higher Value at 49611-49931-50236 with a close around the prominent POC so can give a move away from here in the coming week

- (23-29 May) – to be updated…

- (30 May – 05 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 18th Jun 2024

| Up |

| 50048 – L TPO VWAP (14 Jun) 50151 – C TPO VWAP (14 Jun) 50290 – Swing High (12 Jun) 50384 – A TPO tail (03 Jun) 50566 – B TPO h/b (03 Jun) 50725 – D TPO POC (03 Jun) |

| Down |

| 50010 – VWAP (14 Jun) 49911 – AVWAP (07 Jun) 49750 – PDL 49628 – 07 Jun Halfback 49507 – B TPO h/b (07 Jun) 49333 – Buy Tail (07 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.