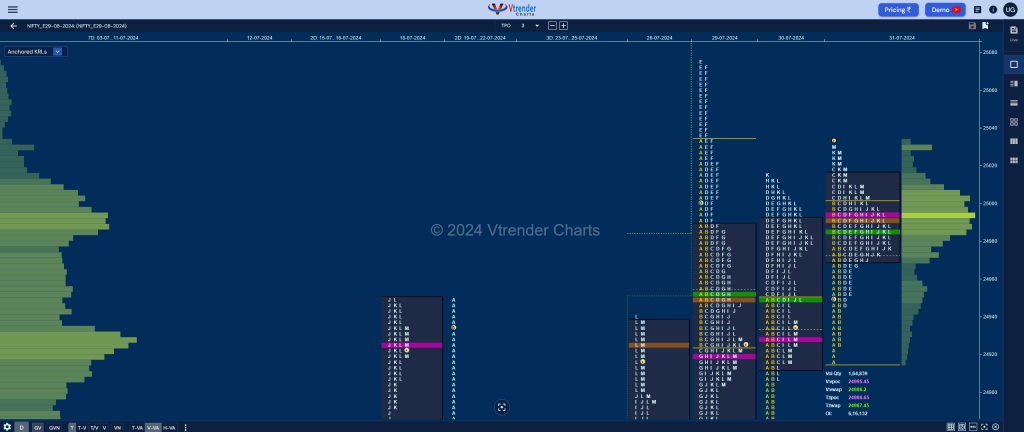

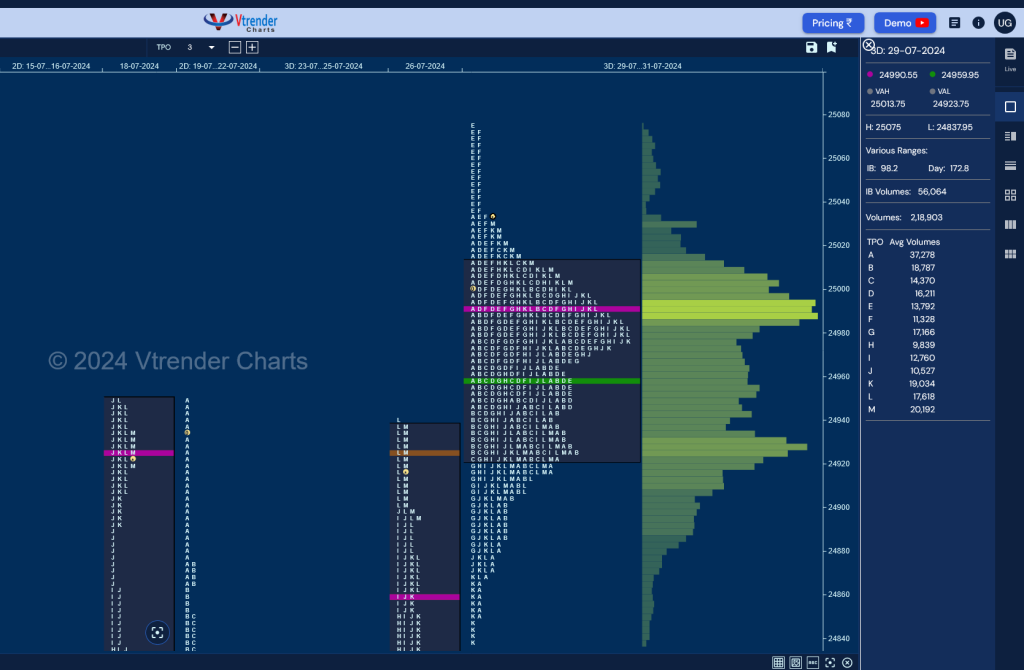

Nifty Aug F: 25013 [ 25033 / 24911 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 11,859 contracts |

| Initial Balance |

|---|

| 89 points (25000 – 24911) |

| Volumes of 45,250 contracts |

| Day Type |

|---|

| Normal – 122 pts |

| Volumes of 1,64,889 contracts |

NF found buying just above the 2-day VAL of 24906 as it showed RB’s in OrderFlow while making a low of 24911 and went on to test the supply zone from 25016 from previous session completing the 80% Rule but could not take out the higher supply point of 25053 (29th Jul) as it made as high of 25033 into the close filling up the balance which is now a 3-day one with Value at 24923-24990-25013 with a close at VAH so has a good chance of probing higher in the coming session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24995 F and VWAP of the session was at 24986

