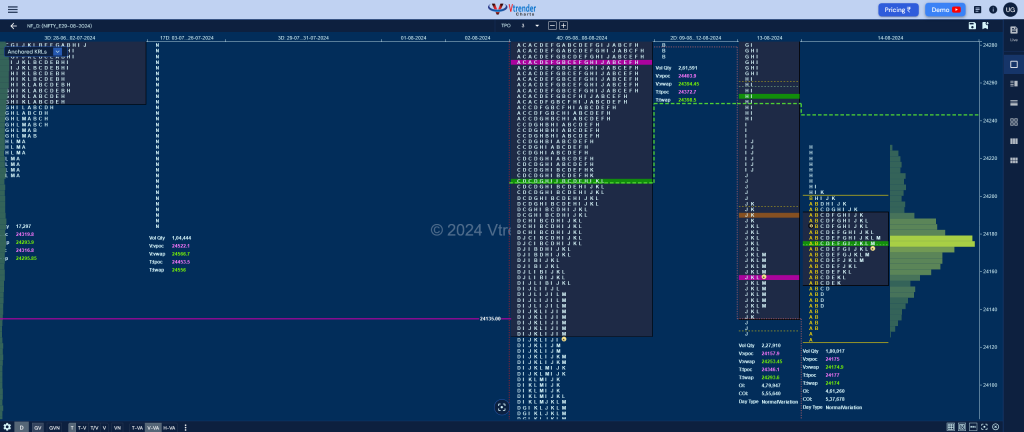

Nifty Aug F: 24174 [ 24228 / 24122 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 20,890 contracts |

| Initial Balance |

|---|

| 77 points (24199 – 24122) |

| Volumes of 50,177 contracts |

| Day Type |

|---|

| Normal – 107 pts |

| Volumes of 1,80,341 contracts |

The trend day imbalance led to a narrow range balance as NF made an Open Auction start making a look down below previous lows but could only manage to tag 24122 and remained in a mere range of 77 points for most part of the day with an attempt to extend higher in the H TPO as it scaled above the extension handle of 24213 and did not find any fresh demand resulting in a responsive selling tail from 24228 to 24206 and a close right at the ultra prominent POC of 24175.

The auction is well placed to give a move away from here in the coming session(s) with the upside reference being the 13th Aug Trend Day VWAP of 24253 and the weekly VWAP of 24317 and the lower level on watch being the Swing Low of 24111 from 08th Aug and the HVN of 24063 from 06th Aug.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24175 F and VWAP of the session was at 24175

- Value zones (volume profile) are at 24154-24175-24191

- HVNs are at 24271 / 24342** / 24930 / 24996 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (09-14 Aug) – The weekly profile is a Neutral Extreme one to the downside with a selling tail at top from 24500 to 24530 and an extension handle at 24240 as it made lows of 24122 building volumes at 24175 into the close leaving overlapping to higher Value at 24237-24403-24528 and this week’s VWAP of 24317 will be an important supply point for the rest of the series.

- (02-08 Aug) – NF opened with a gap down of 200+ points on Friday well below the POC & VWAP of previous week and left an A period selling tail and formed lower value which was followed by another big gap down of 323 points on Monday where it went on to form a Trend Day Down making a low of 29312 and remained in this range for the rest of the week leaving a FA at 24398 on Wednesday and completing the 1 ATR of 24121 on Thursday where it closed with a mini spike leaving a Double Distribution (DD) Trend Down profile for the week with completely lower Value at 24075-24271-24387 and the DD zone from 24398 to 24700 which could see filling up in the coming week if the FA of 24398 gets negated with this week’s VWAP of 24296 being an important supply point in between whereas on the downside, the HVNs of 24088 & 24063 would be the immediate support levels below which the responsive buying tails of 24012 & 23950 could come into play

- (26Jul – 01Aug) – NF has formed a composite ‘p’ shape profile on the weekly timeframe representing weak Market Structure as after starting last Friday with a big Trend Day Up of 487 points it remained in a narrow range for the rest of the days indicating poor trade facilitation at these new ATH levels. Value for the week was completely higher at 24853-24996-25042 and the auction will need to show initiative buying above 25042 in the coming week to continue higher with this week’s VWAP of 24909 being the swing reference on the downside below which it could go in for a test of the Trend Day VWAP of 24748 and the Halfback of 24696 along with extension handles of 24637 & 24576

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 16th Aug 2024

| Up |

| 24175 – POC (14 Aug) 24210 – Sell tail (14 Aug) 24253 – Trend Day VWAP (13 Aug) 24291 – G TPO EH (13 Aug) 24354 – AVWAP (01 Aug) 24404 – 2-day VPOC (09-12 Aug) |

| Down |

| 24155 – PBL (14 Aug) 24111 – Swing Low (08 Aug) 24063 – HVN (06 Aug) 24012 – Buy tail (06 Aug) 23950 – Buy tail (05 Aug) 23912 – Swing Low (05 Aug) |

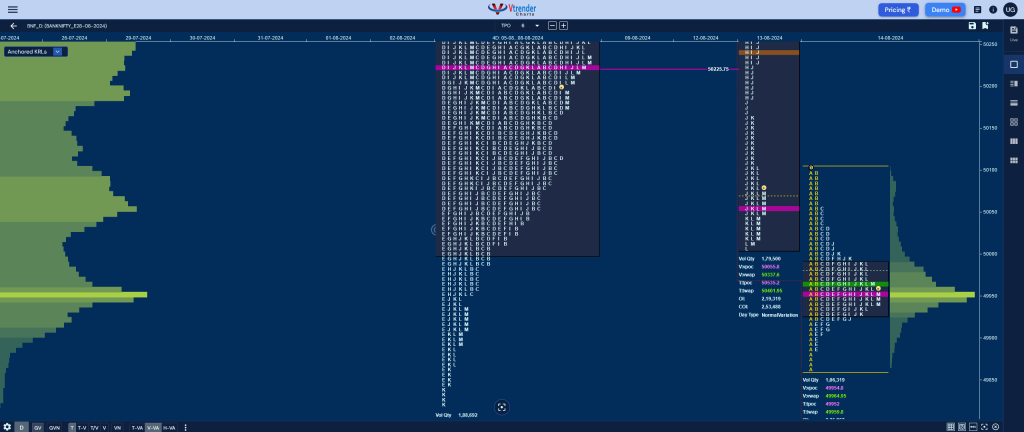

BankNifty Aug F: 49955 [ 50102 / 49865 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 16,080 contracts |

| Initial Balance |

|---|

| 237 points (50102 – 49865) |

| Volumes of 39,261 contracts |

| Day Type |

|---|

| Normal – 237 pts |

| Volumes of 1,06,347 contracts |

BNF made a freak tick of 50300 at open but no volumes were seen in the OrderFlow above 50100 as it continued previous day’s imbalance breaking below the FA of 49950 (07th Aug) and VPOC of 49923 (06 Aug) while making a low of 49865 in the A period taking support right at that day’s buying tail.

The auction then went on to probe higher in the B TPO but could only manage marginal new highs of 50102 indicating lack of demand after which it remained in the narrow 237 point IB (Initial Balance) range for rest of the day showing signs of coiling as it left a PBH at 50015 in the J period after confirming a tiny buying tail at lows from 49885 to 49865 before settling down right at the POC of 49954 leaving a Normal Day with completely lower value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49954 F and VWAP of the session was at 49965

- Value zones (volume profile) are at 49927-49954-49989

- HVNs are at 49954** / 50225** / 51422 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (08-14 Aug) – BNF has formed a Neutral profile this week with completely inside Value at 49895-49954-50591 after a look up into previous week’s DD singles saw supply coming back as it made a high of 50998 and formed a HVN at 50867 from where it formed a Trend Day Down on Tuesday hitting a low of 50005 & dropped further down to 49865 at open on Wednesday breaking below the VPOC of 49923 and saw profit booking by the sellers as the POC shifted down to 49954 and can come back again on a bounce near this week’s VWAP of 50397

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

Business Areas for 16th Aug 2024

| Up |

| 49984 – 14 Aug Halfback 50099 – Sell Tail (14 Aug) 50241 – HVN (13 Aug) 50368 – 13 Aug Halfback 50480 – F TPO VWAP (13 Aug) 50590 – B TPO VWAP (13 Aug) |

| Down |

| 49954 – POC (14 Aug) 49815 – Swing Low (06 Aug) 49660 – Multi-day FA (06 Jun) 49507 – Closing tail (05 Jun) 49385 – 1 ATR (PBH 50015) 49260 – SOC (04 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.