- Value zones (volume profile) are at 24970-24995-25016

- HVNs are at NA** (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 01st Aug 2024

| Up |

| 25019 – M TPO VWAP (31 Jul) 25053 – F TPO POC (29 Jul) 25105 – 1 ATR (POC 24859) 25150 – Weekly ATR 25219 – 1 ATR (WPOC 24522) 25241 – 1 ATR (yPOC 24995) |

| Down |

| 25013 – 3-day VAH (29-31 Jul) 24971 – PBH (31 Jul) 24923 – 3-day VAL (29-31 Jul) 24878 – AVWAP (26 Jul Trend Day) 24827 – H TPO tail (26 Jul) 24785 – G TPO tail (26 Jul) |

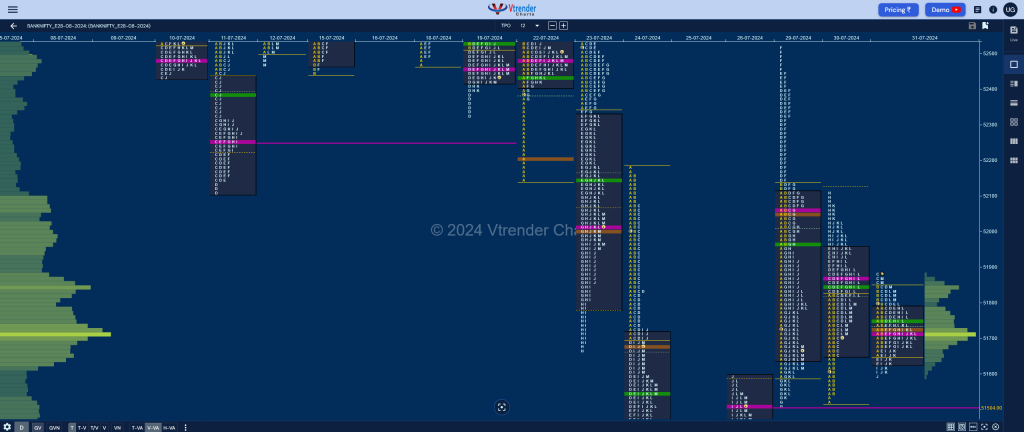

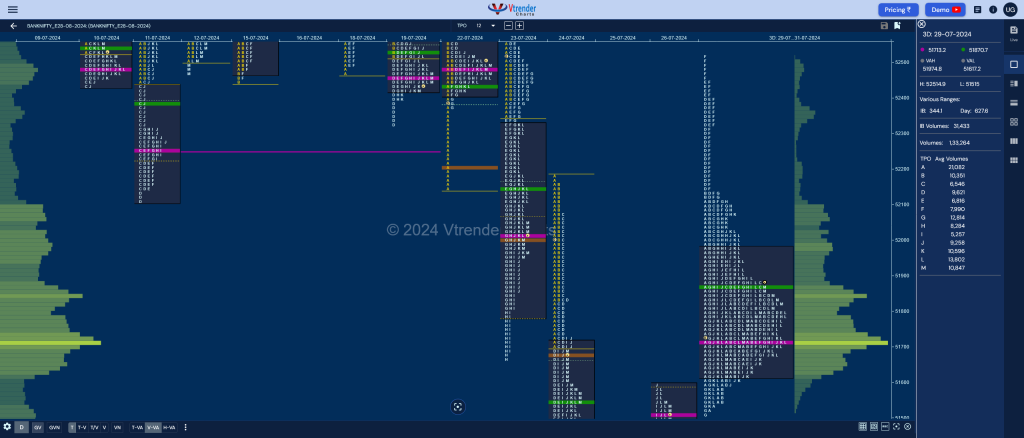

BankNifty Aug F: 51858 [ 51887 / 51589 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 9,797 contracts |

| Initial Balance |

|---|

| 189 points (51840 – 51651) |

| Volumes of 23,864 contracts |

| Day Type |

|---|

| Neutral – 298 pts |

| Volumes of 1,14,111 contracts |

BNF continued the low volume saga as it took support at previos VAL and probed higher but made the dreaded C side extension to 51878 tagging the yPOC of 51865 but could not sustain triggeing a quick drop to VWAP in the D period followed by a break of IBL in the E confirming a Failed Auction at highs but the OrderFlow did not show much selling below the IBL inspite of making lower lows of 51600 & 51589 in the I & J TPOs prompting the buyers to strike back with a big squeeze into the close making new highs of 51887 negating the FA and on the higher timeframe forming a rare Double Inside Day indicating that the coiling may be over and a move away from here can be expected.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51719 F and VWAP of the session was at 51744

- Value zones (volume profile) are at 51635-51719-51789

- BNF formed a FA at 51878 on 31/07 but got negated the same day so staying above it can go for the 1 ATR objective of 52506 in the coming session(s)

- HVNs are at NA (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

Business Areas for 01st Aug 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.